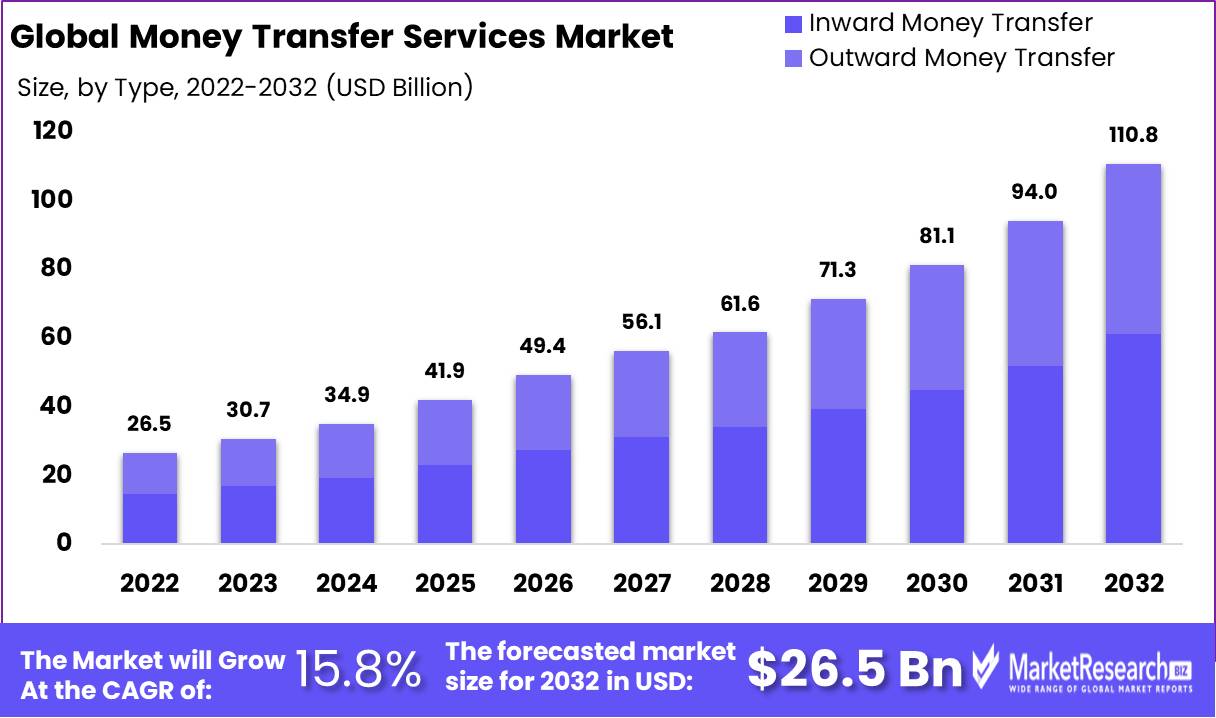

New York, April 21, 2023 (GLOBE NEWSWIRE) -- The global money transfer services market is estimated to be valued at USD 110.8 billion by 2032 from USD 26.5 billion in 2022. It is expected to exhibit a CAGR of 15.8% during the forecast period 2023 to 2032.

Global money transfer services are a method and platform for sending money from one person to another. These services transfer money between people inside the country or internationally. Money transfer services are provided by banks, financial institutions, online payment systems, and other companies which do money transfers.

Request a Money Transfer Services Market Report to find out more about the major revenue-generating segments at https://marketresearch.biz/report/money-transfer-services-market/request-sample/

Key Takeaway:

- On the base of Type, the inward money transfers segment seized a dominant position with a high revenue share.

- As per the channel analysis, the money transfer operators segment was the major market operator system in 2022.

- In terms of end-user, the personal end-users segment led the market in 2022.

- Geologically, Asia-Pacific held an important position with a market share of almost 40% in 2022.

- North America will grow at a significant CAGR from 2023-2032.

Some most popular money transfer services include wire transfers, PayPal, Venmo, and check services. These services' costs and transmission times can differ depending on the provider and the amount.

Factors Affecting the Growth of the Global Money Transfer Services Market

There are several factors that can affect the growth of the global money transfer services market. Some of these factors include:

- Globalization: As businesses become more global and people move to different countries for work or education, the need for cross-border money transfers has increased. This has led to an increase in demand for money transfer services, driving the industry's growth.

- Technological advancements: The advent of new technologies, such as mobile devices and the internet, has made it easier and more convenient for people to transfer money. Digital platforms and mobile applications have made it possible to transfer money instantly and securely, and these technologies are driving the growth of the money transfer market.

- Demographic shifts: The global population is becoming increasingly diverse, with more people moving to different countries and regions. As a result, there is a growing demand for money transfer services that cater to specific cultural and linguistic needs.

Top Trends in the Global Money Transfer Services Market

With the general acceptance of smartphones and the development of mobile banking apps, customers increasingly use their mobile devices to make payments and transfer money. Blockchain-based expenses have increased adhesion as a safer and clearer alternative to traditional payment methods in recent years.

Get a brochure to learn how the Money Transfer Services industry report can make a difference in your business strategy.@ https://marketresearch.biz/report/money-transfer-services-market/#inquiry

Market Growth

Favorable reimbursement conditions for medicines and treatment regarding technologies in the United States are expected to assist the market's growth. Tc-99m is derived from non-highly enriched uranium (HEU). It is an add-on payment provided by the Center for Medical Services (CMS) to hospitals for outpatient procedures. While the initiatives made it easier for patients to get diagnostic medicines used to treat diseases that can kill them. GE Healthcare announced that a new scanner with the latest innovative workflow feature would be available soon, and this scanner gives doctors a great view of pathology and cardiac anatomy to assist them to choose the right treatment for a patient.

Regional Analysis

The global money transfer market was dominated by Asia-Pacific in 2022 and is expected to see development at the highest rate due to the rising number of immigrants and growing acceptance of digital remittances due to fast-advancing technologies, developing customer expectations, and an exchanging regulatory background. The Region of North America is increasing rapidly due to traditional banks, financial organizations, and online payment platforms such as PayPal and Venmo.

Competitive Landscape

The Money transfer software achieves the transfer of money among businesses and between businesses and their clients. B2 B clients and money professionals mostly use money transfer software and transfers to make costs online. Many market players aim to support transactions in many languages, states, and currencies.

Market Key Players:

- Bank of America

- TransferWise Ltd.

- XOOM

- Western Union Holdings Inc.

- JPMorgan Chase & Co.

- Citigroup Inc.

- MoneyGram International Inc.

- RIA Financial Services Ltd.

- UAE Exchange

- Wells Fargo

- Other Key Players

Scope of the Report

| Report Attributes | Details |

| Market Value (2022) | USD 26.5 Billion |

| Market Size in 2032 | USD 110.8 Billion |

| CAGR (2023 to 2032) | 15.8% |

| Asia Pacific Revenue Share | 40.2% |

| North America Revenue Share | 22.8% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

The introduction of novel technologies, such as mobile devices and the internet, has prepared it easier and more suitable for people to transfer money. Digital platforms and mobile applications have made it possible to transfer money fast, and these technologies are driving the growth of the money transfer market.

Market Restraints

The global money transfer services market is restrained by various factor such Financial institutions may be essential to confirm the identity of their customers before allowing them to transfer money. This can include inviting personal info, such as a government-issued ID, a passport, or a utility bill. The purpose of these verification supplies is to prevent fake activity and confirm that the money being transferred is not related to criminal activity.

Market Opportunities

The attention of numerous industry competitors for launching new software in this market is one of the crucial driving forces. The growth of technological solid pipelines and the introduction of new products result from the rising demand for money transferring need. Also, most people with online money transferring encourages companies to introduce innovative goods to global market.

Grow your profit margin with Marketresearch.biz- Purchase This Premium Report at https://marketresearch.biz/purchase-report/?report_id=36088

Report Segmentation of the Global Money Transfer Services Market

Type Insight

In the global money transfer services market by type analysis, the inward money transfers segment dominated the market. This segment transfers money to the country or region from a different location using different digital channels. This type of transfer is mainly used by people who work in other countries and want to send money back home to their families.

Channel Insight

The money transfer operators segment held the highest CAGR. Around the globe, MTOs are non-bank financial organizations that study providing money transfer services. They deal with various services, including cash-to-cash transfers, bank transfers, and mobile money transfers. The MTOs are often used by persons who do not have entree to traditional banking services, such as immigrants or people living in country areas, which will likely anticipate increasing in the segment's growth during the forecast period.

End-User Insight

During the forecast period, it is anticipated that the personal end users segment will likely account for the fastest CAGR. This segment is mainly used by persons who need to transfer money for personal causes, such as paying bills, sending money to friends or family members, or making purchases. The small businesses segment will hold the second-largest share and continue to grow during the forecast period.

For more insights on the historical and Forecast market data from 2016 to 2032 - download a sample report at https://marketresearch.biz/report/money-transfer-services-market/request-sample/

Market Segmentation

By Type

- Inward money transfer

- Outward money transfer

By Channel

- Banks

- Money Transfer Operators

- Other Channels

By End User

- Personal

- Small Businesses

- Other End-Users

By Geography

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Recent Development of the Global Money Transfer Services Market

- In 2019, The company PayPal announced Xoom, a money transfer service that permits consumers to send money straight to bank accounts, mobile wallets, and cash pick-up sites in above 130 countries.

- In 2020, The digital platform Venmo announced its Instant Transfer service, which helps users rapidly transfer money to their bank account for a minor fee.

- In 2021, The big scale platform Wise (formerly TransferWise) went public, calling off on the London Stock Exchange with a market value of above $11 billion.

Related Reports

- Mobile wallet market is expected to value at more than US$ 0.5 Bn in 2019 and is expected to register a CAGR of 16.1%

- Real-time payments market is projected to be US$ 10.83 Bn in 2022 to reach US$ 119.0 Bn by 2031 at a CAGR of 30.5%.

- Voice-based payments market was valued at US$ 21.01 billion in 2020, and is projected to grow at a CAGR of 9.9%.

- Vietnam Mobile Payment market size is expected to be worth around US$ 197.2 Bn by 2031 from US$ 37 Bn in 2021, growing at a CAGR of 18.19% during the forecast period 2021 to 2031.

About Us:

MarketResearch.biz (Powered by Prudour Pvt. Ltd.) delivers customized research solutions by actuating its broad spectrum of research methodologies, databases, and resources, and this is further strengthened by our global experience in syndicated and customized industry projects. Our tailor-made research services include quick market scans, country reports, in-depth market analysis, competition monitoring, consumer research and satisfaction studies, supplier research, growth planning, and quite a lot more.

- Follow Us on LinkedIn: https://www.linkedin.com/company/marketresearch-biz/

- Follow Us on Facebook: https://www.facebook.com/marketresearch.biz

- Follow Us on Twitter: https://twitter.com/PrudourResearch