Pune, Nov. 06, 2024 (GLOBE NEWSWIRE) -- Anti-Money Laundering Market Size Analysis:

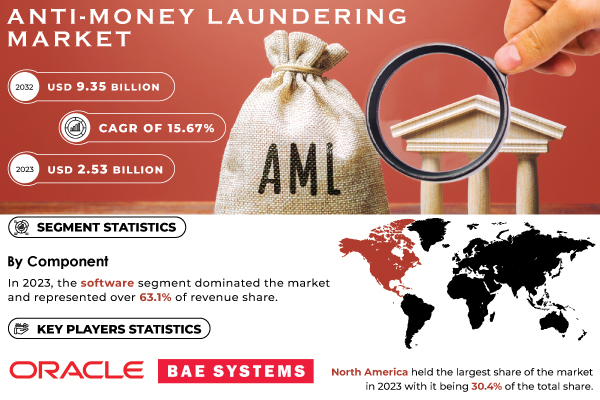

“The S&S Insider report indicates that the Anti-Money Laundering Market size was valued at USD 2.53 billion in 2023 and is expected to grow to USD 9.35 billion by 2032, with a compound annual growth rate (CAGR) of 15.67% over the forecast period from 2024 to 2032.”

The Anti-Money Laundering (AML) market is witnessing considerable growth, mainly driven by increasing regulatory pressures and the growing complexity of financial transactions. Financial institutions are obligated to invest in advanced AML solutions to combat increasingly sophisticated money laundering tactics. There is a rising demand for comprehensive software solutions capable of effectively monitoring transactions and detecting suspicious activities, especially in regions with stringent compliance requirements. A significant factor fueling this market expansion is the growing sophistication of financial crimes. As criminals adopt more advanced laundering techniques, financial institutions must improve their monitoring capabilities. This trend has led to a marked increase in the adoption of AML solutions, particularly those utilizing advanced technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics. These technologies facilitate real-time transaction monitoring and analysis, enabling organizations to identify potential threats more effectively.

Additionally, the rise of cross-border transactions in the digital age presents unique challenges for AML compliance. With the growth of e-commerce and online banking, financial institutions must monitor a larger volume of transactions across various jurisdictions, which further amplifies the demand for efficient and scalable AML solutions that can address these complexities. The AML solutions market includes a diverse range of products, such as software, services, and consulting offerings, with the software segment leading due to its capabilities in real-time transaction monitoring and advanced analytics. The services segment is also expected to see substantial growth as organizations seek expert guidance to navigate the increasingly complex regulatory landscape. Several factors drive the growth of the Anti-Money Laundering market, including the rising demand for reliable and efficient financial services, particularly in rapidly urbanizing regions. Increased awareness within the financial industry about the importance of compliance and risk management has also led to greater investments in advanced AML technologies.

Get a Sample Report of Anti-Money Laundering Market@ https://www.snsinsider.com/sample-request/1844

Major Players Analysis Listed in this Report are:

- FICO - FICO TONBELLER

- Oracle - Oracle Financial Services Analytical Applications

- SAS Institute - SAS Anti-Money Laundering

- LexisNexis Risk Solutions - LexisNexis AML Compliance

- ACI Worldwide - ACI Universal Payments

- NICE Actimize - NICE Actimize Anti-Money Laundering

- InfrasoftTech - InfrasoftTech AML Compliance Solution

- ComplyAdvantage - ComplyAdvantage Screening

- Bae Systems - BAE Systems NetReveal

- Palantir Technologies - Palantir Foundry

- KYC Portal - KYC Portal

- Actico - Actico Compliance Suite

- Elliptic - Elliptic Navigator

- AML Partners - AML360

- Verafin - Verafin Fraud Detection

- CaseWare RCM - CaseWare AML Risk Assessment

- Quantexa - Quantexa Decision Intelligence Platform

- Refinitiv - Refinitiv World-Check

- Amlify - Amlify AML Solution

- FinScan - FinScan AML Screening

Anti-Money Laundering Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 2.53 Billion |

| Market Size by 2032 | USD 9.35 Billion |

| CAGR | CAGR of 15.67% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | •Growth in cyber-enabled fraud and complex financial crimes drives demand for sophisticated AML solutions. •Financial institutions leverage AI to streamline AML processes, improve accuracy, and reduce false positives. •Stricter Know Your Customer (KYC) requirements globally increase the need for comprehensive AML measures. |

Do you have any specific queries or need any customization research on Anti-Money Laundering Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/1844

Segmentation Analysis

By Deployment

In 2023, the on-premise segment captured the largest revenue share in the market, highlighting its importance for companies that prioritize control and security in their compliance systems. Many institutions around the globe prefer on-premise solutions because they offer customization and seamless integration with existing IT infrastructures while enhancing data security and regulatory compliance. A key benefit of on-premise anti-money laundering systems is their ability to be tailored to each organization’s specific requirements, enabling more comprehensive compliance testing.

The cloud deployment model is projected to experience significant growth from 2024 to 2032. This segment has emerged as one of the fastest-growing categories in the global anti-money laundering market, providing flexibility, scalability, and cost benefits. Cloud-based AML solutions streamline operations by allowing for frequent updates and easier integration, which can be more difficult with on-premise systems. These solutions enable financial institutions to leverage next-generation technologies, such as artificial intelligence and real-time data analytics, without incurring substantial infrastructure costs. Additionally, the rise of remote work and the increasing reliance on digital banking services have further propelled the shift toward cloud-native AML options.

Anti-Money Laundering Market Segmentation:

By Component

- Software

- Services

By Product

- Compliance Management

- Currency Transaction Reporting

- Customer Identity Management

- Transaction Monitoring

By Deployment

- Cloud

- On-premise

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By End-Use

- BFSI

- Government

- Healthcare

- IT & Telecom

- Others

Buy an Enterprise-User PDF of Anti-Money Laundering Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/1844

Regional Landscape

North America held the largest share of the market in 2023 with it being 30.4% of the total share. Thanks to its robust regulatory framework and strict enforcement of AML laws, this leadership stands firm. As complex regulations arise with bigger financial institutions to regulate them, the market for advanced AML Solutions needs it as a necessity in North America. It also commits extensive resources to emergent technologies such as artificial intelligence and machine learning, both of which are instrumental in the most effective modern AML constructs. Moreover, the high concentration of financial hubs coupled with the rapid increase in the volume of transaction types add to North America being a country having a higher share in the AML market.

The Asia Pacific anti-money laundering market is expected to grow significantly during 2024-2032. Increasing demand for sophisticated AML solutions across the region after growing cross-border transactions and expanding financial services will increase the growth of this market here. Additionally, accelerating economic development and financial system modernization within Asia Pacific regions are driving enhanced emphasis on AML compliance.

Recent Developments

January 2024: FICO Launched an enhanced version of its AML solution with improved machine-learning algorithms for better anomaly detection.

February 2024: LexisNexis Risk Solutions: Introduced a new AML compliance tool designed to streamline KYC processes for financial institutions.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Anti-money Laundering Market Segmentation, by Component

8. Anti-money Laundering Market Segmentation, By Deployment

9. Anti-money Laundering Market Segmentation, By Product

10. Anti-money Laundering Market Segmentation, By End User

11. Anti-money Laundering Market Segmentation, By Enterprise Size

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practices

15. Conclusion

Access Complete Report Details of Anti-Money Laundering Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/anti-money-laundering-market-1844

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.