Dublin, March 25, 2024 (GLOBE NEWSWIRE) -- The "Australia Gift Card and Incentive Card Market Intelligence and Future Growth Dynamics (Databook) - Q1 2024 Update" report has been added to ResearchAndMarkets.com's offering.

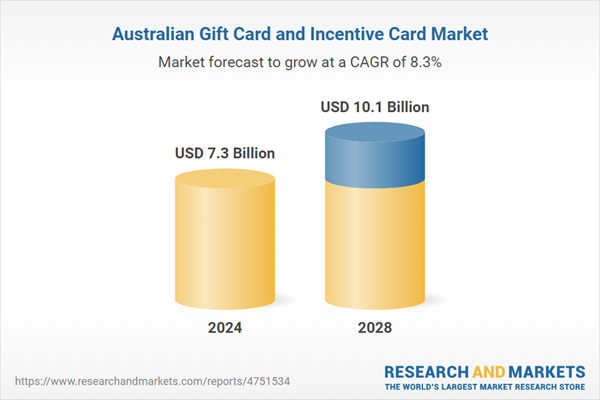

The Australian gift card industry is expected to reach US$7.3 billion in 2024 and will continue to grow over the forecast period to record a CAGR of 8.3% during 2024-2028. The gift card market in Australia is forecast to increase from US$6.7 billion in 2023 to reach US$10.1 billion by 2028.

The uptake of gift cards is expected to be much higher in young generation consumers compared to older counterparts. Although the uptake is rising, the value of unspent gift cards is also on the surge in Australia. The corporate gifting market is expected to gain momentum over the medium term.

With the mental health crisis being at an all-time high, the demand for health and wellness gift cards is poised to grow in Australia in 2024. Australian gift card startups are also focusing on expanding in new markets over the medium term. Europe is one of the regions where startups like Prezzee are planning to expand operations in 2024.

Australian consumers have more than A$1 billion in unspent gift cards, with Gen Z leading the trend

Although the adoption of gift cards is rising at a rapid rate, the amount of unused gift cards has also grown subsequently over the last few years in the Australian market. Based on the survey findings of Finder, Australians are sitting on a whopping A$1.4 billion worth of unused gift cards. The report also revealed that one in three consumers have at least one unused gift card, whereas 24% of the consumers have two or more.

Gift card expiry is a major reason behind the unspent gift cards. Nearly 18% of the consumers stated they were unable to use the gift cards due to expiry. An additional 5% were unable to use the gift cards as the consumers lost them. The report also revealed that 1% were unable to redeem their gift cards as the company went out of business. While baby boomers are the most diligent in spending their gift cards, as only 13% have left them untouched, Gen Z is leading the trend of unused gift cards with 37% failing to redeem the payment card.

The demand for health and wellness gift cards is growing significantly in the Australian market

The mental health crisis is at an all time high in Australia. It is costing billions of dollars to businesses in Australia every year. As a result, businesses are turning to health and wellness-focused gift cards, making sure that their employees are spending money wisely. This trend is projected to grow further over the medium term, thereby aiding the demand for health and wellness gift cards in Australia.

- Mentwell, the digital gift card platform focusing on health and wellness services, has reported strong growth due to soaring demand for such gift cards. In the first 18 weeks of launching, the firm generated a sale of A$5.8 million. This shows the demand for such gift cards in the Australian market. The startup has been bootstrapped and the digital gift card offerings were first rolled out in November 2023.

Mentwell, over the next three years, is also planning to expand its operations in the United States. Furthermore, the firm has set an ambitious target of achieving 60% of personal and business gifting business over the next 10 years.

Australian gift card startups are trimming the workforce and targeting expansion into new markets in 2024

The downturn in the technology market is also having an impact on gift card startups in Australia. Firms, in the sector, are cutting down on their workforce to restructure the business and focus on international expansion.

- Prezzee, one of the leading gift card providers in Australia, has cut down 10% of its workforce. The workforce trimming has affected employees largely in the tech department. During the global pandemic outbreak, the startup expanded its team rapidly, as the firm experienced strong growth.

- Prezzee has now finished the development of several new products. It is now focusing on building its brand and entering new markets globally. This strategic re-focus has impacted various roles leading to job cuts.

This report provides a detailed data centric analysis of gift card market, covering market opportunities and risks across a range of retail categories. With over 75 KPIs at country level, this report provides a comprehensive understanding of gift card market dynamics, market size and forecast.

Company Coverage: Woolworths Supermarkets, Coles, Aldi, Kmart, Bunnings, IGA, Harvey Norman, Big W and JB Hi-Fi.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 268 |

| Forecast Period | 2024 - 2028 |

| Estimated Market Value (USD) in 2024 | $7.3 Billion |

| Forecasted Market Value (USD) by 2028 | $10.1 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Australia |

Report Scope

Total Spend on Gifts

- By Consumer Segment (Retail and Corporate)

- By Product Categories (13 Segments)

- By Retail Sectors (7 Segments)

Gift Card Market Size by KPIs across Consumer Segments

- Gross Load Value

- Transaction Value

- Unused Value

- Average Value Per Transaction

- Transaction Volume

- Average Value of Card Purchased

- Number of Cards

Gift Card Market Size by Consumer Segment

- Retail Consumer

- Corporate Consumer (Small Scale, Mid-Tier, Large Enterprise)

Digital Gift Card Market Size

- By Retail Consumer

- By Retail Purchase Occasion

- By Corporate Consumer

- By Corporate Purchase Occasion

- By Company Size

Gift Card Market Size by Retail Consumer

- By Functional Attribute

- By Occasion

- Value by Purchase Channel

Gift Card Spend by Consumer Behavior and Demographics

- Consumer Purchase Behaviour

- Gift Card Buyer by Age Group

- Gift Card Buyer by Income Level

- Gift Card Buyer by Gender

Gift Card Market Size by Corporate Consumer

- By Functional Attribute

- By Occasion

- By Scale of Business

Gift Spend by Product Categories

- Food & Beverage

- Health, Wellness & Beauty

- Apparel, Footwear & Accessories

- Books & Media Products

- Consumer Electronics

- Restaurants & Bars

- Toys, Kids, and Babies

- Jewelry

- Sporting Goods

- Home & Kitchen Accessories & Appliances

- Travel

- Entertainment & Gaming

- Other

Gift Card Spend by Retail Sector

- Ecommerce & Department Stores

- Restaurants & Bars

- Supermarket, Hypermarket, Convenience Store

- Entertainment & Gaming

- Specialty Stores

- Health & Wellness

- Travel

Gift Card Spend by Distribution Channel

- Gift Card Online Sales

- Gift Card Offline Sales

- 1st Party Sales

- 3rd Party Sales

- Sales Uplift

Gift Card Sales Estimates by Key Retailers

Key Report Benefits

- In-depth understanding of gift card and incentive card market dynamics: Understand market opportunity, key trends and drivers along with five-year forecast (2019-2028) for gift cards and incentive cards in Australia.

- Develop market specific strategies: Identify growth segments and target specific opportunities across consumer segments and occasions to formulate your gift cards strategy; assess market specific key trends and risks.

- Get insights into consumer attitude and behaviour in Australia: Understand changing consumer attitude and behaviour and boost ROI. Get detailed insights into retail spend through gift cards for both retail and corporate consumers.

- Get complete perspective through six essential KPIs: number of cards in circulation, load value, unused value, average purchase value, average value per transaction, and value of transactions.

- Distribution channel insights: Understand gift cards sales dynamics by channels - online vs offline and by 1st party vs 3rd party sales.

For more information about this report visit https://www.researchandmarkets.com/r/l1d8rr

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment