Dublin, Feb. 14, 2024 (GLOBE NEWSWIRE) -- The "Insolvency Software Market by Offering (Solutions, Services), Organization Size (Large Enterprises, & SMEs), Application (Document Management, Financial Transaction Management, Reporting, Compliance, Creditor Management), Vertical - Global Forecast to 2028" report has been added to ResearchAndMarkets.com's offering.

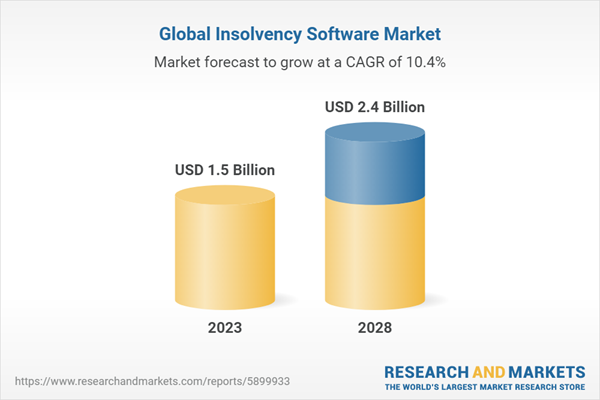

The global Insolvency Software market is projected to grow from USD 1.5 billion in 2023 to USD 2.4 billion by 2028, at a CAGR of 10.4% during the forecast period. Increasing demand for automated tools to make well-informed decisions in insolvency cases will accelerate market growth. Businesses are increasingly using automation and digital tools to improve insolvency processes. This involves speeding up procedures, reducing administrative workloads, enhancing accuracy, utilizing data analytics for better decision-making, facilitating communication and collaboration among stakeholders, ensuring compliance, cutting costs, streamlining document management, automating workflows, and achieving more efficient and successful insolvency outcomes.

By Organization Size, the large enterprise segment is expected to hold the largest market size during the forecast period

Large enterprises are the early adopters of insolvency software. Though large enterprises have the necessary budgets to use the on-premises deployment mode, they are moving toward the cloud deployment mode to avail features such as increased availability, high scalability, and low cost of deployment. The heterogeneous IT environment and the inability of the IT systems to communicate with each other are the chief reasons for the increasing deployment of insolvency software by large enterprises. The demand for insolvency software in large enterprises arises from the necessity to handle intricate insolvency and bankruptcy cases efficiently and compliantly.

By Vertical, the BFSI segment is expected to grow with the highest CAGR during the forecast period

Given the unique demands and complexities of insolvency cases within this sector, the BFSI (Banking, Financial Services, and Insurance) segment is a key area of focus for insolvency software. Insolvency software tailored to the BFSI segment provides a range of specialized features and functionalities to address the specific needs of financial institutions, credit providers, and insurance companies facing insolvency situations. The BFSI vertical has been one of the early adopters of insolvency software solutions.

Asia Pacific is expected to grow with the highest CAGR during the forecast period

The APAC region comprises major economies such as China, India, Japan, and Australia. The region is expected to grow the fastest in terms of insolvency software and services deployment. Growing industrialization and increased competition have proved to be one of the biggest drivers for the insolvency software market in this region.

Research Coverage

The report segments the global Insolvency Software market by offering into two categories: solutions and services. The service segment is divided into five categories: Professional Services and Management Services. By applications into six categories: Document Management, Reporting, Compliance, Financial Transaction Management, Creditor Management, Others, and Others. By vertical into seven categories: IT and Telecommunication, Government, BFSI, Manufacturing, Energy and Utilities, Retail, and Other Verticals. The market has been segmented by region into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

The major players in the Insolvency Software market are Clio (Canada), CARET (US), Altisource (US), Aryza (Ireland), Stretto (US), Epiq (US), Kroll (US), Turnkey IPS (UK), QwikFile (US), Fastcase (US), CaseWare (Canada), Standard Legal (US), LegalPRO (US), PracticePanther (US), Smokeball (US), Litera (US), stp.one (Germany), NeSL (India), Fileassure (Canada), and CloudLex (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their footprint in the Insolvency Software market.

Market Dynamics

- Drivers

- Increase in Adoption of Digitalization within the Financial Industry

- Rise in Number of Bankruptcy Cases

- Need for Cost-Effective and Efficient Solution to Process Volume Without Additional Headcount

- Growth in Demand for Automated Tools to Make Well-Informed Decisions

- Restraints

- Resistance to Shift Away from Legacy Systems

- Opportunities

- Ongoing Trend for Digitalization in IT Industry

- Increase in Automation to Boost Adoption of Emerging Technology

- Rise in Demand for Software Automation and Innovative Applications

- Challenges

- Lack of Data Privacy and Safety

- Maintaining Compliance in Changing Regulatory Landscape

- Need for Third-Party Providers to Enable and Manage Technology and Hosting Aspects

Use Cases

- Aryza Dunning Improved Louwman Dealer Group's Debt Management System

- Stretto Helped Crosby & Fox Better Its Communication Systems

- Stretto Offered Richard West Law Office Its Best Case Solution for Efficient Case-Filing

- Stretto's Solutions Streamlined Nelson Law Office's Functionalities

Regulatory Landscape

- International Organization for Standardization 27001

- Basel Committee on Banking Supervision

- Dodd-Frank Act

- Health Insurance Portability and Accountability Act

- General Data Protection Regulation

- Markets in Financial Instruments Directive

- Financial Industry Information Systems

Companies Profiled

- Altisource

- Aryza

- CARET

- Caseware

- Clio

- CloudLex

- Epiq

- Fastcase

- Fileassure

- Kroll

- LegalPRO

- Litera

- NeSL

- PracticePanther

- QwikFile

- Smokeball

- Standard Legal

- stp.one

- Stretto

- Turnkey IPS

Key Attributes

| Report Attribute | Details |

| No. of Pages | 205 |

| Forecast Period | 2023-2028 |

| Estimated Market Value (USD) in 2023 | $1.5 Billion |

| Forecasted Market Value (USD) by 2028 | $2.4 Billion |

| Compound Annual Growth Rate | 10.4% |

| Regions Covered | Global |

For more information about this report visit https://www.researchandmarkets.com/r/94tab

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment