Dublin, April 11, 2024 (GLOBE NEWSWIRE) -- The "Global Dental Practice Management Software Market Size, Share & Trends Analysis Report by Deployment Mode (On-premise, Web-based, Cloud-based), Application, End-use, Region, and Segment Forecasts, 2024-2030" report has been added to ResearchAndMarkets.com's offering.

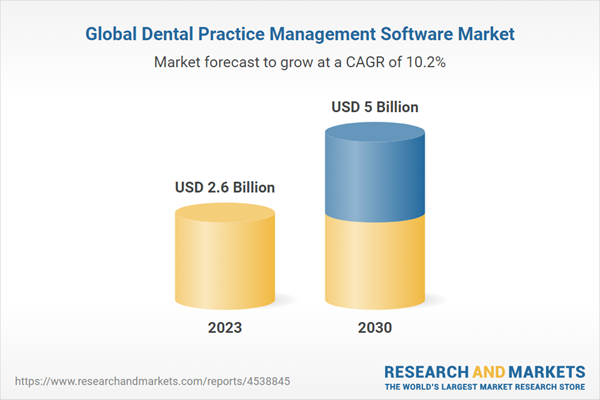

The global dental practice management software market is anticipated to reach USD 5 billion by 2030 and it is projected to grow at a CAGR of 10.17% from 2024 to 2030. The robust government support and increasing number of dental clinics and hospitals have fueled the adoption of Electronic Dental Records (EDRs)which are primary factors driving the market growth. According to the country's National Statistics Institute, there were 40,968 registered dentists in 2022 with 21,638 dental clinics in Spain. As more individuals graduate from dentistry schools and colleges and establish their practices, the potential client base expands significantly.

According to the BBC and the British Dental Association (BDA), there were 6.2, 6.0, 4.8, and 4.4 NHS dentists per 10,000 population in Scotland, Northern Ireland, Wales, and England, respectively, as of May 2022. The rising demand for the latest technology for streamlining the administrative process in dental clinics and hospitals is expected to drive the demand for Dental Practice Management (DPM) software. This trend is further supported by various government initiatives in both the U.S. and European countries, contributing to the overall market growth.

European countries are also undertaking several initiatives to promote oral healthcare services and healthcare IT. According to the report by the Platform for Better Oral Health in Europe, in 2020, an estimated USD 12.39 billion (EUR 11.67 billion) was spent on oral healthcare services in France. Hence, owing to rising government expenditure and greater demand for dental care in the country, the number of dental clinics is steadily increasing. Some of the noticeable initiatives include e-Card (Austria); Interoperable Delivery of European eGovernment Services to Public Administrations, Businesses, and Citizens (IDABC); Norwegian Healthcare System (Norway); Sentillion; Imprivata; Elektronische Gesundheitskarte (Germany); CAREfx; HealthCast, Inc.; IBM Tivoli Access Manager; and Sense.

Moreover, several companies are engaging in partnerships, mergers, acquisitions, and expansion strategies to enhance their market position. For instance, in September 2022, CD Newco, LLC (Curve Dental) partnered with Dental Whale, a prominent practice solution and learning provider in North America. This partnership will provide dental practices with access to various solutions & resources to enhance their operations and improve patient care.

Dental Practice Management Software Market Report Highlights

- Based on deployment mode, the web-based segment led the market with the largest revenue share of 56% in 2023. This is attributed to high demand, increased security, and reasonable pricing structure for the solutions

- Based on application, the insurance management segment led the market with a largest revenue share of 22% in 2023, owing to continuous improvement of dental insurance coverage and rise in the number of dental claims

- Based on end use, the dental clinics segment held the market with the largest revenue share of 48% in 2023, owing to the growing need for software to manage patient data and rise in adoption of Electronic Dental Records (EDR) and appointment scheduling platforms

- North America dominated the market with the revenue share of 40% in 2023. This can be attributed to various factors such as increasing healthcare IT expenditure and growing technological adoption in clinical and hospital settings in the region

- In March 2023, Good Methods Global Inc., a cloud-based DPM software provider, partnered with Pearl Group, a dental AI solution provider. The purpose of this partnership is to integrate Pearl's Second Opinion, a disease detection capability within CareStack's all-in-one practice management system, along with extended access to CareStack users for Practice Intelligence, a Pearl AI platform

Key Attributes

| Report Attribute | Details |

| No. of Pages | 135 |

| Forecast Period | 2023-2030 |

| Estimated Market Value (USD) in 2023 | $2.6 Billion |

| Forecasted Market Value (USD) by 2030 | $5 Billion |

| Compound Annual Growth Rate | 10.1% |

| Regions Covered | Global |

Key Topics Covered

Chapter 1 Dental Practice Management Software Market: Methodology and Scope

Chapter 2 Dental Practice Management Software Market: Executive Summary

Chapter 3 Dental Practice Management Software Market: Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Increasing Number of Dental Practices

3.2.1.2. Increasing Number of Dental Visits

3.2.1.3. Technological Advancements

3.2.1.4. Increase in Dental Tourism

3.2.2. Market Restraint Analysis

3.2.2.1. Poor Reimbursement for Dental Services

3.2.2.2. Less Adoption of Cloud-based DPM Software Among Small Practices

3.3. Business Environment Analysis

3.3.1. Industry Analysis - Porter's

3.3.2. PESTEL Analysis

Chapter 4. Deployment Mode Business Analysis

4.1. Deployment Mode Segment Dashboard

4.2. Deployment Mode Market Movement Analysis, 2023 & 2030

4.3. Market Size & Forecasts and Trend Analysis, by Deployment Mode, 2018 to 2030 (USD Million)

4.4. On-premise

4.5. Web-based

4.6. Cloud-based

Chapter 5. Application Business Analysis

5.1. Application Segment Dashboard

5.2. Application Market Movement Analysis, 2023 & 2030

5.3. Market Size & Forecasts and Trend Analysis, by Application, 2018 to 2030 (USD Million)

5.4. Patient Record Management

5.5. Appointment Scheduling

5.6. Treatment Planning and Charting

5.7. Digital Imaging and Radiography Integration

5.8. Invoice/Billing

5.9. Payment Processing

5.10. Insurance Management

5.11. Lab & X-Ray Orders

5.12. Dental Analytics

5.13. Others

Chapter 6. End-use Business Analysis

6.1. End-use Segment Dashboard

6.2. End-use Market Movement Analysis, 2023 & 2030

6.3. Market Size & Forecasts and Trend Analyses, by End-use, 2018 to 2030 (USD Million)

6.4. Dental Clinics

6.5. Hospitals

6.6. Others

Chapter 7. Regional Estimates & Trend Analysis by Deployment Mode, Application & End-use

7.1. Regional Market Share Analysis, 2023 & 2030

7.2. Regional Market Dashboard

7.3. Market Size, & Forecasts Trend Analysis, 2018 to 2030

7.4. North America

7.5. Europe

7.6. Asia Pacific

7.7. Latin America

7.8. MEA

Chapter 8. Competitive Landscape

8.1. Participant Overview

8.2. Company Market Position Analysis

8.3. Company Categorization

8.4. Strategy Mapping

8.5. Company Profiles/Listing

8.5.1. Henry Schein, Inc.

8.5.2. Carestream Dental, LLC

8.5.3. DentiMax

8.5.4. Practice-Web, Inc.

8.5.5. Nextgen Healthcare, Inc. (NXGN Management, LLC)

8.5.6. ACE Dental

8.5.7. Datacon Dental Systems, Inc.

8.5.8. CareStack (Good Methods Global Inc.)

8.5.9. CD Newco, LLC (Curve Dental)

8.5.10. Dentiflow

8.5.11. Dental Intelligence, Inc.

8.5.12. Jarvis Analytics

8.5.13. Practice Analytics

8.5.14. ABELMed Inc.

For more information about this report visit https://www.researchandmarkets.com/r/perv4s

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment