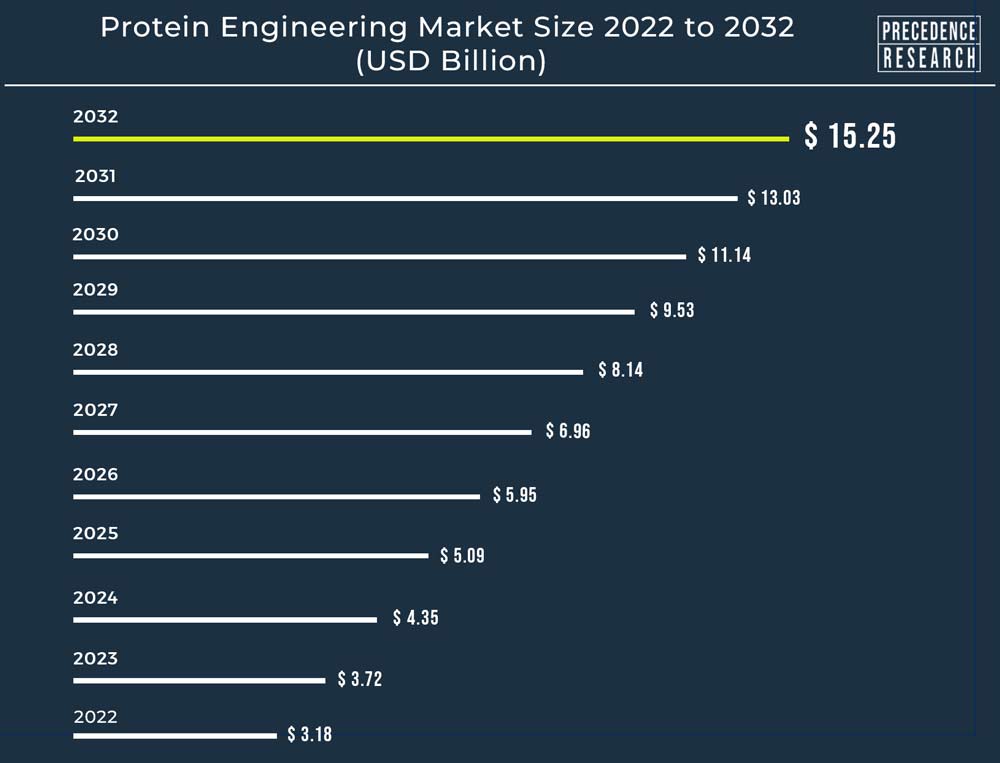

Ottawa, Jan. 05, 2024 (GLOBE NEWSWIRE) -- The global protein engineering market size was valued at USD 3.72 billion in 2023, grew to USD 4.35 billion in 2024 and the industry is expected to grow at a remarkable CAGR of 16.97% between 2023 and 2032.

Protein isolates in their pure form have found applications in several industries, including pharmaceuticals, healthcare, food and beverages, textiles, research and development, etc. Some of the most common commercial forms of protein include pharmaceutical drugs, dietary supplements and energy substitutes, rapid testing kits, and others. Despite their widespread use, scientists indulge in research to develop a better and more advanced variant of the product. This can be obtained by techniques such as genetic variation or post-translation modification and is collectively referred to as protein engineering.

The protein engineering market deals with the sum total of organizations involved in the development and commercialization of products and services associated with synthetically engineered proteins. The global market has grown steadily in the past few decades due to the growing demand for protein-based products in various industries. This multidomain growth is also supported by increasing collaborations between market players, business and trade-benefiting policies, offshoring practices, financial initiatives in the form of grants and investments, and digital advertisements and sales platforms. A global trend for protein-based industrial alternatives, along with upcoming technological advancements in the form of artificial intelligence (AI) and automation, are expected to generate new avenues for the market in the near future.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/2767

The healthcare sector is one of the largest end-users of the protein engineering market. This can be primarily attributed to the growing prevalence of several ailments and developing awareness emerging on the tracks of the 2019 pandemic. As the prevalence of chronic conditions such as cancers and metabolic disorders increases, researchers turn to protein-based pharmaceuticals to provide temporary or complete relief. The same is observed in the case of infectious diseases. The growing ageing population and associated physical and neurodegenerative conditions also support the development of novel protein-based products with unique properties in the pharmaceutical domain.

Growth Factors

Proteins are a family of macromolecules composed of individual amino acid units. Biologically, these complex molecules play a vital role in maintaining a cell's functional and structural integrity as well as several regulatory functions of the organism's tissues and organs. Researchers often target these components to combat chronic conditions such as cancers. 2023 witnessed around four million new diagnoses of cancer and over one million related deaths in America alone, according to the American Cancer Society. Categorized as one of the largest contributors of global morbidities and deaths, cancer generates significant revenue in the pharmaceutical sector. Modification of structural proteins of the cancerous cells helps the body to penetrate the cell or neutralize its immuno-protective effects. For instance, Abevmy (bevacizumab), a biosimilar launched by Biocon Biologics Ltd. and Viatris Inc. in May 2022, offer substantial results for cancer.

Within the pharmaceutical sector, protein-based therapeutics, including vaccines, monoclonal antibodies, peptides, hormones, coagulation factors and enzymes, have attracted the attention of clinical researchers participating in drug development processes for various indications. The overall popularity of the protein-based class of drugs is largely attributed to the myriad clinical benefits presented over traditional drugs. These include reduced toxicity, elevated target specificity, and promising safety profiles.

Market players are rapidly expanding their protein-based products and services portfolios via frequent launches and development activities due to the growing preference for protein-based pharmaceuticals in contemporary medicine and the ever-increasing investment by biopharmaceutical companies in protein engineering procedures. A good example of a bioengineered protein-based treatment alternative is ELFABRIO enzyme replacement therapy by Chiesi Global Rare Diseases and ProTalix BioTherapeutics. ELFABRIO received US FDA approval for the treatment of Fabry disease in adult patients.

Collaborative ventures between market players are a major factor driving the growth of the protein engineering market. The partners often pool their technical specialization and other financial and non-financial resources to significantly enhance their market standing. For instance, Generate Biomedicines & Amgen entered a research partnership in January 2022 to develop protein therapies for five targets. As per the collaborative agreement, Amgen will fund US 50 million dollars for the initial stage with approximately US 1.9 billion dollars in potential transaction value and future royalties. Such developments are anticipated to become a significant protein expression market growth determinant.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Regional insights:

North America holds the dominating share of the protein engineering market. The region's high healthcare spending and the demand for innovative therapies drive investment in protein engineering. Investors and venture capitalists in North America often prioritize biotech and life sciences companies, fostering a conducive funding environment. North America has been at the forefront of technological advancements, including those in biotechnology and protein engineering. The region's access to cutting-edge technologies and infrastructure facilitates the development of novel protein-based therapeutics and technologies.

North America, particularly the United States, is a global hub for research and development in the life sciences and biotechnology sectors. Many leading pharmaceutical and biotech companies are headquartered or have a significant presence in the region, contributing to advancements in protein engineering. Market’s leading players including Amgen Inc., Thermo Fisher Scientific, Genscript Biotech Corp and PerkinElmer Inc are headquartered in the United States that contribute to the market’s growth.

Product Insights

The instrument segment held the largest share of the market in 2022. Protein engineering involves the manipulation and modification of proteins for various applications, including therapeutics and industrial processes. Advanced instruments and tools are crucial for conducting experiments, analyzing protein structures, and optimizing protein functions. Ongoing technological advancements in instrumentation may lead to more precise and efficient protein engineering processes.

Instruments used in the drug discovery process, such as mass spectrometers, liquid chromatography systems, and other analytical tools, contribute to the dominance of the instrument segment. Automation in protein engineering laboratories is becoming more prevalent. Automated instruments and robotic systems can streamline workflows, reduce human error, and increase the overall efficiency of protein engineering processes. The integration of automation technologies contributes to the prominence of the instrument segment.

Technology Insights

The rational protein design segment holds the largest market share of the protein engineering market. Rational protein design involves using computational methods and an understanding of protein structure-function relationships to design proteins with specific desired properties. This approach allows for a more precise and predictable manipulation of protein structures compared to traditional methods. Rational protein design enables researchers to make targeted modifications to proteins, aiming for specific improvements in stability, binding affinity, catalytic activity, or other functional characteristics. This targeted approach is valuable in customizing proteins for various applications, including therapeutics and industrial processes.

Personalized your customization here: https://www.precedenceresearch.com/customization/2767

Protein Type Insights

The monoclonal antibodies segment held the dominating share of the market in 2022. Monoclonal antibodies have been widely used for therapeutic purposes. They are designed to target specific proteins or cells involved in diseases, making them effective in treating conditions such as cancer, autoimmune disorders, and infectious diseases. The therapeutic potential of mAbs has driven significant research and development in this segment. Monoclonal antibodies are a key component of immunotherapy, a rapidly advancing field in cancer treatment. Immunotherapies aim to harness the body's immune system to target and eliminate cancer cells. Engineered mAbs, such as immune checkpoint inhibitors, have shown promising results in various cancers.

End User Insights

The pharmaceutical and biotechnology companies segment dominates the protein engineering market. Protein engineering is crucial in the development of novel drugs and therapeutic proteins. Pharmaceutical and biotechnology companies invest heavily in research and development to create new and improved medications. Engineered proteins can be designed for various therapeutic purposes, such as treating cancer, autoimmune diseases, and genetic disorders. Protein engineering allows for the design of targeted therapies that specifically interact with disease-related proteins. This precision is particularly important in the treatment of complex diseases where traditional approaches might have limitations. Pharmaceutical companies are at the forefront of developing these targeted therapies.

Market Potential

This multidomain expansion of the protein engineering market is primarily supported by collaborations and acquisitions by market players, state grants and policies, and upcoming AI technologies and automation. In May 2023, the World Health Organization (WHO) signed a memorandum of understanding with the Republic of Korea to establish a global epicenter for biomanufacturing training purposes. This consideration by the governmental sector is predicted to profit significantly the low to middle-income nations by providing expertise in the production of biologicals, including vaccines, insulin, monoclonal antibodies, and cancer treatments.

Personalized drugs and other protein-based products expose pharmaceuticals to lucrative business opportunities. Capitalization on such options allows the companies to gain footing in the competitive market. In February 2022, an e-commerce platform named Tierra Protein was introduced by Tierra Biosciences. This new service will enable consumers to design personalized protein engineering items, get them verified, and deliver them to them. This fluidity in therapeutics attracts a massive crowd to the company's website, largely contributing to its revenue.

Industrial adoption of novel technologies drives the growth of the overall market. In the protein engineering market, the rising implementation of machine learning, artificial intelligence, and automation helps enhance the productivity of the drug discovery process. Increasing demand for frequent discoveries of new drugs is driving the demand for automation and technological advancements in the market. For example, NVIDIA decided to expand their generative AI cloud services for customizing AI foundation models in March 2023. Such initiatives aimed to accelerate the creation of new proteins and therapeutics potentiate the market's future growth.

Protein Engineering Market Report Scope:

| Report Coverage | Details | |

| CAGR (2023-2032) | 16.97 | % |

| Market Size in 2023 | USD 3.72 Billion | |

| Market Size by 2032 | USD 15.25 Billion | |

| Base Year | 2022 | |

| Historical Year | 2020-2021 | |

| Forecast Period | 2023-2032 | |

| Largest Market | North America | |

| Segments Covered | By Product, By Technology, By Protein Type, and By End-User | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa | |

We've prepared a service to help you write your own Go-To-Market strategy.

Click to Unlock Your GTM Strategy for the Protein Engineering Market

Browse More Insights:

Medical Tubing Market: The global medical tubing market size was estimated at US$ 9.37 billion in 2021 and is expected to hit US$ 20.45 billion by 2030, growing at a CAGR of 9.1% during the forecast period from 2022 to 2030.

Environmental Biotechnology Market: The global environmental biotechnology market is surging, with an overall revenue growth expectation of hundreds of millions of dollars from 2023 to 2032.

3D Cell Culture Market: The global 3D cell culture market size accounted for USD 1.42 billion in 2022 and it is expected to hit around USD 5.29 billion by 2032, poised to grow at a compound annual growth rate (CAGR) of 14.1% during the forecast period 2023 to 2032.

Cell Culture Media Market: The global cell culture media market size reached USD 5.48 billion in 2022 and is expected to attain around USD 16.84 billion by 2032, growing at a CAGR of 11.89% between 2023 and 2032.

Tissue Engineering Market: The global tissue engineering market size accounted for USD 11.81 billion in 2022 and it is expected to hit around USD 33.38 billion by 2032, expanding at a CAGR of 11% during the forecast period 2023 to 2032.

Industry Spotlight

- In July 2022, Beijing Luzhu Biotechnology and Maxvax Biotechnology discussed their respective progress in raising funds for the vaccine research and development programs. Maxvax raised roughly US 74 million dollars to support multiple clinical trials of its vaccine pipeline.

- In July 2022, Vicinitas Therapeutics raised US 65 million dollars in series A funding.

- In June 2023, Astellas Pharma signed an agreement with Cullgen for research to discover multiple innovative protein degraders.

- In August 2022, BioIVT acquired Cypex's product range of proteins, which complements BioIVT's drug research and development solutions.

- In September 2022, Leaf Expression Systems entered a licensing agreement with KBio. Under the terms of the deal, KBio planned to integrate Leaf's technologies into its plant-based platform to develop novel protein-based therapeutics.

- In February 2023, Gland Pharma decided to expand its Genome Valley facility near Hyderabad. The company's expansion plan includes additional capabilities at its existing facility to manufacture biologicals, antibodies, biosimilars, and recombinant insulin.

Key Market Players:

- Amgen, Inc.

- Agilent Technologies

- Bruker Cor.

- Thermo Fisher Scientific, Inc.

- PerkinElmer, Inc.

- Waters Corp.

- Bio-Rad Laboratories

- Merck KGaA

- Danaher Corp.

- GenScript Biotech Corp.

Company Synopsis

1. Agilent technologies

Agilent is a prominent leader in the life sciences, diagnostics, and applied chemical markets. The company diligently serves laboratories globally by providing a comprehensive range of instruments, services, consumables, applications, and expertise. This unwavering commitment enables customers to acquire the insights they actively pursue.

2. Danaher Corp.

Danaher is a leading company in the life sciences and diagnostics innovator ecosystem. It helps solve several of the world’s most critical health challenges. It aims to simultaneously improve the quality of life for numerous people while consolidating the foundation of a healthful and more sustainable future.

3. Merck Group

The Merck Group, generally referred to as Merck, includes a complex network of around 250 facilities. This is a German multinational company that deals with science and technology and is headquartered in Darmstadt, Germany. With operations spread across 66 countries, Merck boasts a workforce of about 60,000 talented and hardworking employees. The group is divided into three primary segments: Healthcare, electronics, and life sciences. Merck operates in Europe, Asia, Oceania, Africa, and the Americas, with research and development centers in Darmstadt, Tokyo, Boston, and Beijing, as well as other minor facilities in Taiwan, Israel, France, South Korea, India, and the UK. Merck's 2022 report shared its financial earnings. Its net sales were 22,232 million euros, which is 12.9% higher than its 2019 sales of 19,687 million euros.

4. Thermo Fisher Scientific, Inc.

Thermo Fisher Scientific, a worldwide enterprise boasting a workforce of 80,000+, specializes in delivering medical equipment, analytical instruments, and services tailored for research and diagnostics. Their product is about portfolio spans Cell Culture Media, Chemicals, and Chromatography Columns. According to the latest financial report of 2023, the company holds a substantial market cap of $188.36 billion. Future projections for 2023 predict a 1% growth in the core organic revenue generating $42.7 billion and an adjusted EPS of $21.5. In April 2022, Thermo Fisher Scientific launched the GMP-manufactured Gibco CTS TrueCut Cas9 Protein to help researchers meet stringent quality requirements when using genome editing tools.

Market Segmentation:

By Product

- Instruments

- Reagents

- Software & Services

By Technology

- Rational Protein Design

- Directed Evolution

- Hybrid Approach

- De Novo Protein Design

- Others

By Protein Type

- Insulin

- Monoclonal Antibodies

- Vaccines

- Colony Stimulating Factor

- Coagulation Factors

- Other Proteins

By End-User

- Academic Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2767

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real Time Data Intelligence Tool, Visit: www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

For Latest Update Follow Us: