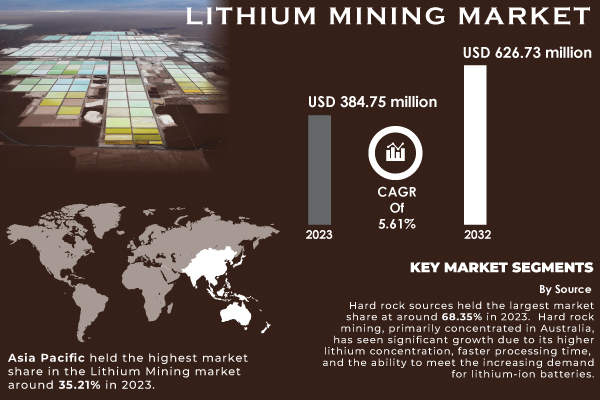

Pune, Aug. 26, 2024 (GLOBE NEWSWIRE) -- According to SNS Insider, The Lithium Mining Market size is projected to reach USD 626.73 million by 2032 and grow at a CAGR of 5.61% over the forecast period of 2024-2032.

Technological Advancements in Lithium Mining Drive Market Growth.

Recent developments in battery recycling techniques are allowing to the advancement and significantly increase in the recovery of lithium from spent batteries. Besides, these technological improvements are aimed at making recycling techniques more efficient and therefore, economically viable. About hydrometallurgical methods, currently used for extracting metals from ores or waste using aqueous solutions, increasing the yield of lithium extracted from batteries is achieved by refining the methods. It may involve the dissolving of lithium-containing compounds with the further selected recovery of the metal following other chemical reactions. Pyrometallurgical techniques, in turn, began to include smelting and refining processes for the recovery of lithium and other valuable metals from battery waste.

Request Sample Report of Lithium Mining Market 2023 @ https://www.snsinsider.com/sample-request/1466

Key Players

- Jiangxi Ganfeng Lithium

- Albemarle Corporation

- Tianqi Lithium

- Sociedad Química y Minera

- Mineral Resources Limited

- FMC Corporation

- Nemaska Lithium Inc.

- Pilbara Minerals

- Wealth Minerals Limited

- Lithium Americas Corp.

For instance, Li-Cycle, a leading lithium-ion battery recycler, expanded its operations with a new facility in Alabama in 2023. This facility, known as the Spoke & Hub system, is designed to handle end-of-life batteries and extract lithium through a combination of mechanical and hydrometallurgical processes.

Moreover, Major automakers and technology companies are increasingly making strategic investments in lithium exploration and mining to secure a reliable supply of this critical material. These companies recognize that lithium is essential for the production of electric vehicle batteries and energy storage systems. To address potential supply shortages and ensure a stable future supply, they are forming partnerships and pursuing acquisitions in lithium-rich regions. For example, several automakers have invested in lithium mining projects or secured supply agreements with mining companies.

Lithium Mining Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 384.75 Million |

| Market Size by 2032 | USD 626.73 Million |

| CAGR | CAGR of 5.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Brine and Hard Rock) • By Type (Chloride, Hydroxide, Carbonate, and Concentrate) • By Application (Batteries, Ceramics and Glass, Lubricants & Grease, Polymer, Flux Powder, Air Conditioning Equipment, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

If You Need Any Customization on Lithium Mining Market Report, Enquire Now @ https://www.snsinsider.com/enquiry/1466

Segmentation Analysis

By Source

Hard rock sources held the largest market share at around 68.35% in 2023. Due to its higher lithium concentration, quicker processing time, and capacity to satisfy the growing demand for lithium-ion batteries, hard rock mining, which is mostly centered in Australia, has experienced tremendous expansion. Brine extraction, which is mostly centered in South America, is not as reliable and consistent as this sort of mining. Lithium-rich brine must be evaporated over an extended period month or even years during the brine extraction process, which makes the brine less responsive to the quick demands of the market.

By Type

lithium hydroxide is leading in the lithium market. The reason is that lithium hydroxide is more suitably used for producing high-energy-density batteries, which are vital for electric vehicles and other advanced energy storage systems. It has become the dominant form because of its better performance in lithium-ion batteries, in high-nickel cathodes especially. The latter type of battery is being used more and more in EVs for the purposes of increasing energy density and extending the range of driving for electric vehicles. Lithium carbonate used to be the more popular choice traditionally and is still required, but overall tendency is that lithium hydroxide is preferred due to being able to meet the demands of new-age battery technologies.

By Application

Batteries held the largest market share around 32.65% in 2023. This industry is now the leading because of increase the demand for lithium-ion batteries brought on by the expanding use of electric vehicles (EVs), renewable energy storage options, and portable gadgets. They are lightweight, have a long cycle life, and are ideal for electric vehicles (EVs) and energy storage systems, lithium-ion batteries are preferred. While lithium finds application in other fields such as air conditioning equipment, polymers, lubricants and grease, glass and ceramics, and polymers, none of these fields compares to the scope of battery applications.

Regional Landscape:

Asia Pacific held the highest market share in the Lithium Mining market around 35.21% in 2023. The region inherently has some of the largest and most abundant lithium reserves, in countries such as Australia and China, and even in comparison to South America. Australia, for example, is a world-class producer of lithium, thereby contributing sizably to Asia Pacific’s market share. Moreover, the rapid growth of the Asia-Pacific electric vehicle and renewable energy sectors creates a huge demand for lithium. This is while the policies of the Chinese government, for instance, can also be seen as vital to the successful mining of the mineral.

Buy Full Research Report on Lithium Mining Market 2024-2032 @ https://www.snsinsider.com/checkout/1466

Recent Developments

- In 2023, Albemarle expanded its lithium hydroxide production capacity in North Carolina, USA. This expansion is expected to increase the plant's production by 50% to meet the growing demand for the electric vehicle market.

- In 2023, Tianqi Lithium completed the expansion of its lithium hydroxide production facilities in China, significantly increasing its production capabilities to cater to the growing EV market.

Key Takeaways:

- The demand for lithium is driven by the rapid growth of electric vehicles (EVs) and renewable energy storage solutions.

- There is increasing investment in lithium mining projects, with significant capital flowing into exploration and production to meet future demand.

- The market is dominated by major players like such as, Albemarle Corporation, SQM, Ganfeng Lithium, and Livent Corporation.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Major Lithium Producers and Mining Regions

5.2 Production Volume and Capacity by Major Country

5.3 Analysis of Lithium Reserves and Resources

6. Competitive Landscape

7. Lithium Mining Market Segmentation, by Source

8. Lithium Mining Market Segmentation, by Type

9. Lithium Mining Market Segmentation, by Application

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Description of Lithium Mining Market Report 2024-2032 @ https://www.snsinsider.com/reports/lithium-mining-market-1466

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

Lithium-Ion Battery Cathode Market Size

https://www.snsinsider.com/reports/lithium-ion-battery-cathode-market-3278

Lithium-Ion Batteries (Li-Ion) Market Share

https://www.snsinsider.com/reports/lithium-ion-batteries-market-2721