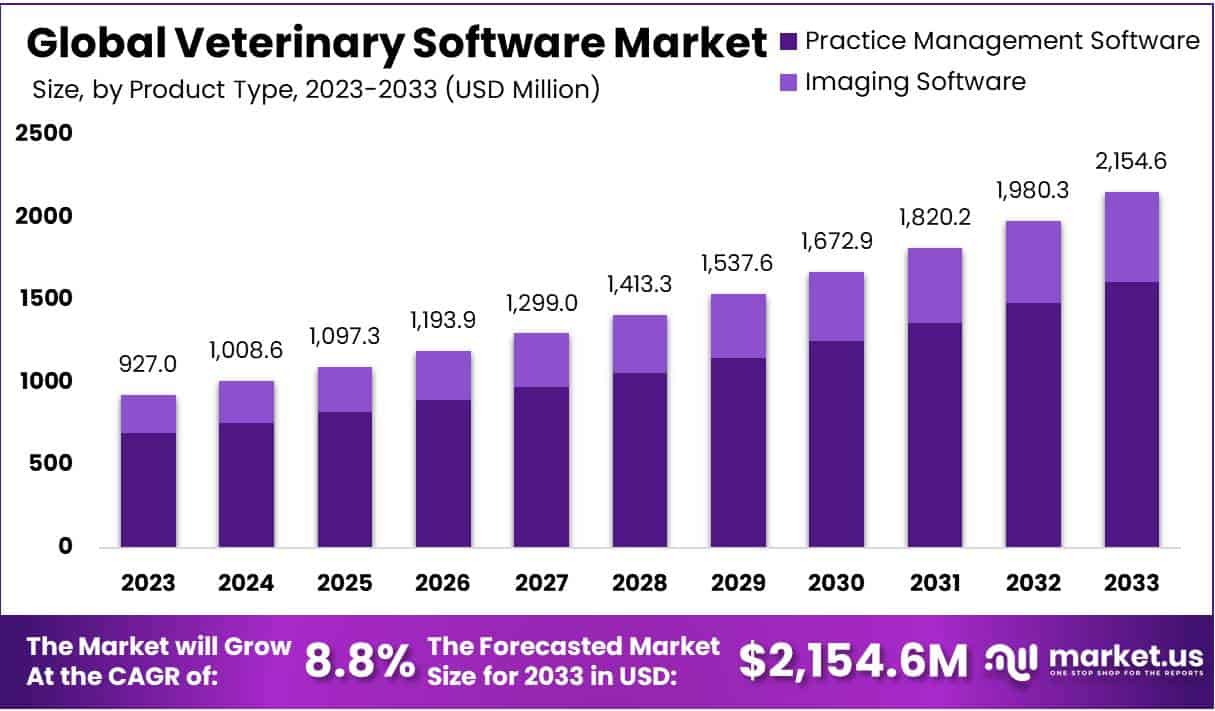

New York, Jan. 03, 2024 (GLOBE NEWSWIRE) -- According to the market.us, the Veterinary Software Market Size is poised for substantial growth, with a projected value of around USD 2,154.6 Million by 2033. This reflects a noteworthy surge from its estimated worth of USD 927 Million in 2023. Over the forecast period from 2023 to 2032, the market is expected to demonstrate a Compound Annual Growth Rate (CAGR) of 8.8%, underscoring the increasing demand for and adoption of veterinary software solutions in the industry. This robust expansion speaks to the evolving landscape and heightened interest in such technological solutions within the veterinary sector.

Veterinary software, a specialized suite for animal healthcare practices, enhances efficiency by digitizing patient records, managing appointments, and handling billing. Offering electronic health records and appointment reminders, optimizes operations, fostering improved patient care. The market's growth, driven by increased pet ownership and technological advancements, integrates cloud computing and AI. Compliance with regulatory standards and the demand for secure electronic health records further fuel adoption. The COVID-19 pandemic accelerated telemedicine adoption, transforming veterinary services globally.

Access a comprehensive market analysis featuring key trends, drivers, and challenges, empowering clients to optimize their strategies and outshine competitors. Check out the PDF sample report @ https://market.us/report/veterinary-software-market/request-sample/

Key Takeaway

- Market Growth: The Veterinary Software Market is on a trajectory to hit a whopping USD 2,154.6 Million by 2032, showcasing a sturdy 8.8% Compound Annual Growth Rate (CAGR) from 2023 to 2032.

- Product Type Dominance: Practice Management Software takes the lead with a substantial 74.8% market share, underscoring the industry's commitment to operational efficiency. Imaging Software, though smaller in market share, is experiencing significant growth.

- Practice Type Dominance: Small Animals claim a lion's share of 58%, benefitting from increased awareness of advanced healthcare management for pets. Mixed Animals, catering to both small and large animals, make a substantial contribution, showcasing the adaptability and versatility of software solutions.

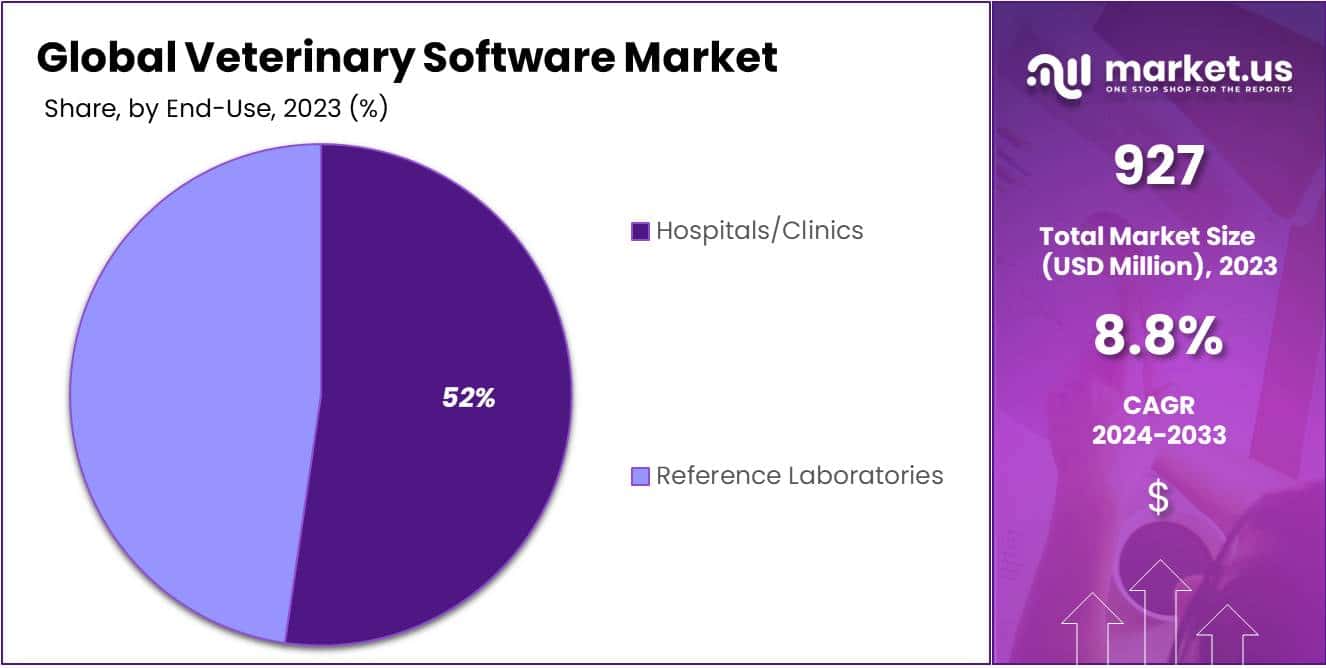

- End-use Dominance: Hospitals and clinics command a significant 52.3% of the market share, highlighting the pivotal role of advanced technological solutions in veterinary healthcare services.

- Regional Vanguard: North America leads the charge with an impressive 41% market share, driven by advanced practices, seamless technological integration, and a robust culture of pet ownership.

Factors affecting the growth of the Veterinary Software industry

The veterinary software industry has seen substantial growth, propelled by factors like technological advancements and the surge in pet ownership. Integration of cloud computing, AI, and machine learning has enhanced software functionality. The increasing awareness of pet health and the trend of pet ownership have fueled demand for efficient veterinary management solutions. Compliance with industry regulations is critical, and veterinary software facilitates secure data management and accurate documentation. Telemedicine adoption has risen, enabling remote consultations and enhancing accessibility. The shift to electronic health records improves accuracy and communication among veterinary professionals.

Efficiency in practice management is a key driver, with veterinary software offering tools for scheduling, billing, and inventory management. The industry focuses on preventive care, and software aids in tracking and managing preventive care schedules. Educational resources and training programs contribute to increased adoption, as veterinary professionals become familiar with software benefits. Market competition drives innovation, with companies introducing new features and specialized solutions. The globalization of veterinary services necessitates standardized, interoperable software for cross-border communication and collaboration. In this dynamic sector, the interconnectedness of veterinary professionals worldwide continues to shape the growth trajectory of veterinary software.

Regional Analysis

In 2023, North America has emerged as a dominant force in the Veterinary Software Market, securing a commanding share of over 41%, translating to a substantial market value of USD 378.1 million. This leadership is attributed to the region's advanced technological landscape, fostering the rapid adoption of innovative veterinary software solutions. With a robust digital infrastructure and tech-integrated healthcare facilities, North America prioritizes operational efficiency and superior patient care. The culture of heightened animal welfare awareness, coupled with a strong pet-owner bond, propels the demand for specialized software tools. Favorable regulatory standards, emphasizing data management and healthcare quality, incentivize investments in cutting-edge solutions. The market's consolidation is further strengthened by strategic collaborations and the presence of key players, making North America a focal point for veterinary software advancements.

To explore the transformative potential of our report for your business strategy, inquire more about the report https://market.us/report/veterinary-software-market/#inquiry

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 927 Million |

| Forecast Revenue 2033 | USD 2154.6 million |

| CAGR (2024 to 2033) | 8.8% |

| North America Revenue Share | 41% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The increasing demand for streamlined veterinary practice management is fueled by the rising need for efficient administrative processes, including appointment scheduling, billing, and medical record management. Technological advancements in veterinary care, such as sophisticated software solutions and digital imaging tools, contribute to improved accuracy in diagnoses and treatments. The growing rates of pet adoption drive the demand for software that can handle the expanding volume of patient data. Additionally, regulatory compliance requirements in the veterinary sector are pushing clinics to adopt digital solutions, ensuring adherence to standards and facilitating paperless operations for enhanced efficiency.

Market Restraints

Implementing veterinary software presents challenges, notably for smaller clinics with constrained budgets, as high initial costs cover training and system integration. Resistance to technology adoption, especially among older practitioners accustomed to traditional methods, hampers widespread software use. Concerns over data security, with a rising reliance on digital platforms, further impede adoption. The lack of standardized practices in the veterinary industry complicates software development, making it difficult to create universally applicable solutions that seamlessly integrate into diverse clinic workflows.

Market Opportunities

The incorporation of telemedicine functionalities into veterinary software offers a significant growth prospect by improving access to care through remote consultations, particularly beneficial in underserved rural areas. Another promising avenue lies in integrating artificial intelligence and machine learning into veterinary software, revolutionizing diagnostics, and treatment planning through image analysis and personalized treatment recommendations. With the globalization of veterinary services, software developers have an opportunity to create solutions aligning with international standards and regulations, facilitating cross-border collaborations. Additionally, the integration of veterinary software with wearable technologies allows for real-time health monitoring, empowering veterinarians with crucial data for informed decision-making.

Get Quick Delivery | Invest in Our Premium Research Report https://market.us/purchase-report/?report_id=29619

Report Segmentation of the Veterinary Software Market

Product Type Insight

In 2023, Practice Management Software has taken a leading position in the Veterinary Software Market, commanding a substantial 74.8% share. This software segment proves instrumental in streamlining administrative tasks, and providing user-friendly interfaces for efficient appointment management, billing, and patient records. Additionally, Imaging Software, though with a smaller share, has shown significant growth, contributing to technological advancements in veterinary diagnostics. Together, these segments drive the market's evolution, emphasizing operational efficiency through Practice Management Software and the growing importance of advanced diagnostic tools with Imaging Software, shaping the future of veterinary software solutions.

Practice Type Insight

In 2023, the veterinary software market thrived with diverse practice types contributing to its expansion. The Small Animals category, dominated by pets like dogs and cats, secured a significant 58% market share due to heightened pet owner awareness. The Mixed Animals segment, handling both small and large animals, played a substantial role, offering versatile software solutions. The Equine segment focused on horse healthcare, demonstrated steady growth with tailored software solutions. Food-producing Animals, addressing livestock and farm animals, met rising demands for comprehensive health management. The Other Types category, encompassing exotic animals and emerging practices, showed promising growth, reflecting the evolving landscape of veterinary care.

End-use Insight

In 2023, the Veterinary Software Market saw notable trends, with Hospitals/Clinics dominating at over 52.3%, emphasizing their crucial role in offering comprehensive veterinary care. These establishments, serving as primary points of contact for pet owners, fuel the robust adoption of veterinary software. Meanwhile, Reference Laboratories, although not as dominant, claim a substantial market share, reflecting their growing importance in diagnostic testing and research. Anticipated shifts in the market point towards continued growth, with Hospitals/Clinics maintaining dominance, while Reference Laboratories are expected to experience accelerated expansion, highlighting the collective commitment to advancing veterinary care through innovative software solutions.

Access a comprehensive market analysis featuring key trends, drivers, and challenges, empowering clients to optimize their strategies and outshine competitors. Check out the PDF sample report @ https://market.us/report/veterinary-software-market/request-sample/

Market Segmentation

Product Type

- Practice Management Software

- Imaging Software

Delivery Mode

- On-premise

- Cloud/Web-based

Practice Type

- Small Animals

- Mixed Animals

- Equine

- Food-producing Animals

- Other product Types

End-use

- Hospitals/Clinics

- Reference Laboratories

By Geography

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Recent Developments in the Veterinary Software Market

- In May 2023, Henry Schein strengthened its position by acquiring Vetstream, a company specializing in veterinary solutions like clinical reference info and practice management software.

- In September 2023, IDEXX Labs launched VetConnect Plus, a cloud-based software to boost veterinary practice management, offering tools for client management, appointments, medical records, and inventory.

- In February 2023, Zoetis and Covetrus merged, creating a global animal healthcare powerhouse with a diverse portfolio covering prevention, diagnostics, treatment, and overall care.

- In March 2023, Vets First acquired Practice-Web, reinforcing its role in veterinary marketing and communications. Practice-Web focuses on website design, SEO, and social media services for veterinarians.

Competitive Landscape

In the ever-changing Veterinary Software Market, various influential players play crucial roles in shaping the industry. Despite offering diverse services, these companies collectively contribute to the industry's growth and development. Their presence not only brings depth to the market but also promotes healthy competition and encourages ongoing innovation.

Market Key Players

- IDEXX Laboratories Inc.

- Hippo Manager Software Inc.

- Antech Diagnostics Inc. (Mars Inc.)

- Esaote SpA

- Henry Schein Inc.

- Patterson Companies Inc.

- ClienTrax

- Digitail Inc

- Vetspire LLC (Thrive Pet Healthcare)

- DaySmart Software

- VitusVet

- Nordhealth AS

Browse More Related Reports

Homeopathic Veterinary Medicines Market Size is projected to reach a valuation of USD 198.91 Mn by 2032 at a CAGR of 5%, from USD 122.12 Mn in 2022.

Veterinary Supplements Market Size is expected to be worth around USD 4.1 Billion by 2033, from USD 2.2 Billion in 2023, growing at a CAGR of 6.3% during the forecast period from 2023 to 2033.

Veterinary Electrosurgery Market Size was worth USD 517.5 Million and is projected to reach USD 1,001 Million by 2032. It is estimated to register the highest CAGR of 7.0% between 2023-2032.

Veterinary Vaccines Market Size is expected to be worth around USD 22.1 Billion by 2032, growing at a CAGR of 7.2% during the forecast period from 2022 to 2032.

Animal Health Market Size is expected to be worth around USD 239 Bn by 2032 from USD 150 Bn in 2022, growing at a CAGR of 4.9% during the forecast period from 2022 to 2032.

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us on LinkedIn

Our Blog: