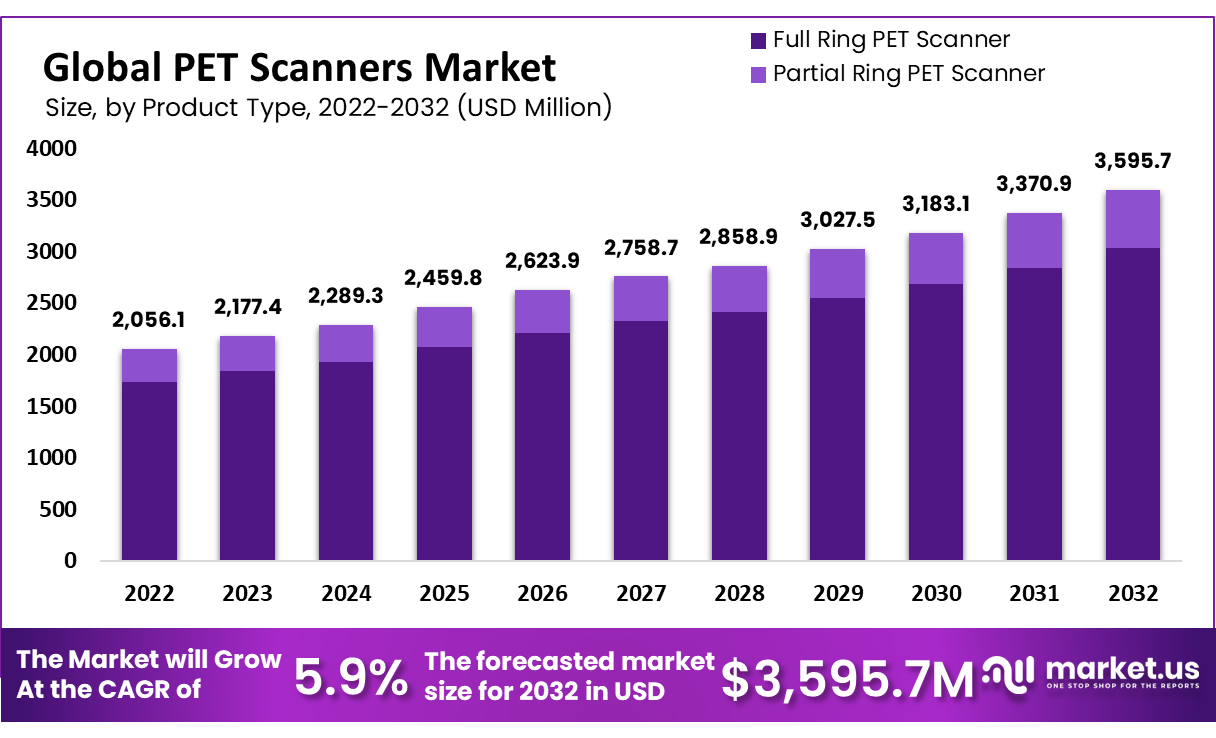

New York, June 28, 2023 (GLOBE NEWSWIRE) -- According to Market.us, the PET Scanners Market size is projected to surpass around USD 3,595.7 Million by 2032 From USD 2,056.1 and it is poised to reach a registered CAGR of 5.9% from 2023 to 2032.

PET imaging or a PET scan is also called Positron emission tomography. It is a type of nuclear medicine imaging. Technical advancement in PET Scanners Market is driving the growth of this market. Significant driving factors in this market are PET imaging for advanced diagnostics applications and oncology and increasing demand for PET analysis in radiopharmaceuticals.

Also, the expanding shift against image-guided acceptance and integration of X-ray tomography with PET is expected further to drive the development of the PET scanner market worldwide. PET scanners can generate three-dimensional (3D) images of abnormal cells, tissues, and organs to notice diseases similar to coronary artery disease, cancer, and brain diseases like epilepsy, Alzheimer's disease, dementia, etc. Changes in the human body are in contrast to structural changes seen in other imaging modalities.

To get additional highlights on major revenue-generating segments, Request the PET Scanners Market sample report at https://market.us/report/pet-scanners-market/request-sample

In real-time, a few radioactive tracers are injected into the patient's body to analyze cellular differences in tissues and organs. A PET scan followed by a CT or MRI scan is accomplished to create a high-contrast picture for proper diagnosis, cancer prognosis, decision support, and detection of seizures and other central nervous systems.

Key Takeaway

- By Product Type, full-ring PET scanners hold the largest market share in 2022 with 84.3%.

- By Modality, PET-CT dominated the market in 2022 with a significant share of 81.98%.

- By Application, the oncology segment dominated the market with 47.0% in 2022.

- By Detector Type, fluorodeoxyglucose was the dominating segment in 2022 and is expected to continue this trend during the forecasted period.

- By end-user, the hospital segment dominated the PET scanners market and held the largest revenue share of 47.13% in 2022.

- In 2022, North America dominated the global PET scanner market with a significant revenue share of 34.20%.

Factors affecting the growth of the PET Scanners industry

Several factors can have an impact on the growth of the PET Scanners industry. Some of these factors include:

- The lack of knowledge to use these devices could curb the growth of the market's positron emission tomography (PET)-computed tomography (CT) scanners over a forecast period.

- The huge expenditure required for these high-end scanners undoubtedly hampers the market growth. As a result, several market players make massive investments in installing new and advanced machines to faster the process, and in return, the cost is increased.

- An important challenge for the market is countries where the technology required to scan PTEs is less available.

- The increased prices of (PET) positron emission tomography are hampering the market growth.

- The temporary half-life of radioisotopes limits the development of the PET scanner market.

- Strict regulatory requirements for PET scanners are coming into the market. In addition, the low stock of radiopharmaceuticals is another obstacle to market growth.

Market Growth

The availability of Medicare PET coverage is a significant opportunity for the PET scanner market. It is estimated that increasing public and private funding to provide patients with the best treatment will drive the market in the years to come. Additionally, the progress of healthcare facilities in developing countries such as India and China will drive the market's growth.

PET is increasingly used in cardiology to visualize myocardial perfusion; hence, the increase in cardiovascular disease cases will contribute to the development of the market. The growth of healthcare facilities in countries like India and China will mainly drive the market's growth at a regional level.

Regional Analysis

Based on regional analysis, North America dominated the global PET scanner market with a significant % revenue share of 34.20% in 2022. This is because of rapid technological advances in the diagnostic and medical imaging sector and the advances in healthcare facilities developed in the region.

Additionally, the presence of significant market players, mergers among the players, FDA approvals, and new product launches are anticipated to boost the global PET scanner market growth. General Electric Company, Hitachi Ltd., Koninklijke Philips N.V., Mediso Ltd., PerkinElmer, Inc., Positron Corporation, Shimadzu Corporation, Siemens AG, Toshiba Corporation, Yangzhou Kindsway Biotech Co. Ltd are key market players of PET scanners market.

In 2022, the Global Pet Scanners Market was valued at US$ 2,056.1 Million. In 2023 and 2032, this market is estimated to register the highest CAGR of 5.9%.

Scope of the Report

| Report Attribute | Details |

| Market Value (2022) | USD 2,056.1 Million |

| Market Size (2032) | USD 3595.7 Million |

| CAGR (from 2023 to 2032) | 5.9% |

| North America Revenue Share | 34.20% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

Chemotherapy, surgery, and radiation therapy are just a few of the therapies available for cancer patients. Around the globe, PET-CT devices are increasingly being used to detect cancer. For example, in a trial of 98 patients with various types of cancer performed at large Asian hospitals, the PET - CT system effectively identified the presence of cancer 77% of the time.

Market Restraints

The ongoing reduction in reimbursement is anticipated to impede market development. Globally, declining payer funding for PET and SPECT procedures has reduced outpatient numbers, limiting patient access to high-quality, cost-effective imaging and diagnostic services and prompting physicians to seek alternative methods, such as PET-CT. According to the SNMMI (Society of Nuclear Medicine and Molecular Imaging), CMS (Centers for Medicare and Medicaid Services) suggested lowering the beta-amyloid PET translation factor 2021 from USD 34.89 2021 to USD 33.58 in 2022 in 2021.

Market Opportunities

The increase in incidence and prevalence of disorders such as Alzheimer's disease, cardiovascular diseases, and cancer are rising globally and generating the need for medical equipment such as PET scanner devices. This is one of the opportunities for the PET scanners market due to technological advancements. As a result, these devices are making high needs in developed and developing nations. In addition, these devices also provide anatomical and surgical information, which is very important for tumor patients.

To understand how our report can bring a difference to your business strategy, Inquire about a brochure at https://market.us/report/pet-scanners-market/#inquiry

Report Segmentation of the PET Scanners Market

Product Type Insight

Based on product category, the PET Scanners market is split into full-ring PET scanners and partial-ring PET scanners. Of these two types, full-ring PET scanners will account for 84.3% of the market in 2022. Over the projection period, the sector is anticipated to grow at a CAGR of 5%. Furthermore, because the full-ring PET scanner has no error and is inconvenient to use when the patient is scanned, next lying on the therapy bed proton, and the better temporal resolution (e.g., 300 ps) leads to lower errors even with a full-ring PET scanner, the segment is expected to hold a significant market share during the forecast period.

Modality Insight

PET-CT and PET-MRI are the two modality segments of the market. PET-CT led the market in 2022 with a substantial share of 81.98% and is expected to continue expanding at a CAGR of 5.5% until the projected period.

A PET-CT contains two scanning techniques: a traditional CT scan and a PET scan, which are used by advanced imaging technology and computer software to produce 3D images or color images of functional movements in the human body to diagnose disorders, whereas other treatment techniques generate images using x-rays or sound waves. A PET/CT method, which combines these technological advancements, enables professionals to swiftly and accurately identify, treat, and watch the disorder.

Application Insight

The PET scanners market is classified into Oncology, Cardiology, Neurology, and other uses based on application research. In 2022, the cancer sector will hold 47.0% of the market. This is due to an increase in the number of cancer patients globally and an increase in the demand for efficient and effective therapy options for decreasing radiation exposure. On the other hand, the cardiology sector is expected to expand at a 5.8% CAGR over the projected timeframe. This is due to the growing number of cardiovascular diseases and the expanding need for non-invasive methods to prevent and control cardiovascular diseases.

Detector Type Insight

Based on the detector type (FDG), fluorodeoxyglucose dominated the segment in 2022. This trend is expected to continue during the forecasted time due to increased fluorodeoxyglucose applications, decreased side effects, and the rise of chronic diseases.

End User Insight

Hospitals dominate the market for PET scanners. In 2022, 47.13% of PET scanners' revenue came from hospitals. The hospital segment is dominant in the market because there are many patients with chronic conditions. As a result, they have access to advanced diagnostic techniques that cannot be easily obtained, including PET scanners, which can quickly diagnose and treat chronic diseases.

To get additional highlights on major revenue-generating segments, Request the PET Scanners Market sample report at https://market.us/report/pet-scanners-market/request-sample

Market Segmentation

By Product Type

- Full Ring PET Scanner

- Partial Ring PET Scanner

By Modality

- PET-CT

- PET-MRI

By Application

- Oncology

- Cardiology

- Neurology

- Other Applications

By Detector Type

- Bismuth Germanium Oxide (BGO)

- Lutetium Oxyorthosilicate (LSO)

- Gadolinium Oxyorthosilicate (GSO)

- Lutetium Fine Silicate (LFS)

- Lutetium Yttrium Orthosilicate

By End-User

- Hospitals and Clinics

- Diagnostic Centres

- PET Centres

- Research Institutes

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Competitive Landscape

With many local and regional players, the market for PET scanners is fragmented. As a result, market players are subject to intense competition from top players, particularly those with strong brand recognition and high distribution networks. As a result, companies have gained various expansion strategies, such as partnerships and product launches, to stay on top of the market.

The following are some of the major players in the global PET scanners market industry:

- General Electric Company

- Hitachi Ltd.

- Koninklijke Philips N.V.

- Mediso Ltd.

- PerkinElmer, Inc.

- Positron Corporation

- Shimadzu Corporation

- Siemens AG

- Toshiba Corporation

- Yangzhou Kindsway Biotech Co. Ltd

- Other Key Players

Recent Development of the PET Scanners Market

- In March 2022, A diagnostic technology producer and researcher, Cerveau Technologies Inc., collaborated with Alector, LLC, to market its new imaging agent (MK-6240) for use in PET scanners to screen the evolution and status of neurofibrillary knots in the brain.

- In February 2021, Siemens Healthineers revealed a new Biograph Vision PET/computed tomography structure in February 2021, which was fixed at the Hospital of the University of Pennsylvania in Philadelphia, making it the first healthcare institution in the United States to organize so.

Browse More Related Reports

- Direct-to-Consumer(DTC) Pet Food Market Size Was To Reach USD 2.1 Billion In 2022 And is projected to reach a revised size of USD 18.6 Billion By 2032

- Pet Food Packaging Market is estimated to be worth USD 11,520 million in 2021 and will grow at 5.2% over the forecast period.

- Pet Toys Market is to grow from USD 8 billion in 2022 to USD 15 billion by 2032, at a CAGR of 6.7%. during the forecast period 2022-2032

- Pet Kennels Market is set to grow at a CAGR of 6.2% over the forecast period, The market is estimated at USD 1630 Million in 2023

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog:

- https://medicalmarketreport.com/

- https://chemicalmarketreports.com/

- https://techmarketreports.com/

- https://foodnbeveragesmarket.com/