US & Canada, Aug. 19, 2024 (GLOBE NEWSWIRE) -- E-invoicing is a growing market, with increasing operations of business-to-company, business-to-customer, and business-to-government, among others. E-invoicing is the electronic exchange of invoices between buyers and suppliers. Depending on the legislation and types of enterprises, e-invoicing is defined differently within nations. Furthermore, electronic invoices are formal invoices that have more than seven necessary fields and require supplier and buyer identification. Various formats for exchanging e-invoices are utilized throughout industries, including supplier direct, buyer direct, SaaS/PaaS model, four corner model, multi-cloud model, and hybrid cloud model. E-invoices can be exchanged directly with consumers or through third-party service providers.

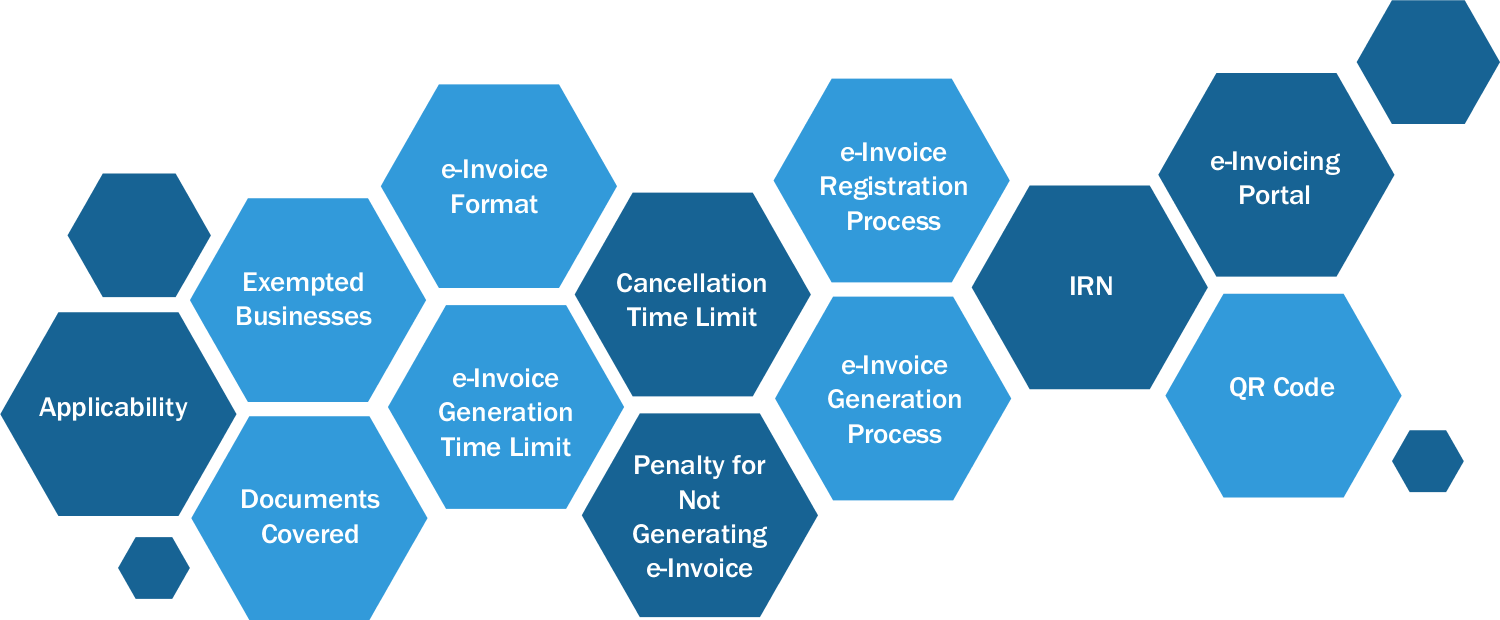

E-Invoicing at a Glance:

Source: The Insight Partners’ Analysis

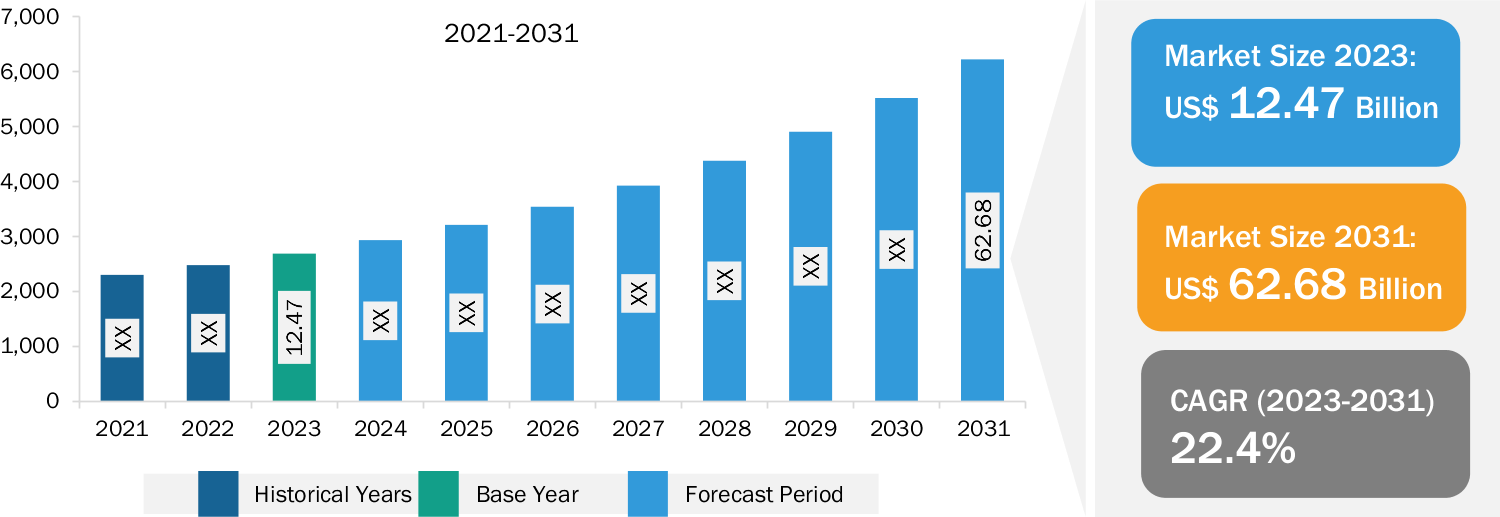

Market Overview:

The E-Invoicing Market size is projected to reach US$ 62.68 billion by 2031 from US$ 12.47 billion in 2023. The market is expected to register a CAGR of 22.4% in 2023–2031.

Source: The Insight Partners’ Analysis

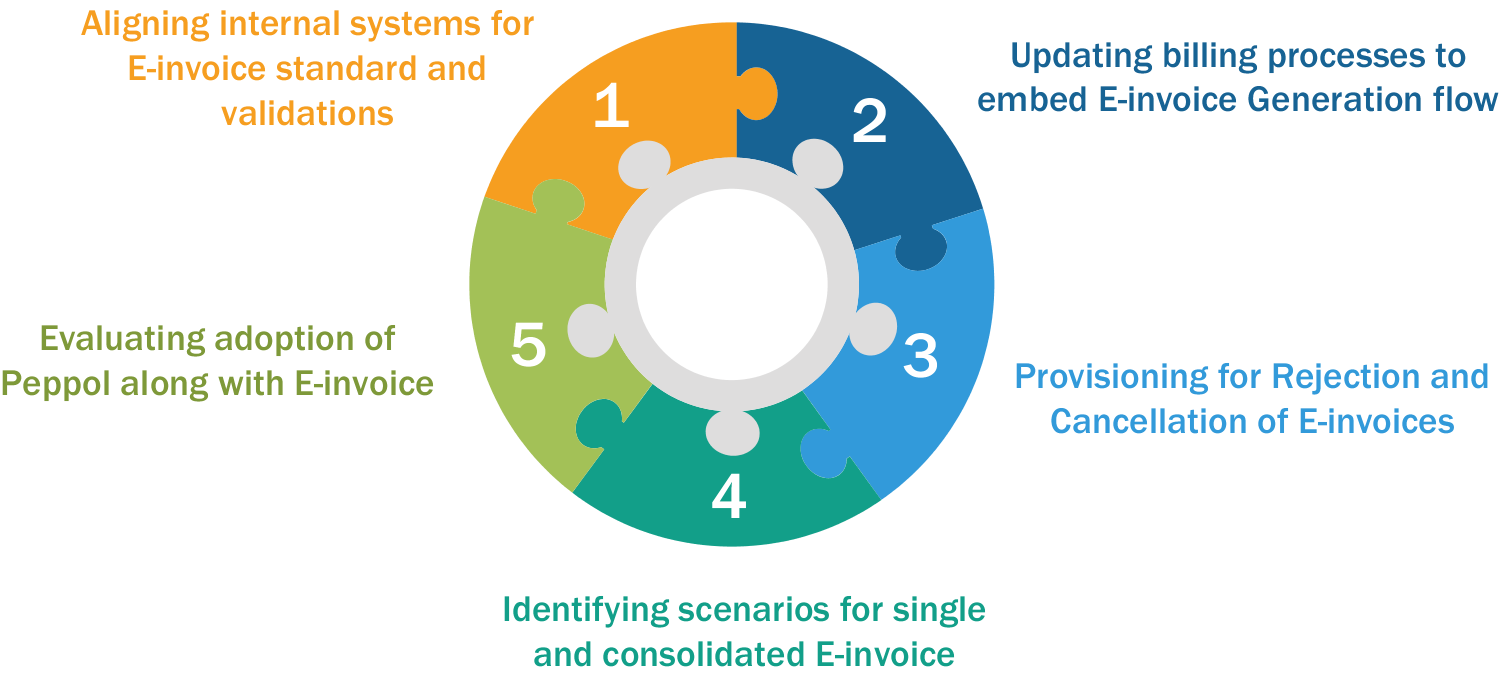

Key Aspects of E-Invoicing Implementation:

Source: The Insight Partners’ Analysis

Download Sample PDF Brochure: https://www.theinsightpartners.com/sample/TIPRE00009392/

Key Market Findings:

- North America dominated the e-invoicing market in 2023 and is expected to grow significantly during the forecast period. More than 200 e-invoicing network operators are present in the US. According to Comarch, global changes in the digitization of documents have substantially impacted American companies to expand internationally and optimize costs related to invoicing. The e-invoicing offers enhanced security, improved efficiency, increased accuracy, cost savings, and better visibility into financial transactions.

- The e-invoicing market in Asia Pacific is expected to grow at the fastest CAGR during the projected period. The regional market is observing the rising implementation of e-invoicing, driven by advancements in automation technologies for an easier and faster process. Therefore, the rising need to adopt a standardized model of invoicing is expected to develop invoicing systems.

- By deployment model, the e-invoicing market is bifurcated into cloud and on-premise. In 2023, the cloud segment held a larger share of the global e-invoicing market owing to its easy implementation, cost savings, and operational flexibility. In addition, the huge diversity of business and financial transactions in B2B, B2C, and B2G is driving the demand for e-invoicing solutions worldwide.

- The retail and e-commerce segment is expected to register the highest CAGR during 2023–2031. E-invoicing is trending in the retail industry for trading and in the e-commerce industry for financial transactions. It is used to streamline invoicing and payment processes, reduce errors, and increase efficiency. With the growing adoption of digital payments and e-commerce in retail, e-invoicing has become necessary for businesses to stay competitive and meet customer expectations.

Key Market Dynamics:

Source: The Insight Partners’ Analysis

Digital Transformation Across Various Industries:

Digital technologies are transforming industries and revolutionizing business processes to enhance operational efficiency and reduce costs. Various large enterprises and SMEs are investing in digital technologies such as cloud computing, artificial intelligence, web apps, IoT, predictive analytics, and big data. Digital transformation and process automation create unparalleled opportunities for businesses to generate large revenue. Moreover, the governments of various countries are taking different initiatives, such as Digital Government Strategy (US), Digital India, and Digital Strategy 2025 (Germany), to increase digitization in order to help companies across various industries improve operational efficiencies. Furthermore, the current manual and paper-based invoice generation process is prone to human errors, which can reduce overall business productivity. Adoption of e-invoicing results in cost reduction and helps in generating and sending invoices to customers with ease. The automation of the invoicing process through e-invoicing leads to strategic and operational advantages for buyers, suppliers, and managers.

Identify The Key Trends Affecting This Market - Download PDF

Rising Demand for Cloud-Based Solutions:

Cloud computing is leading digital transformation owing to its advantages over on-premise deployment. Major advantages of cloud-based solutions include easy deployment, interoperability, cost savings, high efficiency, and on-demand features. Services such as Infrastructure as a Service (IaaS) and Software as a Service (SaaS) are growing rapidly. With the increasing capabilities and benefits of cloud-based solutions in terms of technology integrations such as the Internet of Things (IoT), artificial intelligence (AI), blockchain, big data, and predictive analytics, the demand for these solutions is expected to grow at an impressive rate during 2024–2031. Furthermore, the growing number of small and medium-sized enterprises (SMEs) across the world is projected to fuel the demand for cloud-based e-invoicing solutions.

Competitive Landscape:

Source: The Insight Partners’ Analysis

Recent Market Developments:

- In September 2023, Toyota Boshoku Asia signed a contract with Comarch for the implementation of e-invoicing in Thailand. Comarch supports Toyota Boshoku Asia in setting up an e-invoicing solution for preparing, delivering, and storing digital documents, with digital signatures for tax invoices and receipts complying with Thailand's Revenue Department conditions and requirements.

- In February 2024, Basware, a global leader in AP automation and invoice processing, announced major global expansion plans as Bookings rose 52% and Recurring Revenue Growth accelerated year-over-year (YoY) in 2023.

Obtain Analysis of Key Geographic Markets - Download PDF

Key Company Offerings:

| Sr. No | Companies | Products/Solutions/Services |

| 1 | Basware Corporation | Basware e-Invoicing Network |

| 2 | Cegedim SA | SY Platform |

| 3 | Comarch SA | Comarch e-Invoicing Platform |

| 4 | Coupa Software Inc | Electronic Invoicing |

| 5 | International Business Machines Corp | Sterling E-Invoicing |

Apart from the above-mentioned companies, several other market players (such as Sage Group Plc; Nipendo Ltd; Tradeshift; Transcepta LLC; SAP SE; Zoho Corporation; Tradeshift Holdings, Inc.; easyap.com; Paysimple Inc.; Pagero; CLEARTAX; EDICOM; Webtel Electrosoft Pvt. Ltd.; Avalara, Inc.; and Esker) have also been analyzed to get a holistic view of the global e-invoicing market and its ecosystem.

Standardization in Banking and E-Invoicing:

- With the rising number of interactions, the demand for standardized data structures arose in order to reduce integration processes for all economic parties. As a result, various regulatory measures are implemented in the banking and e-invoicing sectors.

- Open Banking: Owing to open banking regulations, banks are mandated to create standardized APIs and offer third-party providers access to account information and payment initiation data.

- E-invoicing Standardization: Apart from regional and worldwide interoperability activities and standard implementation, the most significant push for e-invoicing is the local adoption of e-invoicing(like) schemes, which establish nation-wise standards. These tax requirements have resulted in the widespread availability of digital invoice data in local standards.

- Combined Impact of APIs and Standardization: The advent of cloud-based services and growing usage of APIs, as well as the adoption of standards, have enabled the integration of invoicing and payments. The integration efforts have dropped in tandem with the availability of structured data.

Order a Copy of this Report at: https://www.theinsightpartners.com/buy/TIPRE00009392/

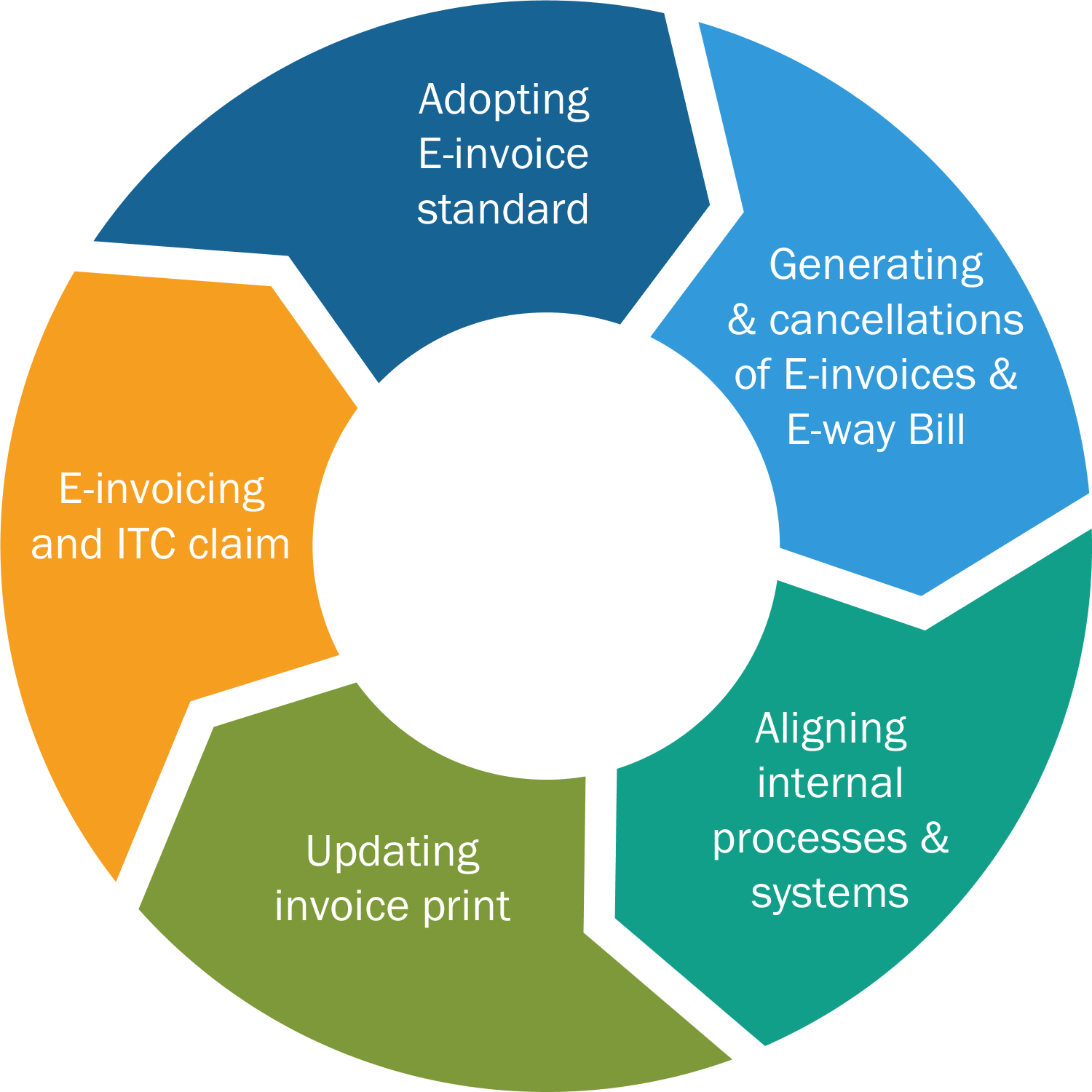

E-Invoice for Business:

Source: The Insight Partners’ Analysis

- Sales Side: The business cycle and invoice processing should be properly performed by the seller. In addition, a seller should also regularly register the invoice on the government portal.

- Purchase Side: Incoming invoices should have been successfully registered with the government to collect Input Tax Credit (ITC). Because the obligation only applies to the informed list of companies, recipients must maintain track of the vendors affected by the rule and ensure that invoices received from such entities include a valid IRN.

- Accounting/Billing Systems: Businesses performing accounting/billing systems should regularly be upgraded to collect IRN from the government, generate invoice output with IRN details, and capture automatic data for incoming purchase invoices with IRN.

Want More Information about Competitors and Market Players? Get PDF

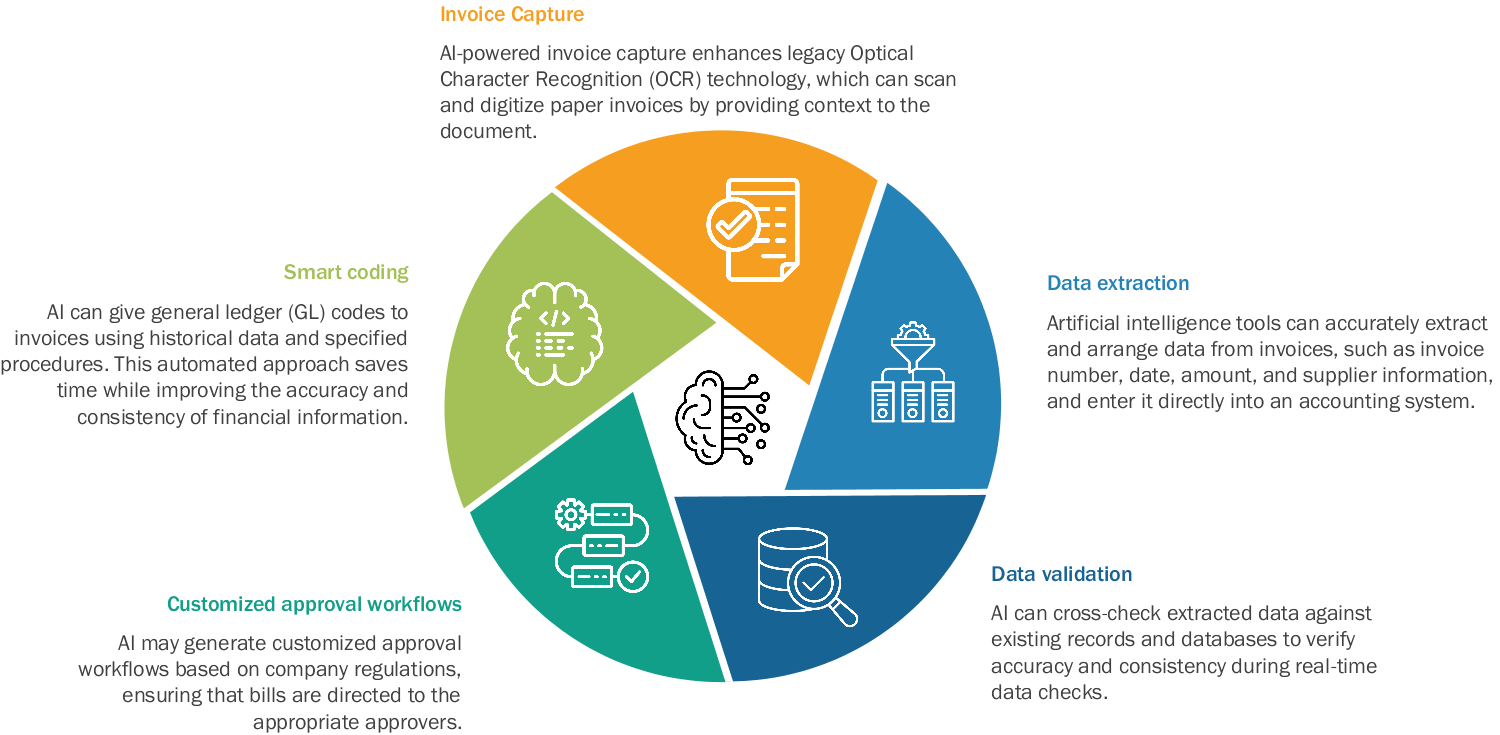

How Does AI Simplify E-Invoicing?

Integrating AI in the invoice process helps in reducing repetitive activities, saving the finance staff and valuable resources. It also reduces the possibility of human error, which improves overall efficiency and accuracy. Thus, AI plays a major role in five data management areas, as given in the figure below:

Source: The Insight Partners’ Analysis

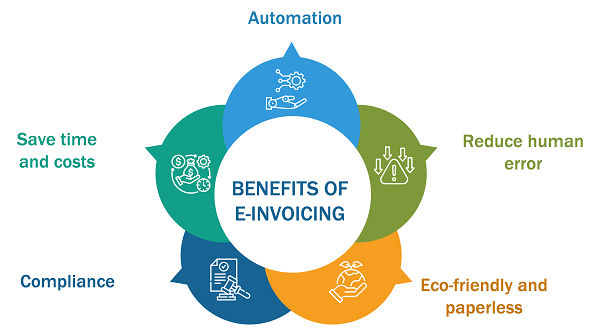

What are the Benefits of E-Invoicing for Businesses?

Invoicing stands out as a critical area where businesses may improve their performance and obtain a competitive edge by adding value to consumers. By automating the invoicing process, businesses can save over 60% of time and invoicing costs, allowing them to devote more resources to other business processes. With an e-invoicing system, invoices can be prepared, delivered, and received in minutes, decreasing processing time and speeding up payment cycles.

Require A Diverse Region or Sector? Customize Research to Suit Your Requirement

Key Benefits of E-Invoicing for Businesses:

Source: The Insight Partners’ Analysis

Related Report Titles:

- North America E-Invoicing Market

- Europe E-Invoicing Market

- Asia Pacific E-Invoicing Market

- Invoice Management Software Market

- Tax Management Market

- Digital Payment Market

- Payment Gateway Market

- Europe and South America Mobile Wallet and Payment Market

- Mobile Payments Market

- Payment Terminal Market

- In-Vehicle Payment Services Market

- Biometric Payment Cards Market

- 3D Secure Payment Authentication Market

- Retail Point-of-Sale Terminals Market

- Recurring Payments Market

- Wearable Payments Devices Market

- Real Time Payments Market

- Virtual Payment (POS) Market

- Payment as a Service Market

- Contactless Payments Market

- Payment HSMs Market

- Banking and Payment Smart Card Market

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Ankit Mathur

E-mail: ankit.mathur@theinsightpartners.com

Phone: +1-646-491-9876

Press Release: https://www.theinsightpartners.com/pr/e-invoicing-market