Selbyville, Delaware,, April 30, 2024 (GLOBE NEWSWIRE) --

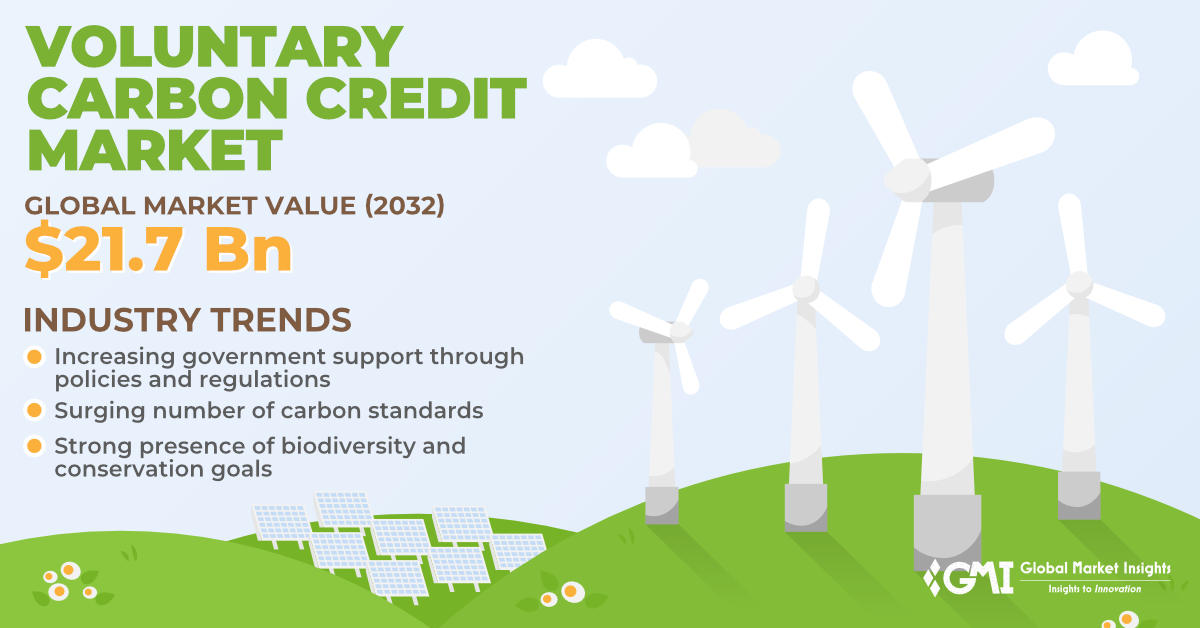

The voluntary carbon credit market is projected to hit USD 21.7 Billion by 2032, as reported in a research study by Global Market Insights Inc.

The increasing awareness and concerns about climate change prompting individuals, organizations, and governments to take proactive measures to reduce carbon emissions will drive the market growth. As part of their corporate social responsibility initiatives and sustainability goals, numerous companies are increasingly seeking to offset their carbon footprint by purchasing carbon credits.

Request for a sample of this research report @ https://www.gminsights.com/request-sample/detail/6937

Governments worldwide are also implementing carbon pricing mechanisms as well as emission reduction targets to combat climate changes effectively. Incentive programs, such as tax credits and subsidies for renewable energy projects and carbon offsetting initiatives are further likely to create a favorable environment for the adoption of voluntary carbon credits.

Based on end use, the voluntary carbon credit market from the household & community segment is likely to accelerate at a robust pace between 2024 and 2032. The heightened awareness and concerns about climate change have prompted individuals and communities to take proactive steps to reduce their carbon footprint. As people become more environmentally conscious, there is a growing inclination towards adopting sustainable practices, including carbon offsetting at the household and community levels. The accessibility and affordability of carbon offsetting options have improved, making it easier for households and communities to participate in carbon credit programs.

North America voluntary carbon credit market is estimated to attain substantial valuation by 2032. Stringent climate regulations and ambitious emission reduction targets set by governments at both the federal and state levels have created a favorable environment for carbon offsetting initiatives. Several regional companies seeking to align with regulatory requirements and demonstrate environmental stewardship are increasingly turning to voluntary carbon credits to offset their emissions and achieve sustainability goals. The increasing involvement of firms in corporate social responsibility (CSR) activities and sustainability initiatives will also bolster demand for voluntary carbon credits across the region.

Some of the prominent voluntary carbon credit market players include The Carbon Trust, The Carbon Collective Company, Climate Impact Partners, Atmosfair, South Pole, ALLCOT, 3Degrees, Ecosecurities, VERRA, ClimeCo LLC., TerraPass, EcoAct, CarbonClear, PwC, Shell, and Microsoft. These firms are focusing on various assets comprising innovative system range, mergers & acquisitions, robust R&D activities as a part of their strategic initiatives. For instance, in February 2024, O-I Glass launched a 75cl bottle, with its carbon footprint and approach to achieving carbon neutrality having been validated by the Carbon Trust.

Make an inquiry for purchasing this report @ https://www.gminsights.com/inquiry-before-buying/6937

Partial chapters of report table of contents (TOC):

Chapter 2 Executive Summary

2.1 Voluntary carbon credit industry 360° synopsis, 2019 - 2032

2.1.1 Business trends

2.1.2 End use trends

2.1.3 Regional trends

Chapter 3 Voluntary Carbon Credit Market Insights

3.1 Industry ecosystem analysis

3.1.1 Vendor matrix

3.2 Regulatory landscape

3.3 Industry impact forces

3.3.1 Growth drivers

3.3.2 Industry pitfalls & challenges

3.4 Growth potential analysis

3.5 Porter's Analysis

3.5.1 Bargaining power of suppliers

3.5.2 Bargaining power of buyers

3.5.3 Threat of new entrants

3.5.4 Threat of substitutes

3.6 PESTEL Analysis

Browse more carbon management industry reports @ https://www.gminsights.com/industry-reports/carbon-management/77

Related Reports:

Carbon Credit Market Size - By Type (Voluntary, Compliance), By End Use (Agriculture, Carbon Capture & Storage, Chemical Process, Energy Efficiency, Industrial, Forestry & Landuse, Renewable Energy, Transportation, Waste Management) & Forecast, 2024 – 2032

https://www.gminsights.com/industry-analysis/carbon-credit-market

North America Carbon Credit Market Size - By Type (Voluntary, Compliance), By End Use (Agriculture, Carbon Capture & Storage, Chemical Process, Energy Efficiency, Industrial, Forestry & Land use, Renewable Energy, Waste Management) & Forecast, 2024 – 2032

https://www.gminsights.com/industry-analysis/north-america-carbon-credit-market

Forestry and Landuse Carbon Credit Market Size - By Type (Voluntary, Compliance) Regional Outlook, Competitive Market Share & Forecast, 2024 – 2032

https://www.gminsights.com/industry-analysis/forestry-and-landuse-carbon-credit-market

About Global Market Insights Inc.

Global Market Insights Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider, offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy, and biotechnology.