New York, Dec. 19, 2023 (GLOBE NEWSWIRE) --

Market Overview and Report Coverage

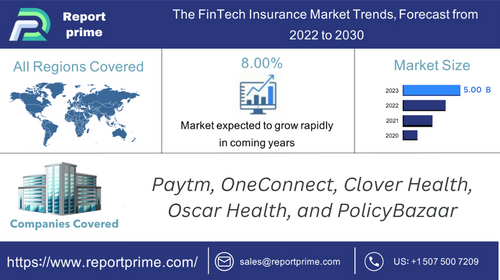

The FinTech Insurance market is a dynamic and rapidly evolving sector, as evidenced by recent market research reports that delve into its various facets. The reports highlight the current market conditions, shedding light on critical factors influencing the industry's growth.The FinTech Insurance Market is expected to grow from USD 5.00 Billion in 2022 to USD 9.24 Billion by 2030, at a CAGR of 8.00% during the forecast period.

The main findings of these reports underscore the escalating adoption of FinTech solutions in the insurance sector. The market is witnessing a surge in demand for advanced technologies, with a notable shift towards cloud-based solutions as opposed to traditional on-premise systems. This trend is indicative of the industry's readiness to embrace more agile and scalable solutions.

In terms of market segmentation, the FinTech Insurance landscape is categorized based on deployment type, including Cloud and On-Premise solutions. Cloud solutions are gaining prominence due to their flexibility and cost-effectiveness. Additionally, applications within the FinTech Insurance market cover a spectrum of services such as Fraud Detection, Customer Relationship Management, Cybersecurity, Payment Gateways, and Financial Transactions.

Geographically, the market has a widespread presence, with significant focus on key regions including North America (NA), Asia-Pacific (APAC), Europe, the United States (USA), and China. These regions are pivotal in driving the FinTech Insurance market's growth, each contributing to the overall momentum in unique ways. North America, for instance, serves as a hub for technological innovation, while Asia-Pacific showcases rapid adoption and integration of FinTech solutions. Europe and the United States are witnessing a surge in investments and partnerships, contributing to the sector's overall development. China, with its burgeoning insurtech landscape, is emerging as a key player in the global FinTech Insurance market.

In the regulatory and legal domain, factors specific to market conditions play a crucial role in shaping the industry. Compliance with evolving regulations and adapting to legal frameworks are key considerations for FinTech Insurance companies to ensure sustainable growth and consumer trust.

In conclusion, the FinTech Insurance market research reports provide valuable insights into the industry's current state, offering a comprehensive overview of market conditions, key findings, and recommendations for stakeholders navigating this dynamic landscape.

Get a Sample PDF of the Report: https://www.reportprime.com/enquiry/sample-report/13361

The FinTech Insurance Market Trends and Market Analysis

FinTech Insurance, or insurtech, refers to the integration of technology and innovation to enhance and streamline various aspects of the insurance industry. This includes leveraging digital platforms, artificial intelligence, and data analytics to offer more efficient, customer-centric, and tailored insurance solutions.

The target market for FinTech Insurance is broad, encompassing both consumers and businesses seeking more accessible, transparent, and personalized insurance products. The future outlook for FinTech Insurance is optimistic, with an increasing trend toward digitalization and a growing demand for innovative insurance solutions. The market is poised for continued expansion as technological advancements reshape traditional insurance models.

Companies operating in the FinTech Insurance market, such as Paytm, OneConnect, Clover Health, Oscar Health, and PolicyBazaar, are at the forefront of driving industry transformation. These companies leverage technology to improve customer experiences, simplify underwriting processes, and enhance risk management.

Recent trends in the FinTech Insurance market include the adoption of artificial intelligence for more accurate risk assessment, the use of blockchain for secure and transparent transactions, and the rise of insurtech partnerships with traditional insurance companies.

However, the industry faces challenges, including regulatory hurdles, data security concerns, and the need for increased customer education on these innovative insurance solutions. Overcoming these challenges will be crucial for the sustained growth and success of the FinTech Insurance market.

Inquire or Share Your Questions If Any Before the Purchasing This Report- https://www.reportprime.com/enquiry/pre-order/13361

Top Featured Companies Dominating the Global |The FinTech Insurance| Market

The competitive landscape of the FinTech Insurance market features prominent players such as Paytm, OneConnect, Clover Health, Oscar Health, and PolicyBazaar, each contributing uniquely to the industry's evolution.

- Paytm: Paytm, a leading digital payments platform, has ventured into the insurance sector, offering a range of insurance products through its platform. Its extensive user base provides a significant market reach.

- OneConnect: OneConnect focuses on leveraging technology to enhance insurance operations. As a provider of insurance technology solutions, it plays a crucial role in streamlining processes for insurers and promoting digital transformation.

- Clover Health: Clover Health utilizes data-driven insights and technology to improve the efficiency of healthcare and insurance services. Its emphasis on data analytics contributes to personalized and effective health insurance solutions.

- Oscar Health: Oscar Health, known for its tech-driven health insurance services, utilizes data analytics and a user-friendly digital platform to offer transparent and consumer-centric health coverage, disrupting traditional health insurance models.

- PolicyBazaar: PolicyBazaar is a prominent online insurance aggregator, providing users with a platform to compare and purchase insurance policies. Its user-friendly interface and extensive product offerings contribute to market growth.

Lemonade reported $68 million in premiums in 2019, representing a 140% increase compared to the previous year. Meanwhile, ZhongAn reported $648 million in gross written premiums for the first half of 2020, a 9.5% increase compared to the same period in 2019. PolicyBazaar has been growing rapidly, reporting a 40% increase in revenue in 2019.

In terms of Product Type, the FinTech Insurance market is segmented into:

- Cloud

- On-Premise

The types of FinTech Insurance deployment, namely Cloud and On-Premise solutions, play pivotal roles in driving market demand. Cloud-based FinTech Insurance offers enhanced flexibility, scalability, and cost-effectiveness, allowing companies to adapt swiftly to evolving industry needs. On the other hand, On-Premise solutions provide a more localized and controlled infrastructure. The shift towards Cloud solutions is fueled by the need for agility, accessibility, and reduced operational costs, amplifying demand in the FinTech Insurance market. This technological flexibility ensures that companies can efficiently meet the dynamic demands of the insurance landscape, contributing to the sector's growth and innovation.

Purchase this Report https://www.reportprime.com/checkout?id=13361&price=3590

In terms of Product Application, the FinTech Insurance market is segmented into:

- Fraud Detection

- Customer Relationship Management

- Cybersecurity

- Payment Gateway

- Financial Transactions

The application of FinTech Insurance spans key areas: Fraud Detection, Customer Relationship Management, Cybersecurity, Payment Gateways, and Financial Transactions. FinTech Insurance utilizes advanced analytics for Fraud Detection, ensuring prompt identification of irregularities. In Customer Relationship Management, it enhances client interactions through personalized, tech-driven solutions. Cybersecurity safeguards sensitive data, while Payment Gateways and Financial Transactions streamline and secure monetary exchanges. The fastest-growing application segment, in terms of revenue, is Cybersecurity. As cyber threats increase, the FinTech Insurance market experiences a surge in demand for robust security solutions, making Cybersecurity a critical and lucrative application within the industry.

The FinTech Insurance Market Regional Synopsis

The FinTech Insurance market demonstrates robust growth across key regions. North America (NA) and Europe witness significant advancements due to tech adoption and regulatory support. The Asia-Pacific (APAC) region, notably China, experiences exponential growth driven by digitalization and a burgeoning insurtech landscape. The USA, being a major player in tech innovation, contributes substantially. While all regions contribute, China and APAC are expected to dominate the FinTech Insurance market, with an estimated combined market share exceeding 40%. This dominance is fueled by rapid technological adoption, rising insurtech startups, and an increasing demand for innovative insurance solutions in these dynamic markets.

Reasons to Purchase the FinTech Insurance Market Research Report:

- Market Insight: Gain a comprehensive understanding of current FinTech Insurance market conditions.

- Trends Analysis: Stay updated on the latest industry trends and emerging technologies.

- Competitive Landscape: Assess the competitive environment and benchmark against key players.

- Strategic Decision-Making: Make informed business decisions based on detailed market intelligence.

- Risk Mitigation: Identify potential risks and challenges in the FinTech Insurance sector.

- Opportunity Assessment: Explore growth opportunities and areas for market expansion.

Purchase this Report https://www.reportprime.com/checkout?id=13361&price=3590