New York, USA, Oct. 16, 2024 (GLOBE NEWSWIRE) -- 80+ Pharma Companies Unite to Shape the Future of RNA-Based Therapeutics | DelveInsight

With over 80 key companies active in the RNA therapies space, the market is projected to grow due to advancements in mRNA, siRNA, and antisense oligonucleotide-based therapies. Emerging RNA-based treatments, especially in areas like oncology, infectious diseases, and genetic disorders, are fueling this expansion.

DelveInsight’s 'RNA Therapies Competitive Landscape – 2024' report provides comprehensive global coverage of available, marketed, and pipeline RNA therapies in various stages of clinical development, major pharmaceutical companies working to advance the pipeline space and future growth potential of the RNA therapies competitive domain.

Key Takeaways from the RNA Therapies Pipeline Report

- Over 80+ companies are evaluating 100+ RNA therapies in various stages of development, and their anticipated acceptance in the RNA therapies market would significantly increase market revenue.

- Leading RNA therapies companies such as Novartis, Arrowhead Pharmaceuticals, Arbutus Biopharm, Dicerna Pharmaceuticals, Inc., SanegeneBio, Alnylam Pharmaceuticals, Eli Lilly and Company, Janssen Pharmaceuticals, Moderna Therapeutics, OliX Pharmaceuticals, ProQR Therapeutics, Fujian Shengdi Pharmaceutical, Silence Therapeutics, WaVe life Sciences, Sirnaomics, ExoRNA Bioscience, Comanche Biopharma, Ractigen Therapeutics, GeneCare Research Institute, Sirana Pharma, DTx Pharma, Aptadel Therapeutics, and others are evaluating novel RNA therapies candidates to improve the treatment landscape.

- Key RNA therapies pipeline in various stages of development include ARO-APOC3, AB-729, ARO-C3, DCR-AUD, SGB-9768, Cemdisiran, LY3561774, JNJ-75220795, mRNA 1230, OLX 702A, Sepofarsen, HRS 5635, Divesiran , WVE 003, STP 122G, STP 707, ER 2001, CBP 4888, RAG 17, RECQL1 siRNA, Research programme: musculoskeletal disorders, Research programme: RNA therapeutics , ADEL 001, and others.

Request a sample and discover the recent advances in the RNA therapies market @ RNA Therapies Competitive Landscape Report

RNA Therapies Overview

RNA therapies are an emerging class of treatments that leverage the body’s natural biological processes to target and modulate gene expression. Unlike traditional therapies that focus on proteins, RNA therapies intervene at the messenger RNA (mRNA) level, offering more precise control over the production of specific proteins involved in disease processes. This can include preventing the translation of harmful proteins, restoring normal protein function, or introducing new therapeutic proteins. RNA therapies have garnered attention due to their potential to treat a wide array of diseases, from genetic disorders to cancers and infectious diseases.

There are several types of RNA therapies, each with distinct mechanisms. mRNA vaccines, such as those used in COVID-19, deliver synthetic mRNA into cells, instructing them to produce a viral protein and trigger an immune response. Small interfering RNA (siRNA) and antisense oligonucleotides (ASOs) work by silencing specific genes, thereby blocking the production of disease-causing proteins. Another promising approach is RNA editing, where specific mutations in mRNA can be corrected to restore normal gene function. These technologies enable highly targeted interventions, making RNA therapies particularly suitable for diseases caused by single gene mutations.

While RNA therapies hold great promise, they also face several challenges. Delivering RNA molecules into cells efficiently and safely remains a major hurdle, as RNA is inherently unstable and prone to degradation. Advances in delivery systems, such as lipid nanoparticles, have improved stability, but further innovations are needed to optimize targeting and minimize side effects. Additionally, RNA therapies can be costly to develop and manufacture. Despite these challenges, the field is rapidly evolving, with numerous RNA-based drugs and vaccines in development, offering new hope for patients with previously untreatable conditions.

RNA Therapies Pipeline Analysis: Drug Profile

LEQVIO: Novartis

LEQVIO (inclisiran) is an injectable treatment given every six months to reduce low-density lipoprotein (LDL) cholesterol, often referred to as "bad" cholesterol. It is a small interfering RNA (siRNA) therapy that targets a liver protein called PCSK9 (proprotein convertase subtilisin kexin type 9), which normally limits the number of receptors that remove LDL cholesterol from the bloodstream. By blocking the translation of PCSK9 mRNA, LEQVIO decreases PCSK9 production, helping to lower LDL cholesterol levels. It is used alongside diet and statins to manage high LDL cholesterol in adults with elevated cholesterol or atherosclerosis. Novartis holds the global rights to develop, produce, and market LEQVIO through a partnership with Alnylam Pharmaceuticals, a pioneer in RNA interference (RNAi) therapies.

Find out more about FDA RNA therapies @ RNA Therapies Analysis

The RNA therapies market has seen rapid growth and significant interest in recent years, driven largely by advances in biotechnology, increasing investments in the development of novel therapies, and the success of mRNA vaccines during the COVID-19 pandemic. With the potential to treat genetic disorders, cancers, infectious diseases, and other conditions that were previously considered untreatable, the RNA therapy market is expected to expand rapidly.

One of the key drivers of the market is the increasing prevalence of chronic and rare genetic diseases. RNA therapies are particularly effective in treating rare genetic disorders by correcting or modulating the expression of specific genes. For instance, the approval of treatments like SPINRAZA (for spinal muscular atrophy) and ONPATTRO (for hereditary transthyretin-mediated amyloidosis) has validated the commercial viability and therapeutic impact of RNA-based drugs. Additionally, RNA therapeutics provide a promising approach for precision medicine, where treatments can be tailored to the genetic profile of an individual patient.

On the competitive front, the RNA therapy market is dominated by both established pharmaceutical companies and emerging biotech startups. Major pharmaceutical players such as Moderna, Alnylam Pharmaceuticals, and BioNTech have made significant strides in developing RNA therapies and are investing heavily in expanding their pipelines. This competitive landscape is further enriched by partnerships and collaborations between biotech companies and academic institutions, which are accelerating innovation and product development. However, challenges such as delivery mechanisms, safety concerns, and scalability of RNA-based therapies still remain critical hurdles that industry players need to address.

Regulatory advancements and supportive government policies also contribute to the market’s positive outlook. Regulatory agencies like the FDA and EMA have shown a willingness to fast-track the approval of RNA-based treatments, particularly for life-threatening or rare diseases with limited treatment options. The success of mRNA vaccines has also built confidence in the safety and efficacy of RNA therapeutics, paving the way for a more streamlined regulatory process for future RNA-based drugs.

To know more about RNA therapies, visit @ RNA Therapies Market Insights

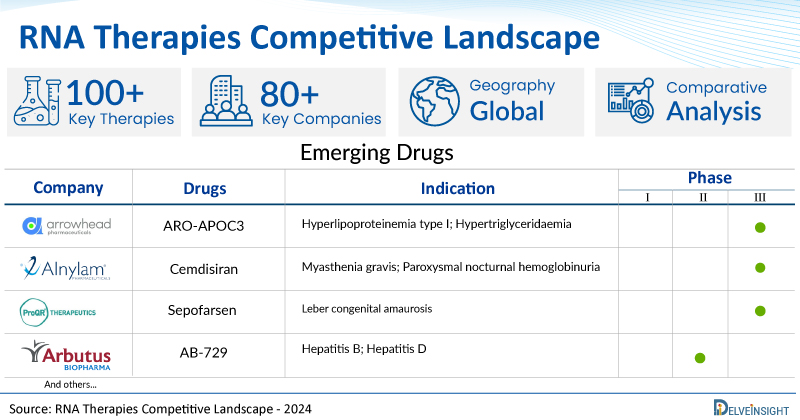

A snapshot of the pipeline RNA therapies mentioned in the report:

| RNA Therapies | Company | Phase | Indication |

| ARO-APOC3 | Arrowhead Pharmaceuticals | III | Hyperlipoproteinemia type I; Hypertriglyceridaemia |

| Cemdisiran | Alnylam Pharmaceuticals | III | Myasthenia gravis; Paroxysmal nocturnal hemoglobinuria |

| Sepofarsen | ProQR Therapeutics | II/III | Leber congenital amaurosis |

| AB-729 | Arbutus Biopharm | II | Hepatitis B; Hepatitis D |

| Solbinsiran | Eli Lilly and Company | II | Cardiovascular disorders; Dyslipidaemias |

| HRS 5635 | Fujian Shengdi Pharmaceutical | II | Hepatitis B |

| ARO-C3 | Arrowhead Pharmaceuticals | I/II | IgA nephropathy; Membranoproliferative glomerulonephritis; Paroxysmal nocturnal hemoglobinuria |

| DCR-AUD | Dicerna Pharmaceuticals, Inc. | I | Alcoholism |

| JNJ-75220795 | Johnson & Johnson Innovative Medicine | I | Fatty liver; Non-alcoholic steatohepatitis |

| OLX 702A | OliX Pharmaceuticals | I | Non-alcoholic steatohepatitis |

| STP 122G | Sirnaomics | I | Thrombosis |

| SGB-9768 | SanegeneBio | Preclinical | Immunological disorders |

Discover more about RNA therapies in clinical development @ RNA Therapies in Clinical Trials

Key Developments in the RNA Therapies Domain

- In July 2024, Rgenta Therapeutics announced the clearance of its IND by the FDA for RGT-61159, which is being developed for the potential treatment of adenoid cystic carcinoma, colorectal cancer, and other solid tumors as well as acute myeloid leukemia.

- In June 2024, Ascidian Therapeutics announced a research collaboration and licensing agreement with Roche for the discovery and development of RNA exon editing therapeutics targeting neurological diseases.

- In May 2024, Achilles Therapeutics plc announced a research collaboration with Arcturus Therapeutics Holdings Inc. to evaluate best-in-class, self-amplifying mRNA (sa-mRNA) personalized cancer vaccines (PCVs) targeting clonal neoantigens. The research collaboration will combine Achilles’ best-in-class AI-driven, tumor-targeting technology with Arcturus’ world-leading sa-mRNA platform.

- In April 2024, Ipsen and Skyhawk Therapeutics signed an exclusive worldwide collaboration to discover and develop novel small molecules that modulate RNA for rare neurological diseases. The agreement includes an option according to which Ipsen would acquire an exclusive license for the worldwide rights to develop successful development candidates (DC).

- In April 2024, MiNA Therapeutics announced a research collaboration and licensing agreement option with Nippon Shinyaku Co., Ltd. The collaboration will allow for the discovery and potential development and commercialization of RNAa therapeutic candidates targeting rare neurodegenerative diseases for which there are currently no treatment options.

- In January 2024, Boehringer Ingelheim agreed to collaborate with Suzhou Ribo Life Science Co and Ribocure Pharmaceuticals AB (Ribo), to develop new RNAi therapeutics for nonalcoholic or metabolic dysfunction-associated steatohepatitis (NASH/MASH). The deal exceeds a value of $2 billion and will utilize Ribo’s expertise in small interfering RNA (siRNA) treatments.

- In January 2024, Ascidian Therapeutics announced that the FDA had cleared its application to begin the first RNA-editing clinical trial in the United States.

Scope of the RNA Therapies Competitive Landscape Report

- Coverage: Global

- Key RNA Therapies Companies: Novartis, Arrowhead Pharmaceuticals, Arbutus Biopharm, Dicerna Pharmaceuticals, Inc., SanegeneBio, Alnylam Pharmaceuticals, Eli Lilly and Company, Janssen Pharmaceuticals, Moderna Therapeutics, OliX Pharmaceuticals, ProQR Therapeutics, Fujian Shengdi Pharmaceutical, Silence Therapeutics, WaVe life Sciences, Sirnaomics, ExoRNA Bioscience, Comanche Biopharma, Ractigen Therapeutics, GeneCare Research Institute, Sirana Pharma, DTx Pharma, Aptadel Therapeutics, and others

- Key RNA Therapies in Pipeline: ARO-APOC3, AB-729, ARO-C3, DCR-AUD, SGB-9768, Cemdisiran, LY3561774, JNJ-75220795, mRNA 1230, OLX 702A, Sepofarsen, HRS 5635, Divesiran , WVE 003, STP 122G, STP 707, ER 2001, CBP 4888, RAG 17, RECQL1 siRNA, Research programme: musculoskeletal disorders, Research programme: RNA therapeutics , ADEL 001, and others.

Table of Contents

| 1. | RNA Therapies Pipeline Report Introduction |

| 2. | RNA Therapies Pipeline Report Executive Summary |

| 3. | RNA Therapies Pipeline: Overview |

| 4. | RNA Therapies Marketed Drugs |

| 4.1. | LEQVIO: Novartis |

| 5. | RNA Therapies Clinical Trial Therapeutics |

| 6. | RNA Therapies Pipeline: Late-Stage Products (Pre-registration) |

| 7. | RNA Therapies Pipeline: Late-Stage Products (Phase III) |

| 7.1. | ARO-APOC3: Arrowhead Pharmaceuticals |

| 8. | RNA Therapies Pipeline: Mid-Stage Products (Phase II) |

| 8.1. | AB-729: Arbutus Biopharm |

| 9. | RNA Therapies Pipeline: Early-Stage Products (Phase I/II) |

| 9.1. | ARO-C3: Arrowhead Pharmaceuticals |

| 10. | RNA Therapies Pipeline: Preclinical and Discovery Stage Products |

| 10.1. | SGB-9768: SanegeneBio |

| 11. | RNA Therapies Pipeline Therapeutics Assessment |

| 12. | Inactive Products in the RNA Therapies Pipeline |

| 13. | Company-University Collaborations (Licensing/Partnering) Analysis |

| 14. | Unmet Needs |

| 15. | RNA Therapies Market Drivers and Barriers |

| 16. | Appendix |

Learn more about RNA therapy @ Antisense RNA Therapies

Related Reports

RNA Interference Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key RNA interference companies, including Silence Therapeutics, Janssen Research & Development, Eli Lilly and Company, Arrowhead Pharmaceuticals, Sylentis, Sirnaomics, Dicerna Pharmaceuticals, Suzhou Ribo Life Science, Alnylam Pharmaceuticals, Suzhou Ribo Life Science, Vir Biotechnology, Arbutus Biopharma, Silenseed, OliX Pharmaceuticals, Bio-Path Holdings, among others.

Global Messenger RNA (mRNA)-based Vaccines and Therapeutics Market

Global Messenger RNA (mRNA)-based Vaccines and Therapeutics Market Insights, Epidemiology, and Market Forecast – 2032 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key global messenger RNA -based vaccines and therapeutics companies, including Moderna, Inc., BioNTech SE, CureVac N.V., Arcturus Therapeutics, Translate Bio, Inc., GSK, among others.

Global Messenger RNA Market Insights, Epidemiology, and Market Forecast – 2032 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key global mRNA companies, including Translate Bio, AstraZeneca, Moderna, Roche (Genentech), BioNTech, Sanofi, Moderna, CureVac, Arcturus, among others.

mRNA Vaccines And Therapeutics Market

mRNA Vaccines And Therapeutics Market Insights, Competitive Landscape, and Market Forecast – 2030 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key mRNA vaccines and therapeutics companies, including Pfizer Inc., BioNTech SE, Moderna, Inc., Gennova Biopharmaceuticals Limited, GSK plc., Daiichi Sankyo, Arcturus, Boehringer Ingelheim International GmbH, Ethris GmbH, CureVac SE, AIM Vaccine Corporation, Charoen Pokphand Group, Argos Therapeutics Inc., Sanofi, Kernal Biologics Inc, among others.

DelveInsight’s Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Consulting Services

Healthcare Conference Coverage

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant, and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance.