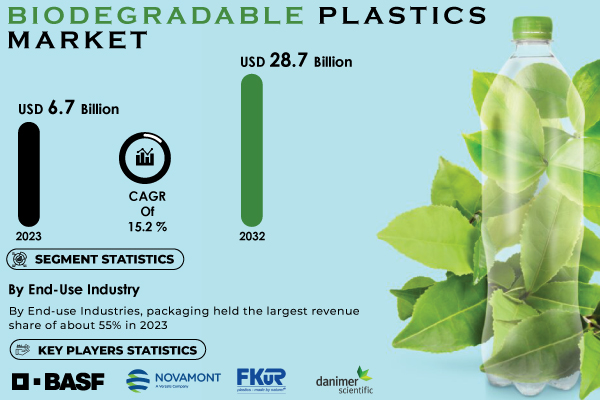

Austin, Oct. 17, 2024 (GLOBE NEWSWIRE) -- “According to the SNS Insider report, The Biodegradable Plastics Market is poised for substantial growth, projected to reach USD 28.7 billion by 2032, with a compound annual growth rate of 15.2% from 2024 to 2032.”

Trends Impacting the Biodegradable Plastics Market

The biodegradable plastics market is witnessing a transformative shift driven by the global emphasis on sustainability and environmental conservation. With growing concerns about plastic waste and its detrimental effects on ecosystems, industries are increasingly turning to biodegradable alternatives. As consumers become more environmentally conscious, there is a marked preference for products that minimize ecological footprints.

Request Sample Report of Biodegradable Plastics Market2024 @ https://www.snsinsider.com/sample-request/2366

Key Players

Raw Key Manufacturers

- FKuR Kunststoff GmbH (BIO-FLEX)

- BASF SE (ecoflex)

- Danimer Scientific (Nodax PHA)

- Novamont S.p.A. (Mater-Bi)

- Biome Bioplastics (BiomeHT)

- Toray Industries, Inc. (Ecodear)

- NatureWorks LLC (Ingeo PLA)

- Plantic Technologies (PLANTIC)

- Mitsubishi Chemical Holdings Corporation (BioPBS)

- Total Corbion PLA (Luminy PLA)

- Kingfa Sci & Tech Co., Ltd. (Ecoworld)

- Corbion N.V. (PURAC)

- Kaneka Corporation (PHBH)

- Cardia Bioplastics (Cardia Biohybrid)

- Agrana Beteiligungs-AG (Agenacomp)

- Clondalkin Group (FlexTop)

- Tianan Biologic Materials Co., Ltd. (PHA-based BioMater-Bi)

- Avantium N.V. (YXY)

- Evonik Industries AG (VESTAMID Terra)

- FKUR Plastics Corp. (Terramac)

Governments worldwide are also implementing stringent regulations to combat plastic pollution. Initiatives aimed at reducing single-use plastics have led to an upsurge in demand for biodegradable options. For instance, several countries have introduced bans on conventional plastics, thus incentivizing manufacturers to innovate and shift towards biodegradable materials.

Opportunities in the Biodegradable Plastics Market

Technological Advancements and Growing Applications

Technological advancements in biodegradable materials are creating exciting opportunities in this market. Innovations such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA) have gained traction due to their versatile applications across various sectors. The food packaging industry, in particular, is rapidly adopting biodegradable plastics as a sustainable alternative to traditional materials. The increasing demand for eco-friendly packaging solutions is driving manufacturers to develop new products that align with consumer preferences.

The agricultural sector is also embracing biodegradable plastics, particularly for mulch films and plant pots. These products not only help improve soil health but also eliminate the need for plastic waste disposal. A study by the European Bioplastics Association reported that the use of biodegradable mulch films is expected to reach 90,000 tons by 2025, underscoring the growing acceptance of biodegradable options in agriculture.

Emerging Markets

Emerging economies are increasingly recognizing the importance of biodegradable plastics as part of their sustainability initiatives. Countries in the Asia-Pacific region, such as India and China, are witnessing a surge in the adoption of biodegradable materials, driven by rapid industrialization and urbanization. These countries are experiencing heightened environmental concerns, leading to government policies that encourage the use of eco-friendly alternatives.

In India, for example, the government has launched initiatives aimed at promoting the production and use of biodegradable plastics in a bid to combat plastic pollution. As a result, manufacturers are increasingly investing in research and development to create innovative biodegradable products tailored to local market needs. According to a report by the Indian Ministry of Environment, about 30% of manufacturers are exploring biodegradable options, indicating a significant shift towards sustainable practices.

Government Initiatives:

| Category | Details |

| Government Policies and Regulations | Various governments are introducing policies to reduce single-use plastic waste and promote biodegradable alternatives. Examples include the European Union's ban on single-use plastics and India's Plastic Waste Management Rules. |

| Tax Incentives | Some governments offer tax benefits or subsidies for companies investing in biodegradable plastic production. For example, in China, tax incentives are provided for green manufacturing sectors, including bioplastics. |

| Environmental Targets | Countries are setting environmental targets for reducing plastic waste. The European Green Deal aims for the EU to become carbon neutral by 2050, with bioplastics playing a significant role in reducing plastic pollution. |

| Legislation on Plastic Packaging | Many countries are mandating the use of biodegradable plastics in packaging. In France, the "Anti-Waste Law" stipulates that all plastic packaging must be recyclable or biodegradable by 2025. |

| Waste Management Regulations | The UK has introduced the "Extended Producer Responsibility" (EPR) policy, which requires producers to cover the full cost of managing the waste they produce, encouraging the use of biodegradable plastics. |

| Government Support for R&D | Japan's "Green Growth Strategy" emphasizes government support for R&D in biodegradable plastics to combat plastic pollution, with a focus on advanced biopolymer technologies. |

If You Need Any Customization on Biodegradable Plastics Market Report, Enquire Now @ https://www.snsinsider.com/enquiry/2366

Which Region Dominated the Biodegradable Plastics Market?

Europe

Europe dominated the biodegradable plastics market in 2023, accounting for approximately 43% of the total market share. The region's strong emphasis on environmental regulations and sustainability practices has positioned it as a leader in biodegradable plastics adoption. European countries have introduced ambitious plans to reduce plastic waste, driving the demand for biodegradable alternatives across various industries.

Recent statistics from the European Commission indicate that the use of biodegradable plastics in packaging is expected to grow by 15% annually, reinforcing the market's positive trajectory in the region. Companies like Total Corbion PLA and Novamont are leading the charge by introducing advanced biodegradable materials that cater to diverse applications.

Segmentation Analysis

Which Type Segment Dominated the Biodegradable Plastics Market?

In 2023, the starch-based biodegradable plastics segment dominated the market, holding approximately 42% of the total market share. Starch-based plastics are derived from renewable resources and are biodegradable, making them an ideal choice for applications such as packaging and disposable cutlery. The increasing use of starch-based materials is attributed to their versatility and eco-friendliness, further enhancing their appeal among consumers and manufacturers alike.

The polylactic acid (PLA) segment also showcased significant growth. PLA is widely used in packaging, textiles, and disposable items due to its compostable nature and lower environmental impact compared to conventional plastics. As awareness of environmental issues rises, the adoption of PLA is expected to continue its upward trajectory.

Key Segments:

By Type

- Starch Based

- PLA

- PBAT

- PBS

- PHA

- Others

By End-Use Industry

- Packaging

- Food Packaging

- Non-Food Packaging

- Tetile

- Agriculture

- Consumer Goods

- Others

Which End -Use Dominated the Biodegradable Plastics Market?

In 2023, the packaging segment accounted for the largest market share, around 55%, driven by the growing demand for sustainable packaging solutions. The food and beverage industry, in particular, is increasingly adopting biodegradable plastics for packaging, aligning with consumer preferences for eco-friendly options. The implementation of government regulations banning single-use plastics has also accelerated the shift towards biodegradable packaging materials.

The agricultural segment is projected to grow significantly, driven by the adoption of biodegradable mulch films and plant pots. Farmers are increasingly recognizing the benefits of biodegradable plastics in enhancing soil health and minimizing plastic waste, further contributing to the market's growth.

Buy Full Research Report on Biodegradable Plastics Market 2024-2032 @ https://www.snsinsider.com/checkout/2366

Recent Developments

- In 2023, BASF launched a new line of biodegradable plastics designed specifically for food packaging applications, highlighting its commitment to sustainability and innovation in the biodegradable plastics sector.

- In 2023, Total Corbion PLA announced an expansion of its production capacity for PLA, responding to the increasing demand for biodegradable plastics across various industries.

Conclusion

The biodegradable plastics market is on the verge of substantial growth, driven by the rising need for sustainable alternatives and increasing consumer awareness about environmental issues. As regulations become more stringent and technology continues to advance, the biodegradable plastics market is expected to thrive in the coming years.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

7. Biodegradable Plastics Market Segmentation, by Type

8. Biodegradable Plastics Market Segmentation, by End-Use Industry

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

Access Complete Report Description of Biodegradable Plastics Market Report 2024-2032 @ https://www.snsinsider.com/reports/biodegradable-plastics-market-2366

[For more information or if you need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain