Dublin, April 23, 2024 (GLOBE NEWSWIRE) -- The "Gas Detection Equipment - Global Strategic Business Report" report has been added to ResearchAndMarkets.com's offering.

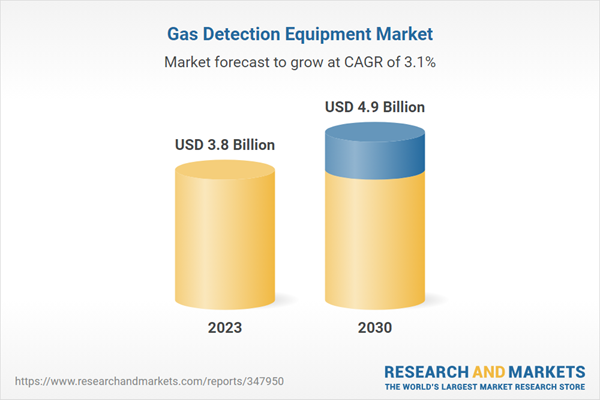

Global Gas Detection Equipment Market to Reach $4.9 Billion by 2030

The global market for Gas Detection Equipment estimated at US$3.8 Billion in the year 2023, is projected to reach a revised size of US$4.9 Billion by 2030, growing at a CAGR of 3.1% over the analysis period 2023-2030.

Gas detection equipment plays a vital role in ensuring safety across various industries, detecting potentially hazardous gases and alerting personnel to potential risks. This comprehensive report provides an introduction to gas detection equipment, tracing its evolution and offering an overview of sensing technologies utilized in the industry.

In terms of market analysis, the report presents the current scenario and outlook for gas detection equipment, with fixed gas detection equipment identified as the largest product segment. However, portable gas detection equipment is expected to exhibit the fastest growth, reflecting the increasing demand for mobility and flexibility in monitoring gas levels.

Electrochemical Detectors, one of the segments analyzed in the report, is projected to record 2.8% CAGR and reach US$1.4 Billion by the end of the analysis period. Growth in the Metal Oxide Detectors segment is estimated at 3.1% CAGR for the next 8-year period.

The competitive landscape of the gas detection equipment market is characterized by fragmentation, with numerous suppliers vying for market share. Leading suppliers are identified, and the report notes the intensifying competition driven by the availability of low-cost products.

The U.S. Market is Estimated at $1 Billion, While China is Forecast to Grow at 5.3% CAGR

Despite developed regions currently contributing the most significant revenue, emerging markets in developing regions are identified as hot spots for future growth, presenting opportunities for market expansion and penetration. Recent market activity is also analyzed to provide insights into ongoing trends and developments shaping the gas detection equipment industry.

The Gas Detection Equipment market in the U.S. is estimated at US$1 Billion in the year 2023. China, the world's second largest economy, is forecast to reach a projected market size of US$384.2 Million by the year 2030 trailing a CAGR of 5.3% over the analysis period 2023 to 2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 2% and 2.8% respectively over the 2023-2030 period. Within Europe, Germany is forecast to grow at approximately 2.6% CAGR.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 816 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value (USD) in 2023 | $3.8 Billion |

| Forecasted Market Value (USD) by 2030 | $4.9 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |

MARKET OVERVIEW

- Influencer Market Insights

- World Market Trajectories

- An Introduction to Gas Detection Equipment

- Evolution of Gas Detection Equipment

- An Overview of Gas Detection Sensing Technologies

- Common Gases Detected in Industries

- Common Gases and their Exposure Limits

- Pros and Cons of Select Gas Detection Technologies

- Gas Detection Equipment: Current Market Scenario and Outlook

- Fixed Gas Detection Equipment: Largest Product Segment

- Portable Gas Detection Equipment Exhibit Fastest Growth

- A Note on Evolution of Portable Gas Detectors

- Fixed Vs. Portable Gas Detection System: A Comparison

- While Developed Regions Remain Major Revenue Contributors, Developing Regions Emerge as Hot Spots for Future Growth

- COMPETITIVE SCENARIO

- Gas Detection Equipment: Fragmented Marketplace

- Leading Suppliers of Gas Detection Systems

- Low Cost Products Intensify Competition

- Recent Market Activity

- Gas Detection Equipment - Global Key Competitors Percentage Market Share in 2023 (E)

- Competitive Market Presence - Strong/Active/Niche/Trivial for Players Worldwide in 2023 (E)

MARKET TRENDS & DRIVERS

- Persistent Need to Ensure Personnel & Plant Safety: Primary Demand Determinant for Gas Detection Equipment Market

- Increasingly Stringent Government Regulations Create Highly Conducive Environment

- A Peek into Regulatory Landscape

- Sophisticated Wireless Systems Step In to Spearhead Next Wave of Growth

- Ability to Address Diverse Needs and Wider Availability: Key Traits of Wireless Systems Market

- Rise of Sophisticated Sensor Technologies Instigates Progressive Momentum

- A Note on Sensor Technologies Used in Gas Detection Equipment

- Hydrogen Gas Detection Elicits Heightened Attention

- CO2 Sensing Gains Traction amid Rising Energy Costs & Stringent Environmental Mandates

- Oxygen Sensing Systems in Novel Designs Come to the Fore

- Natural Gas Detectors Grow in Popularity

- Rising Demand across End-Use Verticals Propels Market Expansion

- Oil & Gas: Major End-Use Sector

- Challenging Conditions of Exploration Call for More Robust and Reliable Detection Devices

- Newer Technologies Pervade H2S Detection Space in Oil & Gas Sector

- Limitations with Conventional Technologies Drive Use of Ultrasonic Devices in Oil & Gas Sector

- High Risks Drive Demand for Gas Detection Equipment in LNG Facilities

- Uptrend in Oil & Gas Sector Signals Bright Prospects for Gas Detection Equipment

- Chemical Industry Relies on Gas Detection Equipment for Regulatory Conformance

- Gas Detection Steps In to Curb Accidents in Chemical Plants

- Criticality of Real-Time Gas Detection in Mining Facilities Bodes Well

- Common Mine Gases: Properties & Health Effects

- From Canaries and Mice to Sensors: Gas Detection in Mining Improves Dramatically through History

- Multiple-Sensor Instruments Emerge as Norm for Gas Detection in Mining

- Power Sector: High-Risk Operational Environment Drives Demand for Gas Detection Equipment

- Rising Demand for Electricity Creates Opportunities for Gas Detection Equipment in the Power Sector

- Gas Detectors Play Indispensable Role in Personnel and Plant Safety in Water & Wastewater Treatment Industry

- Gas Detection in Water & Waste Water Treatment: A Peek into Various Gases and Hazard Locations

- Growing Demand for Semi-Fixed Detectors in Water & Wastewater Treatment Plants

- Offshore Infrastructure Applications Drive Demand for Gas Detection Equipment in Marine Industry

- Regulations for Ensuring Worker Safety in the Shipping Industry

- Customized Gas Detection Systems for SOLAS Compliance

- Ensuring Proper Maintenance and Care

- Gas Detection Equipment Gain Traction in Automotive Manufacturing Environment

- Increasing Automotive Production Augurs Well

- Global Passenger Car Production (In Million Units) for the Years 2010, 2016, 2020, and 2024

- Rising Concerns of Indoor Air Quality Drive Demand for Gas Detection in HVAC Systems

- Hazards of Confined Spaces Drive Demand

- Enclosed Parking Spaces: Potential Application Zones

- Terrorist Attacks Drive Adoption of Gas Detection Equipment

- Technological Advancements & Innovations Maintain Growth Momentum in Gas Detection Equipment Market

- Integration of IoT, Cloud, Digital Communication and Mobile Device Connectivity

- Sensor Technology Advancements Widen Addressable Market

- Faster Response Time: Core Focus Area for Sensor Technology Enhancement

- Select Latest Gas Detection Equipment Models

- Pricing Pressures Continue to Dog the Market

FOCUS ON SELECT PLAYERS

- AirTest Technologies, Inc. (Canada)

- Bacharach, Inc. (USA)

- California Analytical Instruments, Inc. (USA)

- City Technology Ltd. (UK)

- Crowcon Detection Instruments, Ltd. (UK)

- Detector Electronics Corporation (USA)

- Dragerwerk AG & Co. KGaA (Germany)

- Emerson Electric Co. (USA)

- ENMET, LLC (USA)

- ESP Safety, Inc. (USA)

- Gastech Australia Pty Ltd. (Australia)

- GE Grid Solutions (USA)

- Honeywell International, Inc. (USA)

- Honeywell Analytics, Inc. (USA)

- RAE Systems, Inc. (USA)

- Industrial Scientific Corporation (USA)

- Johnson Controls International plc (USA)

- Mil-Ram Technology, Inc. (USA)

- MSA Safety Incorporated (USA)

- Sierra Monitor Corporation (USA)

- RKI Instruments, Inc. (USA)

- Sensidyne, LP (USA)

- Sensor Electronics (USA)

- Siemens AG (Germany)

- Status Scientific Controls Ltd. (UK)

- Teledyne Technologies, Inc. (USA)

- Thermo Fisher Scientific Inc. (USA)

- TQ Environmental Ltd. (UK)

- Trolex Ltd. (UK)

- Yokogawa Electric Corporation (Japan)

For more information about this report visit https://www.researchandmarkets.com/r/machma

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment