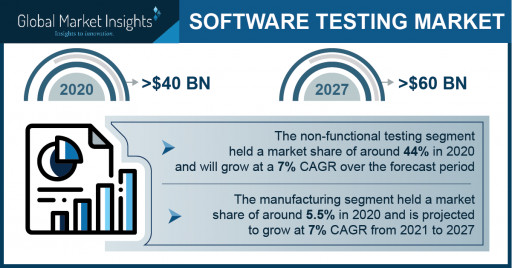

SELBYVILLE, Del., Sept. 27, 2021 (GLOBE NEWSWIRE) -- The software testing market revenue is anticipated to record a valuation of USD 60 billion by 2027, according to the most recent study by Global Market Insights Inc. The increasing trend toward privacy protection and digital security across cryptocurrency, government, and banking sectors is accelerating the demand for blockchain testing services. Blockchain testing helps enterprises to test, validate, encrypt, and decrypt the financial transaction at high speed and manage and secure user identity.

The increasing volumes of cryptocurrency transactions and their market capitalizations are expected to provide opportunities for the software testing providers. According to CoinDesk, the market capitalization for Bitcoin was more than USD 1,079.67 billion in April 2021 compared to USD 158.92 billion in April 2020. In addition, several economies across North America and Europe are now accepting virtual currencies to limit the impact of currency fluctuations. According to a survey conducted by the World Economic Forum, 10% of the global GDP might be stored using blockchain by 2027. The growing adoption of digital payment methods using blockchain technology is expected to increase the demand for software testing services over the forecast period.

Request a sample of this research report @ https://www.gminsights.com/request-sample/detail/3382

The non-functional testing segment held a market share of around 44% in 2020 and will grow at a 7% CAGR over the forecast period. The market growth is driven by the rising demand for non-function testing including performance testing, usability testing, security testing, and API testing in IoT and connected devices. The proliferation of IoT connected devices in the coming years will add new opportunities over the forecast timeline. The majority of the data sharing between IoT terminal devices is in the form of API formats. In addition, the performance testing helps to increase the speed, scalability, and responsiveness of software and applications in embedded IoT devices. Companies are emphasizing on introducing new non-functional testing platforms to stay competitive in the market. For instance, in January 2020, MachNation launched 'MIT-E Pf', a performance and scalability testing software for IoT solutions. The new software can verify the platform performance of up to a million IoT messages per second.

The manufacturing segment held a market share of around 5.5% in 2020 and is projected to grow at 7% CAGR from 2021 to 2027. The manufacturing industries are witnessing extensive adoption of robotics and automation to accelerate productivity with low labor cost, ensuring higher profit margins. Several automation equipment units including CNC machinery, automated assemblies, conveyor systems, and Automated Guided Vehicles (AGVs) are integrated with advanced software, sensors, and microprocessors. These software and hardware components require continuous testing using test automation frameworks.

The Europe software testing market is anticipated to register 5.5% CAGR from 2021 to 2027. The growth is credited to increasing R&D initiatives toward autonomous vehicles and electrification of cars in the region. According to Global EV Outlook 2021 report, Europe witnessed over 1.4 million units of new electric cars registrations in 2020. The electric vehicles are integrated with battery management software, Electronic Control Units (ECU), and automotive sensors, demanding unit testing, integration testing, and system testing. Software testing also offers benefits including Quality Assurance (QA), design verification, and performance assessment of the batteries. The presence of major automotive OEMs, such as Audi, Volkswagen, BMW Group, etc., that are focusing on development of autonomous cars and ADAS systems will further drive the software testing market growth in the region.

Key players operating in the software testing market are engaged in new product launches and improvements to gain a competitive edge in the market. For instance, in October 2020, Tricentis launched Vision AI, an AI-based test design and automation technology. The new technology will help to address the challenges such as heavy application customization, virtual, and remote test customizations. Similarly, in August 2021, Automation Anywhere launched a new RPA Maturity Assessment tool which will help enterprises and automation teams to deploy, adopt, and scale intelligent automation. The new tool will enable its customers to achieve maximum returns on their intelligent automation tasks.

Some major findings of the software testing market report include:

- Rising demand for mobile-based applications is expected to drive the software testing market growth. Various mobile applications for entertainment, money transaction, gaming, and e-commerce requires continuous upgrades to enhance the user experience. This is expected to create a high demand for usability testing, regression testing, and API testing services.

- The functional testing segment is expected to witness a high market share over the forecast period. The growing demand for software agility, lowering capital expenditure, and efficiently managing the IT resources during Software Development Life Cycles (SDLC) is expected to propel the uptake of functional testing services.

- The COVID-19 pandemic positively impacted the software testing market growth in the first half of 2020. Several enterprises across healthcare, entertainment, online banking, and e-retail started investing in digital platforms for the continuity of their businesses in early 2020. This has created high growth opportunities for the software testing service providers during the pandemic.

- The wide adoption of smart home technology products across developed economies, such as Germany, France, the U.S., and Canada, is expected to support the software testing market growth. The smart home technology products, such as robotic vacuums, service robots, smart TVs, and voice assistance systems, are integrated with advanced technologies such as natural language processing (NLP), network security, and Robotic Process Automation (RPA). This will provide opportunities for software testing vendors.

Request customization of this research report at https://www.gminsights.com/roc/3382

- North America is expected to witness the highest growth during the forecast period. The region has a strong presence of leading tech companies including Apple, IBM, Amazon, and Microsoft that are continuously innovating and developing new products to increase their market penetration. This is expected to fuel the software testing industry growth over the forecast period.

- Some of the major players operating in the software testing industry are Wipro Limited, Capgemini, TCS, Tech Mahindra Limited, Qualitest, Microsoft, Infosys, IBM Corp., HCL Technologies, and Cognizant, among others.

- The companies operating in the software testing market are extensively engaged in growth strategies, such as mergers and acquisitions, to accelerate their product offerings and stay competitive in the market.

Partial chapters of report table of contents (TOC):

Chapter 3 Software Testing Industry Insights

3.1 Introduction

3.2 Industry segmentation

3.2.1 Software testing evolution

3.2.2 Manual software testing vs automated software testing

3.2.3 Patent landscape

3.2.4 Automation testing tools & platform analysis

3.2.4.1 Tosca Test Suite

3.2.4.2 Eclipse

3.2.4.3 Selenium

3.2.4.4 Ranorex

3.2.4.5 HPE Unified Functional Testing

3.2.5 AI integrated Automation testing tools & platform

3.2.5.1 Applitools

3.2.5.2 TestCraft

3.2.5.3 Functionize

3.2.5.4 Sauce Labs

3.2.5.5 Testim

3.3 Impact analysis of corona virus (COVID-19) pandemic on software testing market

3.3.1 Global outlook

3.3.2 Impact by region

3.3.2.1 North America

3.3.2.2 Europe

3.3.2.3 Asia Pacific

3.3.2.4 Latin America

3.3.2.5 MEA

3.3.3 Impact on industry value chain

3.3.4 Impact on competitive landscape

3.4 Industry ecosystem analysis

3.4.1 Automation testing tools/platforms

3.4.2 Testing service providers

3.4.3 Cloud service providers

3.4.4 Professional service providers

3.4.5 Managed service providers

3.4.6 End-use

3.5 Technology & innovation landscape

3.5.1 Codeless automation testing

3.5.2 AI & Machine learning for automation

3.5.3 IoT & Big data testing

3.6 Regulatory landscape

3.7 Industry impact forces

3.7.1 Growth drivers

3.7.1.1 Growing adoption of AI and ML in automation testing

3.7.1.2 Increasing adoption of DevOps methodology

3.7.1.3 Rising adoption of agile development environment for Quality Assurance and testing

3.7.1.4 Increase in consumption of mobile-based applications

3.7.1.5 Growing digitalization in developing economies

3.7.2 Industry pitfalls and challenges

3.7.2.1 Lack of skilled professionals

3.7.2.2 High implementation cost prevailing manual testing over automation testing

3.8 Growth potential analysis

3.9 Porter's analysis

3.9.1 Industry rivalry

3.9.2 Threat of new entrants

3.9.3 Buyer power

3.9.4 Supplier power

3.9.5 Threat of substitutes

3.10 PESTEL analysis

About Global Market Insights

Global Market Insights Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider; offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

Contact Us:

Arun Hegde

Corporate Sales, USA

Global Market Insights Inc.

Phone: 1-302-846-7766

Toll Free: 1-888-689-0688

Email: sales@gminsights.com

Related Images

Image 1: Software Testing Market size worth over $60 Bn by 2027

According to GMI report, the software testing market size is estimated to grow at over 7% CAGR from 2021 to 2027.

This content was issued through the press release distribution service at Newswire.com.

Attachment