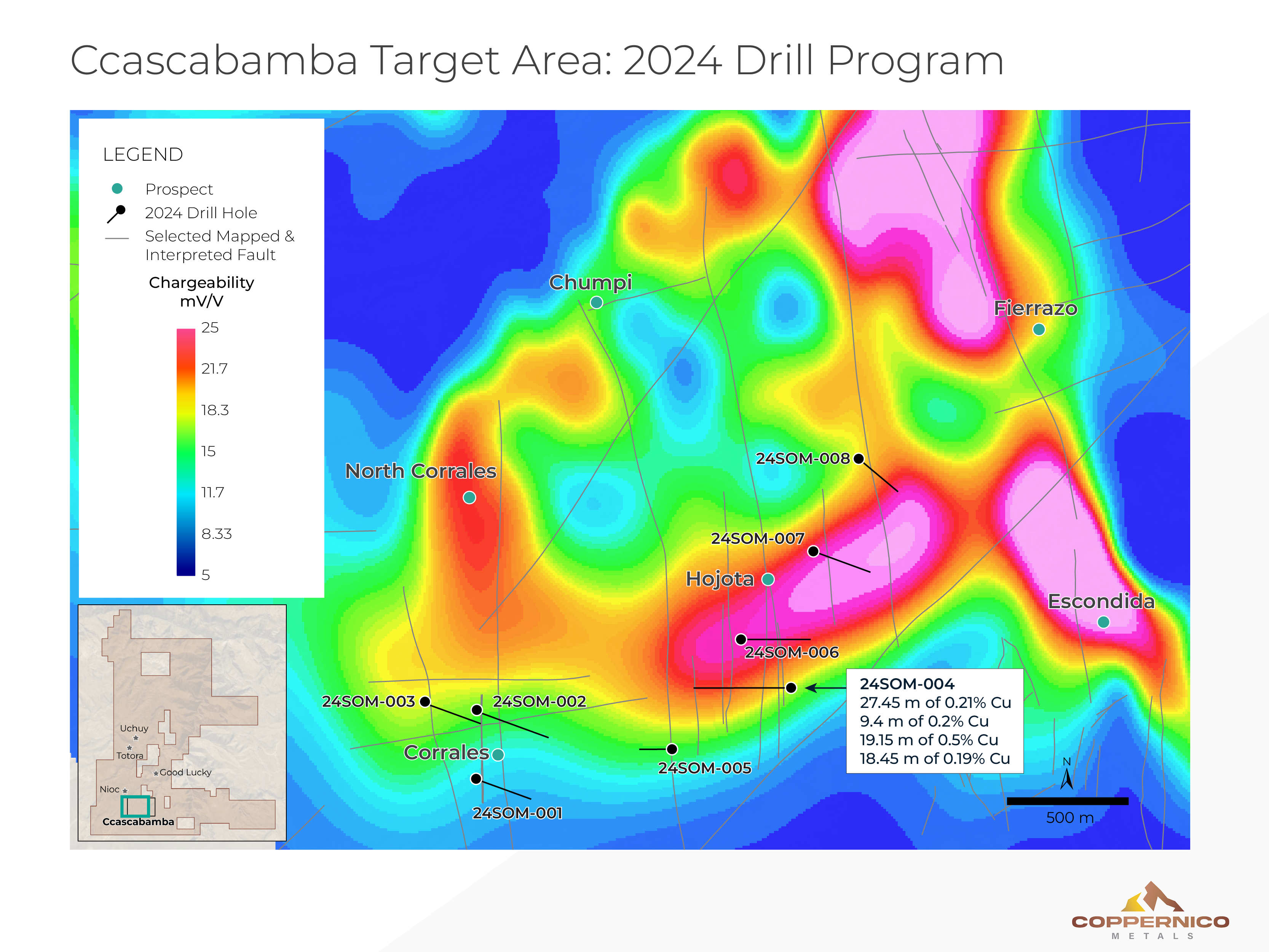

VANCOUVER, British Columbia, Nov. 12, 2024 (GLOBE NEWSWIRE) -- Coppernico Metals Inc. (TSX: COPR) (“Coppernico” or the “Company”), is pleased to provide an update on its inaugural drilling program being conducted through its wholly-owned Peruvian private subsidiary, Sombrero Minerales SAC, at its Sombrero Project in Peru. To date, the Company has identified six significant targets within the Ccascabamba target area (Figure 1) on the Project and initial drilling has tested only small sections of the first two. Notable findings from the first five holes drilled within the Ccascabamba target area include 19 metres (“m”) of 0.50% Copper (“Cu”) and 27 m of 0.21% Cu drilled in hole 4, which is on the margin of a large and prospective chargeability zone subsequently drill tested by holes 6 through 8, for which assay results are pending. Recent highlights and a summary of assay results from the first five holes of the drilling program are presented below.

Press Release Highlights

- Drilling Assay Results within the Ccascabamba target area:

- Hojota Target (holes 4 and 5)

- Hole 4 includes 19.15 m of 0.50% Cu from 91.95 m depth and 27.45 m of 0.21% Cu from 5.75 m depth.

- Shows a strong link between elevated chargeability and increased sulfide content, and broad intervals with anomalous Copper and Zinc (“Zn”) values, representing important validation of the scale and potential of the target.

- Hole 5 demonstrates the widespread development of skarn alteration across the Ccascabamba target area.

- Hole 4 includes 19.15 m of 0.50% Cu from 91.95 m depth and 27.45 m of 0.21% Cu from 5.75 m depth.

- Corrales Target (holes 1-3)

- Holes show garnet skarn alteration at surface, accompanied by elevated Cu, Zn and Manganese (“Mn”) indicating a vector to Cu mineralization to the north, west and east.

- Holes show marble and recrystallized limestone zones below 50-100m depth, and brittle fault zones with hematite and magnetite mineralization with elevated Cu values.

- Hojota Target (holes 4 and 5)

- Expanded drill permit applications are underway, aiming to increase from 49 holes currently permitted, to approximately 200 holes and capacity to operate additional drill rigs, providing flexibility to drill more extensively and more quickly within a larger polygon.

- Trading on the United States OTCQX is anticipated to commence as early as November 14, 2024.

- Upcoming participation at the New Orleans Investment Conference on November 20-23, 2024.

- CEO Presentation on November 23 at 10:45 am CT.

The objective in this early stage of Phase 1 target testing is to refine the three-dimensional understanding of the local geology and correlate it with geophysical and geochemical data. While additional drilling is required, the first five holes have already proven invaluable.

Ivan Bebek, Chair and CEO, commented, “We are well-financed and in the early stages of our budgeted 30-hole core drill program (49 holes permitted), with eight holes completed and assays back from our first five holes. We are highly encouraged with the early indications of the mineralized porphyry/skarn system in hole 4 on the edge of our Hojota target vectoring toward stronger mineralization, and the technical team advancing at a great pace.

The efforts to expand our permits to allow for additional holes and drill rigs reflect our increased confidence in the system and multiple targets, as we look forward to receiving the results of the next holes and continuing to drill the target-rich skarn and porphyry system. This is just the beginning of an opportunity that could provide multiple significant copper and gold targets and discoveries.”

Expanding Permits

Coppernico is applying for permits to increase the drilling capacity at the Sombrero Project by enlarging the permitted area and increasing the number of drill holes to approximately 200. This expansion would also enable additional drill rigs, which would increase the location flexibility and pace of drilling.

In support of these permits, the Company is advancing the Estudio de Impacto Ambiental semidetallado permit (“EIA-SD“). Biological and hydrobiological base line studies are underway, with the EIA-SD studies anticipated to be completed by Q2 2025.

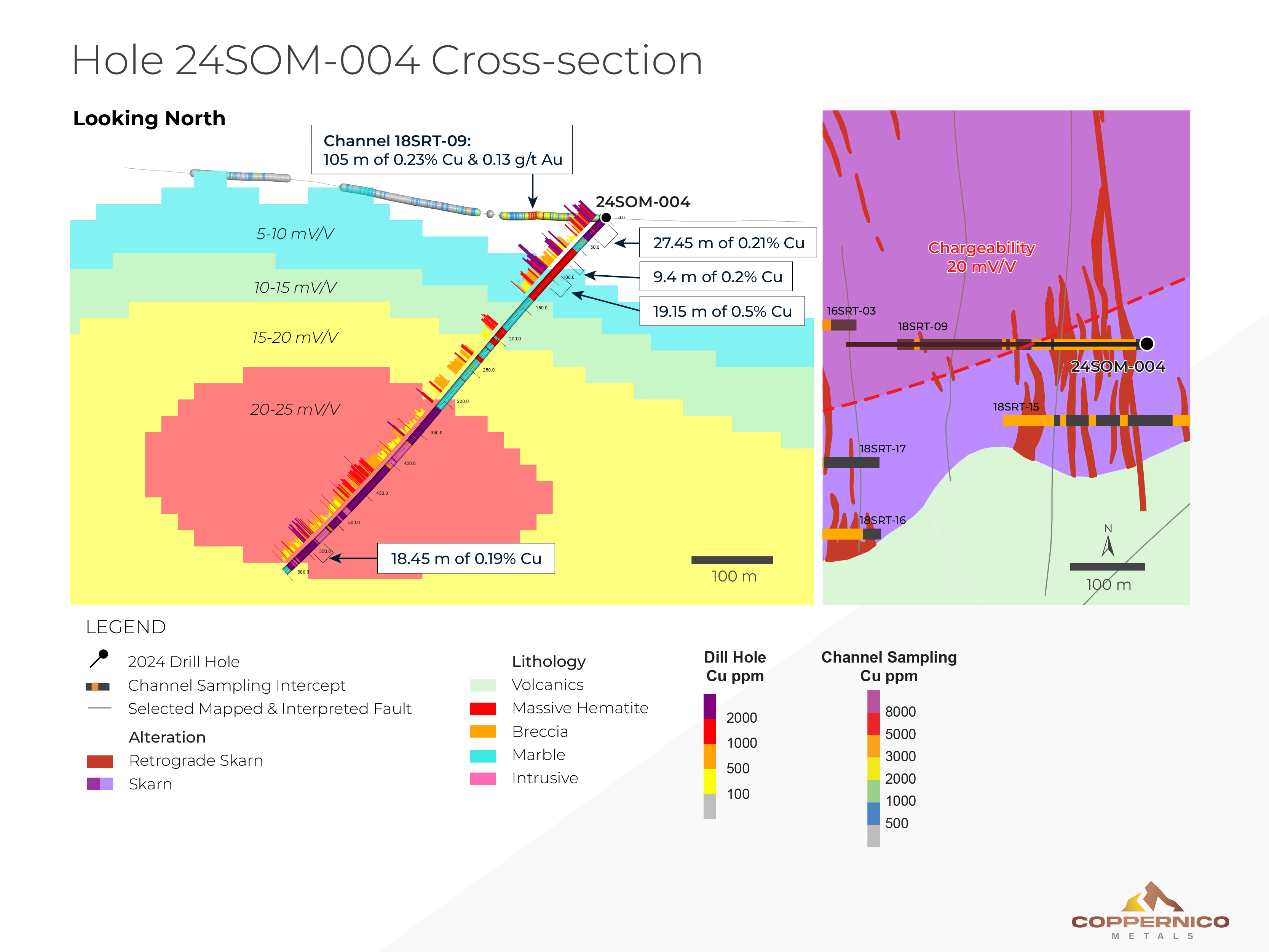

Hojota Target Highlights

Drill holes 24SOM-004 and 24SOM-005 (holes 4 and 5, respectively) targeted different portions of the Hojota area, with hole 4 intersecting mineralization from 6 m to 110 m depth, systematically increasing in grade from 0.2% to 0.5% Cu (Figure 2). These results correlate well with results from surface channel sample 18SRT-09 which intersected 105 m @ 0.23% Cu and 0.13 g/t Au1, within a skarn breccia unit. The deeper interval (see Table 1) is within a 74 m-wide massive hematite replacement body. This large hematite body is highly oxidized and leached and represents an exciting new target for follow-up drilling where hypogene copper mineralization may still be intact at depth.

Hole 5 intersected lithology and alteration very similar to the Corrales drill holes and demonstrates the widespread development of skarn across the Ccascabamba target area. Finding the focus for fluid flow and contact zones is the ongoing objective of drilling.

Corrales Target Highlights

The first three drill holes (24SOM-001, -002, -003) were completed at the Corrales target, revealing a range of encouraging geological features. In the top portions of each drill hole, garnet skarn alteration is present and accompanied by elevated copper (100-500 ppm), zinc and manganese values. Below approximately 50 m to 100 m, extensive marble and recrystallized limestone zones with disseminated pyrite are reported, suggesting a cooler, distal segment of the system. Notably, cutting this marble alteration are brittle fault zones with hematite and magnetite mineralization that also report elevated copper values. While more drilling is required to advance this target area, initial interpretations indicate paths to copper mineralization to the north, west and east, while south of the target area appears to be a more distal part of the hydrothermal system.

Advancing Geologic and Geophysical Understanding

As discussed above, geological understanding in three dimensions is building as drilling continues and is facilitating refinement of future targets for drill testing. Drill hole 4, for example, shows a strong link between elevated chargeability and increased sulfide content. Associated with the elevated chargeability are broad intervals (20 m – 50 m) with anomalous copper and zinc values (0.1% Cu and 0.1% Zn). While these are not considered of economic interest, they represent important validation of the scale and potential of target. The drill holes have also improved definition of location and geometry of the intrusive/limestone contact and demonstrate an increase in sulfides and copper mineralization associated with the contact. Drilling to date continues to demonstrate the large scale of this mineralizing system; hole 4 is approximately 1,200 m east of the Corrales target area and approximately 1,500 m southwest of the Fierrazo target area and intersected broad intervals of alteration and low-grade mineralization to a vertical depth of 450 m, yet remains open.

Outcomes from drilling are also enhancing understanding of the wider Project area, where mapping is further highlighting areas of interest for future drill programs.

Tim Kingsley, Vice President of Exploration, commented, “The drill program continues to advance quickly; we are under budget and on target for planned meters. Drilling has continued north and east of hole 4, testing stronger portions of this chargeability feature. We are pleased to observe a consistent correlation between increased sulfides and elevated chargeability values, with assay results for these new recent holes pending. Looking ahead, the program aims to further refine geologic and geophysical correlations, enhancing our ability to target mineralization with greater confidence. Upcoming drill holes will explore high-potential targets north of Corrales and at the Chumpi and Escondida targets, expanding our understanding of this extensive system(s).”

| Table 1. Composite Assay Results | |||||||

| Hole ID | From (m) | To (m) | Interval (m) | Cu % | Au (g/t) | Ag (g/t) | Zn % |

| 24SOM-001 | *Elevated Copper and Zinc in skarn zones | ||||||

| 24SOM-002 | *Elevated Copper and Zinc in skarn zones | ||||||

| 24SOM-003 | *Elevated Copper and Zinc in skarn zones | ||||||

| 24SOM-004 | 5.75 | 33.20 | 27.45 | 0.21 | 0.10 | 1.60 | 0.16 |

| 65.00 | 74.40 | 9.40 | 0.20 | 0.01 | 0.89 | 0.01 | |

| 91.95 | 111.10 | 19.15 | 0.50 | 0.01 | 1.82 | 0.02 | |

| 527.10 | 545.55 | 18.45 | 0.19 | 0.03 | 0.35 | 0.12 | |

| 24SOM-005 | *Elevated Copper and Zinc in skarn zones | ||||||

| Length weighted assay results. No more than 6 m internal dilution (reported values below 0.2% Cu and/or 0.2 g/t Au). True thickness unknown at this time. Minimum reporting length of 8 m. *Assay values in these holes were anomalous in copper but did not meet the Company’s minimum assay reporting thresholds. | |||||||

Figure 1: Plan map of Phase 1 drilling completed to date at the Ccascabamba target area. Assay results pending from holes 6, 7 and 8.

Figure 2: Cross-section looking north of hole 4 with lithology, Cu assay results and chargeability model.

OTCQX® Best Market Application

Coppernico is pleased to announce that it received a conditional approval for trading of its common shares on OTCQX Best Market (“OTCQX”), a United States trading platform that is operated by the OTC Markets Group in New York. The Company anticipates that trading on OTCQX could commence on or about November 14, 2024, subject to customary approvals and will provide further information at the time the actual date is known.

OTCQX Best Market is the premium tier of the OTC Markets Group, a premiere marketplace for industry leaders among international companies who are committed to providing their U.S. investors with a premium trading and information experience. Investors will be able to find financial disclosure and Real-Time Level 2 quotes for the Company on the OTC Markets website www.otcmarkets.com. This key milestone is expected to enhance trading liquidity and broaden the Company’s exposure to a larger pool of U.S. investors.

The Company will also continue to trade on the TSX under symbol “COPR”.

Conference Participation

Coppernico is pleased to announce its participation in the New Orleans Investment Conference on November 20-23, 2024, where Ivan Bebek, Chair and CEO, will present the Company’s latest developments and will be available for one-on-one meetings with investors, analysts, and industry stakeholders. Mr. Bebek’s 40-minute presentation is scheduled for Saturday, November 23 at 10:45 am CT in Room Churchill B2, 2nd Floor.

Conference presentations are posted on the Company's website at www.coppernicometals.com.

Technical Disclosure and Qualified Person

The scientific and technical information contained in this news release was reviewed and approved by Tim Kingsley, M.Sc., CPG, Coppernico’s VP of Exploration, who is a “Qualified Person” (as defined in NI 43-101).

Quality Control

Analytical samples were taken by sawing HQ or NQ diameter core into equal halves on site and one of the halves was sent to the ALS Lab in Lima, Peru for preparation and analysis. Preparation included crashing core sample to 90% < 2mm and pulverizing 1,000 g of crushed material to better than 95% < 106 microns. All samples are assayed using 30 g nominal weight fire assay with atomic absorption finish (Au-AA23) and multi-element using four acid digest ICP-AES/ICP-MS method (ME-MS61). Where MS61 results were greater or near 10,000 ppm Cu, or 10,000 ppm Zn the assays were repeated with ore grade four acid digest method (Cu-OG62). QA/QC programs for 2024 core samples using internal standard samples, blanks, and duplicates, lab duplicates, lab standards, and lab blanks indicate good overall accuracy and precision.

ON BEHALF OF THE BOARD OF DIRECTORS

Ivan Bebek

Chair & CEO

For further information, please contact:

Coppernico Metals Inc.

Phone: +1 778 729 0600

Email: info@coppernicometals.com

Website: www.coppernicometals.com

Twitter: @CoppernicoMetal

LinkedIn: www.linkedin.com/company/coppernico-metals/

About Coppernico

Coppernico is a mineral exploration company focused on creating value for shareholders and stakeholders through diligent and project evaluation and exploration excellence in pursuit of the discovery of world-class copper-gold deposits in the Americas. The Company’s management and technical teams have a successful track record of raising capital, discovery and the monetization of exploration successes. The Company, through its wholly-owned private Peruvian subsidiary Sombrero Minerales S.A.C., is currently focused on the Ccascabamba (previously referred to as Sombrero Main) and Nioc target areas within the Sombrero Project in Peru, its flagship project, and is regularly reviewing additional premium projects to consider for acquisition.

The Sombrero Project is a land package of approximately 102,000 hectares (1,020 square kilometres) located in the north-western margins of the world-class Andahuaylas-Yauri trend in Peru. It consists of a number of prospective exploration targets characterized by copper-gold skarn and porphyry systems, and precious metal epithermal systems. The Company’s NI 43-101 technical report, with an effective date of April 17, 2024, and as filed on SEDAR+ on May 23, 2024, focuses on the Ccascabamba and Nioc target areas of the Sombrero Project.

Coppernico Metals Inc. is currently listed on the Toronto Stock Exchange under symbol "COPR". More information about the Company can be found on the Company’s profile on SEDAR+ (www.sedarplus.ca and website: www.coppernicometals.com).

Cautionary Note

No regulatory organization has approved the contents hereof.

This news release contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation (collectively, “forward-looking statements”). Forward-looking statements are often identified by terms such as “may”, “should”, “anticipate”, “expect”, “intend” and similar expressions and include, but are not limited to, statements with respect to: the Company’s drill plans, identifying targets for future exploration, the potential of the mineralization, its financial position in the future and the approval and commencement of the Company’s common shares trading on OTCQX. No certainty can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon. Forward-looking statements are based on a number of assumptions and are subject to a number of risks and uncertainties, many of which are beyond the Company’s control, which could cause actual results and events to differ materially from those that are disclosed in or implied by such forward-looking statements. Readers should refer to the risks discussed in the Company’s AIF and other continuous disclosure filings with the Canadian Securities Administrators, available at www.sedarplus.ca. These factors are not, and should not be construed as being, exhaustive. Accordingly, readers should not place heavy reliance on forward-looking statements. The forward-looking statements contained in this new release are expressly qualified by this cautionary statement. Any forward-looking information and the assumptions made with respect thereto speaks only as of the date of this news release. The Company does not undertake any obligation to publicly update or revise any forward-looking information after the date of this news release to conform such information to actual results or to changes in the Company’s expectations except as otherwise required by applicable legislation.

1 See NI 43-101 Technical Report on the Sombrero Main/Nioc Project, Ayacucho Department, Peru – effective date April 17, 2024, prepared by APEX Geoscience Ltd. and Mining Plus.

Photos accompanying this release can be found at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c0d5b7fe-6df5-4e88-a176-2be995782955

https://www.globenewswire.com/NewsRoom/AttachmentNg/6b04bdda-d8e2-491a-8776-77bb11d3d660