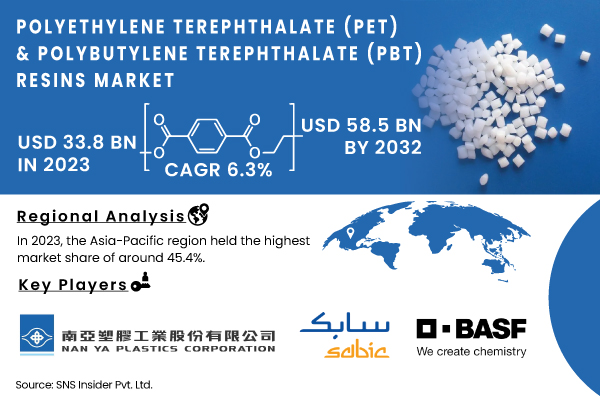

Austin, Sept. 05, 2024 (GLOBE NEWSWIRE) -- According to the SNS Insider report, The Polyethylene Terephthalate (PET) & Polybutylene Terephthalate (PBT) Resins Market size is projected to reach USD 58.5 billion by 2032 and grow at a CAGR of 6.3% over the forecast period of 2024-2032.

Advancements in Resin Technology Drive Market Growth.

There have been significant factors driving the Polyethylene Terephthalate and Polybutylene Terephthalate resins, including the advancements in resin technology. Various resin reforms have been escalating product changes in performance and sustainability. For instance, in June 2024, Dupont introduced a high-performance PBT resin, fulfilling the durability and thermal stability demands of the automotive sector.

Moreover, the U.S. Department of Energy, where its 2023 report indicated that 20% of the funding would be allocated towards the development of advanced materials including resins. This is a prerequisite in the development of energy-efficient and sustainable technologies and, thus is necessary for the driving force of the market.

Request Sample Report of Polyethylene Terephthalate (PET) & Polybutylene Terephthalate (PBT) Resins Market 2024 @ https://www.snsinsider.com/sample-request/2458

Key Players:

- Nan Ya Plastics Corp.

- SABIC

- Indorama Ventures Limited (Bangkok)

- BASF (Germany)

- Mitsubishi Chemical Corporation

- Reliance Industries Limited (India)

- Far Eastern New Century Corporation

- DuPont (US)

- Alpek (Mexico)

Shifting trends toward environmentally friendly packaging solutions have notably increased the demand for Polyethylene Terephthalate and Polybutylene Terephthalate Resins. There is growing pressure on governments across the world to spur the use of eco-friendly package materials.

For example, as highlighted in the study by the U.S. Environmental Protection Agency, recycling rates for products made of PET in the country have grown by approximately 25% in 2023. Another source highlights the European Union’s directive to reduce the amount of waste derived from single-use plastics by more than 50% by 2025. Due to their recyclable qualities and low environmental impact, the PET and PBT resins increasingly satisfy these efforts. Overall, the mentioned components sustain the market, promoted by governmental pressure.

Moreover, the Polyethylene Terephthalate and Polybutylene Terephthalate Resins Market is the increasing demand which is stimulated by the automotive sector. These resins are used increasingly more often among automotive manufacturers because of their excellent mechanical properties, lightweight nature and high-temperature resistance ensuring superior performance in contemporary vehicles. The U.S. Department of Transportation has reported a 12% increase of the use of advanced polymers, among which PBT is included, in the automotive sector in 2023.

Polyethylene Terephthalate (PET) & Polybutylene Terephthalate (PBT) Resins Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 33.8 Billion |

| Market Size by 2032 | US$ 58.5 Billion |

| CAGR | CAGR of 6.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| DRIVERS | • Rising demand for the packaging industry drives the market growth. • Investments in the region's collection/recycling capacities. |

If You Need Any Customization on Polyethylene Terephthalate (PET) & Polybutylene Terephthalate (PBT) Resins Market Report, Enquire Now @ https://www.snsinsider.com/enquiry/2458

Segmentation Analysis

By Type

In 2023, Transparent & Non-Transparent PET held the largest market share of around 58.23%. Transparent PET was observed as the top segment among other types of PET, according to Polaris, due to the packaging applications that require reinforcement in the field of application for several products, primarily in the beverage category. In packaging for products like water and soda, consumers must see the products through high-clarity PET with high strength or barrier properties. This is not only visually appealing but is also vital for maintaining the products’ integrity. In the food industry, Transparent PET is also valued for its safety in food contact applications.

By PET Application

The battery component market in 2023 will see significant growth in the Electrode coating segment. This surge will be sustained by the market’s 65% share, prompted by battery components that are continuously dominating the industry with advanced electrode materials becoming increasingly popular. The latter, such as silicon, graphene, and carbon nanotubes, open up new battery possibilities. Nevertheless, they come with the need for specialized coating. Battery electrodes, the front horses of the battery world, circulate electric energy on and on. Therefore, their sustainability is so important. Through thin-film coating application, their performance and the overall life span could be improved, adding even more to the already growing demand.

Key Segments

By PET type

- Transparent & Non-Transparent PET

- Recycled PET

By PET application

- Bottles

- Films

- Food Packaging

- Others

By PBT application

- Electrical & Electronics

- Automotive

- Consumer Appliances

- Others

Regional Landscape:

Asia-Pacific has been the dominant region in the Polyethylene Terephthalate (PET) & Polybutylene Terephthalate (PBT) Resins Market, driven by rapid industrialization and the growing demand for packaging and automotive materials. China, in particular, plays a pivotal role, with the National Bureau of Statistics of China reporting a 10% year-on-year increase in PET resin production in 2023. The region's robust manufacturing base, coupled with government initiatives such as China's "Made in China 2025" plan, which prioritizes the development of high-performance materials, has solidified its leading position.

Buy Full Research Report on Polyethylene Terephthalate (PET) & Polybutylene Terephthalate (PBT) Resins Market 2024-2032 @ https://www.snsinsider.com/checkout/2458

Recent Developments

- July 2024: BASF SE announced the expansion of its PBT resin production capacity at its Ludwigshafen site in Germany, aiming to meet the increasing demand from the automotive sector.

- May 2024: Eastman Chemical Company introduced a new line of sustainable PET resins designed to enhance recyclability and reduce carbon footprint, in line with global sustainability goals.

Key Takeaways:

- Increasing demand for sustainable packaging solutions is propelling the PET & PBT resins market, with government regulations emphasizing eco-friendly materials.

- Rising use of advanced resins in the automotive industry for their lightweight and durable properties is boosting market growth.

- Asia-Pacific remains the leading region in the market, driven by industrialization and supportive government policies.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

7. Polyethylene Terephthalate & Polybutylene Terephthalate Resins Market Segmentation, by PET Type

8. Polyethylene Terephthalate & Polybutylene Terephthalate Resins Market Segmentation, by PET Application

9. Polyethylene Terephthalate & Polybutylene Terephthalate Resins Market Segmentation, by PBT Application

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Description of Polyethylene Terephthalate (PET) & Polybutylene Terephthalate (PBT) Resins Market Report 2024-2032 @ https://www.snsinsider.com/reports/polyethylene-terephthalate-pet-and-polybutylene-terephthalate-pbt-resins-market-2458

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.