Dublin, Feb. 07, 2024 (GLOBE NEWSWIRE) -- The "Global Sterile Medical Packaging Market by Material (Plastic, Metal, Paper & Paperboard, Glass), Type (Thermoform Trays, Sterile Bottles & Containers, Pre-fillable Inhalers), Sterilization Method, Application, and Region - Forecast to 2028" report has been added to ResearchAndMarkets.com's offering.

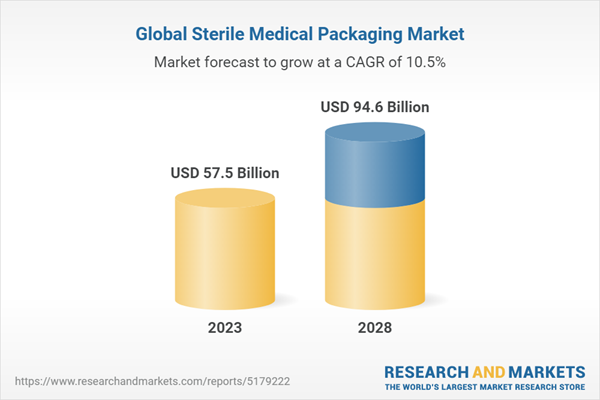

The global sterile medical packaging market is projected to grow from USD 57.5 billion in 2023 to USD 94.6 billion by 2028 at a CAGR of 10.5%. Several factors drive the sterile medical packaging market, including a rising demand for advanced healthcare solutions, strict regulatory standards, and the crucial need for infection control in medical settings. Opportunities are presented by the increasing prevalence of surgical procedures, growth in the pharmaceutical and biotechnology sectors, and ongoing innovations in packaging materials and technologies. However, challenges persist, ranging from intricate regulatory compliance to the necessity for sustainable packaging solutions and the ongoing evolution of pathogens, demanding adaptable and robust sterile packaging strategies.

Glass to be the second largest material used in sterile medical packaging after plastic

Glass is preferred for its exceptional barrier properties, providing an impermeable shield against gases, moisture, and contaminants. This is particularly crucial in preserving the integrity of sensitive pharmaceutical and biological products. Glass is inert, non-reactive, and does not leach harmful substances, ensuring the purity of the contents. Moreover, its transparency allows for easy visual inspection, a critical factor in the pharmaceutical industry. Although heavier than some alternatives, glass's durability, recyclability, and perceived premium quality contribute to its significant market share, making it a preferred choice for sterile medical packaging in specific contexts.

Sterile closures to be the second fastest growing type in the sterile medical packaging market after thermoform trays

Sterile closures are experiencing rapid growth and have become the second-fastest-growing type in the sterile medical packaging market due to their pivotal role in maintaining the sterility and integrity of medical devices and pharmaceutical products. As the demand for advanced healthcare solutions increases, the need for secure and contamination-free packaging becomes paramount. Sterile closures offer a crucial barrier against external contaminants, ensuring the preservation of product sterility throughout its lifecycle. The rise in biopharmaceutical innovations and specialized medications, often requiring meticulous sterile packaging, has propelled the demand for these closures.

The Radiation sterilization holds the second largest market share in the sterile medical packaging market after chemical sterilization

Radiation sterilization method utilizes ionizing radiation, such as gamma rays or electron beams, to eradicate microorganisms and pathogens from packaging materials. Unlike traditional methods like steam sterilization, radiation sterilization is particularly advantageous for heat-sensitive items, ensuring their sterility without exposing them to elevated temperatures. The process is reliable, efficient, and capable of penetrating various packaging materials to reach all surfaces, providing a thorough and uniform sterilization.

Surgical & medical instruments application holds the second largest market share in sterile medical packaging market

Sterile packaging ensures that surgical and medical instruments remain free from contamination and microbial intrusion throughout the entire supply chain, from manufacturing to end-use. This is particularly vital in surgical settings where precision and aseptic conditions are paramount. Sterile packaging solutions such as pouches, wraps, and trays create a barrier against external contaminants, safeguarding the instruments' sterility until the moment of use. As the demand for advanced medical solutions and stringent infection control measures continues to rise, the role of sterile medical packaging in preserving the integrity of surgical and medical instruments becomes increasingly crucial, contributing to the overall efficacy and safety of healthcare practices.

Europe is the second biggest market for sterile medical packaging

Europe's proactive approach to adopting innovative packaging materials and techniques, in tandem with evolving industry trends and heightened consumer expectations, further solidifies its market standing. As Europe continues to witness technological advancements in the healthcare sector and an increasing focus on stringent regulatory compliance, the demand for sterile medical packaging solutions remains robust, making it a key player in the global landscape of sterile medical packaging.

Research Coverage

The market study covers sterile medical packaging across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on material, type, sterilization method, application, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the sterile medical packaging market.

Key Attributes

| Report Attribute | Details |

| No. of Pages | 324 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value (USD) in 2023 | $57.5 Billion |

| Forecasted Market Value (USD) by 2028 | $94.6 Billion |

| Compound Annual Growth Rate | 10.5% |

| Regions Covered | Global |

Market Dynamics

- Drivers

- Increasing Healthcare Expenditure

- Stringent Regulatory Standards

- Rise in Chronic Diseases

- Restraints

- Strict Regulatory Compliance

- Volatile Raw Material Costs

- Opportunities

- Development of Sustainable Packaging Options

- Expansion into Emerging Markets

- Challenges

- Need to Maintain Packaging Integrity

Technology Analysis

- Low-Temperature Sterilization

- Sterilization Packaging

- Internet of Things (IoT) in Primary Packaging of Medical Devices

Case Study Analysis

- Steripack Provides Packaging and Sterilization Solution for Safety Needles

- Challenge

- Solution

- High-Barrier Lidstock Maximizes Seal Strength and Maintains Peelability

- Challenge

- Solution

- Osteonics' Blister-in-a-Blister-in-a-Pouch Safeguards Implants from Oxidation

- Challenge

- Solution

Companies Profiled

- Amcor PLC

- Beacon Converters, Inc.

- Berry Global Group, Inc.

- Billerud AB

- DuPont de Nemours, Inc.

- Eagle Flexible Packaging

- Janco, Inc.

- Multivac Sepp Haggenmuller SE & Co. KG

- Nelipak Corporation

- Oliver Healthcare Packaging Company

- Orchid MPS Holdings, LLC

- Paxxus, Inc.

- Placon Corporation

- PPC Flexible Packaging LLC

- Printpack, Inc.

- ProAmpac Holdings, Inc.

- Riverside Medical Packaging Company Limited

- S.P. Enterprises

- Selenium Medical

- Shanghai Jianzhong Medical Packaging Co. Ltd.

- Sonoco Products Company

- Steripack Group Limited

- Technipaq Inc.

- West Pharmaceutical Services, Inc.

- Wipack Group

For more information about this report visit https://www.researchandmarkets.com/r/a4qdpm

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment