New York / Singapore, March 20, 2024 (GLOBE NEWSWIRE) -- Diamond Standard Co., developer of the world’s only regulated and market traded natural diamond commodities, announces Carats—a fungible digital commodity currency issued by real world Diamond Standard Coins and Bars, now listing on Bitrue. Carats can be used for electronic payments, and are exempt from most money transmitter and cryptocurrency regulations because they are a title to a deliverable commodity. This is the first fungible commodity currency to list on Bitrue, now trading globally.

Carats™ are issued from wirelessly audited, physical commodities held by Brinks. Unlike Bitcoin or stablecoins like Tether, Carats are not issued by a sponsor, by computers, or from thin air. As electronic documents of title, Carats sit outside securities and cryptocurrency regulations, so platforms like social networks or games may be able to offer payment features without money transmitter licenses. The value of Carats is based on the market price of diamond commodities.

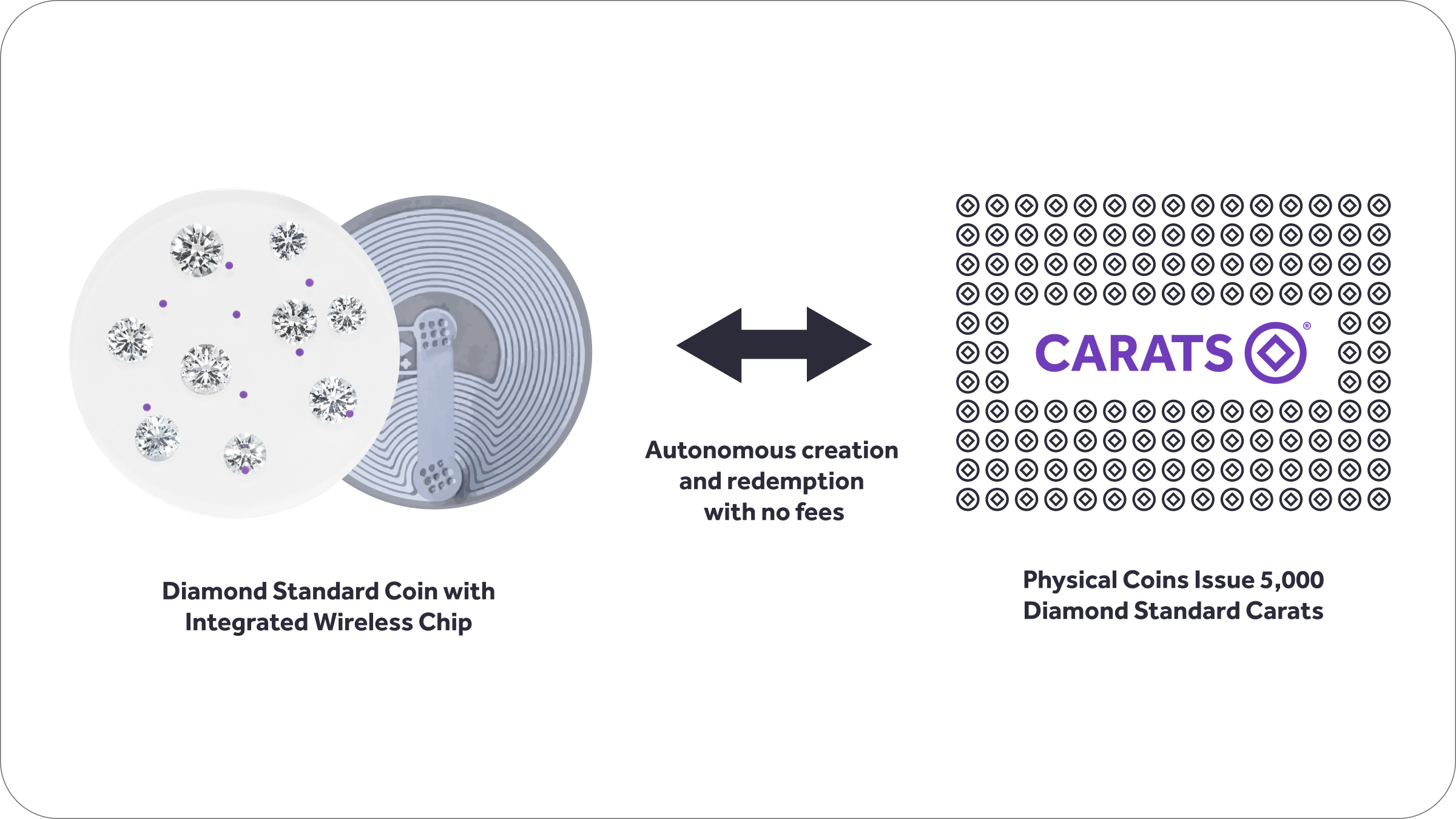

Users can transfer Carats anywhere using a mobile phone, or sell them for local currency. Or return enough Carats to a Diamond Standard Coin or Bar to transact or take delivery of that physical commodity—without requesting permission, and without fees. Carats are equivalent to an investment in Diamond Standard commodities, that can be transacted on a blockchain.

“We are the only company in the world both producing and tokenizing diamonds that continue to function as fungible commodities,” said Cormac Kinney, Founder and CEO at Diamond Standard Co. “With our permissionless system, every owner of a commodity can create Carats, and Carats can’t exist unless a real Diamond Coin has been returned to the smart contract, which enables owners to check on their coins and audit them at any time.” he added.

About Diamond Standard Commodities

Diamonds are a $1.2 trillion natural resource that was previously inaccessible to investors, but today thousands of investors own Diamond Standard commodities. See Wall Street Journal (2) (3), Financial Times, CNBC, Bloomberg (2) (3), Forbes, Coindesk (2) and More.

About Diamond Standard Carats

One Carat is the title to 1/5000th of a Diamond Standard Coin (today’s spot = $4,300) held by Brinks. A Bar equals ten Coins, so each Bar is equal to 50,000 Carats. A Carat is legally and taxwise still a commodity.

The reserve is autonomous: anyone can deposit or withdraw Diamond Standard commodities, without requesting permission from a sponsor. The Carats White Paper was published today and users can buy Carats at diamondstandard.co/carats or outside the U.S. at bitrue.com.

No Cryptocurrency Means No Money Transmission

When cryptocurrencies came into existence, regulators classified them as electronic money. For a platform to support cryptocurrency transactions, it must register as a money transmitter. Global social networks may need hundreds of licenses to enable transactions between users.

Carats use public blockchains and trade on crypto exchanges, but are not created by a sponsor or an algorithm; they are issued by, and redeemable for, individual physical commodities.

Carats Enable Unique Use Cases

Carats are ideal for integration into global social networks, and for international remittances, between users who lack bank accounts, but have mobile phones.

Elon Musk's X (fka Twitter), just received a money-transmitter license from Utah, its 15th since beginning to explore offering payment features in 2019, leaving 34 states in the USA, plus 200 more jurisdictions around the world. Because Carats are commodities, and not money or cryptocurrency, they may be usable for payments or value transfer in social networks like X, as well as by global gaming platforms, without the same requirements for licenses.

About Diamond Standard

By using computer science to optimize diamonds into a market-traded asset, Diamond Standard® enables investors to access a natural resource worth $1.2 trillion—more than all the world’s silver and platinum combined. This breakthrough real world asset is efficiently transacted as a vault receipt token, providing diversification, potential inflation protection, and a new store of wealth for institutional and individual investors, while bringing transparency and efficiency to the diamond supply chain. To Invest Brilliantly® visit www.diamondstandard.co

Connect with Diamond Standard

Diamond Standard Carats: https://www.diamondstandard.co/carats

Twitter https://twitter.com/diamondstandard

Discord https://discord.gg/XejVepHD

YouTube https://www.youtube.com/@DiamondStandard?sub_confirmation=1

Telegram https://t.me/dscarats

Media contact: carat@transformgroup.com

Sales: hello@diamondstandard.co