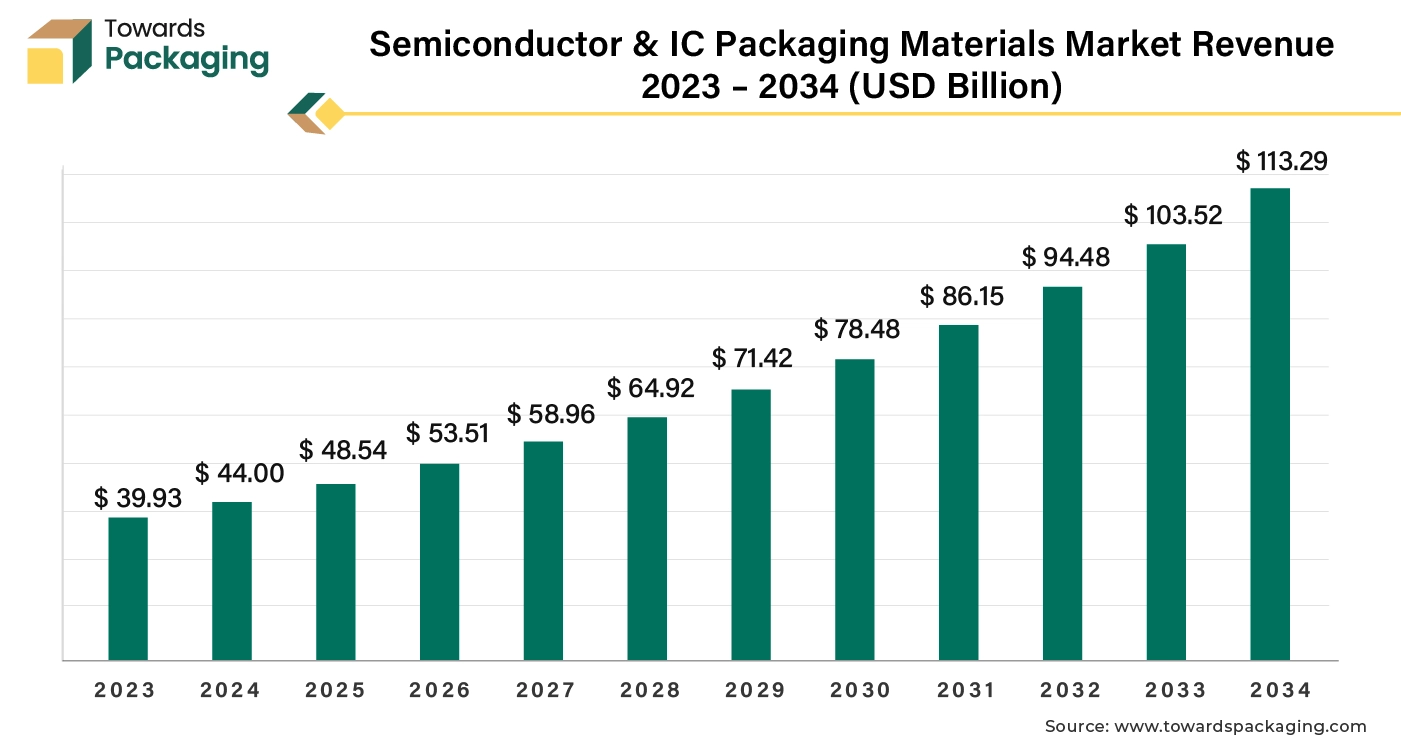

Ottawa, Oct. 22, 2024 (GLOBE NEWSWIRE) -- The global semiconductor & IC packaging materials market size is predicted to increase from USD 48.54 billion in 2025 to approximately USD 113.29 billion by 2034, according to a study published by Towards Packaging a sister firm of Precedence Statistics. The industry is expected to grow at a solid CAGR of 10.2% during the forecast period.

Download Statistical Data: https://www.towardspackaging.com/download-statistics/5258

Market Definition and Growth Factors

The semiconductor & IC packaging material market revolves around the protective layer of packaging, which encases the semiconductor chips and ensures proper function and performance. Along with this, protecting the circuitry from corrosion, shielding the integrated circuit, and ensuring thermal management are the leading objectives of the market. The demand for higher performance and integration of miniaturization, as well as being responsible packaging for facilitating electrical connections, has boosted the market growth.

The heat dissipation feature is attributed to the function of semiconductor packaging. The usage of packaging for high-power and high-frequency applications and the availability of cost-effective materials have been a major factor in the growth of the market. Techniques like the flip chip, ball grid array, wire bonding, and wafer-level packaging are used according to industry requirements. The leading factors that support the growth of the semiconductor and IC packaging material market are heat dissipation and high packaging costs.

Heat is produced in semiconductors when power is consumed, and it turns into waste when defective devices and wires are used. The conduction, convection, and radiation processes in semiconductors increase the growth of the market. Apart from this, high packaging costs can be a major driving factor as advanced packaging devices and high-end applications require high-quality and durable packaging.

The major driving factor is the increasing demand for advanced packaging. It can integrate packaging of multiple chips in a single package, providing higher performance in various applications like generative artificial intelligence, mobile devices, and automotive computing. The single package initialization also abbreviates the manufacturing costs and energy consumption.

The focus on adapting to greater complexity also boosts the market, and the primary changes in fabless chipmakers, foundries, and integrated device manufacturers shift the technological balance from the front end to the back end. The important feature of semiconductor packaging, which is the transformation from a single chip to a whole system design, attracts chip designers, which, as a result, increases the demand in the semiconductor and IC packaging material market.

Get the latest insights on packaging industry segmentation with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Regional Insights

Asia Pacific: Electronic Devices and Global Consumption

The Asia Pacific is the leading region in the semiconductor & IC packaging materials market. The region dominated the market in 2023 due to the increasing consumption of electronic devices, owing to high consumer disposable income and rapid urbanization. The rapid expansion of the electronic industry and the increasing demand for smartphones and automobiles are pushing the semiconductor packaging industry to come up with new packaging designs. Countries like China, Taiwan, South Korea, and Japan are the leading contributors to the semiconductor & IC packaging materials market.

In November 2023, the Japanese Government launched a statement that semiconductors were a crucial source for the region and that they will try their best to maintain and strengthen the semiconductor industry to protect Japan’s Future and its citizens. The statement was launched by Japan’s Ministry of Economy, Trade and Industry.

Europe is a significant and mature region in the semiconductor & IC packaging material market. The expansion of the automotive sector and the presence of leading automotive producers drive the semiconductor demand in the region. According to the European Commission, the automotive sector provides direct or indirect jobs to around 13.8 million people in the region, and it is also one of the largest private investors in research and development. According to the European Union Critical Raw Materials Act and the European Raw Material Alliance, the region is focusing on sustainable solutions to reduce waste generation and dependence on imports.

Get the latest insights on packaging industry segmentation with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

In May 2024, the leading research laboratories of Europe’s semiconductor received funding of €2.5 billion as a part of the European Chips Act which aimed to develop and test computer chips. The bill was introduced in 2023 to encourage domestic chipmaking capabilities which had given a boost to startups and educational institutions with access to manufacturing technologies which were usually prohibited for individual investments.

North America’s Investments in Technology Drive the Market

North America is the fastest-growing region in the semiconductor packaging industry due to rising developments in technology and research departments. In addition, rising demand and consumption of electronic devices further boost the demand for semiconductor packaging. Consumer demand for electronic devices also increases investment in the research and development of sustainable packaging solutions due to the region’s focus on being a sustainable producer and also on innovation.

In November 2023, the National Advanced Packaging Manufacturing Program, which had been an essential development received funding of $3 billion and was also declared as a boost for advanced packaging by the Biden-Harris Administration. The administration aimed for the program to lead the semiconductor manufacturing.

Related markets impacted by the Semiconductor & IC Packaging Materials Market:

3D Semiconductor Packaging Market:

The global 3D semiconductor packaging market size reached US$ 11 billion in 2023 and is projected to hit around US$ 57.19 billion by 2034, expanding at a CAGR of 16.17% during the forecast period 2024 to 2033. The upcoming trends, such as the geographic expansion of electronic companies, focus on launching new semiconductor brands, and innovation in 3D graphics, are the driving factors of the market. The major advantages of adopting 3D packaging include improving speed latency and high performance required in the programming sector, and this has increased the market growth. The integration of AI technology and the incorporation of IoT are the trending opportunities in the market.

Semiconductor Packaging Market:

The global semiconductor packaging market size reached US$ 41.05 billion in 2023 and is projected to hit around US$ 108.82 billion by 2033, expanding at a CAGR of 10.24% during the forecast period 2024 to 2033. Integrating materials like organic substrates, lead frames, thermal interface materials, and encapsulation resins provides efficient packaging measures and drives market growth. The upcoming opportunities in advanced technologies like autonomous systems, 5G connectivity, machine learning, artificial intelligence, and the Internet of Things also increase the market growth. Packaging elements like integrated circuits and heat dissipation are in high demand.

Semiconductor & IC Packaging Materials Market Opportunity

The semiconductor & IC packaging material market offers opportunities to create packaging solutions for 5G networks and the required packaging demands for artificial intelligence and machine learning. The demand for electronic devices and the support of government investments for national security will also create opportunities for market growth. Technological advancements lead to innovative packaging, which must adhere to strict environmental regulations and ensure the effective use of materials, increasing packaging consumption.

The advanced 2D and 3D hybrid bonding and silicon photonics will be crucial in improving system performance and anticipating the upcoming AI and HPC chip innovation. Utilizing technologies like front-end and wafer fabrication will be an effective packaging solution. The advanced packaging technologies systems on a chip, central IC chips, conventional chips, and AMD Ryzen series are effectively used according to the package’s functions. Integrating electronic design automation software stimulates multiple chips in a package and helps the complex packaging process.

Semiconductor & IC Packaging Materials Market Segment

- By product type, the organic substrate segment led the semiconductor & IC packaging materials market in 2023. This is due to its properties, which are heat distribution and manufacturability. Organic substrates provide mechanical and environmental protection and can be conductive interconnectors between semiconductors and PCBs. These substrates are also used for packaging 2.5 D integrated circuits, 3D integrated circuits, mobile phones, flat plate displays, and various other consumer electronics.

- By product type, the bonding wires segment is the fastest-growing segment in the market. This is due to their excellent properties, which provide a strong bond between the wire and substrate and interconnect an IC on a silicon die and its packaging. The bonding wire offers intermetallic compounds, which are products of ultrasonic vibrations.

- By end-use, the consumer electronics segment led the market in 2023 due to the rising adoption of electronic devices. Semiconductor packaging depends upon the electronic device's size and functionality. The increasing production of electronic devices significantly boosts the semiconductor packaging demand.

More Insights in Towards Packaging

- The global 3D CAD software market size reached US$ 11.75 billion in 2023 and is projected to hit around US$ 24.22 billion by 2034, expanding at a CAGR of 6.8% during the forecast period from 2024 to 2034.

- The global 3D rendering market size reached US$ 3.85 billion in 2023 and is projected to hit around US$ 23.78 billion by 2034, expanding at a CAGR of 18% during the forecast period from 2024 to 2034.

- The global 3D IC and 2.5D IC packaging market size reached US$ 55.17 billion in 2023 and is projected to hit around US$ 169.92 billion by 2034, expanding at a CAGR of 10.85% during the forecast period from 2024 to 2034.

- The high impact corrugated boxes market size reached US$ 73.90 billion in 2024 and is projected to hit around US$ 99.57 billion by 2034, expanding at a CAGR of 3.04% during the forecast period from 2024 to 2034.

- The global end-of-line packaging market size is estimated to reach USD 9.50 billion by 2033, up from USD 6.14 billion in 2023, at a compound annual growth rate (CAGR) of 4.60% from 2024 to 2033.

- The global panel level packaging market size is estimated to reach USD 11.13 billion by 2033, up from USD 0.43 billion in 2023, at a compound annual growth rate (CAGR) of 38.60% from 2024 to 2033.

- The global corrugated plastic tray market size reached US$ 665.47 million in 2023 and is projected to hit around US$ 1190.73 million by 2034, expanding at a CAGR of 5.14% during the forecast period from 2024 to 2034.

- The global industrial electronics packaging market size is estimated to reach USD 3.37 billion by 2033, up from USD 2.19 billion in 2023, at a compound annual growth rate (CAGR) of 4.54% from 2024 to 2033.

- The global transit packaging market size reached US$ 231.25 billion in 2023 and is projected to hit around US$ 454.48 billion by 2033, expanding at a CAGR of 6.99% during the forecast period from 2024 to 2033.

- The global barrier films packaging market size is estimated to reach USD 57.74 billion by 2033, up from USD 32.67 billion in 2023, at a compound annual growth rate (CAGR) of 5.99% from 2024 to 2033.

Top Companies in the Semiconductor & IC Packaging Materials Market

- LG Chem Ltd.

- Jiangsu ChangJian Technology Co., Ltd.

- Henkel AG & Co. KGaA

- Kyocera Corporation

- ASE

- Siliconware Precision Industries Co., Ltd.

- Amkor Technology

- Texas Instruments

- IBIDEN CO., LTD.

- Powertech Technology Inc.

- FlipChip International LLC

- Microchip Technology

- Synapse Electronique

Recent Developments:

| Company | Czech Republic |

| Headquarters | Europe |

| Recent Development | In December 2023, the Czech Republic aimed to boost chip production in Europe with collaboration partners from Asia, Taiwan, and Japan. The Ministry of Industry and Trade, the Government Office, and the Czech Republic created the Czech National Semiconductor Cluster through their collaboration. |

| Company | TSMC |

| Headquarters | Hsinchu, Taiwan |

| Recent Development | In August 2024, TSMC, the largest chip manufacturer, began building a new semiconductor factory in Dresden, Germany. The project will be funded with €5 billion and is initiated to lower Europe’s reliance on the Chinese market. Furthermore, Taiwan’s TSMC branch will hold a 70% share in the new project. |

Semiconductor & IC Packaging Market Segments

By Product Type

- Organic Substrate

- Bonding Wires

- Leadframes

- Encapsulation resins

- Ceramics packages

- Die attach materials

- Thermal interface materials

- Solder balls

- Others

By Packaging Technology

- Small outline package (SOP)

- Grid Array (GA)

- Quad flat no-leads (QFN)

- Dual Flat No-Leads (DFN)

- Quad flat packages (QFP)

- Dual-in-line (DIP)

- Others

By End-Use

- Consumer electronics

- Automotive

- Aerospace & Defence

- IT & telecommunication

- Healthcare

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

View Semiconductor & IC Packaging Materials Market Full TOC: https://www.towardspackaging.com/table-of-content/semiconductor-and-ic-packaging-materials-market-sizing

Buy Premium Global Insight @ https://www.towardspackaging.com/price/5258

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/