Pune, Oct. 17, 2024 (GLOBE NEWSWIRE) -- Tokenization Market Size Analysis:

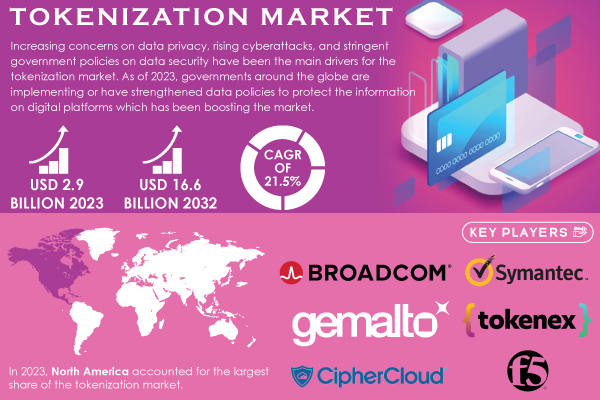

“According to SNS Insider, the Tokenization Market is anticipated to grow to USD 16.6 billion by 2032, achieving a compound annual growth rate (CAGR) of 21.5% from 2024 to 2032.”

The increasing volume of sensitive data being produced, coupled with heightened awareness surrounding data security, has driven organizations to adopt tokenization as a key strategy for protecting confidential information while ensuring compliance with regulations.

Key Growth Drivers in the Tokenization Market

The growing prevalence of cyber threats has emerged as a significant catalyst for the expansion of the tokenization market. As cybercriminals become more sophisticated, organizations across various sectors are compelled to enhance their data protection measures to safeguard sensitive information. Tokenization serves as a robust solution by replacing sensitive data elements—such as credit card numbers or personal identification information—with non-sensitive tokens. This technique effectively minimizes the risk of data breaches, enabling organizations to protect customer information while complying with stringent regulations like the Payment Card Industry Data Security Standard (PCI DSS), the General Data Protection Regulation (GDPR), and the Health Insurance Portability and Accountability Act (HIPAA).

The banking, financial services, and insurance (BFSI) sectors are particularly prominent in driving the demand for tokenization. These industries manage vast amounts of sensitive customer data, making them prime targets for cyberattacks. For instance, the Federal Bureau of Investigation (FBI) reported that financial institutions faced nearly 300,000 cyberattacks in 2022 alone, highlighting the urgent need for effective security solutions. As the industry moves towards digital payment solutions and mobile banking, the necessity for secure transaction data has become increasingly critical. In fact, the U.S. Department of the Treasury has emphasized the importance of safeguarding financial transactions to maintain consumer trust and protect the integrity of the financial system.

Furthermore, the rapid growth of e-commerce and digital transactions has intensified the demand for tokenization solutions. The U.S. Commerce Department noted that e-commerce sales in the United States reached approximately $1 trillion in 2022, underscoring the urgency for organizations to implement robust data protection strategies. This growing reliance on digital platforms necessitates that companies adopt tokenization to ensure the security of customer information, thereby further driving the adoption of tokenization solutions across various sectors.

Get a Sample Report of Tokenization Market@ https://www.snsinsider.com/sample-request/3677

Major Players Analysis Listed in this Report are:

- Gemalto (Thales Group) – (SafeNet Tokenization, Vormetric Data Security Platform)

- TokenEx – (Cloud Tokenization, PCI Compliance Solutions)

- Hewlett Packard Enterprise (HPE) – (SecureData Enterprise, Atalla HSM)

- F5 Networks – (BIG-IP Advanced Firewall Manager, BIG-IP Application Security Manager)

- CipherCloud – (Cloud Security Gateway, Tokenization-as-a-Service)

- Symantec Corporation – (Data Loss Prevention, Symantec Encryption)

- Protegrity USA, Inc. – (Protegrity Cloud, Protegrity Vaultless Tokenization)

- Broadcom Inc. (CA Technologies) – (Layer7 API Gateway, Payment Security Suite)

- Micro Focus – (Voltage SecureData, Security ArcSight)

- Wipro Limited – (Data Discovery and Protection, Cloud Tokenization Service)

Tokenization Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 2.9 billion |

| Market Size by 2032 | USD 16.6 billion |

| CAGR | CAGR of 21.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | •The rise in cyberattacks, data breaches, and financial fraud has increased the demand for tokenization to protect sensitive data, driving market growth. •Growing regulations like GDPR, PCI-DSS, and other data privacy laws globally are pushing organizations to adopt tokenization to ensure compliance with stringent data protection standards. •The increasing adoption of digital payments and e-commerce platforms has made tokenization essential for securing payment data, driving its widespread adoption across industries. •The rise in cloud-based tokenization solutions allows businesses to scale and manage tokenization efforts more efficiently, fueling market growth. |

Do you have any specific queries or need any customization research on Tokenization Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/3677

Market Segmentation Analysis

By Component

In 2023, the solution component segment led the tokenization market, capturing an impressive 79% share. This segment encompasses various tokenization platforms and technologies that organizations deploy to effectively secure sensitive data. These solutions provide multiple functionalities, such as data encryption, access controls, and transaction monitoring, allowing businesses to protect sensitive information while optimizing operational efficiency. The growing recognition of the importance of robust data security measures is expected to bolster demand for comprehensive tokenization solutions, reinforcing this segment’s dominant position in the market.

By Industry Vertical

In 2023, the BFSI sector emerged as the largest revenue contributor in the tokenization market, accounting for a 19.0% revenue share. This sector's dominance stems from its substantial exposure to sensitive customer data, including credit card numbers, bank account details, and personal identification information.

As regulatory compliance requirements tighten in the BFSI sector, organizations are increasingly investing in tokenization solutions to ensure the secure processing of sensitive transactions and to protect customer data from potential breaches. Moreover, the rise of digital banking and mobile payment options has amplified the need for effective tokenization strategies to mitigate risks associated with data exposure.

Tokenization Market Segmentation:

By Component

- Solution

- Services

By Application Area

- Payment Security

- User Authentication

- Compliance Management

- Others

By Technology

- Application Programming Interface-based

- Gateway-based

By Deployment

- Cloud

- On-premises

- By Industry Vertical

- BFSI

- Healthcare

- IT

- Government

- Retail And E-Commerce

- Energy & Utilities

- Other

Regional Insights on the Tokenization Market

North America held a dominant position in the tokenization market in 2023, accounting for a significant share of the revenue. This leadership is attributed to the region's advanced cybersecurity infrastructure, a plethora of financial institutions, and stringent regulatory measures designed to safeguard sensitive data. Organizations in North America are increasingly adopting tokenization solutions to enhance data protection strategies and comply with international regulations like GDPR and PCI DSS.

Conversely, the Asia-Pacific region is projected to witness the fastest growth in the tokenization market, propelled by rapid digitization and increasing cloud technology adoption. Countries such as China and India are experiencing a boom in digital payment solutions and e-commerce, creating a strong demand for effective tokenization strategies to protect consumer information. Furthermore, ongoing government initiatives aimed at promoting data protection and compliance are expected to bolster the growth of the tokenization market in this region.

Buy an Enterprise-User PDF of Tokenization Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/3677

Recent Innovations

- In 2023, TokenEx launched a new tokenization solution featuring enhanced security capabilities, including real-time monitoring and automated compliance reporting.

- In 2022, Thales introduced its advanced tokenization platform, designed to integrate seamlessly with existing data security frameworks to offer comprehensive protection against data breaches.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Tokenization Market Segmentation, By Component

8. Tokenization Market Segmentation, By Application Area

9. Tokenization Market Segmentation, By Deployment

10. Tokenization Market Segmentation, By Technology

11. Tokenization Market Segmentation, By Industry Vertical

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practices

15. Conclusion

Access Complete Report Details of Tokenization Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/tokenization-market-3677

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.