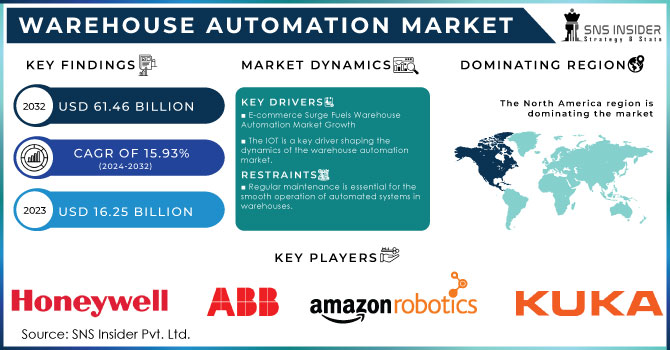

Austin, Aug. 02, 2024 (GLOBE NEWSWIRE) -- The Warehouse Automation Market Size was valued at USD 16.25 billion in 2023. It is projected to reach USD 61.46 billion by 2032, growing at a robust CAGR of 15.93% during the forecast period from 2024 to 2032.

Get a Sample Report of Warehouse Automation Market @ https://www.snsinsider.com/sample-request/4211

Key Players

Some of the major players in the Warehouse Automation Market are Interroll, Honeywell Intelligrated, Jizhong Energy Storage, Viastore Systems, Grey Orange, Swisslog, Kardex Remstar, Fanuc Corporation, Aeologic Technologies, Kiva Systems, Geek+, Yaskawa Electric Corp., KION Group, Daifuku Co Ltd, ABB Ltd, Fetch Robotics Inc., Jungheinrich, ATMOS, Schneider Electric, Amazon Robotics, SSI-Schaefer, Kuka AG, Omron Corporation, Bastian Solutions LLC, Siemens AG, Dorabot, and other players.

The Warehouse Automation Market has been developing rapidly due to the growth of technologies and the requirement for efficient logistics and supply chain operation. In this regard, various automated systems such as robotics, automated guided vehicles, and warehouse management software have been involved in automation. These technologies are used to cover the tasks of order fulfillment and increase accuracy, productivity, and cost-efficiency in the market. Along with this, the emergence of smart warehouses that utilize the Internet of Things and Artificial Intelligence technologies for real-time data to enhance productivity and reduce needed expenses is making a high impact on the industry. The leader in the market is Amazon which has over 11,000 smart warehouses in North America. In 2023, the deployment of over 750,000 robots grew by 40% in comparison to the previous year. The percentage of 52% of warehouse managers have expected this growth, and the abovementioned demand is responded to by significant investment that has already been carried out.

Warehouse Automation Market Report Scope & Overview:

| Report Attributes | Details |

| Market Size in 2023 | USD 16.25 billion |

| Market Size in 2032 | USD 61.46 billion |

| CAGR (2024-2032) | 15.93% |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Market Driver |

|

Do you need any customization research on Warehouse Automation Market, Speak to Our Analyst @ https://www.snsinsider.com/enquiry/4211

Segmentation Analysis

“The hardware segment leads by the component”

The hardware segment dominated with a market share of more than 58% in 2023. There is widespread deployment of hardware solutions in the form of automated storage and retrieval systems, robotic picking systems, automated guided vehicles, conveyor systems, and sensor technology. All these technologies aim to solve the pains of warehousing processes and increase overall efficiency and cost-effectiveness.

“The Retrieval systems and automated storage segment held major market share.”

The retrieval systems & automated storage (AS/RS) segment led the market in 2023 with a market share of over 30%. The main advantage of these systems is high efficiency and accuracy in goods storage and retrieval processes. The technology allows utilizing the warehouse space to its maximum capacity and accepts multiple orders simultaneously.

Regional Developments:

North America had the maximum market share of around 41% in 2023. It is because of the implementation of artificial intelligence and machine learning which allows for a higher warehouse efficiency. Additionally, the region’s high adoption rate of automated solutions including AGVs and robotics shows its focus on improving the logistics and lowering costs.

Asia-Pacific region is projected to experience the highest growth throughout the forecast period. It is due to the increased expansion and development of the e-commerce and retail sectors across countries including China, Japan, and India. The size of the Chinese warehouse automation market will exceed USD 5 billion by 2025 since the growth of the country’s e-commerce giants – Alibaba and JD.com. Japan is a leader in the development of robotics and is another contributor to the high regional growth.

Recent Developments:

- February 2024: Skelchers has implemented an automated goods-to-person system with a partner Hai Robotics in a new distribution center that was opened in Minato City, Tokyo. The system objective was to become more efficient in terms of operational processes, fulfillment time, and order accuracy (Honzajková, Skarnitzl & Chojnacki, 2019).

- June 2024: ABB Robotics announced the introduction of the new OmniCore platform, which is an intelligent automation solution that involves the incorporation of AI, sensors, and cloud computing tools in advanced robotic systems.

Buy an Enterprise User PDF of Warehouse Automation Market Outlook Report 2024-2032 @ https://www.snsinsider.com/checkout/4211

Key Takeaways:

- Companies can benefit from understanding emerging trends and investing in advanced warehouse automation technologies to enhance operational efficiency and accuracy.

- Staying updated with the latest innovations, such as AI, robotics, and IoT, is crucial for maintaining a competitive edge in the Warehouse Automation Market.

- Businesses can explore growth opportunities in key regions like North America and Asia-Pacific, where the demand for automation solutions is rapidly increasing.

- Keeping track of recent product launches and technological advancements helps companies stay ahead in adopting cutting-edge solutions.

- Understanding the drivers and challenges in the Warehouse Automation Market enables businesses to make informed decisions and capitalize on growth opportunities.

Table of Contents – Major Key Points

1. Introduction

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Warehouse Automation Market Segmentation, By Type

- Warehouse System

- Mechanized Warehouse

- Advanced Warehouse

- Basic Warehouse

8. Warehouse Automation Market Segmentation, By Component

- Software

- Hardware

9. Warehouse Automation Market Segmentation, By Vehicle Type

- Passenger vehicles

- Commercial vehicles

- Electric vehicles

10. Warehouse Automation Market Segmentation, By Technology

- Retrieval Systems & Automated Storage

- Automatic Guided Vehicles

- Autonomous Mobile Robots

- Voice Picking & Tasking

- Automated Sortation Systems

11. Regional Analysis

12. Company Profiles

13. Competitive Landscape

14. Use Case and Best Practices

15. Conclusion

Access Complete Report Details @ https://www.snsinsider.com/reports/warehouse-automation-market-4211

About SNS Insider

At SNS Insider, we believe that businesses should have access to the best market intelligence and insights, regardless of their size or industry. That's why we offer a range of solutions tailored to meet the unique needs of each client, from startups to big corporations. With a passion for our work and an unwavering commitment to delivering value, we are dedicated to helping our clients achieve their full potential.