Dublin, Oct. 27, 2023 (GLOBE NEWSWIRE) -- The "India Network as a Service (NaaS) Market, Competition, Forecast & Opportunities, 2029" report has been added to ResearchAndMarkets.com's offering.

The India network as a service (NaaS) Market is growing owning to the increasing data consumption, which has spurred the need to storage and process data efficiently along with rising government investment to provide NaaS. Vertical organizations deploy network services to efficiently use resources, minimize capital expenditures, improve service quality, and increase uptime.

The rapid increase in the number of devices that are being managed over multi and hybrid clouds are proliferating the demand for network as a service. In addition, the growing network complexity, increasing availability of skilled workforce, and operational and development cost advantage across various end-use industries have led to an increased focus on NaaS to overcome the situation of high data consumption.

Moreover, 5G infrastructure investments for fast network connectivity have further boosted the demand for NaaS. Government's measures such as Digital India initiative, emphasis on self-reliance, and adoption of advance technologies are further increasing the capability for NaaS. Many enterprises are adopting NaaS as a cost-effective solution.

Moreover, the market is anticipated to grow due to the rising demand for digital age networking, which enables businesses to progress toward digital transformation and produce new business outcomes by utilizing new digital age technologies such as the internet of things (IoT), cloud computing, and artificial intelligence (AI), thereby relying on different software. Additionally, the growing demand for data and high bandwidth capacity, especially due to increasing smartphone users promotes the development of the data center market of India.

A cloud service paradigm known as network as a service, or NaaS, allows clients to lease networking services from cloud providers. An intelligent and secure NaaS enables enterprises to enjoy the importance of greater flexibility, scalability, automation, predictability, and control to support the high-performance hybrid environment.

The network is one of the most critical components in a digital initiative. In general, NaaS is a business model for virtually subscribing to enterprise-wide area network services. Without having to maintain their own networking infrastructure, NaaS enables users to manage their own networks. NaaS can take the role of multiprotocol label switching connections, virtual private networks (VPNs), and other dated network architectures.

Additionally, it can replace the position of on-premises networking equipment such as load balancers and firewall appliances. The business networking architecture has been significantly impacted by NaaS, a more recent approach for traffic routing and enforcing security requirements. The NaaS paradigm with sophisticated management capabilities enables enterprises to depend on a reliable NaaS provider for non-differentiated, everyday network administration.

This improves the performance and security of corporate networks while freeing up IT personnel time for duties that enable business. Moreover, NaaS offers proactive network monitoring, security policy enforcement, powerful firewall and packet inspection capabilities, and time-series modelling of application and infrastructure performance.

Rapid Adoption of Cloud and Digital Transformation by Indian Companies

People are flocking to the cloud because of its scalability and low cost. Several cloud service providers across the world have revealed their availability zones in India, particularly in locations such as Hyderabad, Delhi (NCR), Chennai, Mumbai, and Bengaluru since they have strong fiber connection in addition to being close to clients.

Three availability zones (AZs) are being built by Amazon Web Services (AWS) in Hyderabad. Microsoft has purchased Hyderabad-area property tracts to establish a new data center zone. While 67% of the large enterprises already accelerated cloud adoption, 39% of medium-sized companies and 38% of small companies embarked on their cloud journey.

Moreover, Mumbai and Delhi-NCR are Google's two cloud computing hubs in India. Enterprises such as Yotta Infrastructure, NTT-Netmagic, STT GDC India, Sify Network as a Service (NaaS)s, and CtrlS are building hyperscale data centers and data center parks in India. Moreover, as cloud-managed services are a vital part of digital transformation, their demand will further expand in the coming years.

5G Will Increase Investments in NaaS

NaaS is gaining ground in the market due to the growing use of connected devices by consumers and businesses. In many Tier II and Tier III cities as well as in rural areas, this has resulted in a significant demand for higher-bandwidth internet, necessitating the implementation of NaaS to process information on comparison with big cities.

Over 25.2 percent of Indian population with 189 Indian cities had 5G coverage as of January 2023, with significant market participants, including Reliance Jio, Bharti Airtel, and Vodafone Idea. In 256 cities, Reliance Jio is offering 5G connection. Bharti Airtel is covering more than 80 cities, while Vodaphone is third.

Throughout India, companies such as Airtel are partnering up to design and build networks by using equipment from large enterprises such as Nokia, Ericsson, and Samsung. Moreover, the 5G implementation offers faster access to information, which will lead to more network services deployments due to the surge in data consumption and complexity.

Rising Demand for NaaS Fueling the Market Growth

The need for cloud-based solutions is increasing due to the use of technology and increasing customer preference for the cloud that allows users to access data remotely. The demand for cloud-based solutions in business is growing as more enterprises are realizing the importance of saving costs and resources by moving data to the cloud instead of building and maintaining on-premises infrastructure.

Over the past decade, NaaS has been heavily used by IT organizations, with a clear trend of adoption by non-IT organizations as well. This is due to the core principles of NaaS that help enterprises deal with complex network systems and processes within their organizations.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 74 |

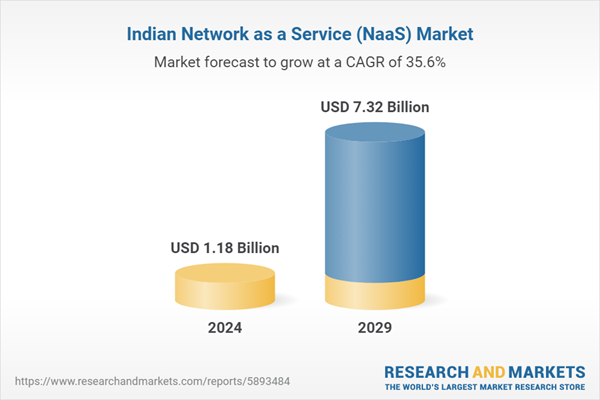

| Forecast Period | 2024 - 2029 |

| Estimated Market Value (USD) in 2024 | $1.18 Billion |

| Forecasted Market Value (USD) by 2029 | $7.32 Billion |

| Compound Annual Growth Rate | 35.5% |

| Regions Covered | India |

Competitive Landscape

- Wipro private Limited

- Verizon Communications India Private Limited

- Cisco Systems India Private Limited

- NEC Corporation India Private Limited

- Oracle Corporation

- Akamai Technologies India Pvt Ltd.

- Tata Communications Limited

- Palo Alto Networks (India) Pvt. Ltd.

- Cloudflare India Private Limited

- Amdocs Development Centre India Llp

Report Scope:

India Network as a Service (NaaS) Market, By Type:

- WAN-as-a-service

- LAN-as-a-service

India Network as a Service (NaaS) Market, By Service:

- Bandwidth on Demand (BoD)

- Wide Area Network (WAN)

- Virtual Private Network (VPN)

India Network as a Service (NaaS) Market, By End-User:

- IT & Telecom

- BFSI

- Healthcare

- Retail & E-Commerce

- Others (Government, Education etc.)

India Network as a Service (NaaS) Market, By Region:

- East India

- West India

- North India

- South India

For more information about this report visit https://www.researchandmarkets.com/r/m5hepg

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment