KEY HIGHLIGHTS:

- Hole MTC-23-060 intercepted multiple near-surface lenses in the bulk tonnage MC Main Zone including 24.9 metres (“m”) of 1.05 grams of gold per tonne (“g/t Au”) and 41.8 m of 0.92 g/t Au at the Montclerg Gold Project (“Montclerg” or the “Project”).

- Hole MTC-23-062 returned one of the highest-grade intercepts drilled to-date within the bulk-tonnage style Main Zone of 3.09 g/t Au over 12.8 m and 1.16 g/t Au over 12.8 m near surface.

- Assay results (8 holes) from the Aljo Mine Target (“Aljo”) remain pending.

- Drilling is planned to resume in the first quarter with a primary focus at Montclerg and testing high-priority targets across the Goldarm Property.

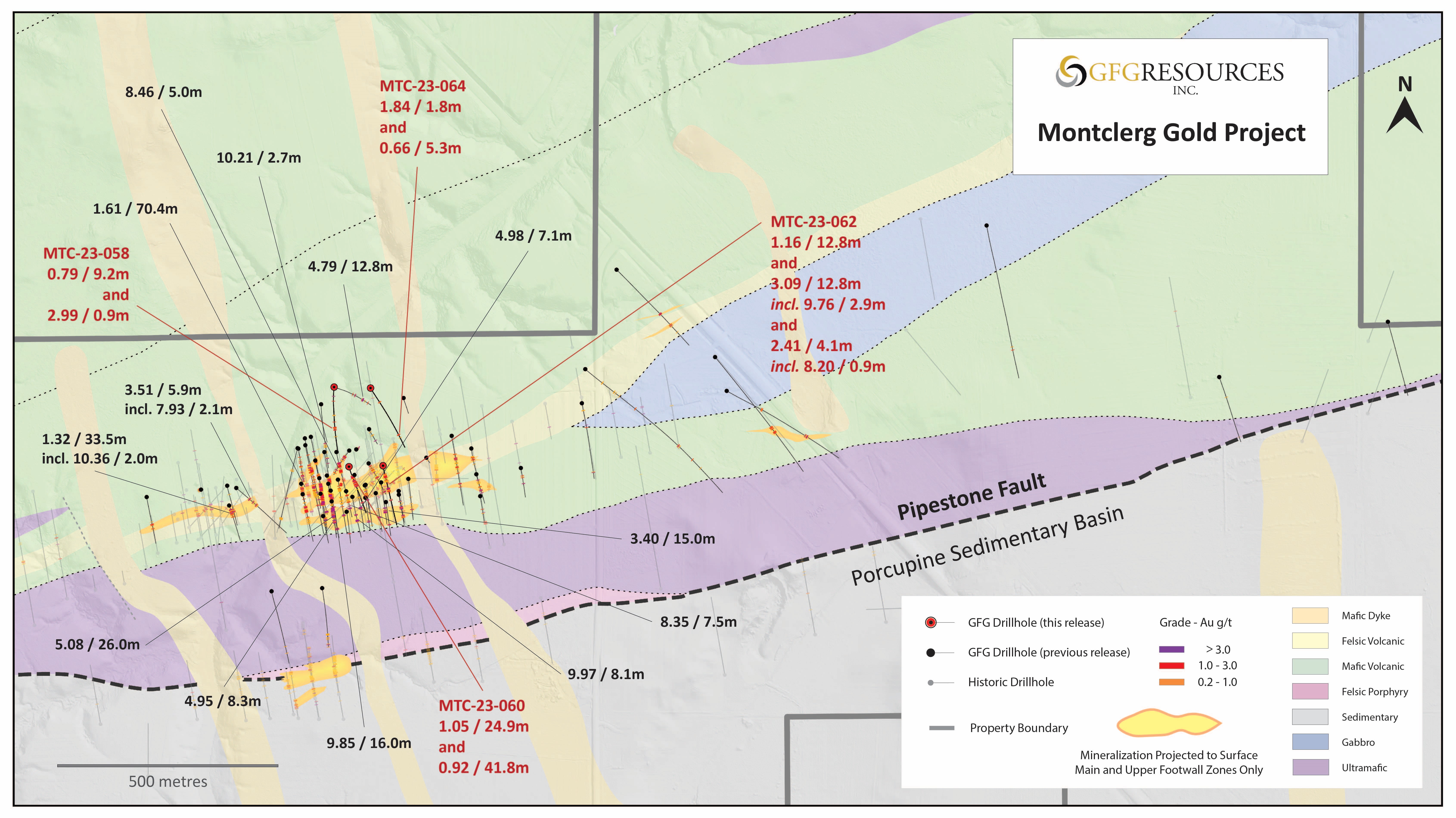

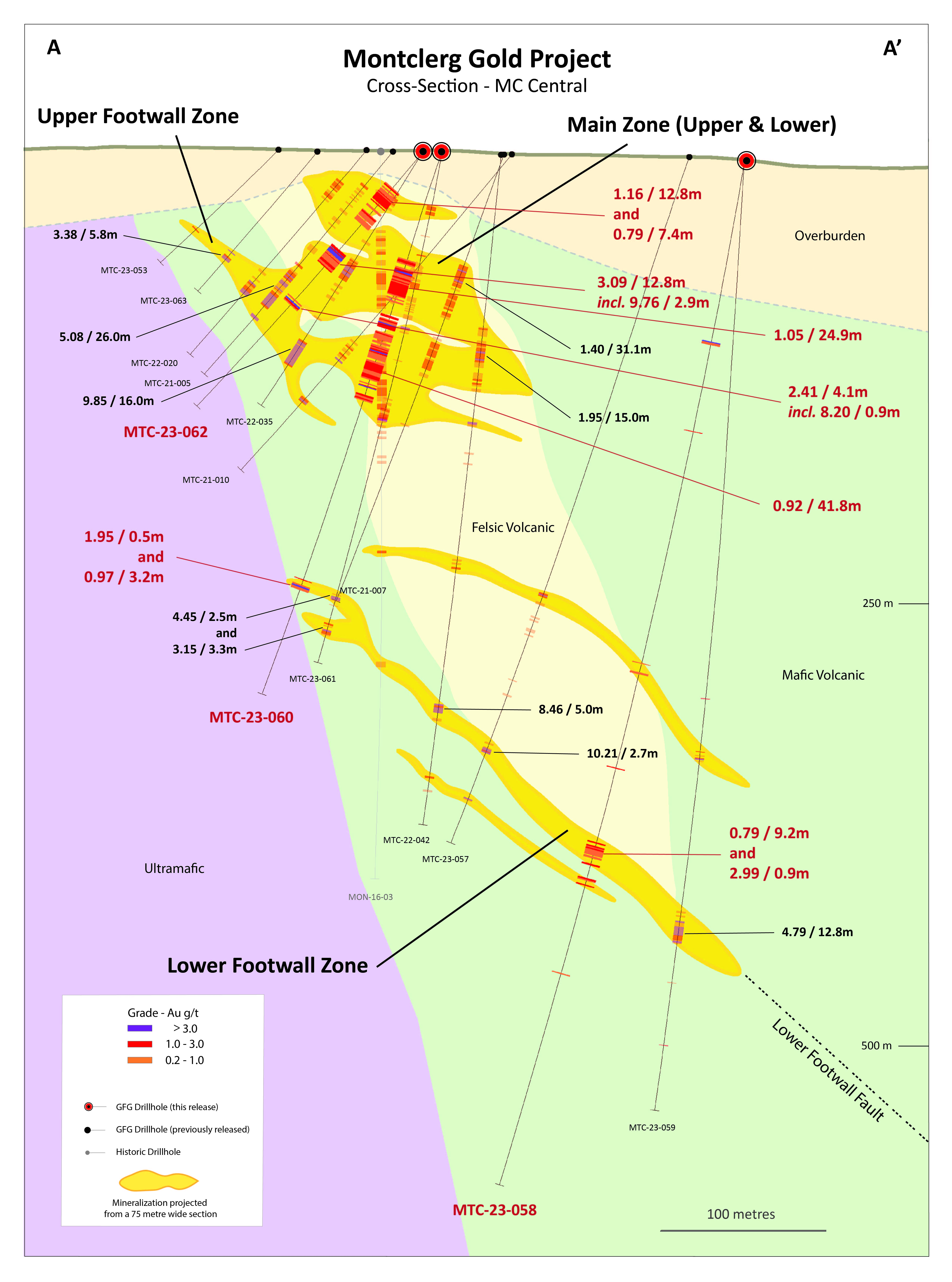

SASKATOON, Saskatchewan, Jan. 17, 2024 (GLOBE NEWSWIRE) -- GFG Resources Inc. (TSXV: GFG) (OTCQB: GFGSF) (“GFG” or the “Company”) reports further gold assay results from the recently completed 2023 Phase 2 drill program at its Montclerg Gold Project, located 40 kilometres (“km”) east of Timmins, Ontario (see Tables 1-2 and Figures 1-6). The results released today are from two infill holes and two step-out holes completed along the Montclerg gold system where GFG has continuously proven and grown a robust gold system since the Company acquired the asset in October 2021.

In the Phase 2 drill program the Company completed a total of 3,613 m from 15 holes (7 at Montclerg and 8 at Aljo). The program focused on step-out and in-fill drilling at Montclerg and tested a spectrum of targets at Aljo located within the Goldarm Property east of Timmins, Ontario. The Company eagerly anticipates releasing the remaining 8 holes from Aljo in the coming weeks as several zones of gold mineralization were observed in core logging.

"To date, our Phase 2 drill program at Montclerg has been a resounding success, proving a robust gold system with multiple high-grade and bulk tonnage gold zones across the Main zones, as well as the Footwall zones,” stated Brian Skanderbeg, President and CEO of GFG. “The consistency of the results from both step-out and infill drilling demonstrate not only the strong continuity of the system but also the significant expansion potential at depth and along strike. In addition to strong results, the infill drilling has been critical in confirming the geometry and coherence of these mineral systems at shallow depths.

Moreover, we await the assay results from Aljo with great anticipation, as the core logging has indicated several promising zones of gold mineralization. Our team is highly motivated by these findings, and we are looking forward to continuing to unlock the value of our strategically located assets for our shareholders."

Table 1: Most Recent Montclerg Gold Project Assay Results from the 2023 Phase 2 Drill Program

| Hole ID | From (m) | To (m) | Length (m) | Au (g/t) | Zone |

| MTC-23-058 | 100.9 | 102.9 | 2.0 | 1.60 | Undefined |

| and | 385.0 | 394.2 | 9.2 | 0.79 | Lower Footwall |

| and | 397.4 | 398.3 | 0.9 | 2.99 | Lower Footwall |

| and | 405.6 | 409.9 | 4.3 | 0.65 | Lower Footwall |

| MTC-23-060 | 63.1 | 88.0 | 24.9 | 1.05 | Upper Main |

| and | 95.7 | 137.5 | 41.8 | 0.92 | Lower Main |

| and | 141.6 | 145.1 | 3.5 | 1.05 | Lower Main |

| and | 249.5 | 250.0 | 0.5 | 1.95 | Lower Footwall |

| and | 252.6 | 255.8 | 3.2 | 0.97 | Lower Footwall |

| MTC-23-062 | 27.0 | 39.8 | 12.8 | 1.16 | Upper Main |

| and | 46.5 | 53.9 | 7.4 | 0.79 | Upper Main |

| and | 72.4 | 85.2 | 12.8 | 3.09 | Upper Main |

| incl. | 74.0 | 76.9 | 2.9 | 9.76 | |

| and | 109.5 | 113.6 | 4.1 | 2.41 | Upper Footwall |

| incl. | 111.1 | 111.9 | 0.9 | 8.20 | |

| MTC-23-064 | 121.8 | 123.6 | 1.8 | 1.84 | Undefined |

| and | 371.3 | 376.6 | 5.3 | 0.66 | Lower Footwall |

*Drill intercepts are presented using a 0.20 g/t Au cut-off and as drilled length with a minimum 0.5 gram-metre product. Composites include internal dilution of up to 3 m at grades less than 0.2 g/t Au. Included intervals are calculated using a 3 g/t cut-off at a minimum 5 gram-metre product unless otherwise stated. True width is estimated to be 50 to 90% of drilled length.

Commentary on Assay Results

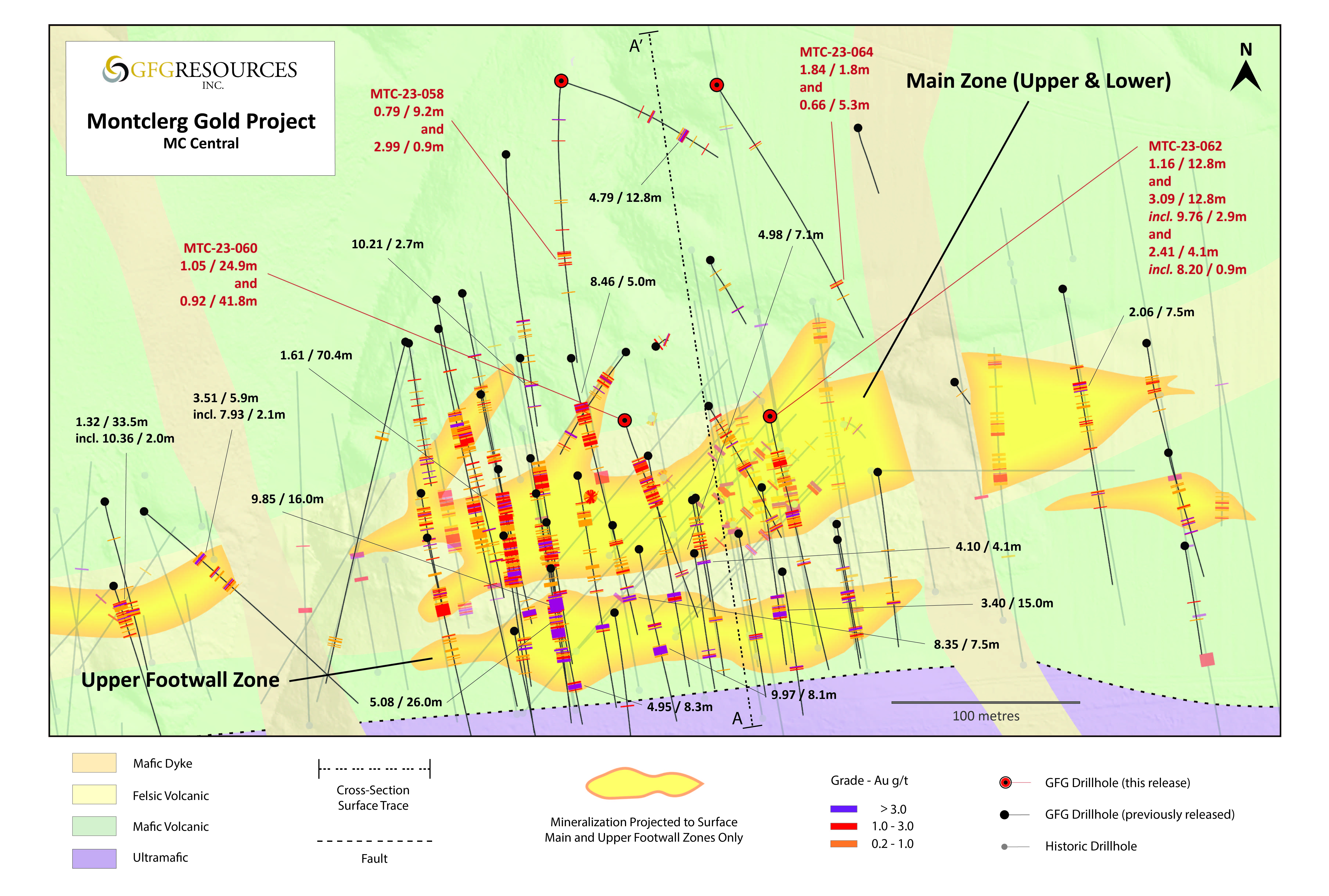

Anders Carlson, Vice President, Exploration of GFG commented, “These results demonstrate both the grade upside within the Upper Main Zone as well as our commitment to drilling significant step-out holes at depth along the Lower Footwall Zone where we believe we can further expand this gold system. Along with the results today, the high-grade zone intersected earlier in the program in MTC-23-059 yielding 4.79 g/t Au over 12.8 m remains the deepest hole drilled to-date at Montclerg and we’re very pleased with the structural and grade continuity observed thus far.”

MTC-23-058 was drilled to test the dip extension of the Lower Footwall Zone (see Figures 3-5). The hole intersects approximately 13 m of weak to moderate sericite-ankerite-silica alteration in mafic volcanic rocks with up to 15% disseminated arsenopyrite and pyrite. Quartz-carbonate veins and veinlets are present throughout the zone yielding 0.79 g/t Au over 9.2 m and 2.99 g/t Au over 0.9 m. This zone is observed between two high-grade intercepts in MTC-23-057 and MTC-23-059 that graded 10.21 g/t Au over 2.7 m including 16.20 g/t Au over 1.5 m and 4.79 g/t Au over 12.8 m including 10.05 g/t Au over 4.3 m, respectively. This hole, while lower grade than those around it, confirms the increased thickness of the Lower Footwall Zone below 350 vertical metres, supporting our belief that the local change in geology has had a positive impact on overall gold endowment at depth.

MTC-23-060 was drilled to infill an area of the Main Zone and to test the upper extent of the Lower Footwall (see Figures 3-5). The hole intersected approximately 80 m of moderate to strong sericite-ankerite-silica alteration in the felsic volcanic-hosted Upper and Lower Main zones yielding intercepts of 1.05 g/t Au over 24.9 m and 0.92 g/t Au over 41.8 m, respectively, with up to 5% disseminated arsenopyrite and pyrite. Further downhole, the Lower Footwall Zone was intersected yielding intercepts of 1.95 g/t Au over 0.5 m and 0.97 g/t Au over 3.2 m within 7 m of weak to moderate ankerite and silica-altered mafic volcanic rocks. This hole fills a gap in drilling within the Main Zone and was successful in defining the upper extent of the Lower Footwall Zone, increasing our confidence in the overall geological model.

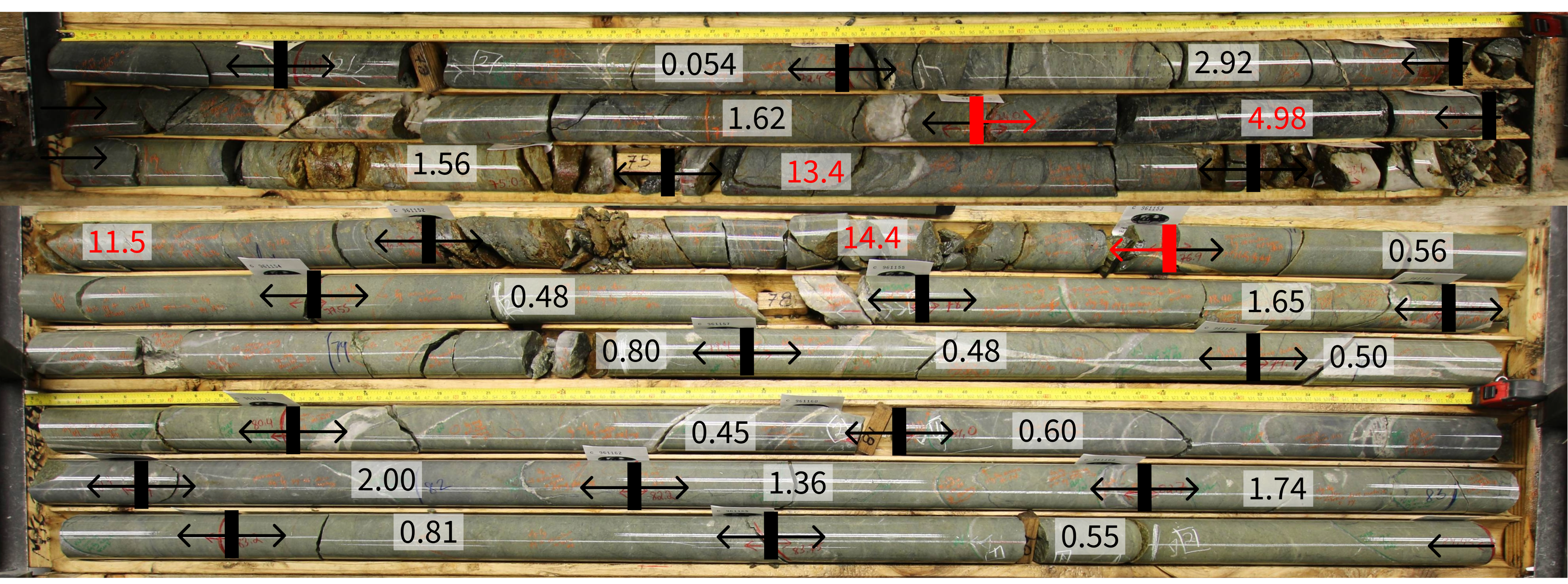

MTC-23-062 targeted an area in the Upper Main Zone which hosted high-grade gold in historical holes drilled at oblique angles and infill the Upper Footwall (see Figures 3-6). The hole intersects 1.16 g/t over 12.8 m and 3.09 g/t Au over 12.8 m in the Upper Main Zone including a high-grade core of 9.76 g/t Au over 2.9 m. This represents one of the highest-grade intercepts drilled to-date within the bulk-tonnage style Main Zone and lies 60 m below surface. Further downhole, an intercept yielding 2.41 g/t Au over 4.1 m including 8.20 g/t Au over 0.9 m is interested in the Upper Footwall Zone. These higher-grade infill holes are important as they show upside to the overall resource grade while allowing us to define the upper margins of the Lower Footwall Zone.

MTC-23-064 is a 150 m step-out to the east of MTC-23-058 along the Lower Footwall Zone as noted above (see Figures 3-5). The hole intersected approximately 7 m of weak to moderate sericite-ankerite-silica alteration in mafic volcanic rocks with up to 7% disseminated arsenopyrite and pyrite. Quartz-carbonate veins and veinlets are present throughout the zone yielding 0.66 g/t Au over 5.3 m. The hole also intersects a hanging wall zone of mineralization 250 m up-hole from the Lower Footwall Zone that grades 1.84 g/t Au over 1.8 m in similarly altered mafic volcanic rocks. The presence of the Lower Footwall Zone, albeit low-grade in this hole, is important for understanding the geological model and testing it beyond the current limits of the known deposit area. The intercepts observed over the course of the 2023 Phase 2 drill program including the deep, high-grade intercept of MTC-23-059 yielding 4.79 g/t Au over 12.8 m show that this system can be extended significantly at depth.

Outlook

Brian Skanderbeg, CEO of GFG commented, “As we look ahead to 2024, our Company is buoyed by the success and the growth opportunities that have emerged within the Goldarm Property. With this optimism, we are gearing up to resume drilling activities later in Q1 at Goldarm with a particular focus on Montclerg, Aljo and initial first pass drilling on several targets across Goldarm.

In tandem, at the Pen and Dore Gold Projects, our team is actively exploring avenues to progress these projects. Our strategic approach is not only aimed at unlocking the inherent value of these district-scale land positions but also at capitalizing on the diverse mineral potential they hold, encompassing gold, volcanogenic massive sulfide, and nickel-copper prospects. We remain steadfast in our commitment to responsibly advance our portfolio and deliver value to our stakeholders."

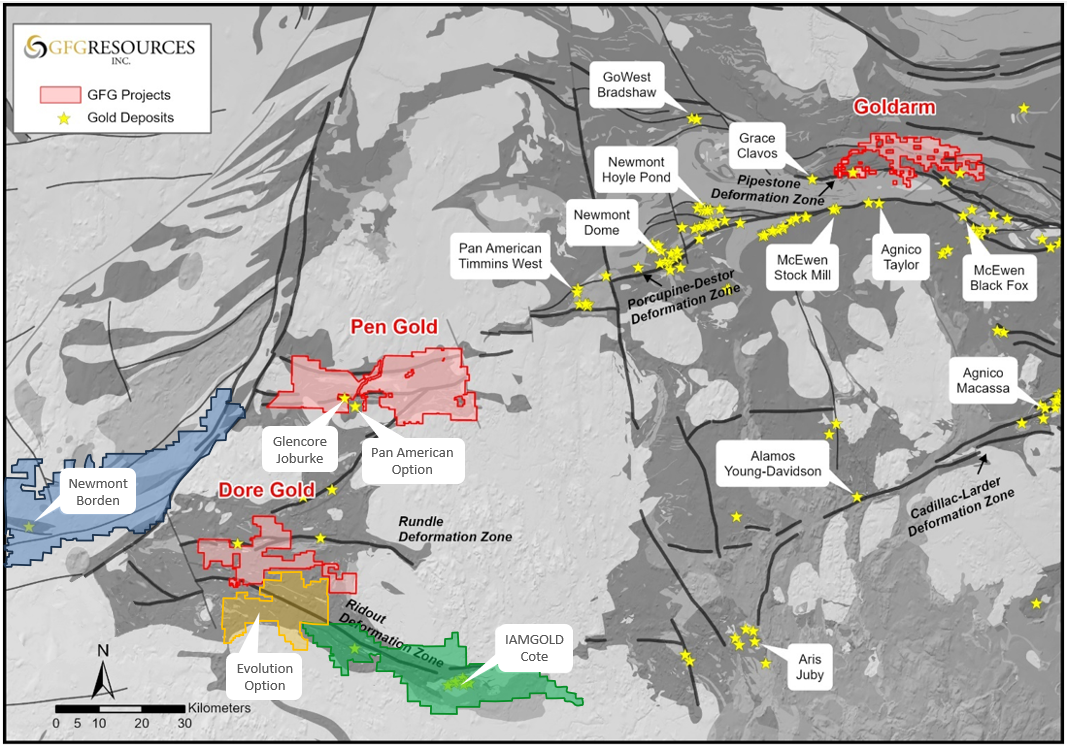

Figure 1: Regional Map of GFG Gold Projects in the Timmins Gold District

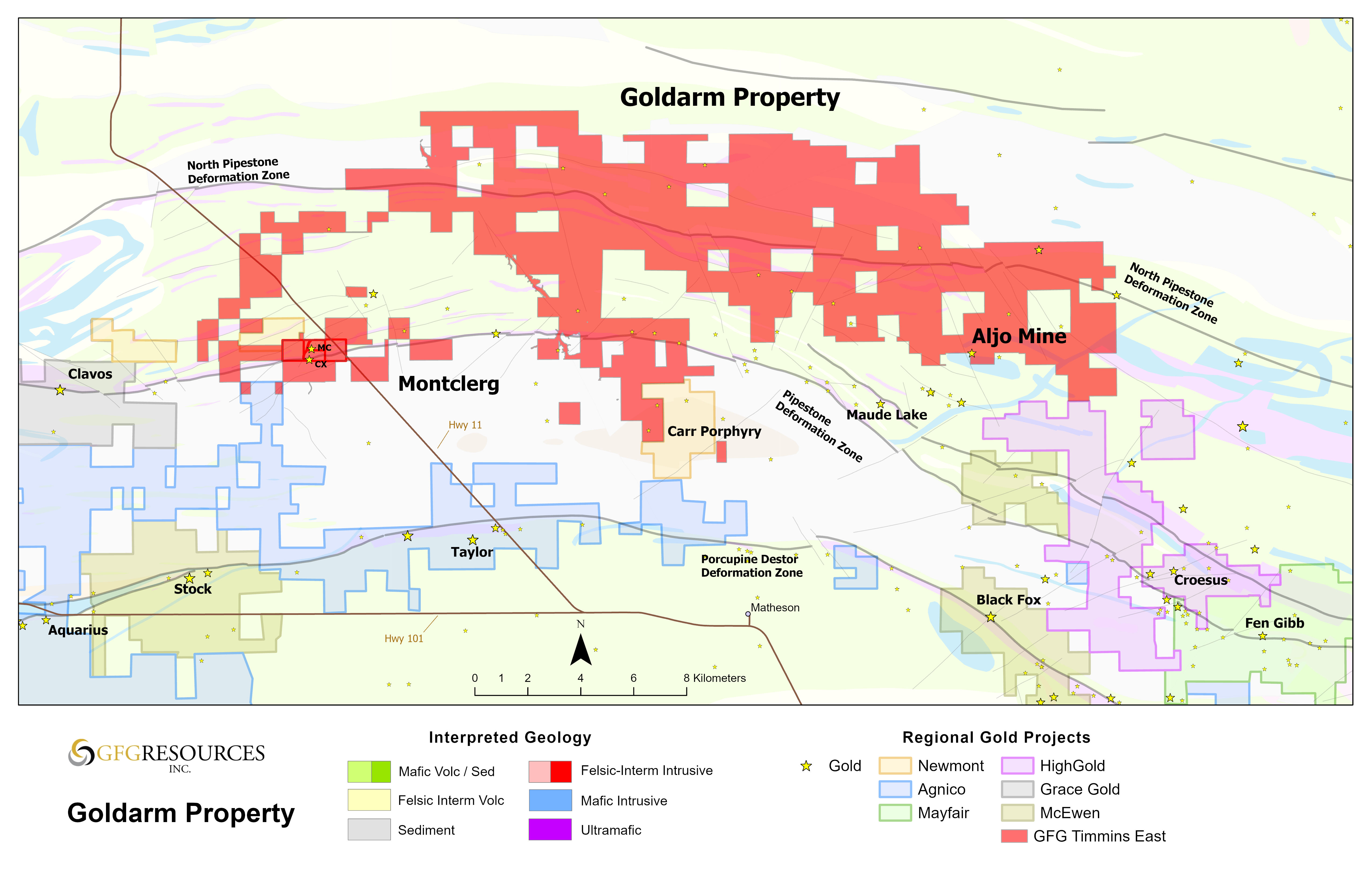

Figure 2: Goldarm Property Plan View Map

Figure 3: Montclerg Gold Project Plan View Map

Figure 4: Montclerg Gold Project MC Central Plan View Map

Figure 5: Montclerg Gold Project Cross Section Map

Figure 6: MTC-23-062 High Grade Gold Zone of 9.76 g/t Au over 2.09 m (74.0m to 76.9 m)

Table 2: GFG Drill Hole Assay Highlights from the Montclerg Gold Project

| Hole ID | From (m) | To (m) | Length (m) | Au (g/t) | Zone |

| MTC-21-001 | 62.5 | 90.0 | 27.5 | 1.56 | Upper Main |

| and | 126.0 | 166.5 | 40.5 | 0.78 | Lower Main |

| incl. | 130.8 | 138.0 | 7.3 | 2.20 | |

| MTC-21-004 | 39.8 | 64.0 | 24.2 | 0.73 | Upper Main |

| and | 75.7 | 86.1 | 10.4 | 1.24 | Lower Main |

| incl. | 81.0 | 85.1 | 4.1 | 2.37 | |

| and | 230.5 | 246.0 | 15.5 | 1.23 | Lower Footwall |

| incl. | 241.7 | 245.0 | 3.3 | 3.09 | |

| MTC-21-005 | 86.0 | 112.0 | 26.0 | 4.82 | Upper Footwall |

| incl. | 94.3 | 96.1 | 1.8 | 15.96 | |

| and | 103.8 | 109.3 | 5.5 | 12.32 | |

| and | 118.9 | 120.6 | 1.7 | 11.29 | |

| MTC-21-006 | 98.3 | 105.8 | 7.5 | 8.34 | Upper Footwall |

| incl. | 98.3 | 101.0 | 2.7 | 15.04 | |

| MTC-21-007 | 65.4 | 95.6 | 31.1 | 1.40 | Upper Main |

| and | 108.0 | 131.0 | 23.0 | 1.11 | Lower Main |

| MTC-21-009 | 45.0 | 60.0 | 15.0 | 1.23 | Upper Main |

| MTC-21-010 | 79.5 | 106.5 | 27.0 | 1.05 | Upper Main |

| incl. | 89.6 | 100.5 | 10.9 | 1.84 | |

| MTC-22-015 | 24.0 | 57.5 | 33.5 | 1.32 | MC West |

| incl. | 24.0 | 28.7 | 4.7 | 5.15 | |

| MTC-22-018 | 52.0 | 57.9 | 5.9 | 3.51 | MC West |

| incl. | 53.9 | 56.0 | 2.1 | 7.93 | |

| MTC-22-019 | 112.6 | 118.1 | 5.5 | 4.38 | Upper Footwall |

| incl. | 112.6 | 116.0 | 3.4 | 6.37 | |

| MTC-22-020 | 22.4 | 34.1 | 11.7 | 1.07 | Upper Main |

| and | 97.0 | 105.3 | 8.3 | 4.95 | Upper Footwall |

| incl. | 102.8 | 105.3 | 2.5 | 12.83 | |

| MTC-22-021 | 50.3 | 72.0 | 21.7 | 1.51 | Upper Main |

| incl. | 62.2 | 64.0 | 1.8 | 8.17 | |

| MTC-22-023 | 17.6 | 88.0 | 70.4 | 1.60 | Upper Main |

| incl. | 35.2 | 42.0 | 6.8 | 2.43 | |

| incl. | 76.2 | 81.0 | 4.8 | 4.97 | |

| and | 124.5 | 133.2 | 8.7 | 2.46 | Upper Footwall |

| incl. | 131.4 | 133.2 | 1.8 | 7.75 | |

| MTC-22-029 | 104.4 | 111.5 | 7.1 | 4.98 | Upper Footwall |

| incl. | 104.4 | 107.6 | 3.2 | 7.02 | |

| incl. | 110.4 | 111.5 | 1.1 | 7.79 | |

| MTC-22-030 | 71.0 | 86.0 | 15.0 | 3.40 | Upper Footwall |

| incl. | 71.0 | 74.0 | 3.0 | 6.21 | |

| also incl. | 81.9 | 82.9 | 1.0 | 17.50 | |

| MTC-22-031 | 285.2 | 292.6 | 7.4 | 2.78 | Lower Footwall |

| incl. | 290.3 | 292.6 | 2.3 | 7.83 | |

| and | 300.4 | 302.0 | 1.6 | 4.59 | Lower Footwall |

| MTC-22-034 | 79.5 | 94.6 | 14.5 | 1.37 | Lower Main |

| incl. | 85.2 | 86.8 | 1.6 | 3.97 | |

| and | 161.7 | 171.0 | 9.3 | 5.26 | Upper Footwall |

| incl. | 163.9 | 168.3 | 4.4 | 10.77 | |

| MTC-22-035 | 72.0 | 85.2 | 13.2 | 2.31 | Lower Main |

| incl. | 77.0 | 82.1 | 5.1 | 4.07 | |

| and | 125.3 | 141.3 | 16.0 | 9.85 | Upper Footwall |

| incl. | 130.3 | 137.8 | 7.5 | 14.99 | |

| MTC-22-036 | 79.0 | 85.0 | 6.0 | 9.63 | Upper Footwall |

| incl. | 80.5 | 84.0 | 3.5 | 15.40 | |

| MTC-22-039 | 79.8 | 83.3 | 3.3 | 4.32 | Upper Footwall |

| incl. | 80.7 | 83.3 | 2.6 | 5.74 | |

| and | 88.0 | 98.3 | 10.3 | 3.95 | |

| MTC-22-041 | 76.2 | 81.0 | 4.8 | 4.89 | Upper Footwall |

| incl. | 81.0 | 80.1 | 1.1 | 14.40 | |

| MTC-22-042 | 96.4 | 119.0 | 22.6 | 1.48 | Lower Main |

| and | 307.3 | 312.3 | 5.0 | 8.46 | Lower Footwall |

| incl. | 309.3 | 312.3 | 2.0 | 16.40 | |

| ALJ-22-002 | 62.1 | 75.0 | 12.9 | 3.03 | |

| incl. | 67.5 | 68.1 | 0.6 | 59.80 | |

| and | 79.0 | 93.9 | 14.9 | 1.32 | |

| incl. | 85.3 | 86.2 | 0.9 | 10.90 | |

| and | 101.0 | 105.3 | 4.3 | 6.58 | |

| incl. | 103.2 | 104.2 | 1.0 | 27.40 | |

| MTC-23-048 | 88.0 | 92.1 | 4.1 | 4.10 | Upper Footwall |

| incl. | 89.8 | 92.1 | 2.3 | 6.30 | |

| MTC-23-054 | 73.1 | 81.2 | 8.1 | 9.97 | Upper Footwall |

| incl. | 75.9 | 78.9 | 3.0 | 16.95 | |

| MTC-23-057 | 254.5 | 256.8 | 2.3 | 2.25 | |

| and | 346.0 | 348.7 | 2.7 | 10.21 | Lower Footwall |

| incl. | 346.0 | 347.5 | 1.5 | 16.20 | |

| and | 375.5 | 376.7 | 1.2 | 2.42 | Lower Footwall |

| incl. | 375.5 | 376.2 | 0.7 | 3.84 | |

| MTC-23-060 | 63.1 | 88.0 | 24.9 | 1.05 | Upper Main |

| and | 95.7 | 137.5 | 41.8 | 0.92 | Lower Main |

| MTC-23-062 | 72.4 | 85.2 | 12.8 | 3.09 | Upper Main |

| incl. | 74.0 | 76.9 | 2.9 | 9.76 |

*Drill intercepts are presented using a 0.20 g/t Au cut-off and as drilled length with a minimum 0.5 gram-metre product. Composites include internal dilution of up to 3 m at grades less than 0.2 g/t Au. Included intervals are calculated using a 3 g/t cut-off at a minimum 5 gram-metre product unless otherwise stated. True width is estimated to be 50 to 90% of drilled length.

**Calculated at a 5 g/t cut-off.

About the Goldarm Property

The Goldarm Property is a large and highly prospective land package east of the Timmins Gold Camp (see Figures 1-2). The consolidated Goldarm Property covers approximately 30 km of the Pipestone Deformation Zone and the North Pipestone Deformation Zone. Within the Goldarm Property, there are several highly prospective gold targets such as the Aljo Gold Mine region, the Carr target, and the Montclerg Gold Project;which is the most advanced target. The Montclerg Gold Project covers 10 km of the highly prospective Pipestone Deformation Zone and is located 48 km east of the prolific Timmins Gold Camp and is adjacent to multiple current and historic gold mines (see Figure 1).

About GFG Resources Inc.

GFG is a North American precious metals exploration company focused on district scale gold projects in tier one mining jurisdictions, Ontario and Wyoming. In Ontario, the Company operates three gold projects, each large and highly prospective gold properties within the prolific gold district of Timmins, Ontario, Canada. The projects have similar geological settings that host most of the gold deposits found in the Timmins Gold Camp which have produced over 70 million ounces of gold. The Company also owns 100% of the Rattlesnake Hills Gold Project, a district scale gold exploration project located approximately 100 km southwest of Casper, Wyoming, U.S.

For further information, please contact:

Brian Skanderbeg, President & CEO

or

Marc Lepage, Vice President, Business Development

Phone: (306) 931-0930

Email: info@gfgresources.com

Website: www.gfgresources.com

Stay Connected with Us

Twitter: @GFGResources

LinkedIn: https://www.linkedin.com/company/gfgresources/

Facebook: https://www.facebook.com/GFGResourcesInc/

Footnote:

(1) Drill intercepts are historical and GFG’s QP has not verified the laboratory accreditation, analytical method, sample size or QA/QC procedures utilized for the historic drill results. True widths have not been estimated.

Potential quantity and grade is conceptual in nature. There has been insufficient exploration to define a Mineral Resource on the Coulson Claims to date and it is uncertain if further exploration will result in the Coulson Claims being defined as a Mineral Resource.

Sampling and Quality Control

All scientific and technical information contained in this press release has been prepared under the supervision of Brian Skanderbeg, P.Geo. President and CEO of GFG, a qualified person within the meaning of National Instrument 43-101.

Drill core samples are being analyzed for gold by Activation Laboratories Ltd. in Timmins, Ontario. Gold analysis consists of the preparation of a 500-gram pulp and an assay of a 50-gram aliquot by Pb collection fire assay with an Atomic Absorption Spectrometry finish (Package 1A2-50. Samples assaying above 5 ppm Au are routinely re-run using a gravimetric finish (Package 1A3-50). Mineralized zones containing visible gold are analyzed by a screen metallic fire assay method. Selected samples are also undergoing multi-element analysis for 59 other elements using a four-acid digestion and an ICP-MS finish (Package MA250) by Bureau Veritas Commodities Canada Ltd. in Vancouver, British Columbia. Quality control and assurance measures include the monitoring of results for inserted certified reference materials, coarse blanks and preparation duplicates of drill core.

Drill intercepts are presented using a 0.20 g/t Au cut-off and as drilled length. Composites include internal dilution of up to 3 m at grades less than 0.2 g/t Au. True width is estimated to be 50 to 90% of drilled length. Sampling protocols, quality control and assurance measures and geochemical results related to historic drill core samples quoted in this news release have not been verified by the Qualified Person and therefore must be regarded as estimates.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

All statements, other than statements of historical fact, contained in this news release constitute “forward-looking information” within the meaning of applicable Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (referred to herein as “forward-looking statements”). Forward-looking statements include, but are not limited to, the Company’s future exploration plans with respect to its property interests and the timing thereof, the prospective nature of the projects, future price of gold, success of exploration activities and metallurgical test work, permitting time lines, currency exchange rate fluctuations, requirements for additional capital, government regulation of exploration work, environmental risks, unanticipated reclamation expenses, title disputes or claims and limitations on insurance coverage. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes”, or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results, “may”, “could”, “would”, “will”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof.

All forward-looking statements are based on various assumptions, including, without limitation, the expectations and beliefs of management, the assumed long-term price of gold, that the Company will receive required permits and access to surface rights, that the Company can access financing, appropriate equipment and sufficient labour, and that the political environment within Canada and the United States will continue to support the development of mining projects in Canada and the United States. In addition, the similarity or proximity of other gold deposits to the Company’s projects is not necessary indicative of the geological setting, alteration and mineralization of the Rattlesnake Hills Gold Project, the Goldarm Property, the Pen Gold Project and the Dore Gold Project.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of GFG to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: actual results of current exploration activities; environmental risks; future prices of gold; operating risks; accidents, labour issues and other risks of the mining industry; availability of capital, delays in obtaining government approvals or financing; and other risks and uncertainties. These risks and uncertainties and the additional risks described in the Company’s most recently filed annual and interim MD&A are not, and should not be construed as being, exhaustive.

Although GFG has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. In addition, forward-looking statements are provided solely for the purpose of providing information about management’s current expectations and plans and allowing investors and others to get a better understanding of our operating environment. Accordingly, readers should not place undue reliance on forward-looking statements.

Forward-looking statements in this news release are made as of the date hereof and GFG assumes no obligation to update any forward-looking statements, except as required by applicable laws.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c9280333-398e-45f9-8f36-bd8f018d4979

https://www.globenewswire.com/NewsRoom/AttachmentNg/caaa9d7d-651d-4efb-a58c-f914db590ce0

https://www.globenewswire.com/NewsRoom/AttachmentNg/21209696-54ab-4042-893e-2dd7114f55af

https://www.globenewswire.com/NewsRoom/AttachmentNg/39af6d71-6c34-4935-a692-ab0f3446f0a8

https://www.globenewswire.com/NewsRoom/AttachmentNg/617c6c4e-ea64-431e-b38c-e2ecb265fce9

https://www.globenewswire.com/NewsRoom/AttachmentNg/a0caaf59-7101-4b87-beb1-1dcb2791c2e5