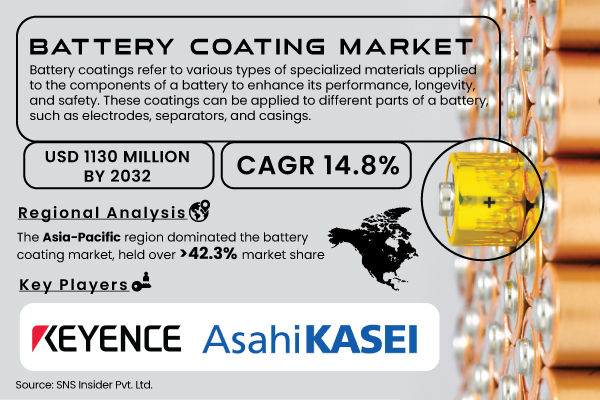

Austin, Sept. 04, 2024 (GLOBE NEWSWIRE) -- The Battery Coating Market Share is projected to reach USD 1130 million by 2032 and grow at a CAGR of 14.8% over the forecast period of 2024-2032.

Download PDF Sample of Battery Coating Market @ https://www.snsinsider.com/sample-request/2456

Customization and Material Innovation Drive Market Growth.

Nowadays, with the diversification of batteries, a continually increasing desire to adjust coating materials to the changing requirements is observed. Innovations in material science drive the creation of specialty coatings that improve such vital characteristics as ion conductivity, mechanical properties, and the ability to maintain a strong bond between the battery suspension and its packet. For instance, in 2023, the U.S. Department of Energy reported on a new development of ion-conductive coatings that significantly improve the efficiency of lithium-ion batteries, and significantly increase the service life of this type of batteries that are crucial for the development of electric vehicles. The increase in demand for high-quality batteries is forecasted in several industries, including automotive, consumer electronics, and renewable energy sources.

For instance, LG Chem added a new coating technology in 2022 that increases the mechanical strength of the battery electrode, thereby lowering the risk of degradation and raising the battery’s lifetime. Similarly, Panasonic, in 2023, introduced an advanced type of adhesive coating, which improves the regularity in the battery system component while not affecting the fundamental reaction.

Moreover, with batteries continuing to become more powerful and compact, effective thermal management has become a critical concern. The current battery generation features extremely high energy density, generating a lot of heat in the process. If not properly managed, this heat will cause the battery to overheat and, potentially, to enter one of the dangerous thermal runaway states. To combat this problem, a significant emphasis is currently being placed on the development of advanced thermal management coatings. These specialized coatings are designed to dissipate heat more effectively and ensure that the battery stays within a stable temperature range during operation.

For instance, the U.S. Department of Energy (DOE) has been actively funding research and development projects focused on improving battery safety and efficiency, including thermal management solutions. In 2022, the DOE allocated over USD 60 million towards advanced battery technologies, emphasizing the need for thermal management systems that can prevent overheating and reduce the risk of thermal runaway.

Battery Coating Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 325 million |

| Market Size by 2032 | USD 1130 million |

| CAGR | 14.8% CAGR by 2024-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Growth Drivers |

|

| Major Regions Covered |

|

If You Need Any Customization on Battery Coating Market Report, Enquire Now @ https://www.snsinsider.com/enquiry/2456

Battery Coating Market Segment Analysis

By Type

Atomic Layer Deposition is gaining traction as one of the leading technologies in the battery coating market. It allows for the creation of extremely thin, highly uniform, and very precise coatings, which makes it one of the most potent tools for the production of battery components. ALD is based on controlled chemical reactions of its precursors on the surface of the substrate on the atomic level. Due to this design, the method provides the necessary precision and control over the material and changes the procedures that typically limit the performance of a specific battery.

By Battery Component

The battery component market in 2023 will see significant growth in the Electrode coating segment. This surge will be sustained by the market’s 65% share, prompted by battery components that are continuously dominating the industry with advanced electrode materials becoming increasingly popular. The latter, such as silicon, graphene, and carbon nanotubes, open up new battery possibilities. Nevertheless, they come with the need for specialized coating. Battery electrodes, the front horses of the battery world, circulate electric energy on and on. Therefore, their sustainability is so important. Through thin-film coating application, their performance and the overall life span could be improved, adding even more to the already growing demand.

Battery Coating Market Regional Overview:

Asia Pacific held the largest market share around 42.3% in 2023. Battery manufacturing technology and the ability of the Asia-Pacific region have pushed it to the front. This region has the best supply chain, the highest RnD investments, and the most battery manufacturers. China, Japan, and South Korea are three of the biggest producers of batteries, both in the present and in the predicted future. China, Korea, and other emerging markets in the region also make strides in innovation, such as Atomic Layer Deposition.

At the same time, the Asia-Pacific is the world’s largest market for electric cars and renewable storage solutions that further necessitate high-quality coatings. Finally, the number of government programs and subsidies, intended to promote so-called “green technologies” by supporting solar panels, EVs, and other tools is very high in the region. Therefore, the Asia-Pacific is the market leader, despite equal significance of North America and Europe, whose development of sustainable materials and use of sustainable coating materials is on par with the Asia-Pacific. The more comprehensive and wide-ranging nature of these developments and the rapid speed with which they are implemented make Asia-Pacific the leader.

Recent Developments

- In 2023, LG Energy Solution announced a breakthrough in battery coating technology with the introduction of a new, high-performance coating material designed to enhance the stability and energy density of lithium-ion batteries.

- In 2023, Samsung SDI unveiled its advanced ALD-based coating technology for next-generation batteries. This technology is expected to improve the efficiency and lifespan of batteries used in electric vehicles (EVs) and renewable energy storage systems.

- In 2023, CATL has recently expanded its research into high-capacity battery coatings to support its new generation of ultra-fast-charging batteries.

Key Takeaways:

- The Asia-Pacific region is leading the market due to its strong battery manufacturing ecosystem, and significant R&D investments.

- The increasing adoption of electric vehicles (EVs) and renewable energy storage systems is fueling the demand for advanced battery coatings that enhance battery efficiency and safety.

Buy Full Research Report on Battery Coating Market 2024-2032 @ https://www.snsinsider.com/checkout/2456

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Battery Coating Market Segmentation, By Type

- Atomic Layer Deposition (ALD)

- Physical Vapor Deposition (PVD)

- Plasma Enhanced Chemical Vapor Deposition (PECVD)

- Chemical Vapor Deposition (CVD)

- Dry Powder Coating

8. Battery Coating Market Segmentation, By Battery Component

- Electrode Coating

- Separator Coating

- Battery Pack Coating

9. Battery Coating Market Segmentation, By Battery Type

- Lithium-Ion Battery

- Lead-Acid Battery

- Nickel-Cadmium Battery

- Graphene Battey

10. Battery Coating Market Segmentation, By Material Type

- Polyvinylidene Fluoride (PVDF)

- Ceramic

- Alumina

- Oxide

- Carbon

- Polyurethane (PU)

- Epoxy

- Others

11. Regional Analysis

12. Company Profiles

13. Competitive Landscape

14. Use Case and Best Practices

15. Conclusion

Access Complete Report Description of Battery Coating Market Report 2024-2032 @ https://www.snsinsider.com/reports/battery-coating-market-2456

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.