CHICAGO, IL--(Marketwire - Mar 29, 2012) - Recent updates to a key TransUnion study found that in 2011 consumers were more likely to pay their auto loans before their credit cards and mortgages. This insight was gained through TransUnion's Payment Hierarchy study update, which also found that the divergence in payment patterns -- where consumers are increasingly apt to pay their credit cards before their mortgages -- has continued for four straight years.

"The reversal in payment patterns between credit cards and mortgages has been well documented, but our findings were illuminating because it had not been previously clear that auto loans were considered a higher priority by consumers than both credit cards and mortgages," said Ezra Becker, vice president of research and consulting in TransUnion's financial services business unit. "With unemployment remaining high and real estate values remaining stagnant or further depreciating, consumers continued to pay their credit cards ahead of their mortgages. However, the importance of their auto loans appears to have trumped even the value they place on their credit cards."

The TransUnion analysis looked at a sample of approximately 4 million consumers in each quarter of 2011 that had at least one open auto loan and one open bankcard and one open mortgage. The study found in each quarter that there was a clear preference for remaining current on auto loans, ahead of credit cards and mortgages. Specifically, of the consumers who were delinquent on any of these products:

- 9.5% were delinquent on an auto loan while current on their credit cards and mortgages

- 17.3% were delinquent on a credit card while current on their auto loans and mortgages

- 39.1% were delinquent on a mortgage while current on their auto loans and credit cards

"In other words, the auto loan is seldom the first choice when a consumer has to decide which payment to miss. A few reasons why auto loans have become the preferred payment to make include the need for an auto to get to work or look for employment, and the fact that an auto loan is not a revolving loan -- the impact of repossession is greater than the loss of a credit card," added Becker. "In addition, consumers may have equity in their autos after several years of payments that they are looking to preserve -- which is no longer the case for most homes. In fact, negative equity has become increasingly common for homes, which may further contribute to the shift in payment preference to auto loans."

While the hierarchy is consistent across states, the magnitude varies, influenced by regional economics and consumer preferences. Below are some state-level statistics for consumers who are 30 or more days delinquent on one loan type while current on the other two loan types:

- Florida:

- 6.1% delinquent on auto; current on credit cards, mortgage

- 11.3% delinquent on credit cards; current on mortgage, auto

- 50.0% delinquent on mortgage; current on credit cards, auto

- Michigan:

- 7.3% delinquent on auto; current on credit cards, mortgage

- 22.0% delinquent on credit cards; current on mortgage, auto

- 38.8% delinquent on mortgage; current on credit cards, auto

- Texas:

- 15.0% delinquent on auto; current on credit cards, mortgage

- 22.0% delinquent on credit cards; current on mortgage, auto

- 34.4% delinquent on mortgage; current on credit cards, auto

"This preference for prioritizing auto loans before credit cards and mortgages was seen in all 50 states and the District of Columbia through 2011," said Becker. "However, the preference for paying auto loans was more pronounced in states like Florida and Michigan, which have seen severe drops in house prices and may have strong consumer affinities for autos, and less pronounced in states like Texas, where house prices have declined less."

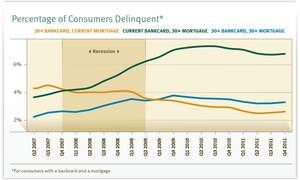

This latest version of the Payment Hierarchy study is the second update to the original released in 2010. The 2010 study observed consumers who had at least one credit card and one mortgage, and examined 30-day credit card and mortgage delinquency data between Q3 2006 and Q4 2011.

The percentage of consumers current on their credit card payments and delinquent on their mortgages first surpassed the percentage of consumers current on their mortgages and delinquent on credit cards in Q1 2008. Although many industry analysts believed that a reversion to the conventional payment hierarchy would ensue once the recession had concluded, this has not yet been the case.

To the contrary, the study found that the hierarchy reversal had become even more widespread, with the percentage of consumers who are delinquent on their mortgages and current on their credit cards rising to as high as 7.4% in Q3 2010 from 4.3% in Q1 2008. The statistic ended 2011 at 6.9%. Conversely, the percentage of consumers who are delinquent on their credit cards and current on their mortgages decreased from 4.1% in Q1 2008 to 3.0% Q4 2010 and has further declined to 2.7% as of Q4 2011.

"Though the percentage of consumers delinquent on mortgages and current on credit cards has dropped in the last year, the payment hierarchy shift is as strong as it was one year ago, with consumers opting to pay their credit cards before their mortgage payments," said Matt Komos, a co-author of the study and a consultant in TransUnion's analytics and decisioning services business unit. "We established in our earlier study that this payment hierarchy reversal was chiefly the result of two factors: the decline in house prices and high and persistent unemployment levels.

"It appears that the shift back to prioritizing mortgage payments ahead of credit cards -- or auto loans -- may only occur once the housing market has stabilized and begins its recovery and the unemployment situation shows significant improvement. Until that time, based on the last four years of data, it would seem that the current payment patterns will remain status quo."

Two states that were greatly impacted by the mortgage crisis -- California and Florida -- continue to have more elevated delinquencies, though signs of recovery appear to have taken place in the last year. In both states, the payment hierarchy divergence occurred two quarters earlier (Q3 2007) than it did at the national level.

Percent of Consumers 30+ Days Delinquent on Mortgage/Current on Credit Card

California |

Pct. Change | Florida |

Pct. Change | USA |

Pct. Change | |

| Q3 2007 | 3.5% | - | 5.1% | - | 4.0% | - |

| Q4 2010 | 10.2% | 192% | 14.5% | 185% | 7.2% | 81% |

| Q4 2011 | 8.8% | (-14%) | 13.8% | (-5%) | 6.9% | (-4%) |

Percent of Consumers 30+ Days Delinquent on Credit Card/Current on Mortgage

California |

Pct. Change | Florida |

Pct. Change | USA |

Pct. Change | |

| Q3 2007 | 3.3% | - | 5.0% | - | 4.1% | - |

| Q4 2010 | 2.5% | (-24%) | 3.2% | (-36%) | 3.0% | (-27%) |

| Q4 2011 | 2.2% | (-12%) | 2.9% | (-9%) | 2.7% | (-10%) |

"As both California and Florida demonstrate, the journey back to the traditional payment hierarchy will likely be a long road," added Komos. "Despite reaching double-digit mortgage delinquency levels that were at least five times greater than normal, the decline in these levels observed in the last year has been rather slow in comparison."

The source of the underlying data used for this analysis was TransUnion's Trend Data, a proprietary historical database consisting of 27 million anonymous consumer records randomly sampled every quarter from TransUnion's national consumer credit database. Using TransUnion's standard definitions of credit card and mortgage trades, TransUnion was able to create and evaluate the custom attributes that are the basis of this study.

About TransUnion

As a global leader in credit and information management, TransUnion creates advantages for millions of people around the world by gathering, analyzing and delivering information. For businesses, TransUnion helps improve efficiency, manage risk, reduce costs and increase revenue by delivering comprehensive data and advanced analytics and decisioning. For consumers, TransUnion provides the tools, resources and education to help manage their credit health and achieve their financial goals. Through these and other efforts, TransUnion is working to build stronger economies worldwide. Founded in 1968 and headquartered in Chicago, TransUnion has employees in more than 25 countries on five continents. www.transunion.com/business

Contact Information:

Contact

Dave Blumberg

TransUnion

E-mail:

Telephone: (312) 972-6646