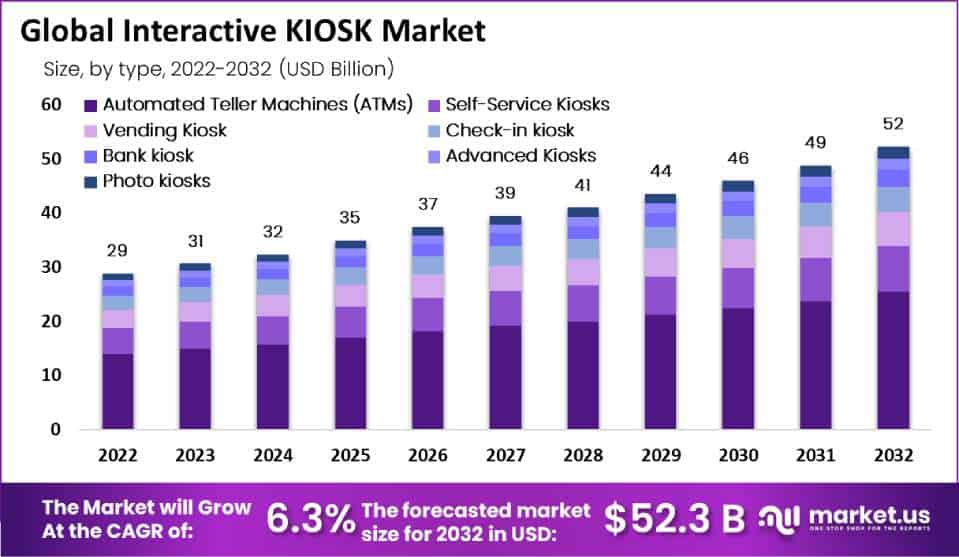

New York, Jan. 11, 2024 (GLOBE NEWSWIRE) -- According to Market.us, The Global Interactive KIOSK Market is projected to be worth USD 31 billion in 2023. The market is likely to reach USD 52 billion by 2032. The market is further expected to surge at a CAGR of 6.3% during the forecast period 2023 to 2032.

Interactive kiosks are self-service devices that allow users to access information, perform transactions, or interact with digital content in a public setting. These kiosks typically feature a touch screen interface, multimedia capabilities, and various peripherals like card readers, printers, or barcode scanners. The interactive kiosk market encompasses the industry and ecosystem around the development, deployment, and utilization of these self-service devices.

Analyst Viewpoint for Interactive KIOSK Market

The Interactive Kiosk market, from an analyst's viewpoint, is on a trajectory of substantial growth, driven by several key factors. Firstly, the increasing demand for self-service in various customer service sectors plays a crucial role. These kiosks offer convenience and efficiency, particularly in retail, healthcare, and banking sectors, where they improve customer experience by reducing wait times and streamlining transactions. Studies reveal that approximately 78% of customers are inclined towards digital interactions and the use of technology to enhance their in-store experiences. Moreover, more than 60% of customers express a preference for digital interactive self-service solutions.

Get a Complete and Professional Sample PDF @ https://market.us/report/interactive-kiosk-market/request-sample/

Key Takeaways

- The Interactive Kiosk market reached USD 52.3 billion by 2032, with a CAGR of 6.3% between 2023 and 2032

- Automated Teller Machines (ATMs) accounted for more than 48.6% of the total market revenue in 2021, followed by Self-Service Kiosks and Vending Kiosks, among others.

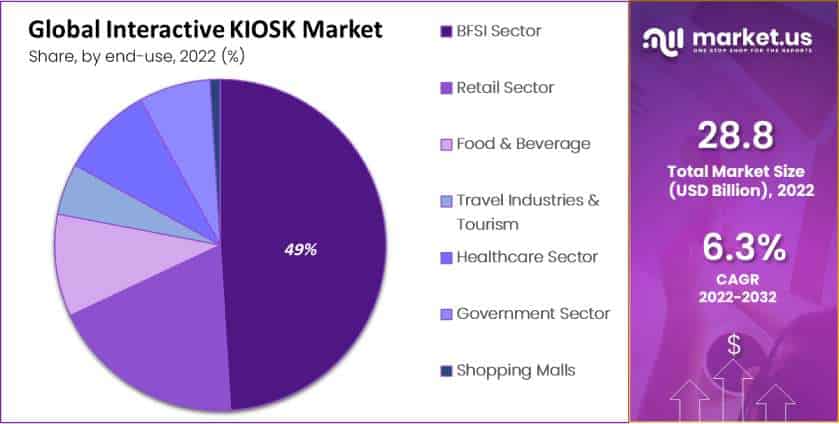

- The BFSI sector dominated the market, accounting for over 49% of global sales in 2021. Other key sectors included Retail, Food & Beverage, Travel Industries & Tourism, Healthcare, Government, and Shopping malls.

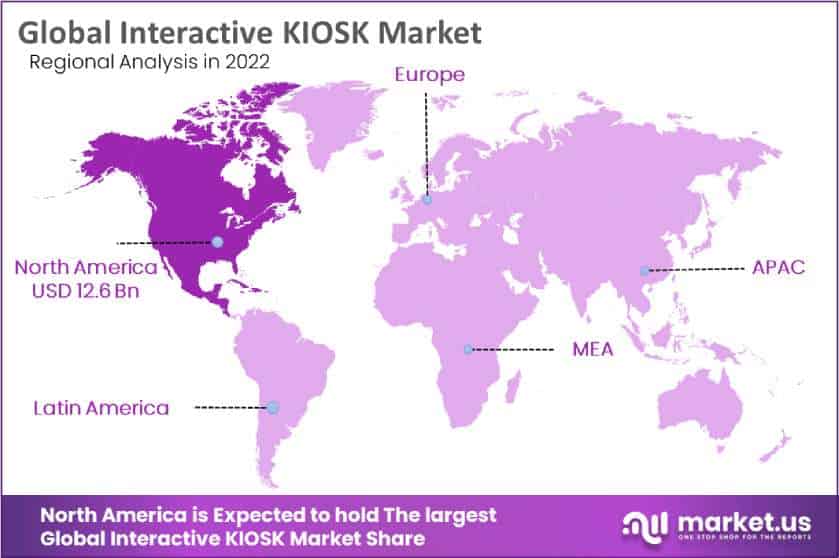

- The North America regional market will account for the largest revenue share, with over 44.0% in 2021, followed by Europe

Buy Now this Premium Report to Grow your Business: https://market.us/purchase-report/?report_id=19488

Factors Affecting the Growth of the Interactive KIOSK Market

- Increasing Demand for Self-Service Solutions: The surge in consumer inclination towards self-service options is propelling the demand for interactive kiosks. The advantages of convenience, speed, and control associated with self-service kiosks are being acknowledged across diverse industries, including retail, hospitality, healthcare, and transportation. The sustained growth in the demand for self-service solutions is poised to drive the expansion of the interactive kiosk market.

- Advancements in Technology: Technological progress plays a pivotal role in propelling the interactive kiosk market. Innovations in touch-screen technology, user interfaces, payment systems, and connectivity options have not only improved the functionality, interactivity, and user experience of interactive kiosks but also paved the way for their broader applications. The integration of emerging technologies such as AI, computer vision, and IoT has added a layer of sophistication, endowing interactive kiosks with advanced features and capabilities.

- Enhanced Customer Experience: Revolutionizing the customer experience, interactive kiosks provide efficient access to information, products, and services, fostering a seamless interaction. Enabling customers to effortlessly explore catalogs, initiate orders, process payments, and seek assistance autonomously, these kiosks optimize operational workflows. Through streamlined processes and reduced wait times, organizations witness an upsurge in customer satisfaction, paving the way for enhanced loyalty and recurring business.

- Cost and Operational Benefits: Interactive kiosks present businesses with both cost and operational advantages. Through the automation of tasks traditionally reliant on human resources, these kiosks contribute to diminished labor costs. Serving as virtual cashiers or information hubs, self-service kiosks allow organizations to redirect their workforce toward more value-added responsibilities. Moreover, these kiosks improve operational efficiency by reducing errors, managing high transaction volumes, and offering real-time analytics, empowering businesses to optimize their overall operations.

The report provides a full list of key companies, their strategies, and the latest developments. Download a Free Sample before buying

Driving Factors:

- Enhanced Customer Experience: Within retail stores, airports, healthcare facilities, and entertainment venues, interactive kiosks emerge as user-friendly, self-directed tools for information retrieval and transaction completion. Featuring intuitive interfaces, these kiosks not only cut down on wait times but also enhance the overall customer experience.

- Efficiency and Cost Savings: The implementation of interactive kiosks results in streamlined operations and cost savings for businesses by automating tasks and minimizing human involvement. These kiosks facilitate self-service functionalities, including check-ins, product browsing, ticket purchases, and other transactions. This, in turn, allows staff to focus on more complex or value-added activities.

- Digital Transformation: The ongoing digital evolution in different sectors is propelling the adoption of interactive kiosks. Organizations are employing these tools to digitize operations, deliver customized experiences, and collect valuable insights into user preferences and behaviors.

- Accessibility and Inclusivity: Interactive kiosks possess the capability to cater to individuals facing disabilities or language barriers, enhancing the accessibility and inclusivity of services and information. Incorporating features like text-to-speech, multilingual support, and adjustable interfaces significantly contribute to a more accessible experience for all users.

Restraining Factors:

- Initial Investment and Maintenance Costs: The deployment of interactive kiosks requires a significant upfront investment, encompassing expenses for hardware, software, customization, and installation. In addition, the ongoing costs associated with maintenance, updates, and technical support may present a barrier, dissuading some organizations from embracing these solutions.

- Integration Challenges: The integration of interactive kiosks with current systems, databases, or backend processes may present complexities. Challenges such as compatibility issues, data synchronization, and ensuring a smooth user experience across various touchpoints can arise, particularly for organizations with legacy infrastructure.

- Security Concerns: Securing user data within interactive kiosks is a critical endeavor, given the presence of sensitive personal information and payment details. To effectively counter potential threats such as data breaches, identity theft, or unauthorized access, organizations must enforce stringent security measures. These measures involve the implementation of encryption, secure authentication mechanisms, and the regular conduct of security audits.

- User Adoption and Behavior: The acceptance and adoption of interactive kiosks vary across demographics and regions. Certain users may exhibit hesitancy towards self-service technology, particularly preferring human interaction for specific tasks. To ensure successful adoption, a thorough understanding of user behavior and preferences, along with the provision of clear instructions and assistance, is essential.

Growth Opportunities:

- Personalized and Targeted Experiences: Opportunities arise with interactive kiosks to personalize user experiences by tapping into data and preferences. Enhancing engagement and increasing conversion rates become achievable by tailoring content, recommendations, or promotions based on individual profiles.

- Integration with Emerging Technologies: Integrating interactive kiosks with emerging technologies like artificial intelligence (AI), computer vision, or augmented reality (AR) can unlock new possibilities. These technologies can enable advanced features such as facial recognition, gesture-based interactions, or immersive experiences, enhancing engagement and value.

- Expansion in Emerging Markets: The interactive kiosk market holds considerable growth potential in emerging markets, especially where the adoption of self-service technology is in its early stages. Untapped opportunities arise in regions with expanding retail sectors, developing transportation infrastructure, and government initiatives aimed at digitizing services.

- Contactless and Hygiene-Focused Solutions: Amidst the post-pandemic scenario, there is a heightened focus on contactless interactions and hygiene. Interactive kiosks emerge as a viable solution, addressing these concerns through touchless interfaces, voice commands, and contactless payment options. This has led to their increased adoption across diverse industries.

Challenges:

- Designing Intuitive User Interfaces: The creation of user-friendly interfaces that address the needs of a diverse user base, considering varying levels of technological proficiency, is a complex task. Achieving harmony between simplicity, functionality, and visual appeal is imperative to guarantee seamless and efficient user experiences.

- Physical Space and Placement: The identification of ideal locations for interactive kiosk deployments involves intricate considerations, including foot traffic, accessibility, and space availability. The feasibility of installing kiosks in particular environments can be affected by spatial constraints or regulatory restrictions.

- Maintenance and Serviceability: The consistent maintenance, cleanliness, and timely resolution of technical issues are imperative for the smooth operation of interactive kiosks. Successfully overseeing a network of these distributed installations and ensuring uninterrupted service can be particularly demanding, especially for organizations with a substantial number of kiosks.

- Competing with Mobile and Online Channels: Interactive kiosks encounter competition from mobile apps and online platforms, both offering self-service features. To distinguish themselves, kiosks must present unique value propositions, like immediate access to physical products or personalized experiences, setting them apart in the digital landscape.

Get deeper insights into the market size, current market scenario, future growth opportunities, major growth driving factors, the latest trends, and much more. Buy the full report here

Report Segmentation of the Interactive KIOSK Market

Type Analysis

In 2022, the Automated Teller Machine (ATM) segment held a dominant position in the interactive kiosk market, capturing more than a 48.6% share. This substantial market share can be attributed to the widespread adoption of ATMs for cash dispensing and banking services, which has been driven by their convenience and 24/7 availability. Additionally, advancements in technology have expanded ATM functionalities, including bill payments and fund transfers, further cementing their utility and popularity.

End-User Analysis

In 2022, the Interactive Kiosk market witnessed a substantial dominance by the BFSI sector, securing a commanding market position with over 49% market share. Financial institutions embraced interactive kiosks to enhance customer service efficiency and streamline operations. These kiosks facilitated seamless transactions, account inquiries, and service inquiries, contributing to the sector's market stronghold. Additionally, the Retail sector demonstrated significant adoption, accounting for a noteworthy share, driven by the growing demand for self-service options and personalized shopping experiences. With a focus on convenience and customer engagement, retailers integrated interactive kiosks for product information, inventory checks, and in-store navigation.

Key Market Segments

By Type

- Automated Teller Machines (ATMs)

- Self-Service Kiosks

- Vending Kiosk

- Check-in kiosk

- Bank kiosk

- Advanced Kiosks

- Photo kiosks

- Mobile kiosk

- Indoor kiosks

- Outdoor kiosks

- Patient information kiosks

By End-Use

- BFSI Sector

- Retail Sector

- Food & Beverage

- Travel Industries & Tourism

- Healthcare Sector

- Government Sector

- Shopping Malls

- Other End-Uses

Regional Analysis

In 2022, the Interactive Kiosk market demonstrated a robust presence in North America, securing a dominant market position with a substantial share exceeding 44%. The region's leadership can be attributed to a proactive adoption of advanced technologies, particularly in sectors like retail, healthcare, and BFSI. The utilization of interactive kiosks in North America was notably driven by the quest for enhanced customer experiences and operational efficiency. Europe, on the other hand, emerged as a significant player in the interactive kiosk landscape, showcasing a progressive market share. The region's inclination towards self-service solutions in various industries, coupled with stringent customer service standards, contributed to the adoption of interactive kiosks.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Top Company Profiles

- Meridian Kiosks

- KIOSK Information Systems

- Olea Kiosks Inc.

- NCR Corporation

- GLORY Ltd.

- Diebold Nixdorf

- REDYREF Interactive Kiosks

- Hitachi Ltd.

- Frank Mayer

- Advantech Co., Ltd.

- Aila Technologies, Inc.

- Diebold Nixdorf AG

- Diebold Nixdorf Inc.

- DynaTouch Corporation

- Other Key Players

Recent Developments

- In 2023, Meridian Kiosks: A new line of modular kiosks designed for easy customization and scalability. The series includes three models: Engage Micro, Engage Mini, and Engage Standard.

- In 2023, KIOSK Information Systems: A high-performance kiosk with a sleek and modern design. The KIiosk 8 is available in a variety of configurations to meet the needs of different businesses.

- In 2023, Olea Kiosks Inc.: Acquired A/V Stump Screens: This acquisition expands Olea Kiosks' product portfolio to include digital signage solutions.

Explore More Reports

- API Management Market will reach USD 49.9 Billion in 2032, from USD 4.5 Billion in 2022; at a CAGR of 28% during forecast period.

- Gas Sensors Market size is expected to be worth around USD 5302 Billion by 2032, growing at a CAGR of 7.80%.

- Virtual Event Market size is expected to be worth around USD 879 Billion by 2032; growing at CAGR of 18.8% from 2022 to 2032.

- Workforce Management Market was valued at USD 9 bn in 2023 and is expected to reach USD 19.8 billion by 2032, highest CAGR of 9.3%.

- Retail Analytics Market size is expected to be worth around USD 39.6 Bn by 2032 from USD 5.7 Bn in 2022, growing at a CAGR of 22%.

- Cloud Security Market size was USD 20.5 Bn in 2022 and is expected to reach USD 148.3 Bn by 2032 at a CAGR of 22.5%

- Educational Robots market size is projected to surpass at USD 5.1 Billion by 2032 and it is growing at a CAGR of 16% from 2022 and 2032.

- Digital Asset Management Market is expected to reach USD 15.2 billion between 2023 and 2032, register the highest CAGR of 13.8%.

- Cyber Security Market size is expected to be worth around USD 533.9 Billion by 2032, growing at a CAGR of 11% during the forecast period.

- Wireless Charging Market is projected to reach USD 63.70 Billion by 2032, with a 24.20% CAGR from 2023 to 2032.

- Artificial Intelligence Market is valued to be worth USD 177 billion in 2023 and it is expected to grow at a CAGR of 36.8% from 2023-2032

- Generative AI Market accounted for USD 10.6 billion in 2022. It is expected to register a CAGR of 31.4% between 2023-2032

- Generative AI in Fashion Market to be valued at USD 1,481 Mn by 2032, from USD 69 Mn in 2022, with a CAGR of 36.9%

- Generative AI in Animation market is estimated to register the highest CAGR of 35.7% and is expected to reach USD 17.7 billion in 2032.

- Generative AI in Business Market size was valued at USD 1.2 billion in 2022 and is expected to grow at a CAGR of 33.5%.

- Generative AI music market was valued at USD 229 Mn in 2022, it is expected to reach USD 2,660 Mn by 2032 with a CAGR of 28.6%.

- Generative AI in Healthcare Market was valued at USD 0.8 billion and is expected to be valued at USD 17.2 billion in 2032.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: