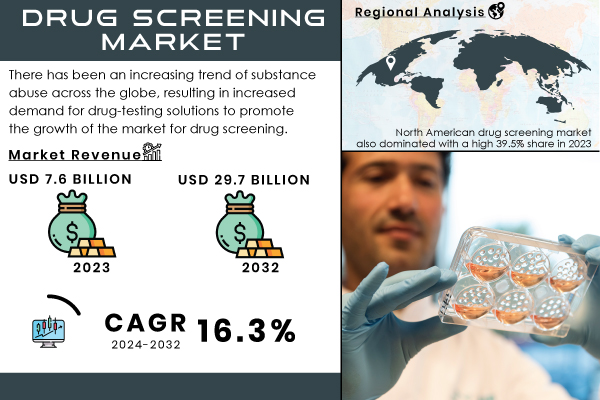

Austin, Nov. 06, 2024 (GLOBE NEWSWIRE) -- The S&S Insider report indicates that, “The Drug Screening Market was valued at USD 7.6 Billion in 2023 and is projected to reach USD 29.7 Billion by 2032, growing at a compound annual growth rate (CAGR) of 16.3% from 2024 to 2032.”

Rising Demand for Drug Testing Solutions Amid Global Substance Abuse Trends

Increasing instances of drug abuse worldwide have led governments to impose strong regulations on workplaces and other public places about reliable drug testing solutions. According to estimates, 2023 witnessed over 112 thousand overdose deaths in the U.S. This statistic reveals the importance of the development of a trustworthy testing solution. In addition, more than half of workplace accidents and nearly 40% of employee thefts are blamed on substance abuse, resulting in an increasing need for screening solutions.

This allows for huge market enablers through government policies; in this case, there is funding for substance use disorders. The U.S. Consolidated Appropriations Act 2023 enables the provision of resources for SAMHSA, as additional efforts in prevention have even been drawn from Canada's Substance Use and Addiction Program. The improvements in drug testing technologies, especially rapid systems and point-of-care technologies, drive the expansion of markets. However, regulatory obstructions often slow down approval in high-potential areas.

Download PDF Sample of Drug Screening Market @ https://www.snsinsider.com/sample-request/4628

Key Players:

- Premier Biotech, Inc.

- Omega Laboratories, Inc.

- Psychemedics Corporation

- Labcorp

- Quest Diagnostics

- Abbott

- Thermo Fisher Scientific Inc.

- Alfa Scientific Designs, Inc.

- OraSure Technologies Inc.

- ACM Global Laboratories

- CareHealth America Corp

- Sciteck, Inc.

- Siemens Healthineers AG

- F. Hoffmann-La Roche Ltd

- MPD Inc.

- Shimadzu Corporation

- Lifeloc Technologies, Inc.

- Drägerwerk AG & Co. KGaA

- Clinical Reference Laboratory, Inc.

- American Bio Medica Corporation

- Intoximeters, Inc.

- AccuSourceHR, Inc.

- Cordant Health Solutions

- Intoxalock

- Millennium Health and Others.

Drug Screening Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 7.6 Billion |

| Market Size by 2032 | USD 29.7 Billion |

| CAGR | CAGR of 16.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Consumables, Instruments, Rapid Testing Devices, Services) • By Sample Type (Urine Samples, Oral Fluid Samples, Hair Samples, Other Samples) • By Drug (Alcohol, Cannabis/Marijuana, Cocaine, Opioids, Amphetamine & Methamphetamine, LSD, Others) • By End Use (Drug Testing Laboratories, Workplaces, Hospitals, Others) |

| Key Drivers | • Transforming Liver Biopsy Technologies and Advancing Patient Care |

If You Need Any Customization on Drug Screening Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/4628

Rising Drug and Alcohol Consumption Fuels Demand for Drug Screening Solutions

Increased consumption of drugs and alcohol has the greatest influence on the growth of the market. As indicated by the World Drug Report 2023, 1 in 17 people aged 15–64 years had used drugs, with users growing to 296 million, thus up by 23%. Of all drugs used, the most commonly used drug remains cannabis, accounting for 219 million users around the world. In fact, alcohol use contributed to an estimated 13,524 deaths in the United States alone in 2022, which is yet another sad testament to the real need for efficient drug screening solutions for workplaces and roads.

Growth of Drug Testing Market Driven by Consumables and Rapid Testing Devices

In 2023, consumables held 36.2% of the drug testing market, and kits and reagents remain essential to the confirmation test. Office of Addiction Services and Supports rolled out a system to distribute 100,000 free xylazine test strips to support harm reduction. Rapid testing devices are also poised for rapid growth because of the increase in opioid use. According to WHO, there are 296 million drug users worldwide with 60 million opioid users. Initiatives such as Kerala Police's October 2023 SoToxa Mobile Test are enhancing the rapid testing landscape. The device delivers results within five minutes.

Urine Sample Segment Leads the Drug Testing Market, Oral Fluid Segment Emerges Rapidly

In 2023, urine samples dominated the drug testing market with a strong 40.1% share due to high urinal drug testing. Urine drug monitoring is important for compliance with prescribed treatments and recognition of substance use, especially in opioid-therapy patients. Besides, urine testing is also accepted by the Department of Health and the Department of Transportation for both point-of-care and laboratory diagnostics. In contrast, the oral fluid market is expected to grow at the fastest rate since oral samples are pretty effective at indicating recent drug use. Despite the challenges that the sample integrity and quantification pose, progress like special collection devices, for example, Oral-Eze, has made oral fluid testing ever more accurate and reliable.

North American Drug Screening Market Leads, While Asia Pacific Experiences Rapid Growth

In 2023, the market for drug screening was mainly dominated by North America with a share of 39.5%, and such key players as Bio-Rad Laboratories and stringent local regulations regarding substance abuse were leading the region. The region is also perceived through the efforts of San Francisco's treatment enrollment mandate, which applies to those attempting to access county funding. The consumption of alcohol and the increased use of cannabis and prescription stimulants are further driving the demand for drug screening in the United States.

The Asia Pacific region is expected to be the fastest-growing area for the drug testing market, primarily due to proactive government measures in reducing drug use and improving testing technologies. This region is seeing countries such as China and Japan improve their capabilities for drug testing through the implementation of rapid test kits and collaborative efforts toward better services. This is particularly strategic since the rate of youth substance abuse continues to rise, and it makes the region a center for significant market growth.

Buy Full Research Report on Drug Screening Market 2024-2032 @ https://www.snsinsider.com/checkout/4628

Key Developments in the Drug Screening Market

- Swedish sample collection company Capitainer raised USD 7.7 million in Series A funding in February 2024. The funding will be used to enhance the production capacity further and build the sales platform for the self-sampling blood collection products both in the EU and in the US, thereby supporting it in facilitating crucial collaborations.

- February 2024 Veriteque partnered with OraSure Technologies for a distribution agreement, marking it as a leading developer of in vitro diagnostic products. In this agreement, Veriteque will use OraSure's rapid point-of-care tests for infectious diseases like HIV, HCV, and syphilis within defined territories. This would help increase access to such crucial, life-saving tests for healthcare providers and patients in these regions.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Trends of Drug Screening Methods (Urine, Blood, Hair, Saliva), by Region (2023)

5.2 Volume of Drug Screening Tests, by Region (2020-2032)

5.3 Healthcare and Occupational Spending on Drug Screening, by Region, (2023)

5.4 Regulatory and Compliance Trends for Drug Screening, by Region (2023)

5.5 Trends in Technology and Innovation in Drug Screening Devices and Kits (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Drug Screening Market Segmentation, by Product

7.1 Chapter Overview

7.2 Consumables

7.3 Instruments

7.4 Rapid Testing Devices

7.5 Services

8. Drug Screening Market Segmentation, By Sample Type

8.1 Chapter Overview

8.2 Urine Samples

8.3 Oral Fluid Samples

8.4 Hair Samples

8.5 Other Samples

9. Drug Screening Market Segmentation, by Drug

9.1 Chapter Overview

9.2 Alcohol

9.3 Cannabis/Marijuana

9.4 Cocaine

9.5 Opioids

9.6 Amphetamine & Methamphetamine

9.7 LSD

9.8 Others

10. Drug Screening Market Segmentation, By End Use

10.1 Chapter Overview

10.2 Drug Testing Laboratories

10.3 Workplaces

10.4 Hospitals

10.5 Others

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Speak with Our Expert Analyst Today to Gain Deeper Insights @ https://www.snsinsider.com/request-analyst/4628

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.