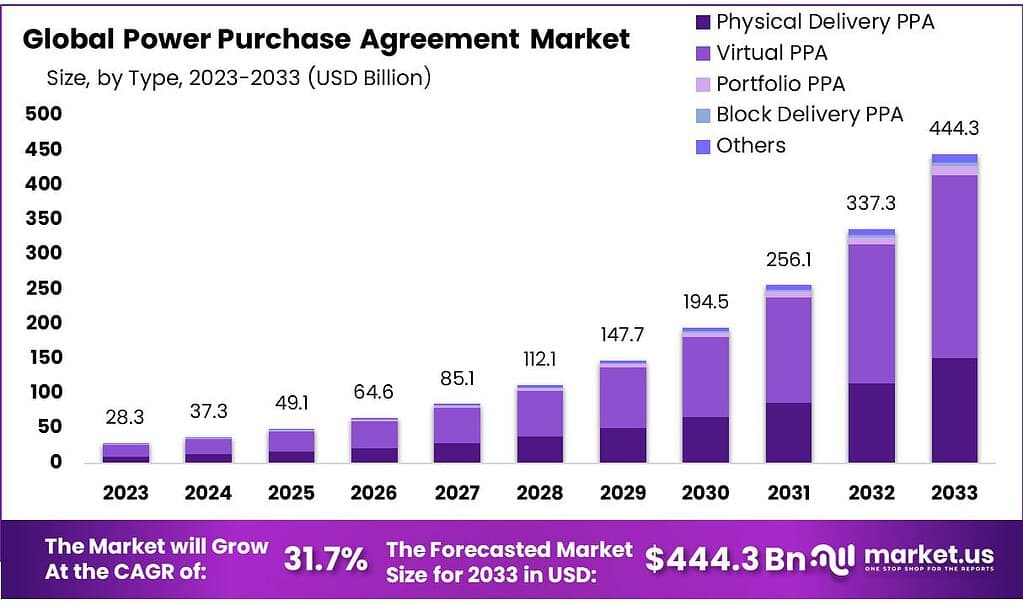

New York, Feb. 21, 2024 (GLOBE NEWSWIRE) -- According to Market.us, the Global Power Purchase Agreement Market size is expected to be worth around USD 444.3 Billion by 2033, from USD 28.3 Billion in 2023, and it is poised to reach a registered CAGR of 31.7% from 2024 to 2033.

A Power Purchase Agreement (PPA) is a contractual agreement between a power generator, often a company producing renewable energy, and a power purchaser or off-taker, which can be a utility, company, or government entity. The agreement outlines the terms under which the power will be generated, sold, and purchased, typically covering aspects such as the duration of the contract, pricing, and delivery of electricity.

PPAs serve as a financial arrangement that enables the development of renewable energy projects by providing a guaranteed revenue stream for the energy produced, making them crucial for financing solar, wind, hydro, and other renewable energy projects. They help mitigate the upfront capital costs associated with renewable energy infrastructure and provide a stable, long-term investment for both generators and purchasers.

To get additional highlights on major revenue-generating segments, Request a Power Purchase Agreement Market sample report at: https://market.us/report/power-purchase-agreement-market/request-sample/

Key Takeaway

- In 2023, the global Power Purchase Agreement (PPA) market was valued at US$ 28.3 billion, indicating a growing interest in renewable energy contracts.

- The market is expected to grow at a 31.7% CAGR from 2024 to 2033, reflecting increasing demand for renewable energy sources.

- Virtual PPAs emerged as a significant portion of the market, holding a 59.2% share in 2023, showcasing their growing acceptance.

- The off-site PPA segment led the market with an 83.1% share in 2023, highlighting the trend towards larger, utility-scale renewable projects.

- Corporates were major contributors, accounting for 32.8% of the market, driven by their commitment to sustainability and renewable energy.

- The wholesale deal type was predominant, with a 62.5% market share in 2023, underlining the bulk purchase of renewable energy by large off-takers.

- The 50-100 MW capacity segment was the most popular in 2023, making up over 49.6% of the market, favored for its balance of scale and manageability.

- Wind energy applications saw the fastest growth, with an 8% CAGR forecasted, indicating wind's competitive edge in renewable energy.

- The commercial sector dominated end-user segments, capturing more than 50% of the market in 2023, emphasizing businesses' shift towards green energy.

- North America led with a 40.7% revenue share in 2023, reflecting the region's aggressive adoption of PPAs to meet renewable energy targets.

Factors Affecting the Growth of the Global Power Purchase Agreement Industry

- Regulatory Policies and Support: Government policies, incentives, and regulatory frameworks play a pivotal role in fostering the adoption of PPAs. Favorable regulations, such as tax benefits for renewable energy projects and mandates for renewable energy consumption, significantly contribute to the industry's growth.

- Corporate Sustainability Goals: An increasing number of corporations are committing to sustainability and setting ambitious targets for renewable energy consumption. These commitments often translate into the adoption of PPAs as a means to secure clean energy and reduce carbon footprints, thereby driving market growth.

- Advancements in Renewable Energy Technologies: Technological advancements in solar, wind, and other renewable energy sectors have led to reduced costs and improved efficiency of renewable energy projects. This makes PPAs more attractive to both energy producers and purchasers.

- Energy Cost Volatility: Fluctuations in traditional energy prices, particularly fossil fuels, encourage businesses to seek more stable and predictable energy costs through PPAs, which often offer fixed pricing structures for the duration of the agreement.

- Access to Finance: PPAs provide a mechanism for securing financing for renewable energy projects by guaranteeing a future revenue stream. This aspect is particularly appealing to developers and investors in the context of increasingly competitive and risk-averse financial markets.

Plan your Next Best Move. Purchase the Report for Data-driven Insights: https://market.us/purchase-report/?report_id=107225

Report Segmentation

By Type Analysis

In 2023, the Power Purchase Agreement (PPA) market saw significant activity in both physical delivery and virtual segments. The virtual PPA segment emerged as the most lucrative, capturing a 59.2% market share, thanks to its flexibility and suitability for businesses without access to on-site renewable projects. These agreements offer long-term stability in energy costs and support corporate sustainability goals by enabling the procurement of renewable energy from distant sources.

On the other hand, the physical delivery PPA segment, holding a 34% share, appealed to buyers seeking direct and reliable access to renewable energy, providing a transparent and straightforward mechanism for purchasing electricity from renewable sources and ensuring a stable supply while offering price stability amidst volatile market conditions.

By Location Analysis

In 2023, the off-site segment of the Power Purchase Agreement (PPA) market significantly outperformed its on-site counterpart, securing an 83.1% share. This dominance is attributed to off-site PPAs' ability to offer businesses and utilities greater flexibility and scalability in sourcing renewable energy.

These agreements allow for the procurement of energy from large-scale projects located in areas optimal for renewable generation, often at lower costs than on-site alternatives. The constraints and challenges of on-site renewable energy production, such as limited space and the need for specialized infrastructure, make off-site PPAs an attractive option for organizations aiming to enhance their sustainability initiatives and reduce operating costs, thus driving the transition towards a more sustainable energy future.

By Category Analysis

In 2023, the corporate sector significantly led the Power Purchase Agreement (PPA) market, capturing an 86.3% revenue share and anticipated to grow at a CAGR of 32.8%. This dominance reflects businesses' growing commitment to sustainability and their efforts to mitigate energy cost volatilities through renewable energy adoption.

With corporations increasingly investing in PPAs to secure long-term energy costs and reduce carbon emissions, the trend is supported by a surge in clean power contracts, such as the 30.9 GW signed in Europe in October 2023. This movement is further propelled by favorable government policies, advances in renewable technologies, and broader societal demand for environmental stewardship, underscoring the corporate world's pivotal role in driving renewable energy commitments through PPAs.

By Deal Type Analysis

In 2023, the wholesale segment emerged as the predominant force in the Power Purchase Agreement (PPA) market, holding a 62.5% share. This dominance is largely due to the segment's ability to meet the demands of large-scale energy purchasers and utilities aiming for large volumes of electricity at stable prices. Wholesale PPAs are particularly attractive for their ability to offer economies of scale by facilitating bulk procurement of renewable energy from significant projects.

Additionally, these PPAs support energy producers by ensuring steady revenue, thereby boosting the financial feasibility of renewable projects. The segment's growth is further propelled by regulatory frameworks and an increasing corporate drive towards sustainability, highlighting the critical role of wholesale PPAs in advancing renewable energy adoption on a grand scale.

By Capacity Analysis

The 50-100 MW segment dominates the Power Purchase Agreement (PPA) market, holding a 49.6% market share in 2023. This capacity range strikes a balance between scalability and manageability, making it suitable for various applications. Projects in this range benefit from economies of scale, reducing the cost per megawatt and enhancing financial viability.

Notably, companies like Evonik and EnBW have entered PPAs, exemplified by a 50 MW offshore wind energy purchase from the "He Dreiht" project, complementing a prior 100 MW acquisition. The ease of integration into existing power grids further contributes to the segment's market leadership, avoiding infrastructural challenges and regulatory hurdles common in larger projects.

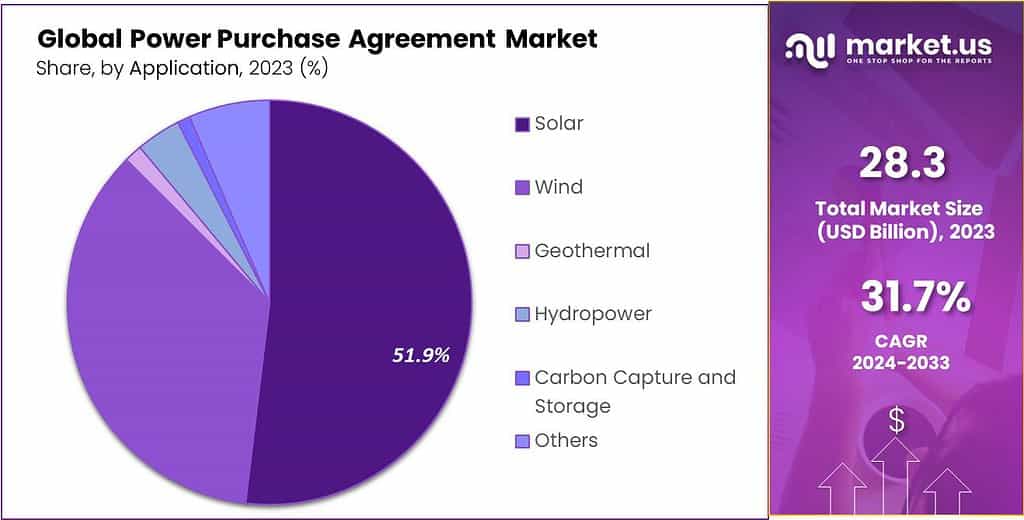

By Application Analysis

Solar Power Purchase Agreements (PPAs) lead the market, claiming over 51% market share in 2023. Their dominance is attributed to a stable and predictable pricing model, especially appealing to commercial and industrial entities seeking protection against fluctuating energy prices. Solar energy's scalability, coupled with declining installation costs, enhances accessibility and economic viability across various applications.

Technological advancements in photovoltaic cells further boost efficiency, driving increased adoption. Notably, the cost-effectiveness of solar PPAs is highlighted by a 1% decrease in the average price to $49.09 per megawatt-hour in the second quarter of 2023, fostering broader acceptance of solar projects.

By End-Use Analysis

The commercial sector dominates the Power Purchase Agreement (PPA) market, holding over 50% market share in 2023. This is attributed to the higher energy demands of commercial enterprises compared to residential users, necessitating stable and long-term energy procurement strategies. PPAs provide commercial entities with the advantage of locking in predictable energy costs, reducing the risk of price volatility in energy markets and aiding in long-term cost planning.

Furthermore, these agreements empower businesses to meet sustainability goals by directly sourcing renewable energy. A notable example is Ørsted and Google's collaboration, where Google will purchase renewable energy from the Helena Wind Farm, supporting Google's commitment to operate on 24/7 carbon-free energy by 2030.

Market Key Segmentation

Based on Type

- Physical Delivery PPA

- Virtual PPA

- Portfolio PPA

- Block Delivery PPA

- Others

Based on Location

- On-site

- Off-site

Based on Category

- Corporate

- Government

- Others

Based on Deal Type

- Wholesale

- Retail

- Others

Based on Capacity

- Up to 20 MW

- 20 50 MW

- 50 100 MW

- Above 100 MW

Based on Application

- Solar

- Wind

- Geothermal

- Hydropower

- Carbon Capture and

- Storage

- Others

Based on End-Use

- Residential

- Commercial

- Industrial

Driving Factors

The global Power Purchase Agreements (PPA) market is expected to be driven by the increasing demand for renewable energy sources, fueled by a global focus on sustainability and a shift towards cleaner energy solutions. The growth in the renewable energy sector, covering solar, wind, hydroelectric, and biomass energy, requires robust financial and contractual frameworks for project viability and stability.

PPAs play a crucial role by facilitating long-term energy sales between producers and purchasers, thereby mitigating risks associated with renewable energy project development. Notably, in the US, corporate procurement has exceeded 70 GW of renewable capacity since 2014, with the corporate sector's market share in contracted renewable capacity surpassing 50% of the total PPA market in 2022.

Restraining Factors

The global power purchase agreements (PPA) market faces limitations due to the restricted availability and complexity of such agreements. Varied laws across states and countries, including outright prohibitions in some areas, contribute to the challenge. Legal provisions in PPAs exhibit inconsistency, with varying degrees of risk acknowledgment. Complexities arise from the extensive legislative and regulatory framework at both federal and regional levels, leading to high transaction costs and lengthy negotiations.

Additionally, the long-term nature of these contracts can be unfavorable in the face of negative price developments. The competitive energy market intensifies scarcity, as the demand for PPAs exceeds the available supply, hindering the expansion of renewable energy initiatives and impeding progress towards a cleaner energy landscape.

Growth Opportunities

The Power Purchase Agreements (PPA) market is witnessing a surge in opportunities with the rising popularity of Virtual Power Purchase Agreements (VPPAs). VPPAs offer businesses and commercial entities a pathway to achieve sustainability goals by allowing producer-owned partnerships, expanding PPA options, and increasing success rates.

Businesses can secure significant financial benefits by opting for VPPAs, locking in low fixed energy prices and receiving Renewable Energy Certificates (RECs) for valid claims on clean energy use and carbon reduction. In the US, over 80% of PPA contracts executed in 2019 were virtual PPA, indicating a growing trend. This presents an opportunity for developing nations like India to embrace VPPAs for renewable energy initiatives.

VPPAs find application across various sectors, including technology, healthcare, media, manufacturing, retail, pharmaceuticals, food and beverage, agriculture, and oil and gas. Suitable for large and small buildings alike, VPPAs connect diverse establishments to renewable energy, ensuring consistent usage.

Moreover, the adoption of PPAs in developing nations, driven by increased investments in renewable energy and supportive government policies, is creating significant opportunities. Transparent power purchase agreements are crucial for funding renewable energy infrastructure in countries like India, making power supply more reliable and affordable.

Key Market Trends

The demand for innovative approaches in the Power Purchase Agreement (PPA) market is rising, particularly with the emergence of Hybrid PPAs. Involving separate agreements for power plants and storage units, Hybrid PPAs leverage sophisticated computer programs and market incentives, such as demand response, to manage projects efficiently and economically. This new method of procuring renewable energy combines transparency, collaboration, and cost-effective solutions, contributing to a more sustainable and adaptable future in the energy industry.

Simultaneously, there is a growing demand for Aggregated PPAs, which typically involve one large buyer, several medium-to-large buyers, and numerous smaller-sized corporates. This three-tiered approach allows small and medium enterprises to collaborate on renewable procurement, gaining economies of scale and enhancing their buying power.

Aggregated PPAs enable these enterprises to access long-term renewables, reducing greenhouse emissions and incentivizing suppliers to decarbonize. This trend is expected to drive increased demand for PPAs and spur developer investments in new renewable projects.

Have Queries? Speak to an expert or To Download/Request a Sample, Click here.

Report Scope

| Report Attribute | Details |

| Market Value (2023) | USD 28.3 Billion |

| Market Size (2033) | USD 444.3 Billion |

| CAGR (from 2024 to 2033) | 8.4% |

| North America Region Revenue Share | 40.7% |

| Historic Period | 2016 to 2023 |

| Base Year | 2023 |

| Forecast Year | 2024 to 2033 |

Regional Analysis

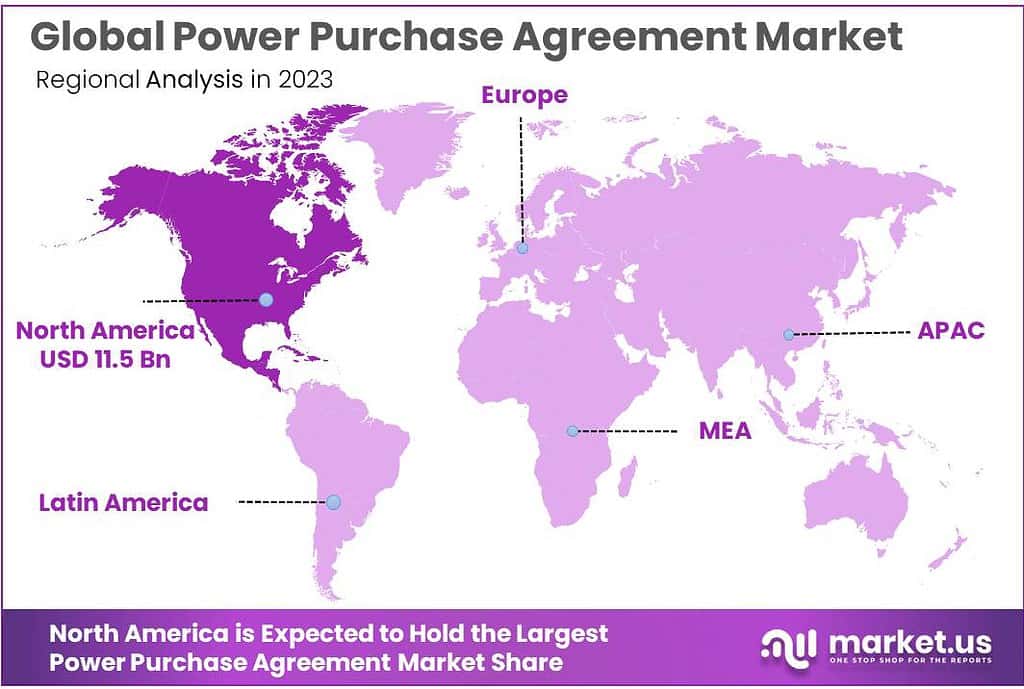

In 2023, North America dominated the Power Purchase Agreement (PPA) market, capturing a 40.7% market share due to robust regulatory support for renewable initiatives. The US and Canada, in particular, offered incentives and policies encouraging the adoption of renewable energy, leading to a record 20 GW of clean PPAs signed by commercial and industrial companies in 2022.

The mature and technologically advanced renewable sector in North America facilitated large-scale projects, driving corporate interest in PPAs for long-term, cost-effective renewable energy. Meanwhile, Europe experienced the fastest growth rate in the PPA market, boasting a 36.6% CAGR, and is poised to surpass North America in market share.

Stringent environmental regulations and ambitious renewable targets set by the European Union fueled this growth, resulting in a record-breaking 16.2 GW of contracted renewable power volumes in 2023, with projections exceeding 20 GW in 2024. The surge in corporate sustainability commitments in Europe further contributed to the demand for renewable PPAs as companies aim to reduce their carbon footprint and ensure a sustainable energy future.

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Competitive Landscape Analysis

The global Power Purchase Agreement (PPA) market is shaped by influential industry players such as General Electric, Siemens AG, Shell Plc, Statkraft, and others. These companies contribute significantly to the development, financing, and operation of renewable energy projects globally, impacting market dynamics. The distribution of market share among these entities is influenced by their geographic presence, technological expertise, and ability to form strategic partnerships.

Key contributors like Iberdrola, S.A., Ørsted A/S, and Enel Global Trading have played a crucial role in advancing the PPA market through extensive renewable energy portfolios and global reach. Specialized firms like Ameresco and Ecohz enrich the competitive landscape by offering tailored energy solutions to meet the increasing demand for sustainable energy sources. These key players are expected to drive innovation, expand renewable energy capacities, and contribute significantly to the transition toward a more sustainable energy future.

Top Key Players

- General Electric

- Siemens AG

- Shell Plc

- Statkraft

- Fairdeal Greentech India Pvt. Ltd.

- Ameresco

- RWE AG

- Enel Global Trading

- Ecohz

- Green sphere Cleantech Services Private Limited

- Iberdrola, S.A.

- Ørsted A/S

- Renew Energy Global PLC

- Drax Energy Solutions Limited

- Other Key Players

Recent Developments

- In Oct 2023, Statkraft and Chiesi Group signed a 10-year renewable power purchase agreement to supply more than 30 gigawatt-hours per year of renewable energy.

- In Oct 2023, RWE signed its first power purchase agreement in the US with the state of New York. The agreement involves the supply of electricity from 1300 MW of offshore wind capacity.

Explore Extensive Ongoing Coverage on Chemical Research Reports Domain:

- Regenerative Agriculture Market was valued at USD 8.8 billion and is predicted to reach USD 31.6 billion by 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 14%.

- laser scarecrows market was valued at USD 340.2 million. This market is estimated to reach USD 573 million in 2032 a CAGR of 5.5% between 2023 and 2032.

- Animal-free-Dairy Products Market was valued at USD 26.1 billion and is expected to reach USD 78.8 billion in 2032. This market is estimated to register the highest CAGR of 12% between 2023 and 2032.

- AI in Food Preservatives Market was valued at USD 420.0 Million. Between 2023 and 2032, this market is estimated to register the highest CAGR of 7.2%. This market is predicted to achieve a valuation of USD 827.3 Million by 2032.

- Jesuit Tea Market size is expected to be worth around USD 558.0 Mn by 2033, from USD 294.5 Mn in 2023, growing at a CAGR of 6.6%

- Broccoli Seed Oil Market size is expected to be worth around USD 804 Million by 2033, from USD 405 Million in 2023, growing at a CAGR of 7.1% during the forecast period from 2023 to 2033.

- Whiskey Market size is expected to be worth around USD 121.4 Billion by 2033, from USD 65.3 Billion in 2023, growing at a CAGR of 6.4% during the forecast period from 2023 to 2033.

- Ready to Drink Premixes Market size is expected to be worth around USD 49.3 Billion by 2033, from USD 25.3 Billion in 2023, growing at a CAGR of 6.9% during the forecast period from 2023 to 2033.

- plant-based proteins market was valued at USD 12.1 Billion and is expected to reach USD 24.1 billion in 2032. This market is estimated to register the highest CAGR of 7.3 % between 2023 and 2032.

- bee vectoring technologies market was valued at USD 21.3 billion. This market is estimated to reach USD 34.7 billion in 2032 at a CAGR of 5.14% between 2023 and 2032.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: