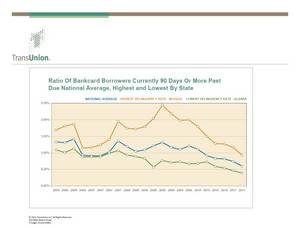

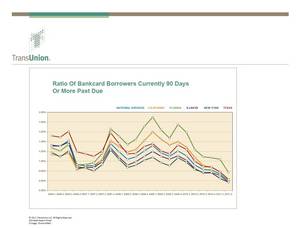

CHICAGO, IL--(Marketwire - Aug 16, 2011) - The national credit card delinquency rate (the rate of borrowers 90 or more days past due) decreased for the sixth consecutive quarter, dropping to 0.6% at the end of the second quarter in 2011. This is the lowest mark observed in 17 years. Credit card debt per borrower increased $20 in the quarter to $4,699, though it remains near record-low levels. This information is reported by TransUnion and is part of its ongoing series of quarterly analyses of credit-active U.S. consumers, evaluating how they are managing credit related to mortgages, credit cards and auto loans.

Although credit card delinquencies were expected to drop, the Q2 2011 TransUnion data released today shows credit card delinquency rates improving by more than at any other time since the recovery began in 2009, both on a quarter-over-quarter basis (-18.9%) and on a year-over-year basis (-34.8%).

"National credit card delinquency rates have fallen to levels not seen since 1994 as consumers continue to tighten their spending," said Ezra Becker, vice president of research and consulting in TransUnion's financial services business unit. "TransUnion believes that the recovering economy is only indirectly impacting delinquency rates. More important and impactful to the decline in bank card delinquency are that consumers are using credit cards more responsibly; a large number of delinquent accounts have moved to charge-off status; and lenders remain conservative in their underwriting."

The record low-level of credit card debt that has continued post recession is supported by a separate TransUnion credit card deleveraging analysis released in July. The analysis found that consumers made an estimated $72 billion more in payments on their credit cards than purchases between the first quarters of 2009 and 2010. This is in contrast to just five years prior when consumers made an estimated $2.1 billion more in purchases than payments. That constitutes a nearly $75 billion turnaround in consumer payment dynamics from 2004 to 2009.

Between the first and second quarters of 2011, 49 states and the District of Columbia experienced declines in their credit card delinquency rates, with North Dakota being the only state to experience an increase. On a more granular level, 83% of metropolitan statistical areas (MSA) saw declines in their credit card delinquency rates in Q2 2011. This is an improvement compared to Q1 2011, when 74% of MSAs experienced a decline. In Q4 2010, only 53% of MSAs experienced such a decline.

TransUnion forecasts that credit card borrower delinquency rates will continue to drift downward for the remainder of 2011 as the economy continues its slow recovery and financial institutions maintain a conservative approach to underwriting.

"Since the recession began, lenders have been increasingly scrutinizing the borrower's overall financial situation, e.g. duration of employment, credit and income history -- holding consumers to higher standards for loan approval," added Becker. "Those approved are less likely to default even in the face of continued high unemployment levels. Although there are still seasonal influences underlying credit card repayment patterns, they have been muted by the conservative use of credit by consumers. As the slow economic recovery continues, this trend should carry through the end of the year."

TransUnion's forecast is based on various economic assumptions, such as gross state product, consumer sentiment, disposable income, and interest rates. The forecast changes as the economy deviates from a conservative economic forecast or if there are unanticipated shocks to the economy affecting recovery.

Q2 2011 Credit Card Statistics - Delinquency Rates

| Quarter over Quarter | Q1 2011 | Q2 2011 | Pct. Change |

| USA | 0.74% | 0.60% | (18.92%) |

| Year over year | Q2 2010 | Q2 2011 | Pct. Change |

| USA | 0.92% | 0.60% | (34.78%) |

| Highest Credit Card Delinquency States | Q2 2011 |

| Nevada | 0.93% |

| Georgia | 0.78% |

| Florida | 0.77% |

| Mississippi | 0.75% |

| Lowest Credit Card Delinquency States | Q2 2011 |

| Alaska | 0.39% |

| North Dakota | 0.40% |

| Iowa | 0.41% |

| Wyoming | 0.42% |

| Top 3 Year-over-Year Declines | Q2 2010 | Q2 2011 | Pct. Change |

| Wyoming | 0.84% | 0.42% | (50.00%) |

| Alaska | 0.73% | 0.39% | (46.58%) |

| California | 1.08% | 0.63% | (41.67%) |

Q2 2011 Credit Card Statistics - Credit Card Debt Per Borrower

| Quarter over Quarter | Q1 2011 | Q2 2011 | Pct. Change |

| USA | $4,679.00 | $4,699.00 | 0.42% |

| Year over Year | Q2 2010 | Q2 2011 | Pct. Change |

| USA | $4,951.00 | $4,699.00 | (5.10%) |

| Highest Credit Card Debt States | Q2 2011 |

| Alaska | $6,926.00 |

| North Carolina | $5,433.00 |

| Colorado | $5,246.00 |

| Georgia | $5,242.00 |

| Lowest Credit Card Debt States | Q2 2011 |

| Iowa | $3,731.00 |

| North Dakota | $3,923.00 |

| Wisconsin | $4,021.00 |

| South Dakota | $4,075.00 |

| Top Year-over-Year Increase | Q2 2010 | Q2 2011 | Pct. Change |

| West Virginia | $4,104.00 | $4,127.00 | 0.58% |

| Top 3 Year-over-Year Declines | Q2 2010 | Q2 2011 | Pct. Change |

| Tennessee | $5,654.00 | $4,685.00 | (17.13%) |

| Montana | $5,378.00 | $4,619.00 | (14.12%) |

| Hawaii | $5,594.00 | $4,871.00 | (12.92%) |

Supporting Resources/Links

TransUnion Trend Data Interactive U.S. Map

TransUnion 1Q11 Credit card Statistics

TransUnion Payment Hierarchy Study

TransUnion Deleveraging Analysis

TransUnion on Twitter

TransUnion's Trend Data database

TransUnion's Trend Data is a one-of-a-kind database consisting of 27 million anonymous consumer records randomly sampled every quarter from TransUnion's national consumer credit database. Each record contains more than 200 credit variables that illustrate consumer credit usage and performance. Since 1992, TransUnion has been aggregating this information at the county, Metropolitan Statistical Area (MSA), state and national levels. For the purpose of this analysis, the term "credit card" refers to those issued by banks.

About TransUnion

As a global leader in information and risk management, TransUnion creates advantages for millions of people around the world by gathering, analyzing and delivering information. For businesses, TransUnion helps improve efficiency, manage risk, reduce costs and increase revenue by delivering high quality data, and integrating advanced analytics and enhanced decision-making capabilities. For consumers, TransUnion provides the tools, resources and education to help manage their credit health and achieve their financial goals. Through these and other efforts, TransUnion is working to build stronger economies worldwide. Founded in 1968 and headquartered in Chicago, TransUnion reaches businesses and consumers in 23 countries around the world. www.transunion.com/business

Contact Information:

Contact

Dave Blumberg

TransUnion

E-mail:

Telephone: 312 972 6646