Dublin, April 15, 2024 (GLOBE NEWSWIRE) -- The "Latin America Wealth Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2020 - 2029" report has been added to ResearchAndMarkets.com's offering.

The Latin America Wealth Management Market size in terms of assets under management value is expected to grow from USD 1.18 trillion in 2024 to USD 1.32 trillion by 2029, at a CAGR of 2.34% during the forecast period 2024-2029.

The Latin American market has been witnessing traditional Private banks as their major player in channelizing the wealth of most of the retail investors. Still, with the decrease in the interest rates and growth of middle-class investors, the retail investors began opting the other alternatives investment. Hence, the share of private banks in total asset management of Latin America slowed down. In Latin America, where the major economies were struggling, the HNWI population grew the least globally, by -0.2%, while HNWI wealth increased by a meagre 1.8%.

HNWI wealth increased in Argentina, Brazil, and Mexico, while the decrease in HNWI wealth in other LATAM regions countered the growth. Together, these three markets account for 71% of LATAM's HNWI population and 83% of its HNWI wealth, and they had 0.3% and 2.4% growth in both population and wealth, respectively. Gains were offset by weakness in other LATAM economies, where the population of HNWIs fell by 1.5%, and wealth fell by 1.0%. The Asset under Management (AuM) has most of the assets remaining in the form of Mutual funds. It is expected to increase at a double-digit rate throughout the forecast period.

In 2020, COVID-19 hit the Latin American Wealth Management Market badly. This was the year of the devastating coronavirus pandemic, and the impact of the lockdown forced the economy to go downward. Despite the pandemic, global wealth increased for the year. Global high net worth individual (HNWI) population and financial wealth increased by 6.3% and 7.6%, respectively. The unprecedented stock market gains in the key market increased the HNWI wealth. A similar scenario was seen in the Latin America Wealth market. Although the HNWI population decreased by 4%, the wealth of HNWI increased by 0.5%.

The large private Banks manage the majority of AuM, but with the increase in the wealth of wealthy families, the number of Family offices managing their money is also increasing.

Latin America Wealth Management Market Trends

Alternative Assets To Boom In Latin America

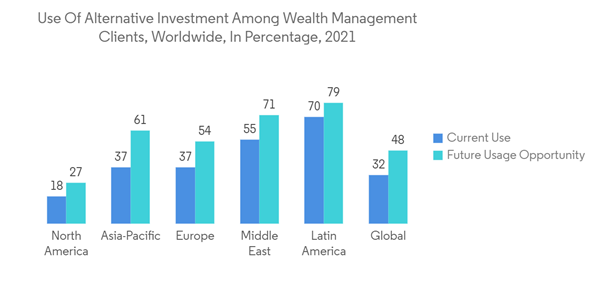

The demands of investors are shifting, but their need for high returns remains constant. Alternative assets will likely grow in popularity in the next years, owing to rising investor demand for ESG considerations. Latin America's fund managers will need to factor these changes into their strategic operations strategies while maintaining a focus on growth and performance.

In the future, most Latin Americans intend to grow their exposure to alternative asset classes, the most popular of which are private equity, private debt, and infrastructure. Many are restricted due to mandates, but it is projected that their allocations will expand even further once regulatory reforms take effect. Chile's 2017 reforms, for example, have allowed pension funds to engage in alternatives, requiring them to dedicate 5% to 15% of their portfolio to these illiquid asset classes. In the future years, as interest rates decrease, pension funds will increasingly resort to alternatives to meet their mandates and meet increased demand.

HNWI Client Type Increasing Wealth Signifying Growth in Latin America Wealth Management Market

In 2021, the wealth of HNWI in Latin America increased by 1.8 %; a similar increase was seen in the region's total wealth. This increased wealth relates to increasing demand for the region's wealth management products and services. This increase signifies a growing wealth management market in Latin America and will remain to show an upward trend throughout the forecast period.

Latin America Wealth Management Industry Overview

The Latin America Wealth Management Market is growing and highly competitive across different countries like Brazil, Columbia, and Peru Latin America offers a huge number of competitive players dominating the market, nowadays grabbing the market more powerfully through mergers and acquisitions and traditional investment opportunities are led by Brazil Market has made the Latin America Wealth Management Market very competitive and strong. International chains and their brands, such as Credit Suisse, and Morgan Stanley, are widely famous and leading the market. Latin America groups such as BTG PActual, and Bradesco have been focusing on technology innovations and offering more platforms for wealth management, thus, leading the Latin America Wealth Management Market for a long time.

Key Topics Covered:

1 INTRODUCTION

2 RESEARCH METHODOLOGY

3 EXCEUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

4.1 Market Overview

4.2 Market Drivers

4.3 Market Restraints

4.4 Industry Value Chain Analysis

4.5 Industry Attractiveness - Porter Five Forces

4.6 Insights of Technology Innovations in the Market

4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

5.1 By Client Type

5.2 By Wealth Management Firm Type

5.3 By Geography

6 COMPETITIVE LANDSCAPE

6.1 Market Concentration Overview

6.1.1 Company Profiles

- Credit Suisse

- BTG Pactual

- Itau Private Bank

- Bradesco

- UBS

- Citi Wealth Management

- Morgan Stanley Private Banking

- 3G Capital

- BBVA Bancomer

6.1.1.10 Other Key Private Banks and Family Offices

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

For more information about this report visit https://www.researchandmarkets.com/r/8f4y5z

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachments

- Latin America Wealth Management Market Use Of Alternative Investment Among Wealth Management Clients Worldwide In Percentage 2021

- Latin America Wealth Management Market Number Of High Net Worth Individuals H N W Is Worldwide By Region In Millions From 2017 To 2021