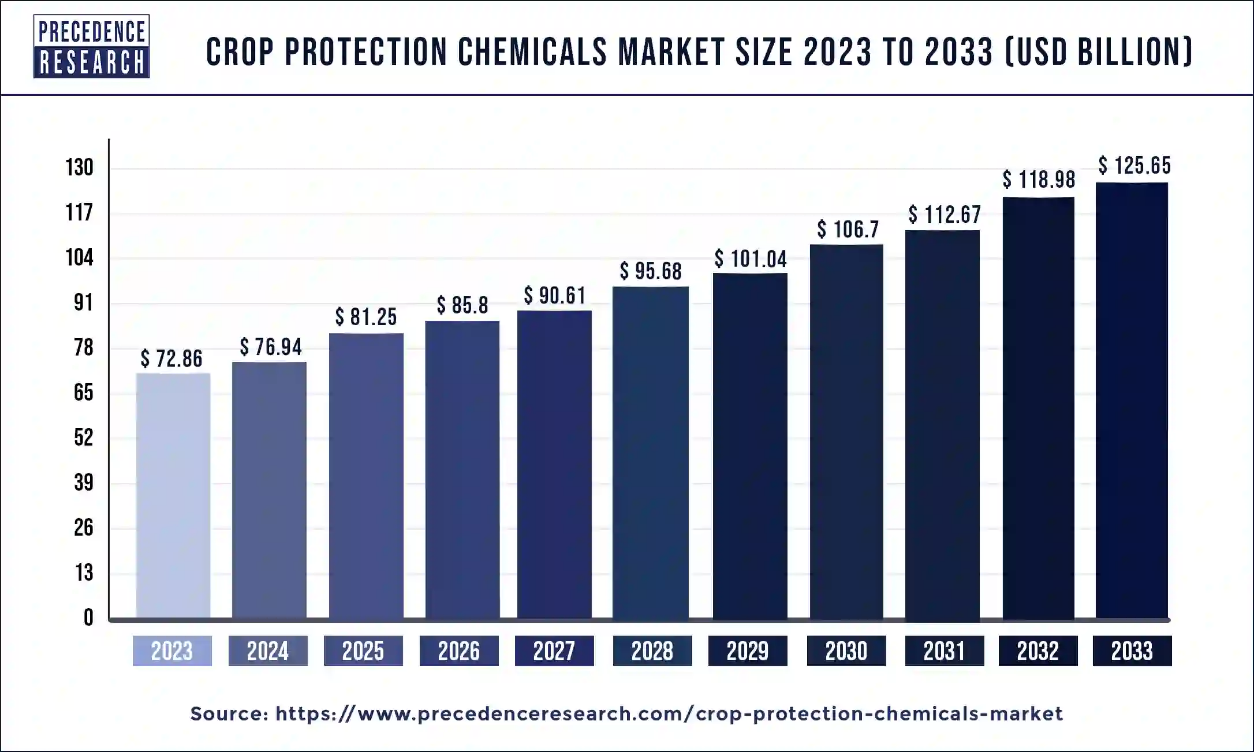

Ottawa, June 27, 2024 (GLOBE NEWSWIRE) -- According to Precedence Research, the global crop protection chemicals market size is predicted to grow from USD 72.86 billion in 2023 to USD 125.65 billion by 2033. The crop protection chemicals market is driven by the increasing need for good crops, consumers changing eating habits and government initiatives.

The crop protection chemicals market refers to the industry focused on the production, distribution, and application of chemicals designed to protect crops from diseases, pests, and weeds. The chemical industry is critical in manufacturing chemicals to preserve agricultural products, such as insecticides, which are necessary in the fight against animal and human illness. The toxicological and environmental characteristics of these chemicals have greatly improved over time.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1607

Research has been done to create effective, specialized compounds while minimizing environmental impact. Due to the regular use of pesticides, pests may become pesticide-resistant, necessitating the development of new products. Fungicides, which destroy or inhibit the growth of unnecessary fungi; herbicides, which kill arthropod pests; and herbicides, which kill undesired plants, are the most common pesticides. The pesticide's efficiency is dependent on the appropriate 3D assembly of groups in its active ingredients structure of the chemicals.

Crop Protection Chemicals Market Key Insights

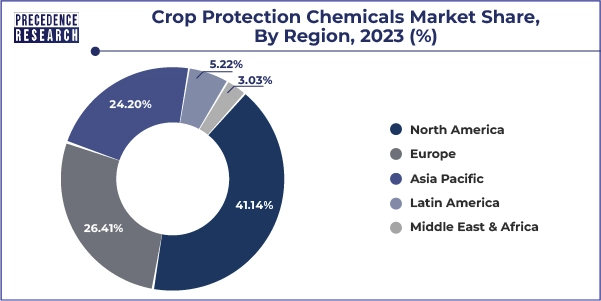

- North America dominated the market with the largest revenue share of 41% in 2023.

- By products, the herbicides segment has held a major revenue share of 41.7% in 2023.

- By crop type, the cereals & grains segment has contributed more than 45% revenue share in 2023.

- By source, the synthetic chemicals segment has generated the biggest revenue share of 80% in 2023.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

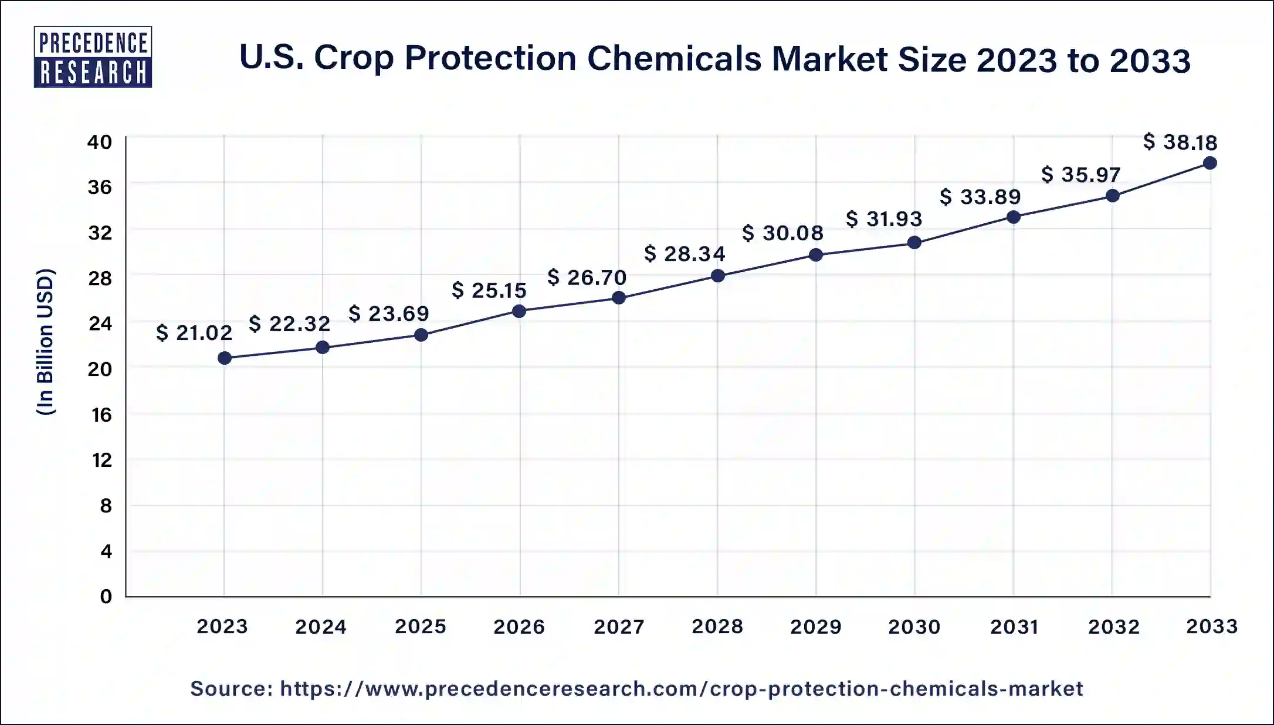

U.S. Crop Protection Chemicals Market Size and Forecast

The U.S. crop protection chemicals market size was valued at USD 21.02 billion in 2023 and is estimated to surpass around USD 38.18 billion by 2033 with a solid CAGR of 6.1% from 2024 to 2033.

North America dominated the crop protection chemicals market in 2023. Environmental awareness, organic cultivation, bio-pesticide use, low-cost crop protection options, and limited arable land contribute to the growth of North American crop protection chemicals. The market is also focusing on integrated pest control and biological seed treatments, which present substantial prospects for manufacturers in this industry.

According to the FDA, in the U.S., federal government agencies are jointly in charge of monitoring pesticide chemical residues in or on food. When pesticides are used per label instructions, the Environmental Protection Agency (EPA) assesses them to ensure they pose no harm to human health or the environment. The maximum residual level of a certain pesticide ingredient allowed in or on a particular type of human or animal food in the United States is known as a tolerance, and it is likewise established by the EPA.

The U.S. Department of Agriculture's Food Safety and Inspection Service (FSIS) regulates meat, poultry, catfish (Siluriformes), and some egg products. The FDA is in charge of enforcing the EPA tolerances for domestic foods shipped in interstate commerce and foods offered for import into the U.S. The pesticide residue monitoring program is one of the many initiatives and tactics used by the FDA to enforce pesticide tolerances.

Scope of Crop Protection Chemicals Market

| Report Attribute | Key Statistics |

| Crop Protection Chemicals Market Size by 2033 | USD 125.65 Billion |

| Crop Protection Chemicals Market Size in 2024 | USD 72.86 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.6% |

| Base Year | 2023 |

| Historical Year | 2021-2022 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Crop Type, Source, Form, Mode of Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Crop Protection Chemicals Market Report Highlights

Product Outlook

The herbicides segment dominated the crop protection chemicals market in 2023. Herbicides are becoming more popular for weed management due to their safety and effectiveness, which are impacted by climate and soil. They are simple to apply, may be employed on densely planted crops, and might be removed easily and rapidly in emergency situations.

They are generally inexpensive and can eliminate unwanted plants. They also help crops develop by removing weeds that compete for nutrients, water, and light. They are also quite safe on potentially eroding ground and may easily clear areas for building. However, herbicides' effectiveness and safety differ by country and law.

Crop Type Outlook

The cereals & grains segment dominated the crop protection chemicals market in 2023. Economic development and population expansion have raised the need for nutritious and functional foods. Maize, wheat, barley, rice, and sorghum are major cereal crops that contribute to daily caloric and protein consumption.

Their nutritional qualities are linked to their minor composition and principal grain component, which include pro-vitamin A and phenols. This increased the need to concentrate on metabolic processes, coordinating nutritional quality factors, creative techniques, new cultivators, and crop protection chemicals.

Source Outlook

The synthetic chemicals segment dominated the crop protection chemicals market. Synthetic insecticides have various advantages over natural chemicals, including certain medications. They have a good effect on animals and biodiversity.

Synthetic compounds, such as pheromones utilized in organic farming, can be produced by millions of moths or butterflies, eliminating the need for direct animal extraction. This method is especially useful for beneficial substances such as pheromones, which attract mates using chemicals. The public frequently overlooks these benefits.

Browse More Insights:

- Agrochemicals Market Size and Forecast: The global agrochemicals market size was valued at USD 229.53 billion in 2023 and is expected to hit USD 305.63 billion by 2033, poised to grow at a CAGR of 2.92% during the forecast period 2024 to 2033.

- Tractor Implements Market Size and Forecast: The global tractor implements market size was valued at USD 30.78 billion in 2022 and is projected to hit around USD 51.93 billion by 2032, growing at a CAGR of 5.37% from 2023 to 2032.

- Precision Farming Market Size and Forecast: The global precision farming market size was estimated at USD 9.8 billion in 2022 and is projected to surpass around USD 34.01 billion by 2032 with a compound annual growth rate (CAGR) of 13.30% over the forecast period 2023 to 2032.

- Regenerative Agriculture Market size and Forecast: The global regenerative agriculture market size was reached at USD 975.20 million in 2022, and it is projected to be worth around USD 4,290.92 million by 2032, poised to grow at a CAGR of 15.97% from 2023 to 2032.

- Biofuels Market Size and Forecast: The global biofuels market size was valued at USD 123.98 billion in 2023 and it will hit around USD 243.37 billion by 2033, with a registered CAGR of 7.02% during the forecast period 2024 to 2033.

- Plant Extracts Market Size and Forecast: The global plant extracts market size was valued at USD 55 billion in 2022 and is expected to hit around USD 98.96 billion by 2032, poised to grow at a CAGR of 6.10% during the forecast period 2023 to 2032.

- Synthetic Fuel Market Size and Forecast: The global synthetic fuel market size was valued at US$ 4.20 billion in 2022 and it is projected to surpass around US$ 31.57 billion by 2032 and growing at a compound annual growth rate (CAGR) of 22.40% during the forecast period 2023 to 2032.

- Liquid Fertilizers Market Size and Forecast: The global liquid fertilizers market size was surpassed at USD 14.99 billion in 2022 and it is likely to grow at USD 21.4 billion by 2032 and growing at a registered CAGR of 3.50% over the forecast period 2023 to 2032.

- Biostimulants Market Size and Forecast: The global biostimulants market size was valued at USD 3.91 billion in 2023 and is projected to reach around USD 11.71 billion by 2033, growing at a CAGR of 11.6% during the time frame 2024 to 2033.

- Biofertilizers Market Size and Forecast: The global biofertilizers market size accounted for USD 2.15 billion in 2022 and is projected to hit around USD 6.83 billion by 2032, growing at a CAGR of 12.3% between 2023 and 2032.

Crop Protection Chemicals Market Dynamics

Drivers

Globalization

Globalization in agriculture provides opportunities for crop protection chemical manufacturers to grow their markets and reach new clients on a worldwide scale. Asia’s increasing middle class is pushing up demand for food and agricultural products, opening up new markets for pest control chemical manufacturers. Globalization also enables businesses to harness their experience and resources, increasing their competitiveness and innovative capabilities.

Increasing need for food crops

The increasing need for good agricultural crops and products fuels the growth of the crop protection chemicals market. Agricultural output is critical to improving nutrition and generating money for many. Global crop output has risen dramatically as land usage has expanded and crop yields have grown. Diets have also become diverse, with fruits, nuts, vegetables, and seeds replacing basic crops such as grain and roots.

Agricultural production has also grown increasingly worldwide, when it was formerly specialized and restricted to domestic markets. Large volumes of food are now traded globally, diversifying cuisines throughout the world and providing a significant source of revenue for farmers, particularly in low-income nations. This transformation is critical to fulfill the needs of crops with an increasing population.

Customize this study as per your requirement@ https://www.precedenceresearch.com/customization/1607

Restraint

Environmental concerns and strict regulations

Pest Control Chemical manufacturers confront severe regulatory compliance issues as a result of pesticide use being heavily regulated globally. Pesticide registration can be time-consuming and costly, requiring considerable testing and documentation. Furthermore, restrictions may change between countries and regions, making international sales difficult.

Pesticides have a substantial environmental impact, as they can contaminate soil, water, and air, harming non-target species and ecosystems. Some insecticides are highly persistent, lasting years or decades in the environment. This has raised public concern regarding pesticide use, prompting calls for safer and more sustainable pest management methods.

Opportunity

Advancement in technology

The pest control chemical manufacturing business is benefiting from technology improvements such as novel chemical formulations and delivery mechanisms, which allow for more efficient and specific pest control treatments.

Precision agriculture approaches use data and analytics to enhance agricultural yields while reducing pesticide use. This trend is projected to continue, allowing producers to create personalized treatments for specific farmers and crops, increasing the effectiveness of pest control products.

Crop Protection Chemicals Market Leaders

- BASF SE

- Sumitomo Chemical Co. Ltd

- The Dow Chemical

- Arysta Lifesciences Corporation

- Adama Agricultural Solutions Ltd.

- Bayer CropScience AG

- Nufarm Limited

- Jiangsu Yangnong Chemical Group Co. Ltd

- America Vanguard Corporation

Recent Developments:

- In May 2024, Coromandel International Ltd's shares increased 1.87 percent after the company introduced ten new crop protection products, including three unique products, a neem-coated bio plant and soil health booster, and five generic formulations aimed at increasing crop production and managing insect infestations.

- In March 2024, Coromandel, in collaboration with ISK Japan, released Prachand, a Japanese product designed to protect rice crops from pests such as stem borers and leaf folders, to reduce possible productivity losses by up to 70%. The business also created a formulation for the autumn armyworm insect.

- In January 2024, Syngenta Crop Protection and Enko identified a novel chemical to manage fungal infections in crops, employing a platform that speeds up R&D discovery. The new chemistry targets illnesses that may ruin cereal harvests and employs artificial intelligence and machine learning techniques to develop effective, selective compounds. This technique reduces the time necessary for discovery while guaranteeing that compounds fulfill safety standards. This highlights how digital technology may shorten the time required for R&D discovery.

- In October 2023, BASF invested €2 million in a new fermentation factory in Ludwigshafen that will produce biological and biotechnology-based crop protection products. The factory will generate value-added goods such as biological fungicides, seed treatments, and Inscalis®, a new pesticide produced from a fungal strain. Commissioning is scheduled for the second half of 2025, and the factory will employ 30 workers in manufacturing, engineering, logistics, and maintenance.

Market Segmentation:

By Products

- Herbicides

- Selective

- Non-Selective

- Glyphosate

- Atrazine

- 2,4-D

- Others

- Fungicides

- Chlorathalonil

- Sulfur

- PCNB

- Maneb

- Others

- Insecticides

- Malathion

- Carbaryl

- Chlorpyrifos

- Others

- Biopesticides

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Source

- Synthetic Chemicals

- Biologicals

By Form

- Dry

- Liquid

By Mode of Application

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Others (chemigation and fumigation)

By Regions

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1607

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

https://www.towardsautomotive.com

For Latest Update Follow Us: