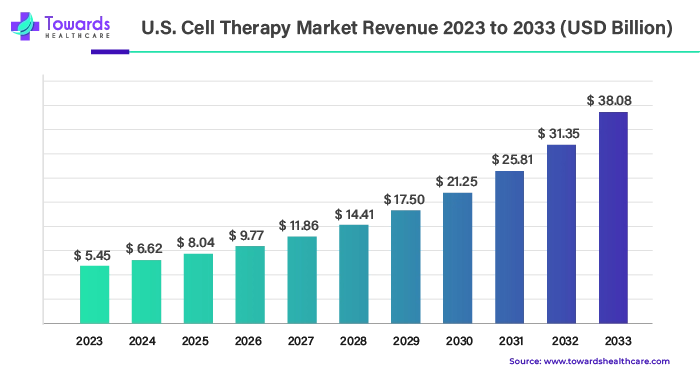

Ottawa, July 30, 2024 (GLOBE NEWSWIRE) -- The global U.S. cell therapy market size is predicted to grow from USD 5.45 billion in 2023 to approximately USD 38.08 billion by 2033, a study published by Towards Healthcare a sister firm of Precedence Statistics.

Download a short version of this report @ https://www.towardshealthcare.com/personalized-scope/5159

Key Takeaways

- By therapy type, the autologous segment dominated the market in 2023.

- By therapy type, the allogenic therapies segment is estimated to grow at the fastest CAGR during the forecast period.

- By therapeutic area, the oncology segment dominated the market in 2023 and is expected to remain dominant during the forecast period.

U.S. Cell Therapy Market at a Glance

The U.S. cell therapy market involves advanced research and diverse applications in the field of cell therapy. The increasing incidence of chronic disorders increases the demand for cell therapy. Cell therapy is a technique in which modified cells are transplanted into the human body to prevent or treat a disease. Common disorders treated with cell therapy include cancer, skin disorders, blood-related disorders, genetic disorders, and neurological disorders. Cell therapy is classified into two major subtypes, depending on the origin of the cells to be transplanted into the patient, autologous and allogenic cell therapy. Autologous cell therapy demonstrates deriving cells from the patient’s body tissues and reinjecting them back to the desired site. Allogenic cell therapy involves utilizing donor cells (other than the patient’s cells), either genetically related or unrelated, and administering them to the patient.

Top Companies

- Intellia Therapeutics

- CRISPR Therapeutics

- Bluebird Bio

- Kite Pharma

- ImmunityBio

- Poseida Therapeutics

- Pfizer

- AstraZeneca

- Akron Biotech

- Vertex Pharmaceuticals

- Gilead Sciences, Inc.

- Atara Biotherapeutics

- Johnson & Johnson

Increasing Incidences of Chronic Disorders as a Driver for U.S. Cell Therapy Market

The rising incidence and prevalence of chronic disorders in the U.S. like cancer, cardiovascular disorders, neurological disorders, blood-related disorders, and autoimmune disorders increase the demand for the use of cell therapies for efficient treatment. They can also help treat several rare diseases, whose treatments are unavailable. Cell therapies are most widely used for treating cancer.

According to the American Cancer Society, 2,001,140 new cancer cases were reported in the U.S., with 611,720 deaths due to cancer in 2024. Hence, recent advancements in stem cell therapies and CAR-T cell therapy are necessary to provide cutting-edge treatment to patients. Cell therapies are known to provide more benefits than long-term conventional treatments. Cell therapies are revolutionizing medicine by providing individualized treatment based on a patient’s cellular composition.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

High Cost of Therapies

Although cell therapies offer numerous advantages, they also have several disadvantages that hinder their commercialization. The high cost of cell therapies limits patients' ability to afford a novel treatment regimen. The lack of feasibility to study cell therapy for rare disorders in clinical trials due to the insufficient number of subjects makes it difficult to provide evidence for its use in treating rare disorders. Additionally, there is limited accessibility for patients to benefit from advanced therapies. All these reasons combat the growth of the cell therapy market in the U.S.

Use of AI for the Manufacturing of Cell Therapy to Open Lucrative Opportunities

The rising demand for cell therapy necessitates its supply in all parts of the U.S. Robotics and AI can be used to solve certain manufacturing and scale-up issues. The application of AI in manufacturing leads to automation.

The large-scale manufacturing of allogeneic cells is comparatively feasible due to their availability compared to autologous cells, as they are derived from the patient’s body. Manufacturing times and expenses will decrease through the use of bioreactors and other automated production techniques. The incorporation of robotics into manufacturing facilitates precision and reproducibility in the products.

Geographical Insights

The U.S. is at the forefront of the cellular therapy market globally. The rising incidence of chronic disorders, increasing investments and collaborations, advanced research and development, and state-of-the-art healthcare facilities drive the cell therapy market in the U.S. North America’s overall position in the market has splurged the contribution of the United States. Increasing awareness leads to an increase in demand for the use of regenerative medicines. California, Texas, Florida, New York, Colorado, Massachusetts, Illinois, Arizona, Pennsylvania, and Washington are the leading states that contribute significantly to stem cell therapy.

Moreover, increased investment from both public and private sectors is fueling research and development in this field. Major pharmaceutical and biotechnology companies are investing heavily in cell therapy research, resulting in a robust pipeline of new therapies. Additionally, the rising prevalence of chronic diseases and an aging population are driving demand for advanced therapeutic solutions.

- In February 2024, AstraZeneca announced a 300 million USD investment for the manufacturing of cell therapy in the U.S. The cell therapy platform in the U.S. will facilitate critical cancer trials and future commercial supply.

- In June 2024, researchers at the University of Chicago conducted a study to demonstrate the potential of stem cell therapy for curing type 1 diabetes. They found that seven out of twelve patients did not require insulin shots after the administration of VX-880, proving that stem cells can restore pancreatic function.

Customize this study as per your requirement @ https://www.towardshealthcare.com/customization/5159

Segmental Insights

By Therapy Type

The autologous therapy segment dominated the U.S. cell therapy market in 2023. Autologous cell therapy involves deriving the cells from the patient’s body tissues and reinjecting them back to the patient. The cells are generally obtained from the bone marrow or peripheral blood and processed in the lab. The cells are allowed to grow in the cultured environment and are reinjected back to the patient through injection, infusion, or transplantation The chances of immune reactions are lower for autologous cell therapy. Autologous cell therapy can be customized according to the patient’s requirements. Due to these reasons, autologous cell therapy is the preferred choice and is responsible for market growth.

The allogeneic cell therapy segment is estimated to grow at the fastest CAGR during the forecast period. This therapy includes extracting donor cells and injecting them into the patient’s body. The donor can be related or unrelated to the patient, however, the samples must be matched to the recipient before injecting. This therapy saves time and resources by obviating the need for personalized cell preparation and retrieval. Additionally, compared to autologous treatments, allogenic stem cell therapies can scale more easily, improving accessibility and possibly reducing production and patient costs.

By Therapeutic Area

The oncology segment dominated U.S. cell therapy in 2023 and is estimated to remain dominant during the forecast period. Cell therapies are most widely used for treating cancers such as melanoma and lymphoma. In cases where chemotherapy and radiotherapy are resistant, cell therapies prove beneficial for treating cancer. This therapy detects cancer cells in the body and attacks them.

Browse More Insights of Towards Healthcare:

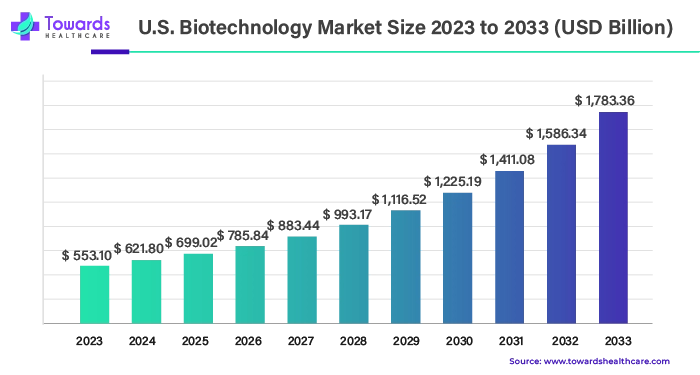

1. U.S. Biotechnology Market Growth and Future Outlook

The U.S. biotechnology market was valued at $553.10 billion in 2023 and is projected to reach $1,783.36 billion by 2033. This growth reflects a CAGR of 12.42% from 2024 to 2033.

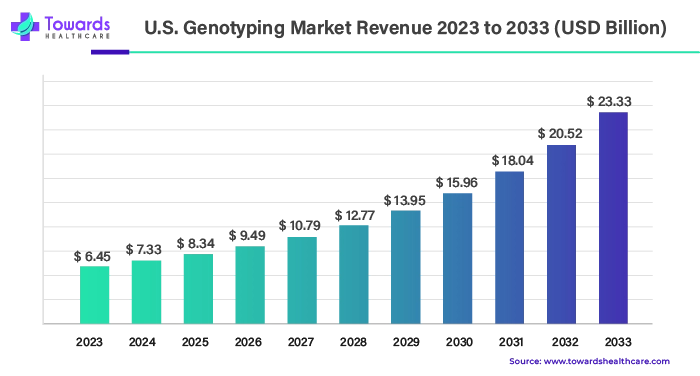

2. U.S. Genotyping Market Size, Outlook, and Company Analysis

The U.S. genotyping market was valued at $6.45 billion in 2023 and is forecasted to grow to $23.33 billion by the end of 2033. This growth reflects a significant CAGR of 13.72% from 2024 to 2033.

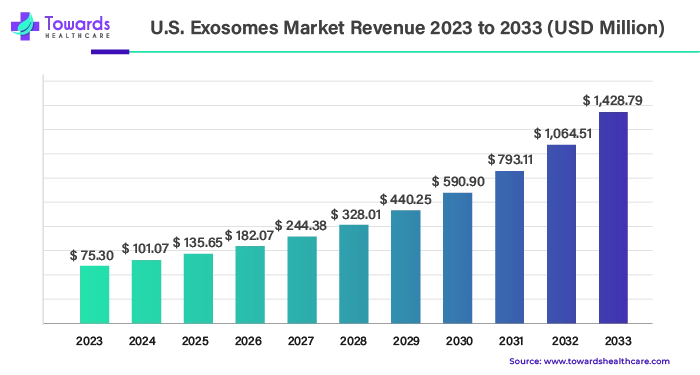

3. U.S. Exosomes Market Analysis: Size, Growth Forecast, and Key Players

The U.S. exosomes market was valued at $75.30 million in 2023 and is projected to grow to $1,428.79 million by 2033. This expansion represents a remarkable CAGR of 34.22% from 2024 to 2033.

4. The U.S. behavioral health market was valued at USD 83.47 billion. It is projected to grow to USD 136.60 billion by 2032, achieving a CAGR of 5.1% from 2023 to 2032.

5. The 503A U.S. compounding pharmacies market is projected to expand from USD 3.99 billion in 2022 to approximately USD 7.18 billion by 2032, growing at a CAGR of 6.11% from 2023 to 2032.

6. The U.S. home infusion therapy market surged to USD 16.99 billion in 2023 and is projected to grow to USD 32.81 billion by 2033. The market is anticipated to continue its CAGR of 7.3% through 2033.

7. The generative AI in healthcare market valued at USD 1.07 billion in 2022, is projected to expand at a CAGR of 35.1% from 2023 to 2032, reaching approximately USD 21.74 billion by 2032

8. The AI in drug discovery market was valued at approximately USD 1,495.28 million in 2022. It is anticipated to reach around USD 14,518.68 million by 2032, growing at a CAGR of 20.08% from 2022 to 2032.

9. The telehealth and telemedicine market was valued at USD 214.55 billion in 2023. It is expected to grow to USD 869.22 billion by 2033, with a strong CAGR of 15.5% during this period.

10. The global Internet of Things (IoT) in healthcare market was valued at over USD 36.20 billion in 2022. It is expected to expand USD 305.55 billion by 2032. This growth is anticipated to occur at a CAGR of 23.4%.

Recent Breakthroughs in the U.S. Cell Therapy Market

- In April 2024, the USFDA approved Carvykti cell therapy, developed by Johnson and Johnson Legend Biotech, for treating a type of blood cancer.

- In May 2024, the USFDA approved the cancer cell therapy Breyanzi, developed by Bristol Myers Squibb, for treating follicular lymphoma, a type of blood cancer. Breyanzi is a type of CAR-T cell therapy that modifies T-cells to attack cancer.

- In June 2024, the USFDA approved a phase II clinical trial of KYV-101 CAR-T cell therapy, developed by Kyverna’s Therapeutics, for treating stiff-person syndrome (SDS) patients. KYV-101 is a fully autologous CAR-T cell product that targets B cells in autoimmune disorders and is intended for use in patients suffering from these conditions.

- In July 2024, DiscGenics, Inc., announced USFDA approval for a phase III clinical trial of allogeneic, injectable disc progenitor cell therapy for symptomatic lumbar degenerative disc disease. The therapy is a revolutionary regenerative and minimally invasive treatment for a patient suffering from degenerative disc disease.

U.S. Cell Therapy Market TOC | Table of Content

Introduction

- Research Objective

- Scope of the Study

- Definition and Taxonomy

Research Methodology

- Research Approach

- Data Sources

- Assumptions

Executive Summary

- Synopsis

- Analyst Recommendations

Market Dynamics

- Trends and Drivers

- Challenges and Barriers

Market Overview

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Value Chain Analysis

- Raw Material Sourcing

- Manufacturing Process

- Logistics & Transportation

- Buyer Preferences

- Trends

- Market Trends

- Technological Trends

- Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitute

- Threat of New Entrants

- Degree of Competition

- PESTLE Analysis for 5 Leading Countries

- Regulatory Framework for Leading Countries/Regions

- Supply Demand Analysis

- Production & Consumption Statistics

- Export Import Statistics

- Price Trend Analysis

U.S. Cell Therapy Market Assessment

- Overview

- U.S. Cell Therapy Market Size Value (US$) and Volume (Billion Tons), by Therapy Type (2021 – 2033)

- Allogeneic Therapies

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Mesenchymal Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Others

- Stem Cell Therapies

- Autologous Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- T Cell Receptor (TCR)-based

- Others

- T-Cell Therapies

- Allogeneic Therapies

- U.S. Cell Therapy Market Size Value (US$) and Volume (Billion Tons), by Therapeutic Area (2021 – 2033)

- Oncology

- Dermatology

- Others

Cross Segments Analysis

By Therapy Type

- Allogeneic Therapies

- Overview

- Oncology

- Dermatology

- Others

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Overview

- Oncology

- Dermatology

- Others

- Mesenchymal Stem Cell Therapies

- Overview

- Oncology

- Dermatology

- Others

- Hematopoietic Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Overview

- Oncology

- Dermatology

- Others

- Others

- Overview

- Therapeutic Applications

- Keratinocytes & Fibroblast-based Therapies

- Autologous Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- Overview

- Oncology

- Dermatology

- Others

- T Cell Receptor (TCR)-based

- Overview

- Oncology

- Dermatology

- Others

- CAR T Cell Therapy

- Others

- Overview

- Therapeutic Applications

- T-Cell Therapies

By Therapeutic Area

- Oncology

- Allogeneic Therapies

- Overview

- Specific Applications

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Overview

- Specific Applications

- Mesenchymal Stem Cell Therapies

- Overview

- Specific Applications

- Hematopoietic Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Overview

- Specific Applications

- Others

- Overview

- Specific Applications

- Keratinocytes & Fibroblast-based Therapies

- Autologous Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- Overview

- Specific Applications

- T Cell Receptor (TCR)-based

- Overview

- Specific Applications

- CAR T Cell Therapy

- Others

- Overview

- Specific Applications

- T-Cell Therapies

- Allogeneic Therapies

- Dermatology

- Allogeneic Therapies

- Overview

- Specific Applications

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Overview

- Specific Applications

- Mesenchymal Stem Cell Therapies

- Overview

- Specific Applications

- Hematopoietic Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Overview

- Specific Applications

- Others

- Overview

- Specific Applications

- Keratinocytes & Fibroblast-based Therapies

- Autologous Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- Overview

- Specific Applications

- T Cell Receptor (TCR)-based

- Overview

- Specific Applications

- CAR T Cell Therapy

- Others

- Overview

- Specific Applications

- T-Cell Therapies

- Allogeneic Therapies

- Others

- Allogeneic Therapies

- Overview

- Specific Applications

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Overview

- Specific Applications

- Mesenchymal Stem Cell Therapies

- Overview

- Specific Applications

- Hematopoietic Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Overview

- Specific Applications

- Others

- Overview

- Specific Applications

- Keratinocytes & Fibroblast-based Therapies

- Autologous Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- Overview

- Specific Applications

- T Cell Receptor (TCR)-based

- Overview

- Specific Applications

- CAR T Cell Therapy

- Others

- Overview

- Specific Applications

- T-Cell Therapies

- Allogeneic Therapies

Integration of AI in U.S. Cell Therapy Market

- Introduction to AI in Cell Therapy

- Overview of AI Technologies

- Role of AI in Cell Therapy

- AI Applications in Cell Therapy

- Data Analysis and Interpretation

- Predictive Analytics

- Pattern Recognition

- Treatment Personalization

- Patient-Specific Treatment Plans

- Adaptive Therapy Models

- Drug Discovery and Development

- Identifying Potential Therapeutic Targets

- Accelerating Preclinical Studies

- Clinical Trials Optimization

- Patient Recruitment and Retention

- Trial Design and Monitoring

- Data Analysis and Interpretation

- AI in Cell Therapy Manufacturing

- Process Automation

- Automation of Production Processes

- Quality Control and Assurance

- Supply Chain Management

- Inventory Management

- Logistics Optimization

- Process Automation

- AI-Driven Diagnostics

- Disease Detection and Prognosis

- Early Detection of Target Diseases

- Prognostic Models for Disease Progression

- Biomarker Discovery

- Identifying and Validating Biomarkers

- Disease Detection and Prognosis

- AI and Regulatory Compliance

- Regulatory Guidelines for AI Integration

- FDA Guidelines and Approvals

- Ethical Considerations

- Data Privacy and Security

- Ensuring Patient Data Protection

- Compliance with HIPAA and Other Regulations

- Regulatory Guidelines for AI Integration

- Case Studies

- Successful AI Implementations

- Examples from Leading Companies

- Impact on Treatment Outcomes

- Lessons Learned and Challenges

- Challenges Faced During AI Integration

- Strategies for Overcoming Barriers

- Successful AI Implementations

- Future Trends and Innovations

- Emerging AI Technologies

- Advances in Machine Learning and Deep Learning

- Future Applications in Cell Therapy

- Impact on Market Dynamics

- Market Opportunities and Threats

- Potential for Disruption

- Emerging AI Technologies

Production and Consumption Analysis

- Introduction

- Overview of Production and Consumption Data

- Production Data

- Production Overview

- Production by Therapy Type

- Allogeneic Therapies

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Mesenchymal Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Others

- Autologous Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- T Cell Receptor (TCR)-based

- Others

- T-Cell Therapies

- Production by Therapeutic Area

- Oncology

- Dermatology

- Others

- Consumption Data

- Consumption Overview

- Consumption by Therapy Type

- Allogeneic Therapies

- Stem Cell Therapies

- Hematopoietic Stem Cell Therapies

- Mesenchymal Stem Cell Therapies

- Non-Stem Cell Therapies

- Keratinocytes & Fibroblast-based Therapies

- Others

- Autologous Therapies

- T-Cell Therapies

- CAR T Cell Therapy

- T Cell Receptor (TCR)-based

- Others

- T-Cell Therapies

- Consumption by Therapeutic Area

- Oncology

- Dermatology

- Others

- Analysis and Insights

- Trends in Production and Consumption

- Key Drivers and Challenges

Opportunity Assessment

- New Product Development

- Emerging Trends in Cell Therapy

- Innovation in Therapy Types

- Case Studies of Recent Product Launches

- Plan Finances/ROI Analysis

- Financial Projections and Budgets

- Return on Investment (ROI) Metrics

- Cost-Benefit Analysis of Cell Therapy Investments

- Supply Chain Intelligence/Streamline Operations

- Overview of Supply Chain for Cell Therapies

- Strategies for Optimizing Supply Chain Efficiency

- Risk Management in Supply Chain

- Cross-Border Intelligence

- Market Opportunities in International Markets

- Regulatory Considerations for Cross-Border Operations

- Partnership and Collaboration Opportunities Abroad

- Business Model Innovation

- Emerging Business Models in Cell Therapy

- Case Studies of Successful Business Model Adaptations

- Strategic Recommendations for Business Model Enhancement

- Blue Ocean vs. Red Ocean Strategies

- Analysis of Blue Ocean Strategies in Cell Therapy

- Competitive Landscape and Red Ocean Strategies

- Strategic Recommendations for Differentiation and Market Expansion

Company Profiles

- Aurion Biotech

- Company Overview

- Geographic Footprints

- Financial Performance

- Product Portfolio

- SWOT Analysis

- R&D Efforts

- Recent Developments & Strategic Collaborations

- Product Launch/M&A/Technical Collaboration

- Vertex Pharmaceuticals Incorporated

- Cellular Biomedicine Group, Inc

- Nkarta, Inc

- Atara Biotherapeutics, Inc

- Johnson & Johnson

- CARGO Therapeutics, Inc.

- Bristol-Myers Squibb Company

- Selecta Bioscience

- Gilead Sciences, Inc.

Regulatory and Policy Framework

- Overview of Regulatory Environment

- U.S. Regulatory Agencies

- Regulatory Pathways for Cell Therapies

- Compliance and Standards

- Policy Impacts

- Healthcare Policy and Reimbursement

- Legislation Affecting Cell Therapy

- Ethical and Legal Considerations

- Future Outlook and Opportunities

- Anticipated Regulatory Changes

- Opportunities for Policy Advocacy

- Impact on Market Dynamics

Emerging Trends

- Technological Innovations

- Advancements in Cell Therapy Technologies

- Integration with Digital Health

- Market Developments

- New Product Introductions

- Investment and Funding Trends

- Consumer and Patient Trends

- Changing Patient Preferences

- Trends in Patient Expectations and Demand

- Adoption Rates and Market Penetration

- Changing Patient Preferences

Appendices

- Definitions and Terminology

- References

Acquire our comprehensive analysis today @ https://www.towardshealthcare.com/price/5159

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Gain access to the latest insights and statistics in the healthcare industry by subscribing to our Annual Membership. Stay updated on healthcare industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the curve with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of healthcare: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations. We are a global strategy consulting firm that assists business leaders in gaining a competitive edge and accelerating growth. We are a provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations.

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardsautomotive.com

https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-healthcare

Get Our Freshly Printed Chronicle: https://www.healthcarewebwire.com