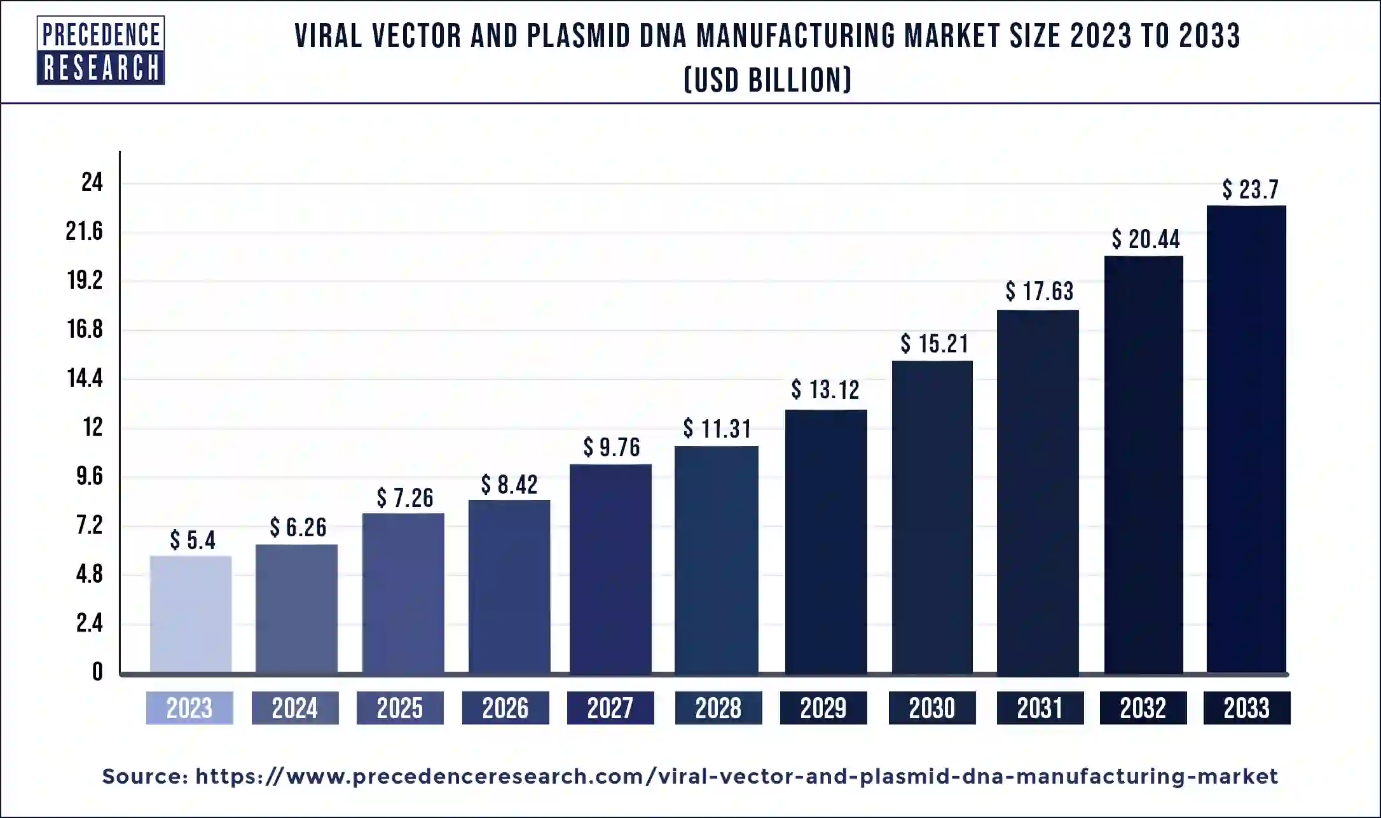

Ottawa, May 24, 2024 (GLOBE NEWSWIRE) -- The global viral vectors & plasmid DNA manufacturing market size is estimated to grow from USD 5.4 billion in 2023 to USD 20.44 billion by 2032, According to Precedence Research. The viral vectors & plasmid DNA manufacturing market is driven by growing genetic disorders, changing lifestyles, and rising technological advancements.

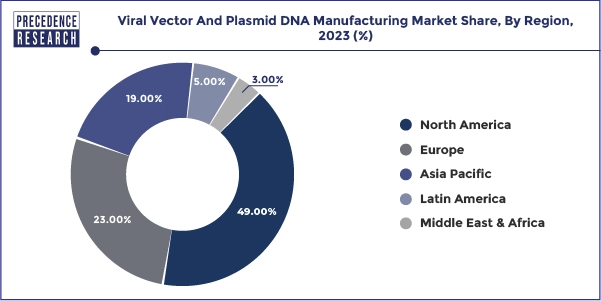

North America viral vectors & plasmid DNA manufacturing market size was valued at USD 2.64 billion in 2023 and is predicted to surpass around USD 11.61 billion by 2033.

The viral vectors & plasmid DNA manufacturing market is a biopharmaceutical industry segment that produces these tools for gene therapy and vaccine development, delivering genetic material into cells. Using viral vectors, molecular biologists can introduce genetic material into cells in vivo or in vitro. Specialized mechanisms have developed in viruses to enable effective transduction.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1012

Viral vectors were first utilized in gene therapy and vaccine development in the 1970s. They can temporarily express a gene or integrate into a cell's DNA. Small extrachromosomal DNA molecules called plasmids exsist in eukaryotic, archaeal, and bacterial species. They give selection benefits like antibiotic resistance and carry genes advantageous to the organism's survival. Artificial plasmids facilitate recombinant DNA replication in molecular cloning. They may be purchased online and injected into cells through transformation.

Viral Vectors & Plasmid DNA Manufacturing Market Key Insights

- North America dominated the market with the highest revenue share of 49% in 2023.

- By Vector Type, the AAV segment has a 21% revenue share in 2023.

- By Workflow, the downstream processing segment shows a dominant position in the viral vectors & plasmid DNA manufacturing market, accounted 54% revenue share in 2023.

- By application, the vaccinology segment has accounted largest revenue share of around 22.5% in 2023.

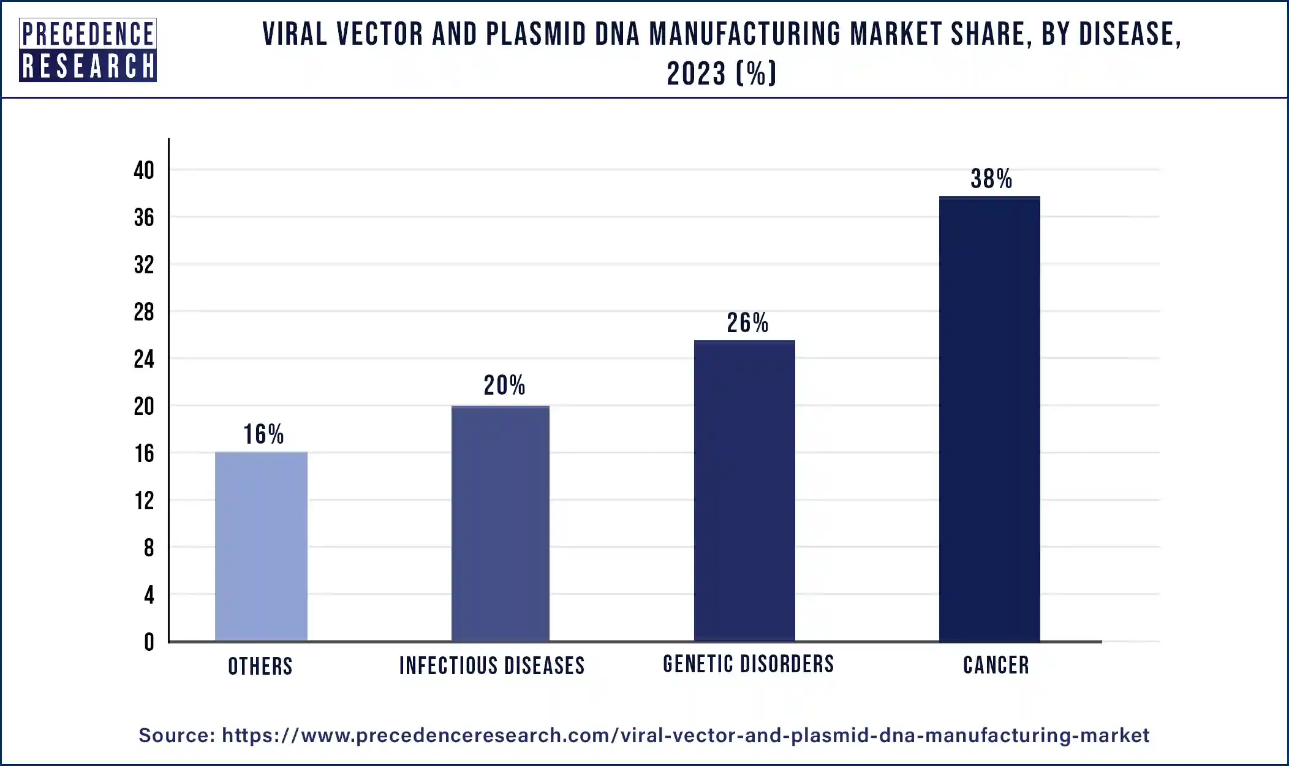

- By Disease, the cancer segment dominated the market with 38% revenue share in 2023.

- By end use, the research institutes segment has captured revenue share of around 58.4% in 2023.

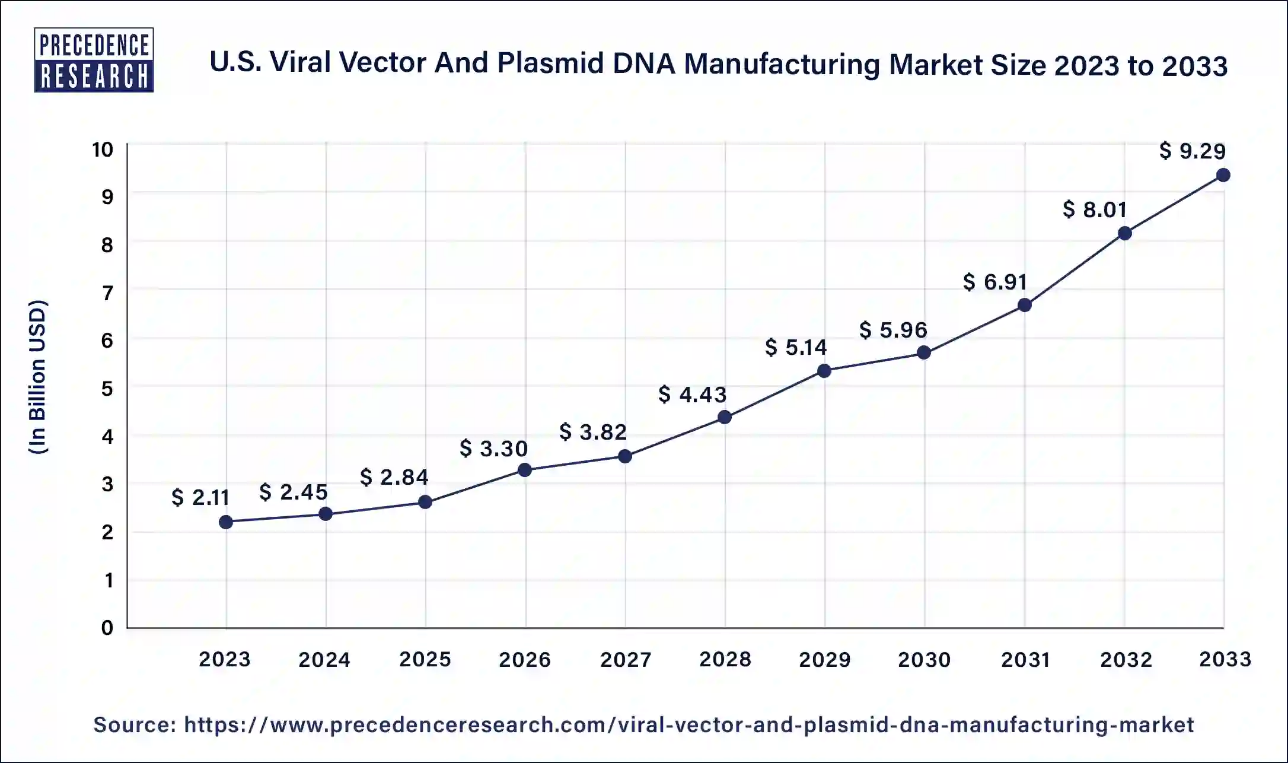

U.S. Viral Vectors & Plasmid DNA Manufacturing Size and Growth 2024 to 2033

The U.S. Viral Vectors & Plasmid DNA Manufacturing market size accounted for USD 2.45 billion in 2024 and is estimated to hit around USD 9.29 billion by 2033, expanding at a remarkable CAGR of 15.97% from 2024 to 2033.

North America dominated the viral vectors & plasmid DNA manufacturing market. North America is a significant market for producing plasmid DNA and viral vectors, with the US representing the most crucial share thanks to its developed healthcare system, robust biopharmaceutical sector, and kind regulatory framework. Prominent biopharmaceutical hotspots draw talent and capital, propelling industries' innovation. Health Canada is in charge of directing the creation of novel treatments, and Canada, which has a robust research infrastructure and government financing, is also expanding in this field. North America is anticipated to continue to be a significant player in vaccinations and gene treatments.

Europe Viral Vectors & Plasmid DNA Manufacturing Market Size and Growth 2024 to 2033

The Europe viral vectors & plasmid DNA manufacturing market size was valued at USD 1.43 billion in 2024 and is expected to reach around USD 5.45 billion by 2033, growing at a CAGR of 15.95% from 2023 to 2033.

| Forecast Year | Market Size (USD Billion) |

| 2023 | USD 1.24 Billion |

| 2024 | USD 1.43 Billion |

| 2025 | USD 1.66 Billion |

| 2026 | USD 1.93 Billion |

| 2027 | USD 2.24 Billion |

| 2028 | USD 2.60 Billion |

| 2029 | USD 3.01 Billion |

| 2030 | USD 3.49 Billion |

| 2031 | USD 4.05 Billion |

| 2032 | USD 4.70 Billion |

| 2033 | USD 5.45 Billion |

The fastest-growing region for the viral vectors & plasmid DNA manufacturing market is Europe. Europe's robust biopharmaceutical sector, sophisticated healthcare system, and regulatory framework make it a significant market for producing plasmid DNA and viral vectors. In this industry, the EU—which includes the UK, France, Germany, and Switzerland—plays a significant role.

The European Medicines Agency oversees the EU's regulatory system and offers precise rules for vaccinations and gene treatments. Innovative therapy development is spearheaded by European biopharmaceutical businesses and research institutions, propelling market expansion. Switzerland, a center for the production of biopharmaceuticals, is another critical participant because of its regulatory framework, which prioritizes patient safety and product quality.

Viral Vectors & Plasmid DNA Manufacturing Market Report Coverage

| Report Attribute | Key Statistics |

| CAGR | 15.94% from 2024 to 2033 |

| Market Size in 2023 | USD 5.4 Billion |

| Market Size in 2024 | USD 6.26 Billion |

| Market Size by 2033 | USD 23.7 Billion |

| Base Year | 2023 |

| Historic Data | 2021-2022 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Vector Type, Application, Workflow, End-User, Disease, and Region |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Viral Vectors & Plasmid DNA Manufacturing Market Highlights

By Vector Type

AAV dominated the viral vectors & plasmid DNA manufacturing market in 2023 as it is known for long-term gene expression and minimal immunogenicity. Lentiviral vectors are the most prominent and fastest-growing vectors in the market. Gene therapy delivers genetic material to target cells via viral vectors and plasmid DNA. Common varieties include adenovirus vectors, which may infect numerous cell types and contain vast quantities of genetic material, and adeno-associated virus (AAV) vectors. Lentiviral vectors, like HIV, incorporate their genetic material into the host cell genome, resulting in stable gene expression.

Customize this study as per your requirement@ https://www.precedenceresearch.com/customization/1012

By Application

In 2023, the gene therapy segment dominated the viral vectors & plasmid DNA manufacturing market. Gene therapy is a medical procedure employing genetic material to fix or replace defective genes, restoring normal cell function. It can cure genetic illnesses such as cystic fibrosis and muscular dystrophy, modify DNA sequences with methods like CRISPR-Cas9, or introduce a new gene to replace missing or non-functional genes.

Cell therapy is the fastest-growing segment of the market. The cell therapy market is rapidly growing, utilizing living cells for treating diseases like cancer, cardiovascular, neurological, and autoimmune disorders, driven by advancements in cell biology, regenerative medicine, and immunotherapy.

Vaccinology uses viral vectors and plasmid DNA to generate and manufacture vaccines. Viral vectors introduce genetic material encoding antigens from a disease into the host, inducing an immunological response. This method has been utilized to treat illnesses such as COVID-19, Ebola, and HIV. Plasmid DNA vaccines, which encode antigens from a pathogen, are being studied for diseases such as influenza, Zika, and cancer. The advantages include stability, simplicity of manufacturing, and quick generation of novel diseases.

By Disease

Cancer segment has contributed more than 38% of revenue share in 2023. The viral vectors and plasmid DNA are vital in cancer immunotherapy, which uses the body's immune system to fight cancer. They can be applied to gene therapy, CAR-T cell therapy, and plasmid DNA vaccines. Gene therapy involves introducing therapeutic genes into cancer cells, whereas vaccinations activate the immune system to detect and fight cancer cells. CAR-T cell treatment targets particular proteins in cancer cells, whereas plasmid DNA vaccines carry tumor antigen genes. These medicines are being tested in clinical trials for various cancers, with encouraging outcomes.

Genetic disorders are the fastest-growing segment in the market due to their constantly rising rate. Genetic disorders need treatment on the genetic level. There are various gene therapies in which vectors are used to replace the damaged DNA segment or add new genetic material that is missing. Advanced technology and continuous research in this field are boosting growth.

Browse More Insights:

- U.S. Plasmid DNA Manufacturing Market: The U.S. plasmid DNA manufacturing market size reached USD 550 million in 2023 and is predicted to hit around USD 3,270 million by 2033 with a CAGR of 19.26% from 2024 to 2033.

- Red Biotechnology Market: The global red biotechnology market size was valued at USD 385.01 billion in 2023 and is expected to reach over USD 649.31 billion by 2033, growing at a CAGR of around 5.36% from 2024 to 2033.

- Cell and Gene Therapy Market: The global cell and gene therapy market size was exhibited at USD 15.46 billion in 2022 and is projected to hit around USD 82.24 billion by 2032, growing at a CAGR of 18.3% from 2023 to 2032.

- Cell and Gene Therapy Clinical Trials Market: The global cell and gene therapy clinical trials market size reached USD 10.05 billion in 2022 and is expected to hit around USD 40.98 billion by 2032, growing at a CAGR of 15.09% from 2023 to 2032.

- Cancer Gene Therapy Market: The global cancer gene therapy market size was estimated at USD 2.85 billion in 2023 and is projected to hit around USD 17.49 billion by 2033, poised to grow at a CAGR of 19.8% from 2024 to 2033.

- Cell and Tissue Preservation Market: The global cell and tissue preservation market size was valued at USD 4.22 billion in 2023 and it is expected to hit over USD 11.98 billion by 2033 with a remarkable CAGR of 11.01% from 2024 to 2033.

- Cell Culture Market: The global cell culture market size was estimated at USD 26.54 billion in 2023 and it is expected to surpass around USD 63.60 billion by 2032 with a registered CAGR of 10.20% from 2023 to 2032.

- Gene Delivery Technologies Market: The global gene delivery technologies market size accounted for USD 4.01 billion in 2022, and it is projected to surpass around USD 17.07 billion by 2032 with a CAGR of 15.59% from 2023 to 2032.

- Cancer Biologics Market: The global cancer biologics market size was valued at USD 102.01 billion in 2023 and is anticipated to reach around USD 214.59 billion by 2033, growing at a CAGR of 7.12% from 2024 to 2033.

Viral Vectors & Plasmid DNA Manufacturing Market Dynamics

Driver: Increased genetic disorders

The increasing frequency of genetic illnesses is driving the need for gene treatments. This, in turn, boosts the need for plasmid DNA and viral vector production. A person's DNA can have anomalies that lead to genetic diseases, which can cause various health problems. The need for therapies has grown as a result of more diagnoses brought about by improvements in genetic testing and raised awareness of genetic illnesses.

The need for gene treatments is driven by the rising prevalence of uncommon genetic diseases and the possibility of treating the underlying cause of these ailments. Advancements in gene therapy research, regulatory incentives, and the growing uses of gene therapy drive the need for viral vectors and plasmid DNA manufacture. The increasing investment in research and development by biopharmaceutical companies and academic institutions is also driving the demand for gene therapies.

- In Feb 2024, Niloufer Hospital in Hyderabad launched a newborn screening program to discover unusual genetic disorders. The program was meant to detect congenital hypothyroidism, congenital adrenal hyperplasia, glucose-6-phosphate dehydrogenase (G6PD), galactosemia, and biotinidase deficiency.

Restraint: High development costs

One major obstacle in the viral vectors & plasmid DNA manufacturing market is the high development cost. The lengthy research and discovery phases, preclinical and clinical investigations, regulatory clearance, ramping up of production, expenses associated with intellectual property, and market volatility are the causes of this. Preclinical and clinical studies are crucial for developing viral vectors and plasmid DNA technologies.

Preclinical studies assess safety, efficacy, and pharmacokinetics in laboratory animals, while clinical studies evaluate therapy safety and effectiveness in human subjects. Regulatory approval requires these studies. These expenses can be pretty costly because of the specialist knowledge needed, the lengthy approval process, the requirement for thorough testing and documentation, and the possibility of intellectual property protection. As a result, these exorbitant development expenses may discourage investment in R&D, especially from startups or smaller businesses.

Opportunity: Diversification of product portfolio

Companies may use strategic possibilities to broaden their product portfolio, enter new therapeutic areas, and innovate by diversifying their business in the viral vectors & plasmid DNA manufacturing market. As a result, there may be an increase in the market, less dependency on specific markets, and creative ways to solve unmet medical needs. Technological innovation is essential to create unique viral vectors and plasmid DNA constructions that may be used in various therapeutic contexts. Access to patient populations and knowledge may be gained through strategic collaborations with healthcare providers, research institutes, and biopharmaceutical businesses.

Investing in new viral vector platforms may help a company stand out from the competition and fill gaps in the market. Expanding geographically into developing nations with a rising need for vaccinations and gene treatments can be profitable. One can get access to new markets, technology, and knowledge through partnerships with other businesses. Providing complementary services can increase competitiveness. Expanding a company's market presence and diversifying its product line are other benefits of acquisitions or mergers with different companies.

Recent Developments:

- In February 2024, Andelyn Biosciences Inc. was chosen to manufacture adeno-associated vectors (AAV) therapies for eight rare disease programs under the Foundation for the National Institutes of Health's Accelerating Medicines Partnership (AMP) Bespoke Gene Therapy Consortium (BGTC). Andelyn will optimize and scale AAV therapy processes for CNGB1 Retinitis Pigmentosa 45 and NPHP5 retinal degeneration.

- In October 2023, The National Institute for Innovation in Manufacturing Biopharmaceuticals (NIIMBL) launched a program to develop economically viable manufacturing processes and analytical platforms for adeno-associated virus gene therapy vectors to provide high-quality vectors without regard to cost or speed.

- In August 2023, Charles River Laboratories collaborated with Fondazione Telethon to produce High-Quality (HQ) plasmid DNA for lentivirus manufacturing. The cooperation will utilize Charles River's cell and gene contract development and manufacturing capabilities and GMP-compliant plasmid DNA batches for ex vivo cell and gene therapy.

- In May 2023, Avantor and Cytovance are collaborating to expand their plasmid DNA service, aiming to address the $1.5bn market driven by advanced therapy pipelines.

Viral Vectors & Plasmid DNA Manufacturing Market Players

- Addgene

- Aldevron

- Takara Bio Inc.

- Creative Biogene

- uniQure N.V.

- Oxford Biomedicaplc

- Cobra Biologics

- Novasep

- Merck Waisman Biomanufacturing

- The Cell and Gene Therapy Catapult

- FUJIFILM Holdings Corporation

Market Segmentation

By Vector Type

- Adenovirus

- Plasmid DNA

- Lentivirus

- Retrovirus

- AAV

By Application

- Gene Therapy

- Antisense & RNAi

- Cell Therapy

- Vaccinology

By Disease

- Cancer

- Genetic Disorders

- Infectious Diseases

- Others

By Workflow

- Upstream Processing

- Vector Recovery/Harvesting

- Vector Amplification & Expansion

- Downstream Processing

- Fill-finish

- Purification

By End-User

- Biopharmaceutical and Pharmaceutical Companies

- Research Institutes

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Rest of the world

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1012

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

For Latest Update Follow Us:

LinkedIn | Facebook | Twitters