RIMOUSKI, Québec, March 04, 2024 (GLOBE NEWSWIRE) -- Puma Exploration Inc. (TSX-V: PUMA, OTCQB: PUMXF) (the “Company” or “Puma”) reports the execution of definitive sale agreements dated March 1, 2024 (collectively, the “Raptor Agreements”) to welcome a new explorer in New Brunswick: Raptor Resources Limited (“Raptor”).

In 2021, in accordance with Puma’s “DEAR” (Development, Exploration, Acquisition and Royalties) business strategy to generate maximum value for its shareholders with low share dilution, the Company’s non-core base metals assets (collectively, the “Copper Projects”) were optioned to Canadian Copper Inc. (CSE: CCI) (“Canadian Copper” or “CCI”) pursuant to an option agreement dated June 30, 2021, as amended (the “Option Agreement”) in order to provide the Copper Projects with the visibility and attention that they deserved (see Puma’s news release dated July 6, 2021).

More particularly, the Turgeon, Chester, Murray Brook West and Legacy Projects formed part of the Copper Projects. Following satisfaction of all closing conditions under the Option Agreement, this transaction closed on June 2, 2022 (the “Option Closing Date”). Before the execution of the Raptor Agreements, Puma was holding a 100% interest in each of the Projects. Canadian Copper’s right to earn a 100% interest in the Projects was contingent on two (2) remaining payments of CAD$1,000,000 each payable to Puma at the latest on the second (2nd) and third (3rd) anniversary of the Option Closing Date, either in cash or in common shares of Canadian Copper.

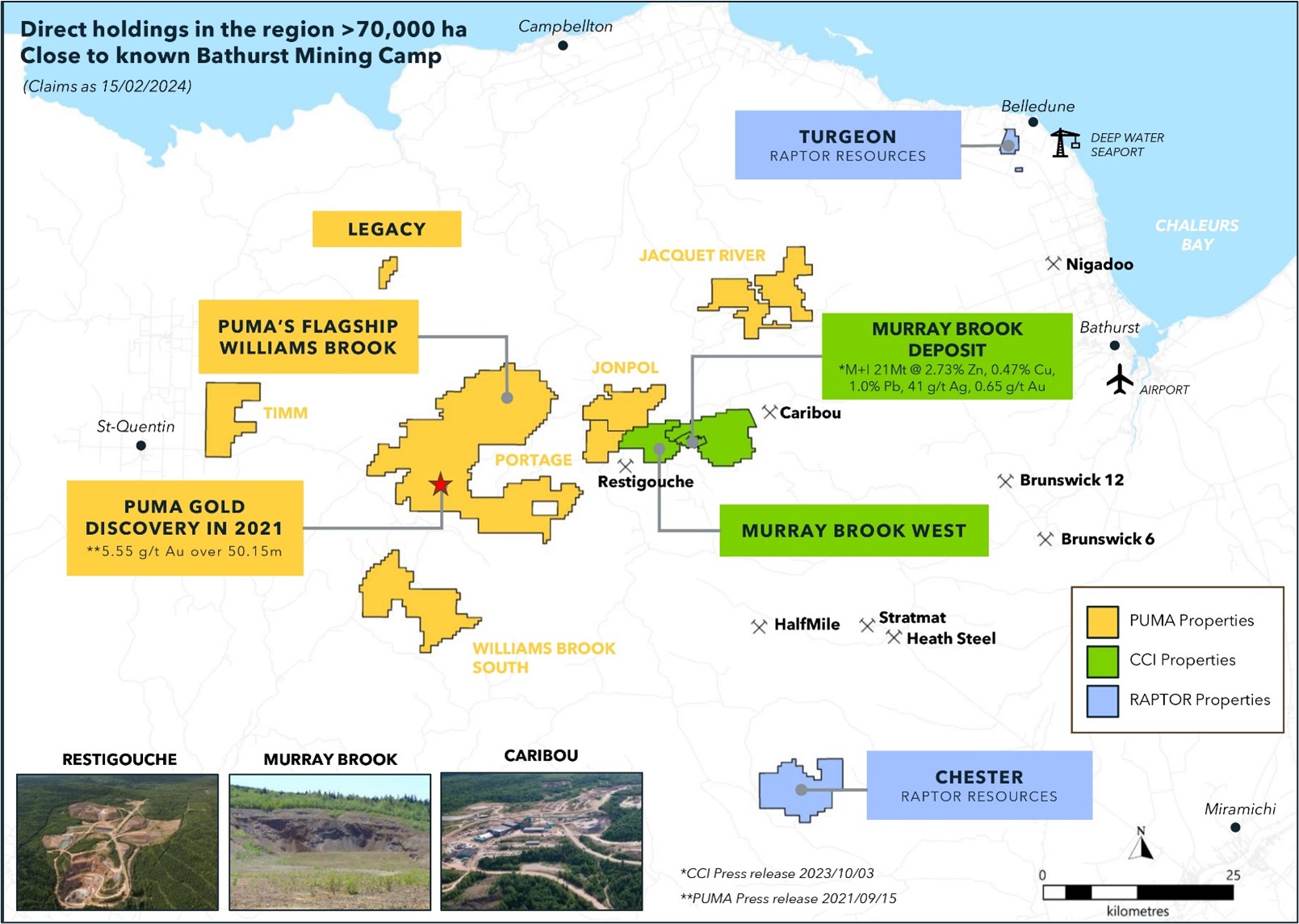

In connection with Canadian Copper’s recent acquisition of the Murray Brook deposit (see Canadian Copper’s news release dated February 1, 2024), Canadian Copper has identified an opportunity to sell its interests in the Chester and Turgeon Projects to focus on developing the Murray Brook deposit and surrounding property. Following the execution of the Raptor Agreements, Canadian Copper retains its option rights on the highly prospective Murray Brook West Project and now controls over 15km of the favourable Caribou Mine horizon (see Figure 1).

The sale of the Chester and Turgeon Projects to Raptor will allow Puma to further monetize its copper assets and unlock their value. To earn a 100% interest in the Chester and Turgeon Projects, Raptor will make non-dilutive cash payments and issue common shares to Puma over the next two (2) years in place and in lieu of the payments initially payable by Canadian Copper under the terms of the Option Agreement. With large equity positions in both Canadian Copper and Raptor, Puma will benefit from both companies’ valuation growth as it continues to focus on developing the Williams Brook Gold Project.

Puma’s President and CEO Marcel Robillard stated, “I’m delighted to welcome Raptor to the Bathurst Mining Camp! Having a new player actively exploring in the region is great news. An Australian explorer also brings exposure to new exploration methodologies, connections to other explorers down under, and increased visibility. That could translate into potential new investors and funding partners for Puma. We’re always looking to increase shareholder value and creative ways to finance and control share dilution. The new agreements with Raptor bring in cash in the coffers at a time when markets are down and gives shareholders significant upside - with a stake in two other companies, we’re multiplying the odds for success and share appreciation.”

Figure 1: Puma’s assets and landholdings in Northern New Brunswick

Particulars of the Raptor Agreements

Chester Project

Subject to completion of due diligence and satisfaction of certain other conditions, including a capital raising by Raptor by way of prospectus of at least AUD$10,000,000 and receipt of a conditional approval to list its securities on the Australian Securities Exchange (the “ASX”) on or before June 30, 20241, Raptor has agreed to acquire a 100% interest in the Chester Project.

The consideration payable to Puma for the acquisition of the Chester Project will be as follows2:

- AUD$500,000 in cash

- 4,000,000 shares of Raptor at a deemed value of at least AUD$0.20 per share (AUD$800,000)3

- If the closing conditions are not satisfied or waived on or before June 30, 2024, Raptor may elect, by paying an extension fee of $20,000, to extend the period during which the closing conditions must be satisfied by a further period of two (2) months.

- A separate consideration will be payable by Raptor to Canadian Copper as follows: a non-refundable fee of $100,000, 4,000,000 shares of Raptor and a cash amount capped at a maximum of $750,000 by way of reimbursement of exploration expenditures incurred by Canadian Copper on the Chester Project.

- ASX listing rules mandate a minimum issue price of AUD$0.20 per share. Consideration value assumes a AUD$0.20 price per share.

In addition, upon acquisition by Raptor of a 100% interest in the Chester Project, Puma will be granted a 2% NSR royalty on all saleable production, half of which (1%) can be bought back for CAD$1,000,000 on Big Sevogle River Property (7045).

Turgeon Project

Subject to completion of due diligence and satisfaction of certain other conditions by March 1, 2025, at the latest, Raptor has agreed to acquire a 100% interest in the Turgeon Project.

The consideration payable to Puma for the acquisition of the Turgeon Project will be as follows1:

- AUD$375,000 in cash

- AUD$375,000 worth in shares of Raptor2.

- A separate consideration of AUD$750,000 will be payable by Raptor to Canadian Copper in cash or Raptor Shares.

- The number of shares to be issued to Puma will be calculated using a 10-day VWAP.

Amendment to Option Agreement between Canadian Copper and Puma

Concurrently with the execution of the Raptor Agreements, to accommodate the new structured deal with Raptor, Puma and Canadian Copper have agreed to amend the Option Agreement to allow Canadian Copper to (a) sell to Raptor its interests in the Chester and Turgeon Projects and (b) maintain its option to acquire a 100% interest on the Murray Brook West Project. In addition, the Legacy Project will no longer be subject to the Option Agreement (see Figure 1).

As the consideration under the Raptor Agreements will be payable by Raptor to Puma in Australian dollars, Canadian Copper has agreed to compensate Puma for any difference in value resulting from the exchange rate between Canadian and Australian dollars in cash or the issuance of additional shares of Canadian Copper. The objective for Puma is to receive from Raptor the same consideration value as the one that it negotiated in its initial option deal with Canadian Copper, of which CAD $2M remains receivable.

In addition, if Raptor does not proceed with any of the payments as stipulated under the Raptor Agreements for the acquisition of the Chester and the Turgeon Project, Canadian Copper will have to satisfy the aggregate consideration payable to Puma under the terms of the Option Agreement as amended, to acquire a 100% interest thereto or abandon its option rights thereunder.

The transactions described in this news release are subject to approval from the TSX Venture Exchange.

About Canadian Copper Inc.

Canadian Copper is a Canadian-based mineral exploration company with a copper and base metals portfolio of historical resources and grassroots projects. Canadian Copper is focused on the prolific Bathurst Mining Camp (“BMC”) of New Brunswick, Canada. There are currently 90,044,760 shares issued and outstanding in the Company. Visit www.canadiancopper.com for more information.

About Puma Exploration

Puma Exploration is a Canadian-based mineral exploration company with precious metals projects in Northern New Brunswick. Puma’s flagship Williams Brook Gold Project comprises four properties covering more than 49,000 ha near paved roads and with excellent infrastructure nearby. The land package is located near the Rocky Brook Millstream Fault (“RBMF”), a major regional structure formed during the Appalachian Orogeny and a significant control for gold deposition in the region.

Since 2021 and with less than C$12.5M of exploration investment. Puma has made multiple gold discoveries at the Williams Brook property and believes that the property hosts an extensive orogenic gold system.

Qualified Person

Dominique Gagné, P.Geo., a Puma consultant and a qualified person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects, reviewed and approved this release's technical information.

Connect with us on Facebook / X/ LinkedIn.

Visit www.explorationpuma.com for more information or contact:

Marcel Robillard, President and CEO, (418) 750-8510; president@explorationpuma.com

Mia Boiridy, Head of Investor Relations and Corporate Development, (250) 575-3305; mboiridy@explorationpuma.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements: This press release may contain forward-looking statements. Such forward-looking statements involve several known and unknown risks, uncertainties, and other factors that may cause the actual results, performance, or achievements of Puma to be materially different from actual future results and achievements expressed or implied by such forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made, except as required by law. Puma undertakes no obligation to publicly update or revise any forward-looking statements. The quarterly and annual reports and the documents submitted to the securities administration describe these risks and uncertainties.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/53f7125b-e16f-4f93-a3b4-5b29d6a4ad33