Pune, Nov. 08, 2024 (GLOBE NEWSWIRE) -- Payment Processing Solutions Market Size Analysis:

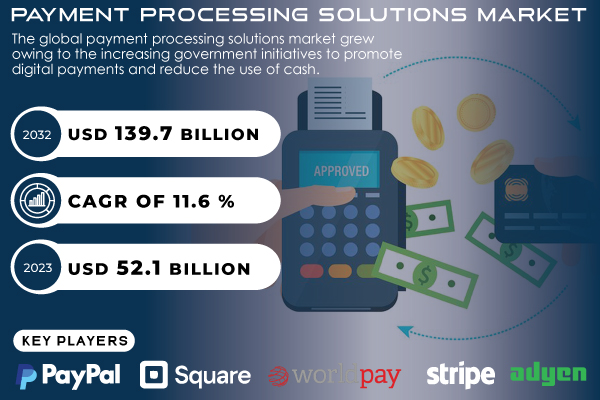

“The S&S Insider report indicates that the Payment Processing Solutions Market size was valued at USD 52.1 billion in 2023 and is expected to grow to USD 139.7 billion by 2032, expanding at a CAGR of 11.6% over the forecast period of 2024-2032.”

The payment processing solutions market is growing at rapid speed due to the advancement of digital payment system, and the continuing shift towards e-commerce. With the rapid transition of businesses towards online sales, fast, secure, and seamless payment solutions have never been more desirable. This trend is being further accelerated by the widespread use of mobile devices and mobile payment applications. As digital wallets gain popularity, and with report estimating that mobile proximity payment users will reach 380 million by 2024, consumers now expect the ability to pay across various platforms — including smartphones, wearables, and online banking — transforming the landscape of payment processing. Furthermore, rising penetration of digital wallets, point-of-sale (POS) terminals and contactless payments are expected to boost the revenue growth of this market.

Across the world, governments are placing new regulations that promote better payment security — for example, Europe has rolled out its Payment Services Directive (PSD2), which requires additional authentication steps around transactions. This rules and regulations is expected to increase the market demand for sophisticated safe payment, which in turn will boost the market growth. In addition, advancements in Artificial Intelligence (AI), Machine Learning (ML), and block chain technology enable market participants to proffer rapid, secure and transparent payment services.

One of the most important market drivers has been the increased demand for contactless payments since COVID-19. With more businesses turning into e-commerce and online payment systems, the demand for efficient and secure payments technologies has spiked. Factors such as the increasing prevalence of subscription-based services, digital currencies, and fintech innovation are likely to extend this growth trend going forward.

The payment processing solutions market is also experiencing significant macro trends. As disposable incomes rise and global internet penetration improves, consumers are coming to digital payments. Market expansion is also driven by the increasing adoption of digital wallets and peer-to-peer payment systems.

Get a Sample Report of Payment Processing Solutions Market@ https://www.snsinsider.com/sample-request/3600

Major Players Analysis Listed in this Report are:

- PayPal (PayPal Payments Standard, PayPal Here)

- Square, Inc. (Square Point of Sale, Square Online)

- Adyen (Adyen Payment Gateway, Adyen Terminal)

- Stripe (Stripe Payments, Stripe Atlas)

- Authorize.Net (AIM API, Accept.js)

- Worldpay (Worldpay Gateway, Worldpay eCommerce)

- FIS (Worldpay Gateway, FIS Payments)

- Ingenico (Ingenico Connect, Ingenico Move/5000)

- PayU (PayU Payment Gateway, PayU Wallet)

- Alipay (Alipay Wallet, Alipay QR Code Payment)

Payment Processing Solutions Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 52.1 billion |

| Market Size by 2032 | USD 139.7 billion |

| CAGR | CAGR of 11.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | •The growing need for fast and efficient payment systems is driving the adoption of real-time payment solutions. Initiatives like the Federal Reserve's FedNow are enhancing opportunities for both B2C and B2B transactions •Banks are increasingly offering BaaS models that allow businesses to integrate payment services into their platforms via APIs. This approach streamlines payment processing and enhances customer experience, leading to greater adoption of these solutions. •Corporates are opting to manage their payment processes internally to enhance control and improve customer experience. This trend is fueling the growth of corporate treasury management systems, enabling companies to handle payments more efficiently |

Do you have any specific queries or need any customization research on Payment Processing Solutions Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/3600

Segmentation Analysis

By Payment Method

The credit card segment dominated the market in 2023 with more than 35% of total revenue share. Also, credit card processing tools are beneficial for the business and help businesses integrate important information like orders, shipping, invoicing and inventory into their ERP systems to ensure smooth operations. The manual entry of data during the payment process is cumbersome and prone to errors, whereas integrated credit card solutions provide a flow of data directly into an enterprise’s ERP systems where there are fewer opportunities for mistakes. Due to this constant stram of data feeding into the ERP, human error can be eliminated as well as duplicate input.

- -wallet segment is anticipated to see the highest CAGR during the forecast period. The growing penetration of smartphones and laptops is fueling the growth of e-wallets owing to their speed and convenience of payment process. Besides, the increasing number of e-commerce platforms worldwide is also contributing to the expansion of this segment in the e-wallet sector.

Payment Processing Solutions Market Segmentation:

By payment method

- Credit Card

- Debit Card

- eWallet

- Automatic Cleaning House (ACH)

- Others

By Vertical

- BFSI

- Government And Utilities

- Telecom

- Healthcare

- Real Estate

- Retail

- Media And Entertainment

- Travel And Hospitality

- Others

Regional Analysis

In 2023, North America maintained its leadership in the payment processing solutions market which held a 35% share of global revenue. This dominance is attributed to the region's extensive use of digital payments and widespread adoption of credit and debit cards. Government support for cashless transactions has further strengthened North America's market position. Major players like PayPal, Stripe, and Square lead the way in innovation, continuously developing advanced solutions to meet customer demands. Moreover, North America's advanced digital infrastructure and regulatory frameworks, such as the Payment Card Industry Data Security Standard (PCI DSS), continue to solidify its market leadership.

The Asia-Pacific region is projected to experience the highest compound annual growth rate from 2024 to 2032. A 24% rise in digital transactions, as reported by the People’s Bank of China, along with the growing user bases of platforms like Alipay and WeChat Pay, are driving this growth. The region’s large population and advanced mobile and communication technologies make it a key area for digital banking innovation. The rapid growth of online transactions in China and India is further accelerating this trend, with the Reserve Bank of India reporting a 46% increase in digital payment traffic in 2023, largely due to the adoption of the UPI system and the Digital India initiative.

Buy an Enterprise-User PDF of Payment Processing Solutions Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/3600

Recent Developments

In June 2023, Adyen unveiled its Payout services, which are designed to speed up payment processing and enable customers to access acquired funds faster, using their preferred method.

In June 2023, Amazon Web Services launched AWS Payment Cryptography, a service focused on streamlining cryptographic operations for securing data in payment processing applications. It also simplifies payment key management by automating the generation and handling of keys.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Payment Processing Solutions Market Segmentation, By payment method

8. Payment Processing Solutions Market Segmentation, By Vertical

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

Access Complete Report Details of Payment Processing Solutions Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/payment-processing-solutions-market-3600

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.