TRUCKEE, CA--(Marketwire - Jan 8, 2013) - Clear Capital (www.clearcapital.com), the premium provider of data, collateral risk assessment, and real estate asset valuation and analytics, today released its Home Data Index™ (HDI) Market Report with data through December 2012. Using a broad array of public and proprietary data sources, the HDI Market Report publishes the most granular home data and analysis earlier than nearly any other index provider in the industry.

Report highlights include:

- Home prices in 2012 finished the year strong, boosted off the market lows of early 2012.

- December's quarterly trends were mostly flat, indicating potential fiscal cliff and winter impact.

- 2013 forecasts call for continued, moderate growth as some potential buyers get priced out of the market.

"Overall the housing recovery still shows evidence of pushing ahead, as indicated by our December home price trends and 2013 forecasts. Quarterly home prices mostly mirrored those of last month and suggest that some buyers took pause in the initial winter months. Yet, looking back over 2012, national yearly price gains of 4.9% are still strong," said Dr. Alex Villacorta, Director of Research and Analytics at Clear Capital. "The housing landscape, however, could quickly shift should the broader economy tumble back into recessionary territory. Whether by perception or actual decrease in buying power for the average consumer, residual effects of the fiscal cliff deal could cause housing to change course. But as it stands now, home prices have continued to show resiliency by posting their largest yearly gain in nearly two and a half years.

"2013 should be interesting for the housing market, where national gains should continue to see upward growth but likely at a more modest rate. Keeping in mind our current gains are off market lows at the start of the year, 2013 gains will be measured against a higher price floor after a full year of recovery. On a local level, we expect to see shifts in the status quo for some hot markets, like Phoenix, as some buyer segments get priced out of recovering markets. As those buyers search for opportunities, markets with improving local economies and low price points, like Minneapolis, could become the new targets. At the end of the day, there are still plenty of great deals to be had across the country, investors looking for decent return, and pent up homebuyer demand on the verge of materializing."

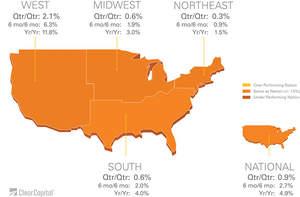

December Quarterly Trends: Short term trends hold steady with little growth across the nation and four regions.

Nationally, home prices in December rose 0.9% over the rolling quarter, nearly unchanged from November's quarterly rate of growth of 1.0%. Mild quarterly gains likely reflect some pause from buyers who tend to put purchase plans off over the holiday and winter season.

The Midwest and the South, each with quarterly gains of 0.6%, saw December trends soften slightly over November. When compared to the heat of the summer, it's clear the momentum from the Midwest and the South has stalled, where in July quarterly prices gained 2.1% and 1.5%, respectively.

The Northeast experienced gains of 0.3% over the rolling quarter, nearly unchanged over the prior month's rate of growth. Moderate price changes are not out of character for the region, where quarterly price gains surpassed 1.0% one time in 2012, and 0.5% only twice over the course of the year.

The West was the only region to see a slight uptick in quarterly price gains, with 2.1% growth. As reported throughout the year, the West has been the front-runner of the recovery. December home price trends offer further confirmation of the strongest regional rebound happening in the Western region.

December Yearly Trends and 2013 Forecasts: Long-term trends strengthen in December, but expected to moderate over 2013.

National year-over-year price gains picked up steam in December, coming in at 4.9%. Closing the year out just shy of 5.0%, December yearly gains, as measured against the market lows at the start of 2012, will likely be a high watermark for the near-term recovery. Through 2013, national home prices are forecasted to grow by 2.1%. The more than 50% reduction is expected partly because of a higher starting price base, now a full year into the recovery. At the regional level, there are no surprises in year-over-year growth. The West leads while the Northeast continues to struggle.

The West experienced a continuation of impressive year-over-year growth, up to 11.8% in December. The ramp up in gains again reflects a market that was hard hit, and, like national prices, saw its lowest price level at the start of 2012. A forecast of just 2.8% for 2013 points to a moderating recovery for the West, as buyers adjust to a higher priced market.

The last time the South saw gains at year's end was in 2006. So the region's year-end gains of 4.0% marks an overall great year for the South. Only once this year did the region see gains over 4.0%, while 2.0% price gains are forecasted through 2013.

This time last year, the Midwest saw prices fall by 3.0%. Current home prices have notably improved with December prices rising 3.0% year-over-year, just 0.1 percentage point higher than in November. The Midwest's recovery is forecasted to unfold into 2013, with expected yearly gains of 2.3%.

As expected, the Northeast saw the lowest rate of yearly growth among all four regions at 1.5%. While it was the first to see minor gains of 0.1% in January 2012, the regional recovery never took hold. Yearly price gains only broke out above 2.0% once over the year. And more of the same is forecasted in 2013, with yearly gains expected to hit only 1.4%.

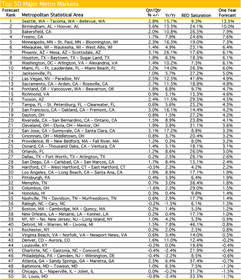

Top 50 Major Metro Markets: Advanced recoveries for some, continued volatility for others.

Major metro markets continued to experience a wide range of price trends in December, with continued variability expected through 2013. While each market's home price trends remain dependent on local economic conditions, there are some commonalities. The strongest recoveries have generally unfolded in two types of markets: Hard-hit markets like Phoenix, Miami, and Las Vegas, offering investors attractive deals, and markets like Seattle, San Jose, and San Francisco, with relatively strong local economies attracting buyers despite relatively high price points.

Generally we expect markets with the strongest recoveries underway to experience moderate growth in 2013, as rising prices bring many markets into alignment with long-run historical norms. Slower growth in markets with robust recoveries underway can be seen as a more mature stage of recovery, rather than a weakness.

Out of the top 50 major metro markets in 2013, Seattle, a market with a strong recovery already underway, is expected to see the highest gains at 13.5%. Unlike other strong performing markets, Seattle is not expected to see a notable moderation of growth. The metro's relatively strong job market is expected, in part, to continue to drive housing gains overall.

Metro markets' underlying price points will continue to dictate trend variability into 2013. We see many lower-priced markets with a higher propensity to shift trends, when measured by percentage change. Birmingham is projected to see the second highest rate of growth out of the top 50 metros, at 10.0% in 2013, with a median price-per-square-foot of just $75. Small shifts in price in Birmingham create large swings in percentage change, unlike a market like San Jose that has a median price-per-square-foot of $363. For example, a $10 increase in median price-per-square-foot would represent 13.3% growth for Birmingham and just 2.8% growth for San Jose.

Out of all top 50 major metros, only eight markets should see prices fall in 2013. Of those eight markets, average declines should come in at just 0.9%. St. Louis home prices in 2013 are expected to fall 1.7%, the largest of forecasted declines in the top 50 major metros. St. Louis, however, is another one of those low-priced markets, with a median price-per-square-foot of just $66. As expected, this market could easily see notable percentage point shifts with small changes in price.

All told, 2012 ended strong and 2013 is poised for a continued recovery. The national housing market has continued to grow at a healthy pace, and chances of a robust recovery are slim in 2013, in part because we have less ground to make up. While prices are still off their peaks by 37.6%, they are now more aligned with historical average rates of growth. While a larger economic setback could easily change the course for the worse, current rates of growth signal the market is slowly calibrating itself to pre-bubble rates and prices.

| Top 50 Major Metro Markets | ||||||||||

| Forecast Rank | Metropolitan Statistical Area | Qtr/Qtr % +/- |

Yr/Yr | REO Saturation | One Year Forecast | |||||

| 1 | Seattle, WA – Tacoma, WA – Bellevue, WA | 2.8% | 15.7% | 9.3% | 13.5% | |||||

| 2 | Birmingham, AL – Hoover, AL | 3.6% | 13.3% | 24.1% | 10.0% | |||||

| 3 | Bakersfield, CA | 2.0% | 10.8% | 26.5% | 7.9% | |||||

| 4 | Fresno, CA | 1.7% | 7.9% | 24.6% | 7.6% | |||||

| 5 | Minneapolis, MN – St. Paul, MN – Bloomington, WI | 2.3% | 16.3% | 19.0% | 7.3% | |||||

| 6 | Milwaukee, WI – Waukesha, WI – West Allis, WI | 1.4% | 4.9% | 23.1% | 6.4% | |||||

| 7 | Phoenix, AZ – Mesa, AZ – Scottsdale, AZ | 3.1% | 26.1% | 17.6% | 6.1% | |||||

| 8 | Houston, TX – Baytown, TX – Sugar Land, TX | 1.8% | 6.3% | 18.3% | 6.1% | |||||

| 9 | Washington, DC – Arlington, VA – Alexandria, VA | 1.4% | 10.2% | 7.3% | 6.1% | |||||

| 10 | Miami, FL – Ft. Lauderdale, FL – Miami Beach, FL | 2.2% | 14.0% | 26.3% | 6.0% | |||||

| 11 | Jacksonville, FL | 1.0% | 5.7% | 27.2% | 5.0% | |||||

| 12 | Las Vegas, NV – Paradise, NV | 2.5% | 12.5% | 41.8% | 4.9% | |||||

| 13 | Sacramento, CA – Arden, CA – Roseville, CA | 2.7% | 11.5% | 18.9% | 4.8% | |||||

| 14 | Portland, OR – Vancouver, WA – Beaverton, OR | 1.8% | 6.8% | 9.7% | 4.7% | |||||

| 15 | Richmond, VA | 0.9% | 5.1% | 15.3% | 4.6% | |||||

| 16 | Tucson, AZ | 2.4% | 11.5% | 29.5% | 4.5% | |||||

| 17 | Tampa, FL – St. Petersburg, FL – Clearwater, FL | 0.6% | 5.6% | 25.2% | 4.3% | |||||

| 18 | San Francisco, CA – Oakland, CA – Fremont, CA | 3.0% | 16.1% | 14.4% | 4.2% | |||||

| 19 | Dayton, OH | 0.8% | 1.5% | 27.2% | 4.2% | |||||

| 20 | Riverside, CA – San Bernardino, CA – Ontario, CA | 1.5% | 8.9% | 23.8% | 4.1% | |||||

| 21 | Cleveland, OH – Elyria, OH – Mentor, OH | 1.9% | 3.8% | 31.1% | 3.6% | |||||

| 22 | San Jose, CA – Sunnyvale, CA – Santa Clara, CA | 3.1% | 17.2% | 8.8% | 3.3% | |||||

| 23 | Cincinnati, OH – Middletown, OH | 0.8% | 3.7% | 20.4% | 3.2% | |||||

| 24 | Providence, RI – New Bedford, MA – Fall River, MA | 1.2% | 0.3% | 8.0% | 3.2% | |||||

| 25 | Oxnard, CA – Thousand Oaks, CA – Ventura, CA | 1.4% | 5.1% | 18.1% | 3.1% | |||||

| 26 | Orlando, FL | 1.2% | 8.6% | 26.0% | 3.0% | |||||

| 27 | Dallas, TX – Fort Worth, TX – Arlington, TX | 0.2% | 2.5% | 26.1% | 2.6% | |||||

| 28 | San Diego, CA – Carlsbad, CA – San Marcos, CA | 1.7% | 8.4% | 15.1% | 2.4% | |||||

| 29 | Hartford, CT – West Hartford, CT – East Hartford, CT | -0.5% | 2.3% | 4.2% | 2.2% | |||||

| 30 | Los Angeles, CA – Long Beach, CA – Santa Ana, CA | 1.9% | 8.9% | 17.1% | 1.9% | |||||

| 31 | Pittsburgh, PA | 0.4% | 5.9% | 6.4% | 1.9% | |||||

| 32 | Memphis, TN | 0.7% | 3.0% | 36.4% | 1.8% | |||||

| 33 | Columbus, OH | -1.6% | 2.3% | 29.0% | 1.5% | |||||

| 34 | Honolulu, HI | 0.3% | 0.4% | 9.8% | 1.4% | |||||

| 35 | Nashville, TN – Davidson, TN – Murfreesboro, TN | 0.6% | 2.9% | 17.7% | 1.4% | |||||

| 36 | Raleigh, NC – Cary, NC | -0.2% | -1.5% | 6.1% | 1.3% | |||||

| 37 | Boston, MA – Cambridge, MA – Quincy, MA | 0.2% | 1.4% | 5.5% | 1.2% | |||||

| 38 | New Orleans, LA – Metairie, LA – Kenner, LA | 0.2% | 0.4% | 17.1% | 1.0% | |||||

| 39 | NY, NY – No. New Jersey, NJ – Long Island, NY | 1.0% | 4.2% | 5.3% | 0.9% | |||||

| 40 | Detroit, MI – Warren, MI – Livonia, MI | 1.5% | 7.8% | 46.1% | 0.8% | |||||

| 41 | Rochester, NY | 0.2% | 2.0% | 2.5% | 0.8% | |||||

| 42 | Virginia Beach, VA – Norfolk, VA – Newport News, VA | 0.6% | 3.4% | 14.0% | 0.5% | |||||

| 43 | Denver, CO – Aurora, CO | 1.6% | 11.0% | 12.4% | -0.2% | |||||

| 44 | Louisville, KY | -0.2% | 0.0% | 19.6% | -0.4% | |||||

| 45 | Charlotte, NC – Gastonia, NC – Concord, NC | -0.4% | -2.4% | 21.9% | -0.4% | |||||

| 46 | Philadelphia, PA – Camden, NJ – Wilmington, DE | -0.4% | -2.2% | 8.5% | -0.6% | |||||

| 47 | Atlanta, GA – Sandy Springs, GA – Marietta, GA | 2.5% | 6.4% | 37.4% | -0.7% | |||||

| 48 | Baltimore, MD – Towson, MD | 1.0% | 6.5% | 7.5% | -1.3% | |||||

| 49 | Chicago, IL – Naperville, IL – Joliet, IL | 0.0% | -0.2% | 31.7% | -1.5% | |||||

| 50 | St. Louis, MO | -0.8% | -2.4% | 33.5% | -1.7% | |||||

About the Clear Capital® Home Data Index™ (HDI) Market Report

The Clear Capital HDI Market Report provides insights into market trends and other leading indices for the real estate market at the national and local levels. A critical difference in the value of the HDI Market Report is the capability of Clear Capital to provide more timely and granular reporting than other home price index providers.

The Clear Capital HDI Market Report:

- Offers the real estate industry (investors, lenders, and servicers), government agencies, and the public insight into the most recent pricing conditions, not only at the national and metropolitan level, but within local markets as well.

- Is built on the most recent information available from recorder/assessor offices, and then further enhanced by adding the company's proprietary streaming market data for the most comprehensive geographic coverage and local insights available.

- Reflects nationwide coverage of sales transactions and aggregates this comprehensive dataset at ten different geographic levels, including hundreds of metropolitan statistical areas (MSAs) and sub-ZIP code boundaries.

- Includes equally-weighted distressed bank owned sales (REOs) from around the country to give the most real world look of pricing dynamics across all sales types.

- Allows for the most current market data by providing more frequent updates with patent pending rolling quarter technology. This ensures decisions are based on the most up-to-date information available.

Clear Capital Home Data Index Methodology

- Generates the timeliest indices in patent pending rolling quarter intervals that compare the most recent four months to the previous three months. The rolling quarters have no fixed start date and can be used to generate indices as data flows in, significantly reducing the multi-month lag time experienced with other indices.

- Includes both fair market and institutional (real estate owned) transactions, giving equal weight to all market transactions and identifying price tiers at a market specific level. By giving equal weight to all transactions, the HDI is truly representative of each unique market.

- Results from an address-level cascade create an index with the most granular, statistically significant market area available.

- Provides weighted repeat sales and price-per-square-foot index models that use multiple sale types, including single-family homes, multi-family homes, and condominiums.

About Clear Capital

Clear Capital (www.clearcapital.com) is the premium provider of data and solutions for real estate asset valuation and collateral risk assessment for large financial services companies. Our products include appraisals, broker price opinions, property condition inspections, value reconciliations, automated valuation models, quality assurance services, and home data indices. Clear Capital's combination of progressive technology, high caliber in-house staff, and a well-trained network of more than 40,000 field experts sets a new standard for accurate, up-to-date, and well documented valuation data and assessments. The Company's customers include the largest U.S. banks, investment firms, and other financial organizations.

The information contained in this report is based on sources that are deemed to be reliable; however no representation or warranty is made as to the accuracy, completeness, or fitness for any particular purpose of any information contained herein. This report is not intended as investment advice, and should not be viewed as any guarantee of value, condition, or other attribute.

Contact Information:

Alanna Harter

Marketing Manager

alanna.harter@clearcapital.com

530.550.2515