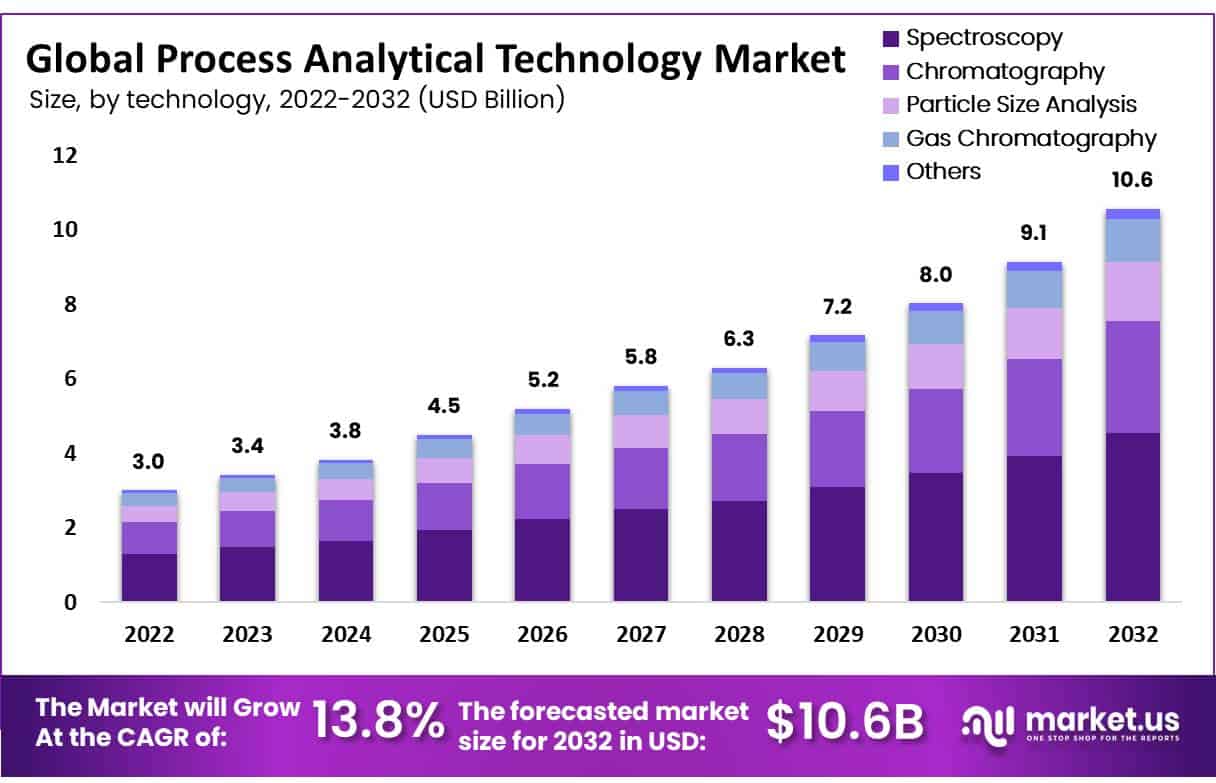

New York, April 18, 2023 (GLOBE NEWSWIRE) -- The global process analytical technology market size is expected to be worth around USD 10.6 billion by 2032 from USD 3.0 Billion in 2022, growing at a CAGR of 13.8% during the forecast period 2023 to 2032. Process Analytical Technology (PAT) is a system of tools, technologies, and strategies that are used in the manufacturing industry to monitor and control manufacturing processes in real time. The goal of PAT is to ensure that manufacturing processes are consistent and produce products that meet predefined quality standards. This may include the use of various sensors, process analyzers, and control systems that are integrated into the manufacturing process. By using PAT, manufacturers can optimize their processes and reduce the risk of product failure or non-compliance with regulatory standards.

Market.us has identified key trends, drivers, and challenges in the market, which will help clients improve their strategies to stay ahead of their competitors. - View a sample report @ https://market.us/report/process-analytical-technology-market/request-sample/

Key Takeaway:

- By technology, in 2022, the Process Analytical Technology market was dominated by the spectrography segment due to its increased usage.

- By product & service, the analyzers segment dominated the largest market share in product and service type analysis and accounted for the largest revenue share in the Process Analytical Technology market in 2022.

- By application, the large molecule segment dominated the largest market share in application type analysis.

- By measurement, in 2022, the in-line segment dominated the largest market share.

- By end-user, the pharmaceutical manufacturer's segment is dominated the largest market share in end-user analysis.

- In 2022, North America dominated the market with the highest revenue share of 33.8%.

- Europe is the fastest-growing market for PAT, driven by the growth of the pharmaceutical and biotechnology industries in the region.

Factors affecting the growth of the Process Analytical Technology industry?

- There are several factors that can have an impact on the growth of the Process Analytical Technology industry. Some of these factors include:

- Increased demand for quality control: The need for higher-quality products is driving the growth of the PAT industry. As the regulatory environment becomes more stringent and customers become more demanding, manufacturers are seeking ways to improve their production processes and ensure consistent quality.

- Advancements in analytical technology: Advances in analytical technology have made it possible to collect and analyze data in real time, enabling manufacturers to optimize their production processes and reduce waste. This has led to the development of new PAT tools and techniques that are more accurate, reliable, and cost-effective.

- Automation of manufacturing processes: The use of automation in manufacturing processes is driving the growth of the PAT industry. Automation has made it possible to collect and analyze large amounts of data in real time, allowing manufacturers to make better decisions and optimize their production processes.

- Rising healthcare costs: The rising cost of healthcare is driving the need for more efficient manufacturing processes in the pharmaceutical industry. PAT can help pharmaceutical manufacturers reduce costs by improving production efficiency, reducing waste, and ensuring consistent product quality.

- Increased awareness of environmental concerns: Environmental concerns are driving the need for more sustainable manufacturing processes. PAT can help manufacturers reduce waste and energy consumption, leading to more sustainable and environmentally friendly production processes.

To understand how Process Analytical Technology market report can bring a difference to your business strategy, Inquire about a brochure at https://market.us/report/process-analytical-technology-market/#inquiry

Market Growth

One of the key drivers of the growth of the PAT market is the increasing demand for quality control and assurance in the manufacturing industry. The need for consistent product quality and regulatory compliance is driving the adoption of PAT solutions across a range of industries, including pharmaceuticals, food and beverages, chemicals, and others. Advancements in analytical technology, such as the development of new sensors and data analytics tools, are also driving the growth of the PAT market. the market for Process Analytical Technology is expected to grow significantly in the coming years due to the increasing demand for quality control, advancements in analytical technology, and the need for consistent product quality and regulatory compliance across various industries.

Regional Analysis

The North American market for process analytical technology is expected to be the most lucrative, both in terms of revenue and market share, during the period 2022-2032. In 2022, the region saw a boom in process analytical technology due to the presence of major pharmaceutical, food and beverage, and chemical companies in the region. The high adoption of PAT solutions in the pharmaceutical industry, along with the stringent regulatory environment, is driving the growth of the market in this region. The regional market for Process Analytical Technology reached a revenue share above 33.8%.

The adoption of advanced analytics and process optimization technologies is driving the growth of the process analytical technology (PAT) market in North America, with the US being the largest market in the region. In Europe, the growth of the pharmaceutical and biotechnology industries is propelling the expansion of the PAT market, with Germany, France, and the UK being the largest markets for PAT in the region.

To know about the regional trends and drivers that will have an impact on the market - Request a sample report!

Scope of the Report

| Report Attribute | Details |

| Market Value (2022) | USD 3.0 Billion |

| Market Size (2032) | USD 10.6 Billion |

| CAGR (from 2022 to 2032) | 13.8% |

| North America Revenue Share | 33.8% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

Today, cancer is the leading cause of death worldwide. According to the World Health Organization (WHO), with around 10 million deaths in 2020 worldwide. It is the second leading cause. About one-sixth of worldwide deaths are caused by cancer. Additionally, 19.3 million cases of cancer were reported in 2020. This number is expected to rise to 30.2 million by 2040. Various cancers can be caused by factors like excessive alcohol consumption, tobacco use, unhealthy lifestyle, lack of exercise, and other conditions. The mortality rate can be decreased if cancer is detected early. Process Analytical Technology aids in identifying biomarkers and proteins that help in the detection of the disease. The most common cancer diagnostic tests are imaging, endoscopy, genetic testing, biopsy, and laboratory tests. Market growth is further supported by the increasing number of tests being performed.

Market Restraints

The market for Process Analytical Technology will face additional challenges over the forecast period because of the increased adoption of the refurbished diagnostic imaging system, strict regulatory guidelines, low benefit-to-cost ratio biomarkers, and higher capital investments. C.T. Scan is not recommended due to high radiation exposure and can cause helium shortage.

Market Opportunities

As the demand for quality control and process optimization increases in various industries, the prospects for process analytical technology (PAT) are also expected to grow. The development of innovative technologies such as portable spectroscopy, multi-dimensional chromatography, and microfluidics is expanding the capabilities of PAT and creating new opportunities for its application. The growth of emerging markets in regions such as Asia-Pacific and Latin America offers significant prospects for the expansion of the PAT market. With the costs of PAT technologies becoming more affordable, small and medium-sized enterprises (SMEs) are increasingly adopting these technologies to enhance their production processes and compete with larger companies.

Immediate Delivery Available | Buy This Premium Research Report@ https://market.us/purchase-report/?report_id=12431

Report Segmentation of the Process Analytical Technology Market

Technology Insight

The spectroscopy segment is the most dominated in the global process analytical technology market, contributing to 43.1% of the total revenue share in 2022. This technology provides real-time information about the chemical and physical properties of a product and includes sub-segments such as near-infrared spectroscopy, Raman spectroscopy, and Fourier transform infrared spectroscopy. The chromatography technology segment, which involves separating components from a mixture, is widely used in the pharmaceutical and biotechnology industries and accounted for a 10.3% CAGR in 2022.

Product & Service Insight

The analyzers segment is expected to be the most profitable, accounting for 32% of the market share in 2022. The sensors and probes product segment is estimated to have a CAGR of 11.3%. Analyzers are used to monitor process parameters such as temperature, pressure, and pH in various industries such as oil and gas, chemicals, and petrochemicals. This dedicated equipment is crucial in providing real-time analysis of process data.

Application Insight

The dominant segment in the global process analytical technology market is the large molecule segment. This segment pertains to the use of sophisticated analytical tools and technologies for the production and development of drugs based on large molecules, which include proteins, peptides, antibodies, and nucleic acids. The manufacturing processes for these types of drugs are complicated, and their analysis requires specialized analytical technologies capable of monitoring and regulating critical parameters.

Measurement Insight

The in-line segment is expected to be the most dominated in the global process analytical technology market, with the largest revenue share of 42.5% during the forecast period. On the other hand, the on-line segment is projected to have a CAGR of 11.3% during the forecast period. In-line measurement refers to the measurement of process parameters during the manufacturing process, while on-line measurement pertains to the measurement of process parameters outside the manufacturing process, but in close proximity to it.

End-User Insight

The pharmaceutical manufacturer's segment is projected to be the most profitable in the global process analytical technology market, with the largest revenue share of 32.5% during the forecast period. Meanwhile, the biotechnology manufacturers segment is expected to have the fastest growth during the forecast period. PAT tools and techniques are extensively used in the pharmaceutical industry to monitor drug production processes, maintain product quality, and enhance manufacturing efficiency.

If you want to get a better understanding of the report, you can access a PDF sample, which includes the complete table of contents, list of exhibits, selected illustrations, and example pages @ https://market.us/report/process-analytical-technology-market/request-sample/

Market Segmentation

Based on Technology

- Spectroscopy

- Molecular Spectroscopy

- Atomic Spectroscopy

- Mass Spectrometry

- Chromatography

- High-Performance Liquid Chromatography

- Gas Chromatography

- Others

- Particle Size Analysis

- Gas Chromatography

- Others

Based on Product & Service

- Analyzers

- Sensors & Probes

- Samplers

- Software & Services

Based on Application

- Small Molecules

- Large Molecules

- Manufacturing Applications

- Other Applications

Based on Measurement

- Off-line Measurement

- In-line Measurement

- At-line Measurement

- On-line Measurement

Based on End User

- Pharmaceutical Manufacturers

- Biopharmaceutical Manufacturers

- Contract Research and Manufacturing Organizations

- Other End Users

By Geography

- North America

-

- The US

- Canada

- Mexico

- Western Europe

-

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

-

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

-

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

-

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Competitive Landscape

The PAT market is highly competitive, with several key players operating in the market. These companies are focusing on various strategies such as new product development, partnerships, collaborations, and mergers and acquisitions to maintain their market position and increase their market share. Companies are also investing in research and development to develop innovative solutions and expand their geographical presence through partnerships and collaborations. For example, in 2020, PerkinElmer Inc. announced the launch of its new process analyzer, the Lactoscope FT-A, for milk and dairy analysis. This new product is expected to help the company increase its market share in the dairy industry.

Some of the major players include:

- PerkinElmer Inc.

- Shimadzu Corporation

- Carl Zeiss AG

- Mettler-Toledo International Inc.

- Emerson Electric Co.

- ABB Ltd.

- Danaher Corporation

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Bruker Corporation

- Sartorius AG

- Hamilton Company

- Repligen Corporation

Recent Development of the Process Analytical Technology Market

- In 2021- Agilent Technologies announced a collaboration with PureHoney Technologies to develop a new platform for rapid and comprehensive cannabis analysis.

- In 2021- Yokogawa Electric Corporation launched a new cloud-based PAT solution called "OpreX Analyzer".

- In 2021- ABB Ltd. launched a new PAT solution called "ABB Ability Smart Sensor for chemical dosing" which enables the efficient use of chemicals in industrial processes.

Browse More Related Reports:

- Healthcare Analytical Testing Services Market was valued at US$ 12.524 Billion in 2021. This market is expected to grow at 9.2% CAGR

- Liquid Analytical Instruments Market was valued at USD 489.21 mn in 2021 and is forecast to grow at a CAGR of 5.2% during 2022-2032.

- Biometric Seat Technology Market was valued at USD 211.2 million and is expected to reach USD 701.3 million in 2032.

- Downstream Processing Market accounted for USD 24,405 million in 2021. It is estimated to grow at a CAGR of 14.7% between 2023 to 2032.

- Business Process Outsourcing Market was valued at USD 245.9 billion in 2022 and expected to grow US$ 544.8 billion in 2032. Between 2023 and 2032 this market is estimated to register a CAGR of 8.5%.

- Blockchain Technology market was valued at USD 72 billion. Between 2023 and 2032, this market is estimated to register the highest CAGR of 68%

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us on LinkedIn | Facebook | Twitter

Our Blog: