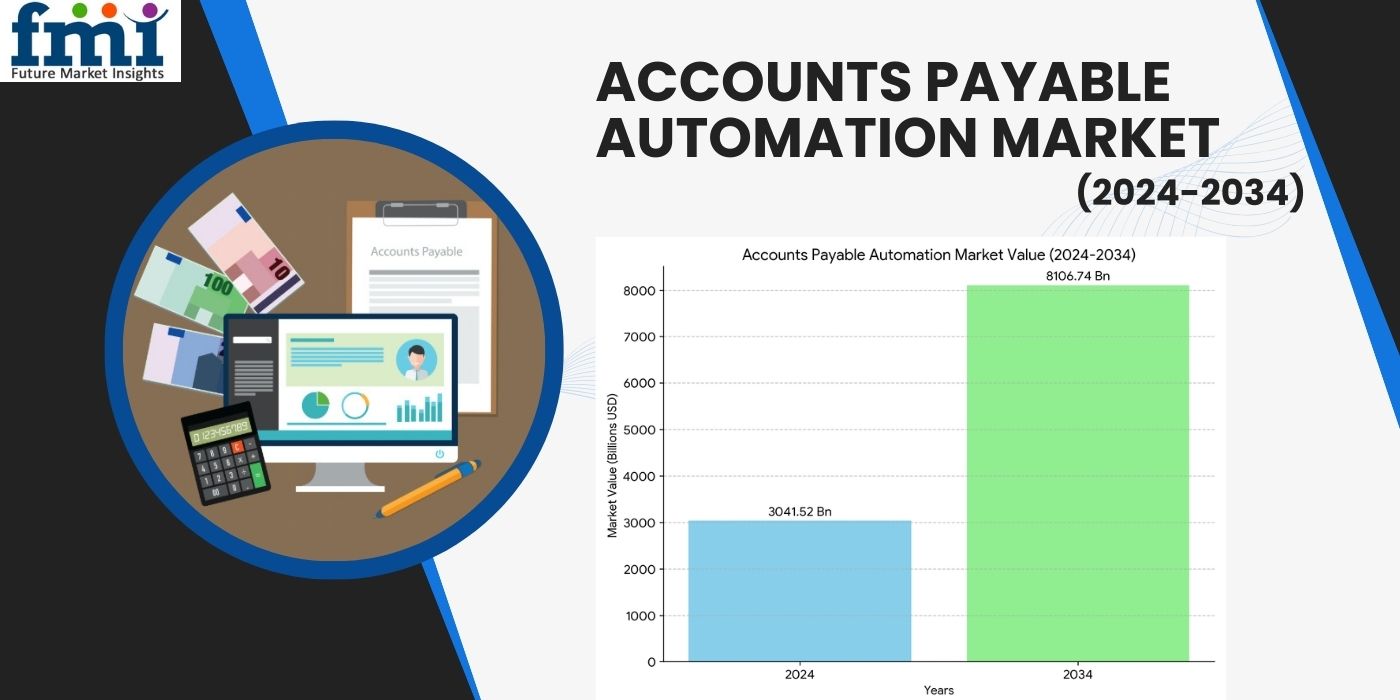

NEWARK, Del, Aug. 13, 2024 (GLOBE NEWSWIRE) -- The accounts payable automation market is registered to be valued at USD 3,041.52 million by 2024. The market valuation is estimated to be USD 8,106.74 million by 2034, projected at a CAGR of 10.30%. A key driver of the AP automation market is organizations' boost in adopting digital transformation initiatives worldwide. Businesses recognize the benefits of automating their accounts payable processes to streamline operations, improve efficiency, and reduce manual errors.

The development in the volume of invoices and transactions and the need for cost savings and process optimization further fuel the demand for AP automation solutions. The market faces threats such as data security concerns and resistance to change from traditional processes. As organizations transition from manual to automated AP workflows, ensuring the security and privacy of sensitive financial data becomes paramount.

Data breaches and compliance risks pose significant threats to adopting AP automation solutions, requiring robust security measures and regulatory compliance frameworks to mitigate risks effectively. Resistance from employees accustomed to traditional paper-based processes may hinder adoption, necessitating change management strategies and employee training programs to overcome barriers to implementation.

Amidst these challenges, the AP Automation Market presents opportunities for innovation and growth. One opportunity lies in developing cloud-based AP automation solutions, offering scalability, flexibility, and accessibility to businesses of all sizes. Cloud technology enables seamless integration with existing ERP systems, facilitating rapid deployment and minimizing upfront investments in infrastructure.

Vendors can capitalize on emerging opportunities and differentiate themselves in the competitive landscape by offering comprehensive end-to-end solutions that address the entire procure-to-pay process.

An account payable (AP) automation solution refers to the technology that assists organizations in streamlining and automating the accounts payable process. An AP automation system makes the work easier by incorporating the easy processing of invoices from suppliers and implementing a digital workflow to facilitate every step in the process. In addition, AP automation can be applied to any software program or process that automates the entire accounts payable process by utilizing its background elements.

The use of technology is the main driver behind how businesses are carried out across the globe. Multiple industries such as finance are being impacted by this push for technological innovation. Developing a digital strategy for businesses is becoming a standard practice for companies in an ever-more technologically advanced world.

In any company, accounts payable is an integral part of its financial operations, which is responsible for ensuring that all of its obligations are handled appropriately. Traditionally performed through manual processes and paper documentation, digital solutions are facilitating evolution in this domain. Many companies have already developed and implemented software for automating a variety of tasks with great success, so it will only take a matter of time before more companies will adopt this implementation approach.

Business-to-business transactions are used by companies and businesses to pay suppliers and clients. In turn, this should help companies adhere to their purchasing policies in the market. All of these factors have led more companies to automate their accounts payable processes in the market. In order to improve the payment process and reduce invoice processing time, the market for accounts payable automation is expected to grow at a rapid pace. Moreover, the increasing demand for companies to reduce the number of delays in completing their payments is also expected to increase the growth of the market.

Key Takeaways from the Market Study

- Based on solution, the AP automation software is accounted to hold a market share of 53.70% in 2024.

- China is expected to register at a CAGR of 12.4% by 2034.

- The United States registers significant growth, projected at a CAGR of 8.2% by 2034.

- Based on the industry, the BFSI segment is accounted to hold a market share of 25% in 2024.

“The boom in demand for efficiency and cost savings within organizations as businesses seek to streamline their financial processes and reduce manual labor is a significant reason propelling the growth of the accounts payable automation market,” Says Sudip Saha Managing Director and Co-Founder at Future Market Insights.

What are the Challenges in the Market for Accounts Payable Automation?

Although organizations invest significant time and money in new technology, their accounts payable departments still face many challenges that result in high costs and inefficient processes. In emerging economies, there is little understanding of the benefits of AP automation, as well as little awareness of the virtues of AP automation so this will act as a challenge to the market. The global accounts payable automation market is expected to be hindered by a lack of awareness about the digital world and literacy of the benefits of accounts payable automation in the emerging market during the forecast period.

This market growth is limited by increasing concerns over data encryption and security, which are among the major factors limiting the growth of this market. An insufficient number of skilled professionals and complicated software are keeping the market from growing. Growing numbers of non-standard invoicing, as well as a lack of specific structured information, have further contributed to the decline of this market's growth.

A Full Report Analysis:

https://www.futuremarketinsights.com/reports/accounts-payable-automation-market

Competitive Landscape

Competition centers on product innovation, scalability, and integration capabilities, with companies vying to capture market share amidst growing demand for streamlined financial processes and digital transformation initiatives. Some of the recent developments are:

- In January 2022, SAP SE collaborated with Icertis and enhanced its contract management solution portfolio, leveraging Icertis' technology for enterprise contract intelligence. This partnership aimed to deliver more valuable services to customers.

- In November 2021, Oracle Corporation introduced Oracle Fusion ERP Analytics, simplifying financial data processing. The solution targeted large and mid-sized businesses, strengthening Oracle's market presence.

Key Players

- SAP

- Sage

- Tipalti

- Freshbooks

- FIS

- Zycus

- Bottomline Technologies

- Coupa Software

- Comarch

- Financial Force

More Valuable Insights Available

Future Market Insights offers an unbiased global accounts payable automation market analysis, providing historical data from 2019 to 2023 and forecast statistics from 2024 to 2034

To understand market opportunities, the accounts payable automation market is segmented based on Solution (AP Automation Software, AP Automation Services), Industry (BFSI, Retail, IT & Telecom, Healthcare, Manufacturing, Energy & Utilities, Others) and Region (North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa).

Accounts Payable Automation Market: Key Segmentations

By Solution:

- AP Automation Software

- AP Automation Services

By Industry:

- BFSI

- Retail

- IT & Telecom

- Healthcare

- Manufacturing

- Energy & Utilities

- Others

By Region:

- North America

- Latin America

- Western Europe

- Eastern Europe

- South Asia and Pacific

- East Asia

- The Middle East and Africa

About the Technology Division at Future Market Insights

The technology team at Future Market Insights offers expert analysis, time-efficient research, and strategic recommendations to provide authentic insights and accurate results to help clients worldwide. With over 100+ reports and one million+ data points, the team has analyzed the industry lucidly in 50+ countries for over a decade. The team briefly analyzes key trends, including competitive landscape, profit margin, and research development efforts.

Author By:

Sudip Saha is the managing director and co-founder at Future Market Insights, an award-winning market research and consulting firm. Sudip is committed to shaping the market research industry with credible solutions and constantly makes a buzz in the media with his thought leadership. His vast experience in market research and project management a consumer electronics will likely remain the leading end-use sector cross verticals in APAC, EMEA, and the Americas reflects his growth-oriented approach to clients.

He is a strong believer and proponent of innovation-based solutions, emphasizing customized solutions to meet one client's requirements at a time. His foresightedness and visionary approach recently got him recognized as the ‘Global Icon in Business Consulting’ at the ET Inspiring Leaders Awards 2022.

Have a Look at the Related Reports of the Technology Domain:

The growing demand for Accounts Receivable Automation reflects businesses' need for efficient, accurate, and streamlined financial processes, enhancing cash flow management and reducing manual errors in invoicing and collections.

The surge in Account-Based Data Software is revolutionizing targeted marketing strategies, enabling businesses to drive personalized engagements, enhance lead quality, and achieve unprecedented growth through precise data-driven insights.

Global machine automation controller market is expected to hit a valuation of USD 64.5 billion by the forecast period 2022 to 2032. Through the end of 2032, the market is likely to grow at a CAGR of 6.3%.

Emerging trends in IT robotic automation highlight advancements in AI-driven solutions, increasing operational efficiency, and transforming routine tasks into dynamic processes, ultimately enhancing productivity and decision-making capabilities.

The increasing demand for account-based advertising software reflects businesses' need for precise targeting and personalized marketing strategies to enhance customer engagement and drive higher conversion rates.

The form automation software market global analysis indicates that the revenue stands at USD 364 million in 2024 and is projected to surpass USD 1,780 million by 2034.

The global Recruiting Automation Software Market was valued at around USD 496.8 Million in 2021. With a projected CAGR of 2.7% for the next ten years, the market is likely to reach a valuation of nearly USD 660 Million by the end of 2032.

The application release automation market is anticipated to flourish at a strong CAGR of 15.3% between 2023 and 2033. The market is expected to hold a market share of USD 12.14 billion by 2033.

Home automation sensors enhance daily living by intelligently managing lighting, climate, and security systems, ensuring convenience, energy efficiency, and safety while adapting seamlessly to individual preferences and routines.

The global smart home automation market is estimated to grow from USD 72 Billion in 2022 to USD 168 Billion in 2032 while displaying a CAGR of 8.84% during the 2022-2032 period.

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-845-579-5705

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube