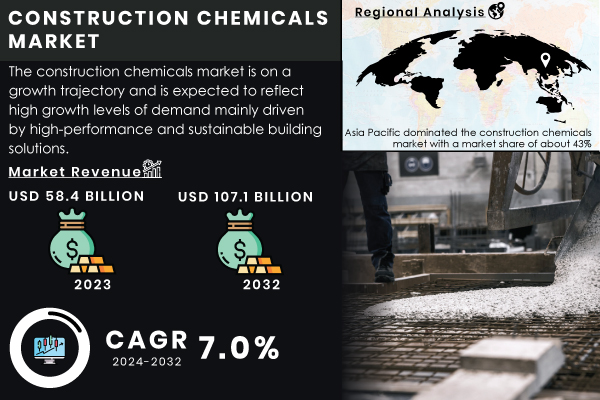

Austin, Oct. 11, 2024 (GLOBE NEWSWIRE) -- “According to the new market research report The Construction Chemicals Market was worth USD 58.4 billion in 2023 and is expected to grow to USD 107.1 billion by 2032, with a CAGR of 7.0% in the forecast period 2024-2032.”

With the rapid urbanization and heavy investment in the infrastructure sector of different economies, interest in construction chemicals is accelerating due to the ensuing infrastructure projects for roads, bridges, and dams. Among these infrastructure applications, concrete admixtures, waterproofing solutions, and anchoring systems offer a probability of unique performance and longevity. An increase in the number of constructions related to infrastructure is increasing the demand for construction chemicals and hence promoting the growth of the construction chemicals market. Furthermore, growing environmental concerns and regulatory pressures are forcing industry players to conduct their operations on sustainable grounds. Accordingly, sustainability opened certain potential opportunities for eco-friendly construction chemicals, such as bio-based adhesives, admixtures from recycled content, and low-VOC coatings.

Request Sample Report of Construction Chemicals Market 2024 @ https://www.snsinsider.com/sample-request/1457

Key Players

- Ardex Group (Ardex X 7, Ardex K 15, Ardex WPM 300)

- Arkema (Kraton, Eliokem, Rilsan)

- BASF SE (MasterSeal, MasterEmaco, Elastocrete)

- Cross International Plc (Cross Riser Seal, Cross Duct Seal, Cross Wall Seal)

- Dow Inc. (DOWSIL 736, DOWSIL 795, DOWSIL 3145)

- Fosroc, Inc. (Fosroc Renderoc, Fosroc Conbextra, Fosroc Nitobond)

- Henkel AG & Co. KGaA (SikaBond, Loctite PL Premium, Ceresit)

- MBCC Group (Master Builders Solutions, MBT Admixtures, MBCC MasterSeal)

- MAPEI S.p.A. (Mapelastic, Ultraplan, Keraflex)

- Pidilite Industries Ltd. (Fevicol, Dr. Fixit, M-Seal)

- RPM International Inc. (Rust-Oleum, DAP, Tremco)

- Saint-Gobain (Gyproc, Isover, Weber)

- Sika AG (Sikaflex, SikaTop, SikaBond)

- Tata Chemicals (Tata Chemicals White Cement, Tata Chemicals T-Plus, Tata Chemicals Varnish)

- The Dow Chemical Company (DOWSIL Sealants, DOWSIL Construction Grade, DOWSIL 100% Silicone)

- The Lubrizol Corporation (Lubrizol CPVC, Lubrizol G-Block, Lubrizol R&D Coatings)

- W. R. Grace & Co. (Grace Construction Products, Aqualoc, Adva)

- Tremco Incorporated (Tremco Sealants, Tremco Weatherproofing, Tremco Insulation)

- H.B. Fuller Company (FullerMax, Loxeal, Lepage)

- GCP Applied Technologies (Grace Construction Products, Easi-Set, ADVA)

Also, buildings should be designed and constructed to be able to resist such forces in case of severe weather conditions that are projected to intensify in the future. High-performance construction chemicals are increasingly offering greater strength and resilience to structures. Key players are trying to strengthen buildings against negative environmental elements, creating growing demand for products such as corrosion inhibitors, fire retardants, and seismic-resistant materials. The companies are also taking initiatives such as partnerships, collaborations, investments, and geographical expansion of their business that help to boost market growth. For instance, in June 2024, Saint-Gobain acquired FOSROC, a global leader in construction chemicals, for $1,025 million in cash, expanding its footprint with projected combined sales of €6.2 billion across 73 countries post-acquisition. FOSROC anticipates $487 million in 2024 sales with an 18.7% EBITDA margin, operating 20 plants and offering a range of construction solutions globally.

This growing emphasis on durability and resilience is likely to boost the high-performance construction chemicals market. On the other hand, extreme price volatility for raw materials is one of the major factors challenging the market. Changes in the prices of such key raw materials as petroleum derivatives and cement, fundamentally, along with specialty chemicals in general, affect cost structures for manufacturing companies that make products. This could be occasioned by changes in global geopolitics, breaks in supply chains, or alterations in demand versus supply scenarios worldwide. This challenge to the growth of the market will be made more manageable by robust strategies in supply chain management, which include diversification of suppliers, forward contracts, and constant scanning of market trends.

Construction Chemicals Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 58.4 billion |

| Market Size by 2032 | US$ 107.1 Billion |

| CAGR | CAGR of 7.0 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Key Drivers | •Growing Demand for Eco-Friendly Products in Various Industries Boosts the Construction Chemicals Market Growth •Rapid Urbanization and Infrastructure Development Propel Construction Chemicals Market Growth |

If You Need Any Customization on Construction Chemicals Market Report, Enquire Now @ https://www.snsinsider.com/enquiry/1457

Segment Analysis

By material, Concrete Admixtures dominated the construction chemicals market in 2023 with a market share of over 60% and are expected to grow significantly with the highest CAGR during the forecast period. The demand for construction chemicals from this segment is enhanced by the development of new concrete admixtures with improved properties. This is attributed to the high usage of admixtures, as these help reduce the overall construction cost by changing the characteristics of the hardened concrete, in comparison with other types of construction materials. For example, adding admixtures to concrete can reduce the water requirement by 5–10%. Further, admixtures improve the concrete quality and help in smoothening the construction process.

Key Segments:

By Product Type

- Adhesives & Sealants

- Anchors & Grouts

- Concrete Admixtures

- Concrete Protective Coatings

- Flooring Resins

- Repair & Rehabilitation Chemicals

- Surface Treatment Chemicals

- Waterproofing Chemicals

- Others

By End-User

- Residential

- Commercial & Industrial

- Infrastructure

Recent Developments Showcase Technological Advancements and Strategic Partnerships

April 2024: Vink Chemicals, one of the major players, began constructing an entirely new production site in Schwerin, Germany. Located in the Göhrener Tannen industrial estate, this facility provides 45 permanent jobs and has made it possible to bring further raw materials into production.

May 2023: Oriental Yuhong signed a strategic cooperation agreement with Hebei Aorun Shunda Group for collaborative research on multidimensional waterproofing membranes, insulation coats, and other solutions.

June 2023: Fosroc allied with Chemtech, one of the large construction chemicals companies. Both companies have entered this partnership to use Chemtech's network for the

Regional Analysis

In 2023, the Asia-Pacific region held a revenue share of about 35% in the global construction chemicals market. Against the backdrop of rapid urbanization across megacities like Shanghai, Tokyo, and Delhi among others, comes consistent demand for construction chemicals, thereby giving way to rampant construction of high-rise buildings, large infrastructure projects, and city expansions. In addition, initiatives on the part of governments, such as the Belt and Road Initiative by China, are responsible for entailing heavy investments in infrastructure across many countries in the region. This will consequently increase demand for vast volumes of construction chemicals. It is also expected that this region will gain a larger fraction of construction chemicals from its growing interest in sustainability, represented by stricter environmental regulations. Therefore, companies like Japan-based Nippon Paint and India-based JSW are serious about innovating into sustainable solutions for this growing demand, further anchoring the Asia–Pacific lead in the construction chemical market.

Buy Full Research Report on Construction Chemicals Market 2024-2032 @ https://www.snsinsider.com/checkout/1457

SNS View on Construction Chemicals Market

The rise in demand from the construction industry and the flexibility to use sustainable and energy-efficient materials are big factors for the market growth of construction chemicals. On the other hand, low consumer awareness about the long-term benefits of construction chemicals and volatility in their regulatory environment are major factors acting as headwinds to the growth of this market. At present, the residential sector accounts for the largest consumption among the various market segments for construction chemicals, due to urbanization and demand for sustainable infrastructure. High entry rates of new entrants eyeing available international opportunities characterize the market, while established business stock engages in strategic partnerships towards capacity expansion and entry into new emerging markets. Within the past decade, there has been a surge in joint ventures, mergers, and acquisitions in the bid to win long-term contracts with the expectation of gainful and stable global operations.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

7. Construction Chemicals Market Segmentation, by Product Type

8. Construction Chemicals Market Segmentation, by End-User

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

Access Complete Report Description of Construction Chemicals Market Report 2024-2032 @ https://www.snsinsider.com/reports/construction-chemicals-market-1457

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain