New York, Nov. 18, 2024 (GLOBE NEWSWIRE) --

Overview

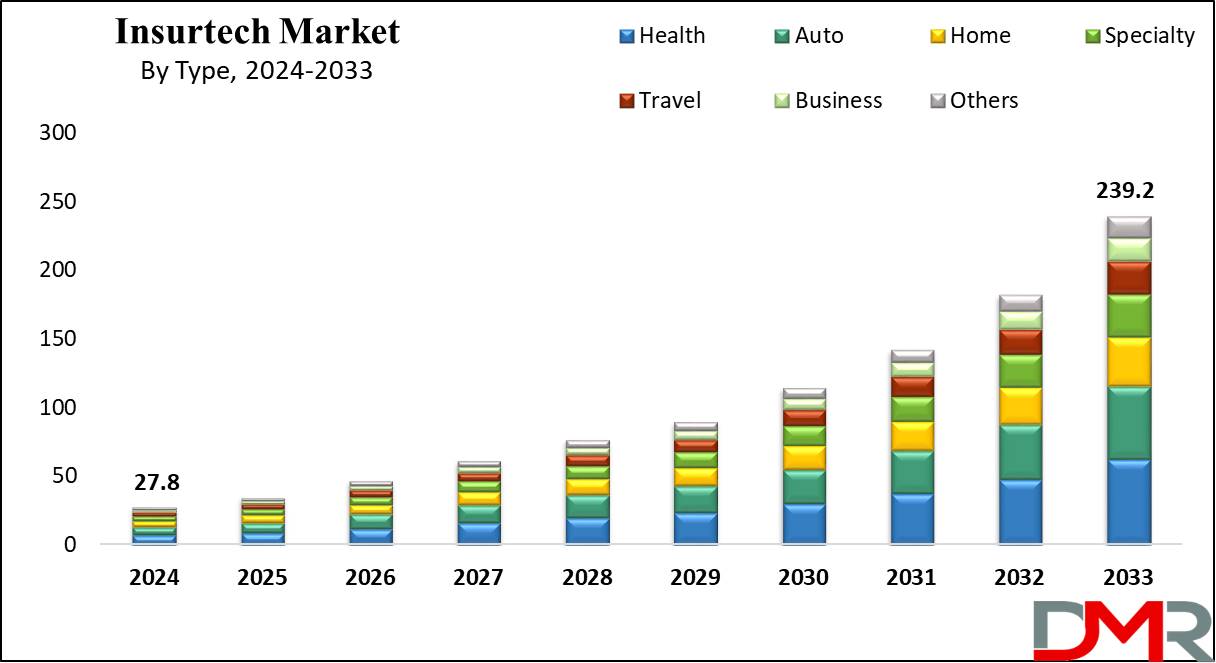

The Insurtech Market size is expected to reach USD 27.8 billion by 2024 and is further anticipated to reach USD 239.2 billion by 2033 according to Dimension Market Research. The market is anticipated to register a CAGR of 27.0% from 2024 to 2033.

Insurtech is the technology and innovative approaches to enhance and transform the insurance industry, which term integrates "insurance" and "technology," showing the incorporation of digital solutions & development to improve various aspects of insurance services, as it focuses on improving customer experience, reducing operational costs, enhancing risk assessment, and driving innovation within the insurance industry, making it more accessible, efficient, and responsive to modern needs.

Get Your Sample Report – Request Now at https://dimensionmarketresearch.com/report/insurtech-market/request-sample/

The US Overview

The Insurtech Market in the US is projected to reach USD 9.2 billion in 2024 at a compound annual growth rate of 25.3% over its forecast period.

The U.S. insurtech market provides growth opportunities through AI, machine learning, and digital platforms, improving customer experience and operational efficiency. The need for customized products and partnerships between insurers and startups drive innovation. However, regulatory challenges pose hurdles for new entrants, making it essential to balance innovation with compliance for sustained growth.

Important Insights

- The Insurtech Market is expected to grow by USD 204.7 billion by 2033 from 2025 with a CAGR of 27.0%.

- The health segment is anticipated to get the majority share of the Insurtech Market in 2024.

- The cloud computing segment as a technology is expected to lead the market in 2024.

- The managed service segment is anticipated to get the largest revenue share in 2024 in the Insurtech Market.

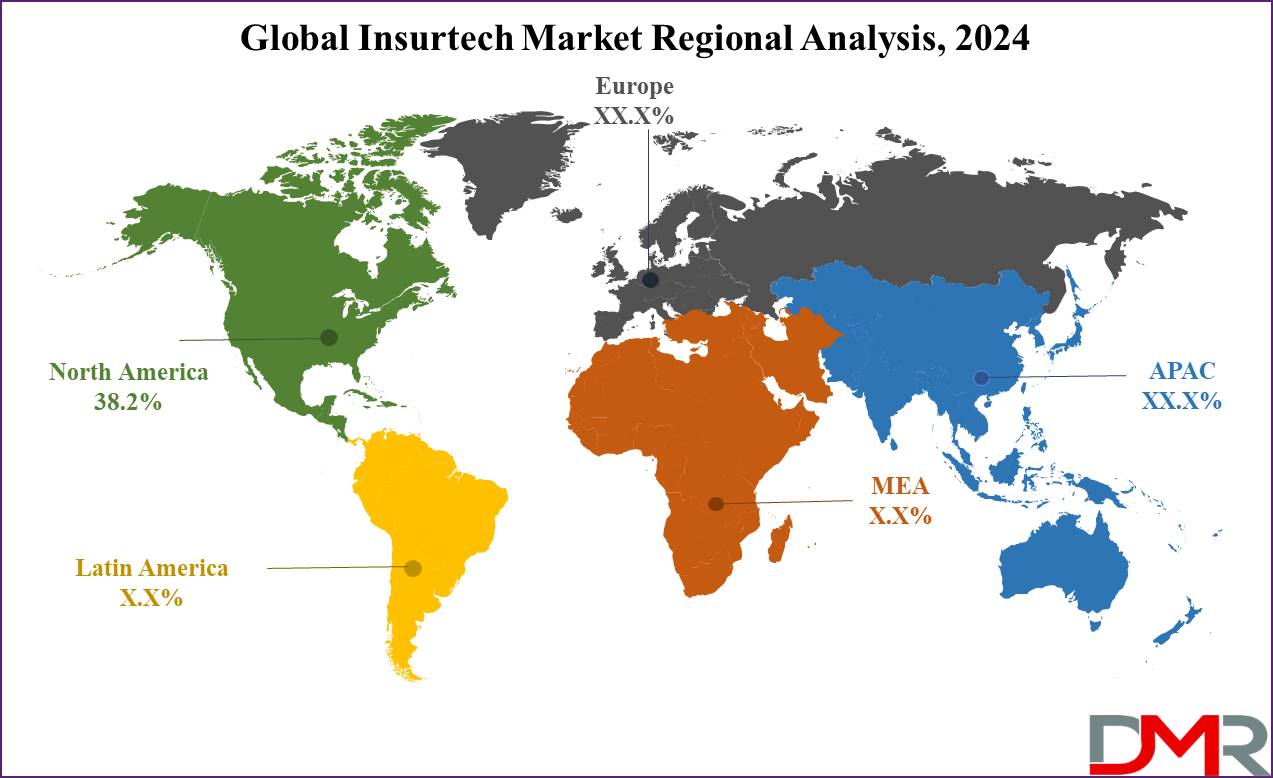

- North America is predicted to have a 38.2% revenue share in the Global Insurtech in 2024.

Global Insurtech Market: Trends

- AI and Predictive Analytics Integration: Insurers are using AI &machine learning for more precise underwriting, dynamic pricing, and fraud detection. Predictive analytics helps insurers understand customer behavior, optimize risk assessment, and offer personalized policies.

- Blockchain Adoption: Blockchain technology is being explored for ease of claims and underwriting through smart contracts, minimizing the need for intermediaries and improving transparency in processes.

- Telematics and IoT for Risk Management: Devices like vehicle telematics and home sensors enable real-time data collection, enabling insurers to offer behavior-based premiums and improve claims processing.

- Hybrid Digital-Human Interaction: While digital platforms are getting prominence, maintaining a human element remains crucial for complex processes. Insurers are aiming on omnichannel strategies, balancing digital and personal interactions to enhance customer engagement and satisfaction.

Transform your business approach with strategic insights from our report. Get in touch to request our brochure today! : https://dimensionmarketresearch.com/report/insurtech-market/download-reports-excerpt/

Insurtech Market: Competitive Landscape

The Insurtech market experiences competition between traditional insurers using technology and startups driving disruption with customer-focused solutions. Both are in partnership with tech firms to enhance data analytics, streamline processes, and provide customized products. As consumer expectations evolve, companies innovate through digital platforms, developing accessible, tailored insurance solutions and intensifying competition across the industry.

Some of the major players in the market include DXC Technology Company, Insurance Technology Services, Shift Technology, Damco Group, Wipro Ltd, and more.

Some of the prominent market players:

- DXC Technology Company

- Insurance Technology Services

- Shift Technology

- Damco Group

- Wipro Ltd

- ZhongAn Insurance

- Quantemplate

- Appian

- EIS Group

- Prima Solutions

- Other Key Players

Insurtech Market Scope

| Report Highlights | Details |

| Market Size (2024) | USD 27.8 Bn |

| Forecast Value (2033) | USD 239.2 Bn |

| CAGR (2024-2033) | 27.0% |

| The US Market Size (2024) | USD 9.2 Bn |

| Leading Region in terms of Revenue Share | North America |

| Percentage of Revenue Share by Leading Region | 38.2% |

| Historical Data | 2018 - 2023 |

| Forecast Data | 2025 - 2033 |

| Base Year | 2023 |

| Estimate Year | 2024 |

| Segments Covered | By Type, By Technology, By Service, By End User |

| Regional Coverage | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Regional Analysis

North America is anticipated to lead the insurtech market in 2024 by having over 38.2% of global revenue, driven by high consumer spending on insurance and the need for flexible, customizable plans, mainly in property and health insurance. The growth of insurtech startups further expands the market expansion with innovative solutions. Further, the Asia Pacific region is anticipated to be the fastest-growing market, driven by emerging economies and financial hubs like Singapore, India, and Hong Kong. The growing smartphone penetration and affordable premium plans are driving adoption, positioning the region for substantial growth in the sector.

Access This Exclusive Report – Buy Now at https://dimensionmarketresearch.com/checkout/insurtech-market/

By Region

North America

- The U.S.

- Canada

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Segment Analysis:

The managed services segment is anticipated to lead the insurtech market by 2024, providing insurers with a strategic path to transformation through technology integration, best practices, operational efficiency, and compliance support. As insurers adopt advanced business models, managed services are set for major growth. Further, the support & maintenance segment is set to grow the fastest, due to the adoption of advanced technologies and the modernization of legacy software. Insurers are investing in these services to improve operations, improve customer experiences, and stay competitive in a rapidly evolving market.

Insurtech Market Segmentation

By Type

- Health

- Auto

- Home

- Specialty

- Travel

- Business

- Others

By Technology

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

By Service

- Consulting

- Support & Maintenance

- Managed Services

By End User

- BFSI

- Automotive

- Manufacturing

- Transportation

- Government

- Health

- Retail

- Others

Claim Your Free Sample Report Today at https://dimensionmarketresearch.com/report/insurtech-market/request-sample/

Global Insurtech Market: Driver

- Advanced Technologies: The adoption of AI, machine learning, and data analytics improves efficiency, customization, and customer experience.

- Rising Demand for Customization: Consumers look for flexible, tailored insurance products and simplifies digital platforms.

- Insurer-Startup Collaborations: Collaborations between traditional insurers and tech startups promote innovation and meet transforming consumer needs.

- Smartphone & Digital Penetration: The increase in the mobile usage drives the adoption of digital insurance solutions, making services more accessible.

Global Insurtech Market: Restraints

- Regulatory Challenges: Complex requirements that need to be met create barriers for new entrants and slow innovation.

- Data Security Concerns: Handling sensitive customer data increases the risks of breaches and impacts trust.

- Legacy Systems: Traditional insurers struggle to integrate new technologies with outdated infrastructure.

- High Competition: Intense rivalry among startups & incumbents limits market share and profitability.

Global Insurtech Market: Opportunities

- Personalized Products: The increase in demand for customized insurance solutions provides opportunities for innovation.

- AI and Data Analytics: Using advanced technologies improves customer experience & operational efficiency.

- Expanding Partnerships: Partnerships between insurers & startups promote new business models and solutions.

- Emerging Markets: The increase in digital adoption in regions like Asia Pacific presents significant growth potential.

Recent Developments in the Insurtech Market

- October 2024: Insurity announced that Insurance at Glia will deliver a keynote address at Excellence in Insurance, which is created as a peer forum for insurance and MGA executives and professionals and would bring together over 300 experts from 115+ leading insurance companies and MGAs to network, discuss, and generate innovative ideas to propel P&C insurance forward

- September 2024: Bharatsure launched four insurance products for gig workers, students, digital users, and companies looking for better employee benefits, which provide health and personal accident coverage at a premium payment of Rs 69 per month.

- August 2024: NEXT Insurance unveiled its selection in CNBC's inaugural list of the World's Top Insurtech Companies of 2024 in the digital insurer category, which highlights the transformative power of its early investment in technology to change small business insurance and address a critical market gap in the industry.

Browse More Related Reports

Drone Insurance Market Expected to reach a value of USD 1.8 billion by 2024 and grow at a CAGR of 9.1%, achieving a projected market value of USD 3.8 billion by 2033.

Trade Finance Market Estimated at USD 53.0 billion in 2024, this market is anticipated to expand at a CAGR of 5.3%, reaching USD 84.3 billion by 2033.

Home Insurance Market Valued at USD 268.6 billion in 2023, it is forecasted to grow at a CAGR of 7.4%, reaching USD 509.6 billion by 2033.

Travel Insurance Market Predicted to reach USD 25.3 billion globally by 2024, with a robust CAGR of 16.0%, pushing the market value to USD 95.9 billion by 2033.

Healthcare Insurance Market Projected to achieve a market size of USD 2,584.8 billion in 2024, growing at a CAGR of 7.9%, and reaching USD 5,120.9 billion by 2033.

Term Insurance Market Expected to attain a value of USD 1,215.0 billion by 2024, further growing at a CAGR of 8.8%, and reaching USD 2,601.2 billion by 2033.

Educational Tourism Market Estimated at USD 416.8 billion by 2024, this market is set to grow at a CAGR of 13.5%, reaching an impressive value of USD 1,301.6 billion by 2033.

About Dimension Market Research (DMR):

Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts into work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world. We also believe that our clients don’t always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.