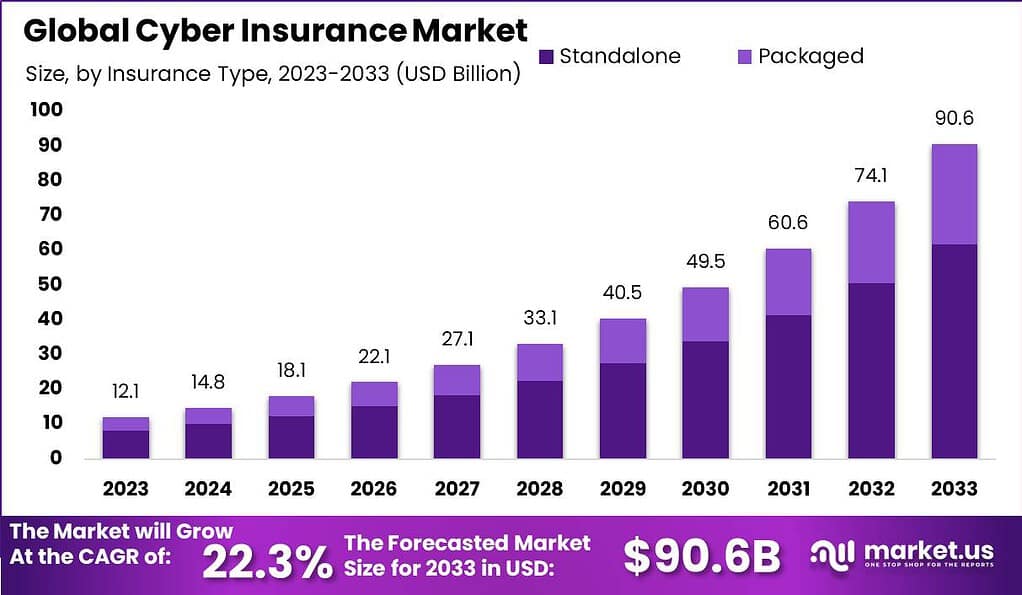

New York, Jan. 10, 2024 (GLOBE NEWSWIRE) -- The Global Cyber Insurance Market size was projected to be USD 12.1 billion in 2023. By the end of 2024, the industry is likely to reach a valuation of USD 14.8 billion. During the forecast period, the global market for cyber insurance is expected to garner a 22.3% CAGR and reach a size of USD 90.6 billion by 2033.

Cyber insurance refers to a type of insurance coverage that protects businesses and individuals against financial losses and liabilities resulting from cyber-attacks, data breaches, and other cyber incidents. It helps organizations manage and mitigate the risks associated with cyber threats by providing financial compensation for various costs, including data breach response, legal fees, regulatory fines, business interruption, and customer notification.

The cyber insurance market encompasses the industry and ecosystem surrounding cyber insurance products and services. It includes insurance companies, brokers, underwriters, risk assessors, cybersecurity firms, and legal experts. These stakeholders collaborate to offer insurance policies, assess cyber risks, provide risk management services, and assist policyholders in the event of a cyber incident.

The report provides a full list of key companies, their strategies, and the latest developments. Download a PDF Sample before buying

Key Takeaways

- The global cyber insurance market is projected to reach USD 90.6 billion by 2033, with a steady CAGR of 22.3% during the forecast period from 2024 to 2033.

- Standalone cyber insurance policies dominated the market in 2023, capturing over 68.2% market share due to their customized coverage for cyber threats.

- Third-Party Coverage accounted for over 62.1% of the market, emphasizing the importance of protecting businesses from claims resulting from data breaches or cyber incidents.

- Large Enterprises constituted a dominant segment with over 72.4% share, prioritizing comprehensive cyber insurance coverage.

- The BFSI sector led the market with a 28.3% share due to its extensive handling of sensitive financial data.

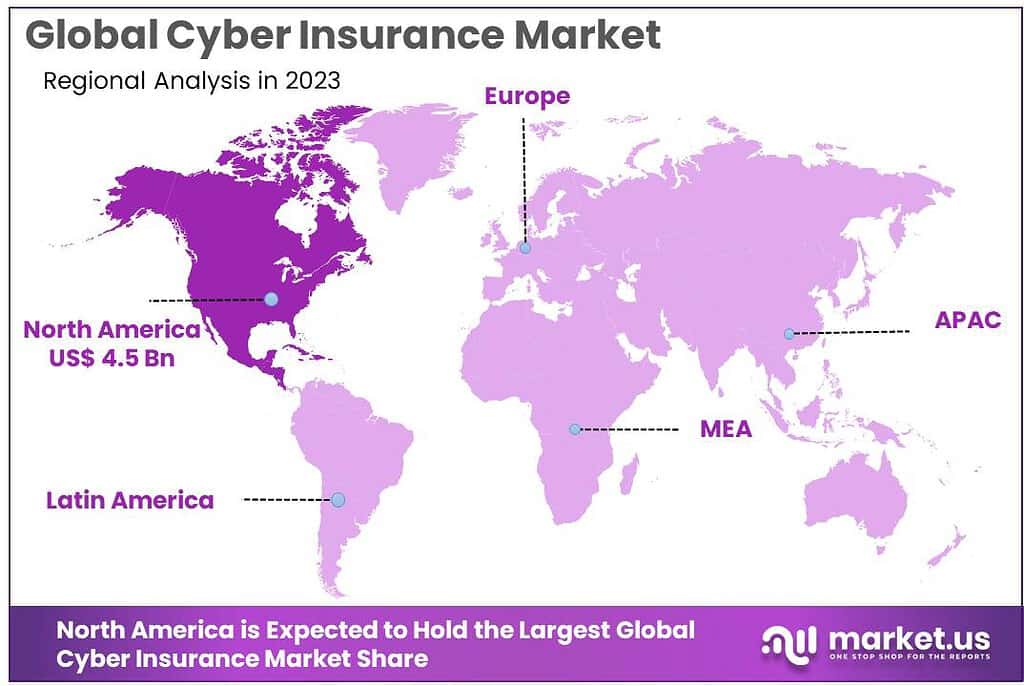

- North America commanded a significant revenue share of 37.6%, followed by Europe and the Asia-Pacific region, highlighting their proactive approach in investing in comprehensive cyber insurance solutions.

- Market players like American International Group, Inc., Aon PLC, The Chubb Corporation, and others are developing advanced risk assessment tools and predictive analytics to offer precise and tailored cyber insurance policies.

Get deeper insights into the market size, current market scenario, future growth opportunities, major growth driving factors, the latest trends, and much more. Buy the full report here

Several factors contribute to the growth of the cyber insurance market

- Rising cyber threats and attacks: The proliferation of cyber threats such as data breaches, ransomware attacks, and other forms of cybercrime has created a greater awareness of the need for cyber insurance. High-profile cyber incidents and the potential financial losses associated with them have pushed organizations to seek insurance coverage against these risks.

- Evolving regulatory environment: Governments and regulatory bodies worldwide are enacting stricter data protection and privacy regulations. Compliance with these regulations often requires organizations to have cyber insurance coverage as a risk mitigation measure. This regulatory pressure has driven the demand for cyber insurance.

- Increasing financial impact of cyber incidents: Cyber incidents can result in significant financial losses for organizations, including costs associated with data breach response, legal fees, regulatory fines, reputational damage, and business interruption. As the financial impact of cyber incidents becomes more apparent, businesses are turning to cyber insurance as a means of transferring some of these risks.

- Growing awareness and understanding of cyber risks: There is a growing recognition among organizations of all sizes and industries that cyber risks are a real and substantial threat to their operations. This increased awareness has led to a greater understanding of the need for cyber insurance and its role in managing cyber risks effectively.

Scope

| Report Attributes | Details |

| Market Value (2023) | US$ 12.1 Billion |

| Forecast Value 2033 | US$ 90.6 Billion |

| CAGR (2023 to 2032) | 22.3% |

| North America Revenue Share | 37.6% |

| Biggest market | Banking, Financial Services, and Insurance (BFSI) |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

Report Segmentation

Insurance Type Analysis

In 2023, the Standalone Segment held a dominant market position in the cyber insurance market, capturing more than a 68.2% share. This segment's substantial market share can be attributed to its focused and comprehensive coverage against cyber threats. Standalone cyber insurance policies are tailored specifically to address the complex and evolving nature of cyber risks, offering coverage for a wide range of incidents including data breaches, cyber theft, ransomware attacks, and business interruption due to cyber incidents. These policies are particularly favored by large organizations and industries that are highly susceptible to cyber threats, such as finance, healthcare, and retail, where the impact of a cyber-attack can be significantly detrimental.

Coverage Type Analysis

In 2023, the Third-Party Coverage segment held a dominant market position in the cyber insurance market, capturing more than a 62.1% share. This significant market share is largely due to the increasing demand for liability protection against cyber incidents. Third-party cyber insurance policies are designed to cover liabilities and legal costs that arise from breaches affecting customers' or other parties' data. This includes legal defense costs, settlements, and judgements related to data breaches, network security failures, and violations of privacy policies. The growth of this segment is propelled by the heightened regulatory environment, with stringent data protection laws like GDPR in Europe, mandating robust cybersecurity measures. Businesses, especially those handling sensitive customer data, are increasingly investing in third-party coverage to mitigate the financial risks associated with potential lawsuits and regulatory penalties.

Enterprise Size Analysis

In 2023, the Large Enterprises Segment held a dominant market position in the cyber insurance market, capturing more than a 72.4% share. This significant dominance is largely attributed to the high level of cyber risk exposure that large enterprises face due to their vast and complex digital infrastructure. Large businesses, often operating globally, are prime targets for cyberattacks due to the valuable data they possess and their extensive reliance on digital processes. To mitigate these risks, large enterprises invest heavily in comprehensive cyber insurance policies that provide extensive coverage for a range of potential cyber incidents, including data breaches, network disruptions, and cyber extortion. These policies are tailored to cover the substantial financial risks involved, including loss of revenue, legal liabilities, and recovery costs.

Industry Vertical Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) Segment held a dominant market position in the cyber insurance market, capturing more than a 28.3% share. This significant market share is primarily due to the critical nature of the data handled by these industries and their high vulnerability to cyber attacks. Financial institutions hold sensitive customer information and engage in substantial online transactions, making them prime targets for cybercriminals. The BFSI sector, therefore, heavily invests in cyber insurance policies to mitigate the financial and reputational risks associated with data breaches, online fraud, and operational disruptions. These policies cover a range of liabilities, including legal fees, customer compensation, and recovery costs, ensuring business continuity and compliance with regulatory standards.

Request Sample Report and Drive Impactful Decisions: https://market.us/report/cyber-insurance-market/request-sample/

Key points related to the cyber insurance market are as follows:

Driving Factors:

- Increasing Cyber Threats: The rise in cyber-attacks, data breaches, and ransomware incidents has heightened awareness among businesses about the potential financial and reputational damages. This drives the demand for cyber insurance as a risk mitigation strategy.

- Evolving Regulatory Landscape: Governments and regulatory bodies worldwide are implementing stricter data protection and privacy regulations, imposing significant penalties for non-compliance. Cyber insurance helps organizations comply with these regulations and cover potential fines and legal costs.

- Growing Dependency on Technology: Businesses heavily rely on digital infrastructure, cloud services, and interconnected systems, making them more vulnerable to cyber risks. The need for cyber insurance arises from the recognition that traditional security measures alone may not be sufficient to protect against sophisticated cyber threats.

- Risk Transfer and Financial Protection: Cyber insurance provides a means of transferring and mitigating financial risks associated with cyber incidents, giving businesses peace of mind and a safety net when facing potential losses.

Restraining Factors:

- Lack of Cyber Risk Awareness: Some organizations may not fully comprehend the potential consequences of cyber incidents or underestimate their vulnerability, leading to a lower demand for cyber insurance.

- Complex Risk Assessment: Assessing cyber risks and determining appropriate coverage can be challenging due to the ever-changing threat landscape and the complexity of cybersecurity vulnerabilities and controls. This complexity may deter businesses from obtaining cyber insurance.

- Affordability and Coverage Limitations: The cost of cyber insurance premiums, especially for smaller businesses, can be a barrier to adoption. Additionally, policy coverage may have limitations, exclusions, and deductibles that organizations need to carefully evaluate.

- Insufficient Historical Data: The relatively new nature of cyber insurance makes it challenging to accurately predict and price cyber risks. Insurers may face limitations in developing actuarial models and rely on limited historical data for underwriting cyber insurance policies.

Growth Opportunities:

- Expansion of the Cyber Insurance Market: The increasing frequency and severity of cyber incidents offer growth opportunities for the cyber insurance market as businesses recognize the need for comprehensive coverage against evolving cyber threats.

- Industry-Specific Policies: Tailoring cyber insurance policies for specific industries, such as healthcare, finance, or manufacturing, can address unique risks and compliance requirements, providing targeted solutions to businesses in different sectors.

- Risk Management Services: Insurers can expand their offerings by providing holistic risk management services, including cybersecurity assessments, incident response planning, and employee training, to help policyholders proactively manage cyber risks.

- Collaboration with Cybersecurity Firms: Partnerships between insurers and cybersecurity firms can enhance the effectiveness of cyber insurance policies by integrating risk assessment services, threat intelligence, and incident response capabilities.

Challenges:

- Rapidly Evolving Cyber Threats: Cyber threats are continuously evolving, and new attack vectors emerge regularly. Keeping up with the evolving threat landscape poses a challenge for insurers to accurately assess and price cyber risks.

- Uncertain Loss Quantification: Estimating potential financial losses resulting from a cyber incident can be difficult due to intangible factors such as reputational damage, customer churn, and long-term business impact. Quantifying these losses accurately is a challenge for insurers and policyholders alike.

- Limited Standardization: The absence of standardized terminology, policy language, and coverage frameworks in the cyber insurance market can create confusion and inconsistencies, making it challenging for businesses to compare policies and make informed decisions.

- Insufficient Cybersecurity Measures: Inadequate cybersecurity practices and controls within organizations can increase the likelihood of cyber incidents and impact the insurability and pricing of cyber insurance policies.

Key Market Segments

Insurance Type

- Standalone

- Packaged

Coverage Type

- First-Party Coverage

- Third-Party Coverage

Enterprise Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

Industry Vertical

- IT & Telecommunications

- BFSI

- Healthcare

- Retail & E-Commerce

- Government

- Other Industry Verticals

Top Key Players in the Cyber Insurance Market

The competitive landscape of the Market has also been examined in this report. Some of the major players include:

- American International Group, Inc.

- Aon PLC

- The Chubb Corporation

- Zurich Insurance Group Ltd

- Allianz SE

- AXIS Capital Holdings Limited

- Beazley PLC

- Lockton Companies, Inc.

- Munich Re Group

- The Travelers Companies, Inc.

- CNA Financial Corporation

- Liberty Mutual Group

- Other Key Players

For details on companies and their offerings "Buy a report"!

Regional Analysis

In 2023, North America held a dominant market position in the cyber insurance market, capturing more than a 37.6% share. This leading position can be attributed to the region's advanced technological infrastructure, the presence of major global corporations, and heightened awareness of cyber threats. The United States, in particular, has seen a significant uptick in cyber insurance adoption due to the increasing frequency of cyber attacks and stringent regulatory requirements for data protection. Canadian and other North American businesses also contribute to this trend, investing heavily in cyber insurance to safeguard against the financial repercussions of data breaches and cyber-attacks.

By Geography

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Explore more ongoing coverage in the Information and Communications Technology Market Reports Domain:

- Same Day Delivery Market is projected to expand from USD 10.1 Billion in 2023 to USD 66.8 Billion by 2033, at CAGR of 20.8%.

- Machine Learning Operations (MLOps) Market is likely to attain a valuation of USD 75.42 Billion by 2033, Develop at a CAGR of 2.60%.

- Capacitive Sensors Market is anticipated to be USD 74.3 bn by 2033. It is estimated to record a steady CAGR of 7.1% in the forecast period.

- HR Analytics Market is likely to top a valuation of USD 9.9 billion in 2032 at a CAGR of 13.4% between 2023 and 2032.

- Electric Powertrain Market size is expected to be worth around USD 1,015 bn by 2032 from USD 103 bn in 2022, grow at a CAGR of 26%.

- Digital Remittance Market leading to a projected CAGR of 15.0%, estimated to gain a valuation of approximately USD 77.7 Billion by 2032.

- Drone Package Delivery Market size was reached at USD 64,926.9 bn by 2032 and is expected to grow at a growth rate (CAGR) of 47.5%.

- Dental Practice Management Software Market size is projected to surpass at USD 6.88 Billion by 2032; growing at a CAGR of 11.89%.

- Multi-factor Authentication Market is expected to be valued at USD 49.7 in 2032, from USD 14.4 Bn in 2023 with a CAGR of 15.2%.

- Testing, Inspection and Certification Market is projected to be USD 224.9 Bn in 2022 to reach USD 349.3 Bn by 2032, at a CAGR of 4.5%.

- Online Food Delivery Market is expected to reach around USD 483.9 billion by 2032; this market is estimated to register a CAGR of 12%.

- Artificial Intelligence Market is valued to be worth USD 177 billion in 2023 and it is expected to grow at a CAGR of 36.8% from 2023-2032

- Generative AI in Content Creation Market is anticipated to be USD 175.3 billion by 2033. It is estimated to record a steady CAGR of 31.2%

- Power Electronics Market will exceed USD 94.21 billion by 2032 with a projected compound annual growth rate (CAGR) of 8.3%.

- Aircraft Manufacturing Market size is projected to surpass at USD 641.6 Bn by 2033 and it is growing at a CAGR of 4.7% from 2024 and 2033.

- Commercial Drones Market is anticipated to be USD 125.9 billion by 2033. It is estimated to record a steady CAGR of 29.9%.

- Interactive Whiteboard Market was valued at US$ 4.2 Bn in 2023 and is expected to reach around USD 7.6 billion in 2032; highest CAGR of 7.1%.

- Semiconductor Intellectual Property (IP) Market is projected to be worth USD 11.3 billion by 2032, growing at a CAGR of 6.7%.

- 5G fixed wireless access market accounted for USD 24.6 Bn in 2023 and is projected to reach USD 411.5 Bn by 2032, with a CAGR of 38%.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: