New York, Nov. 18, 2024 (GLOBE NEWSWIRE) -- Overview:

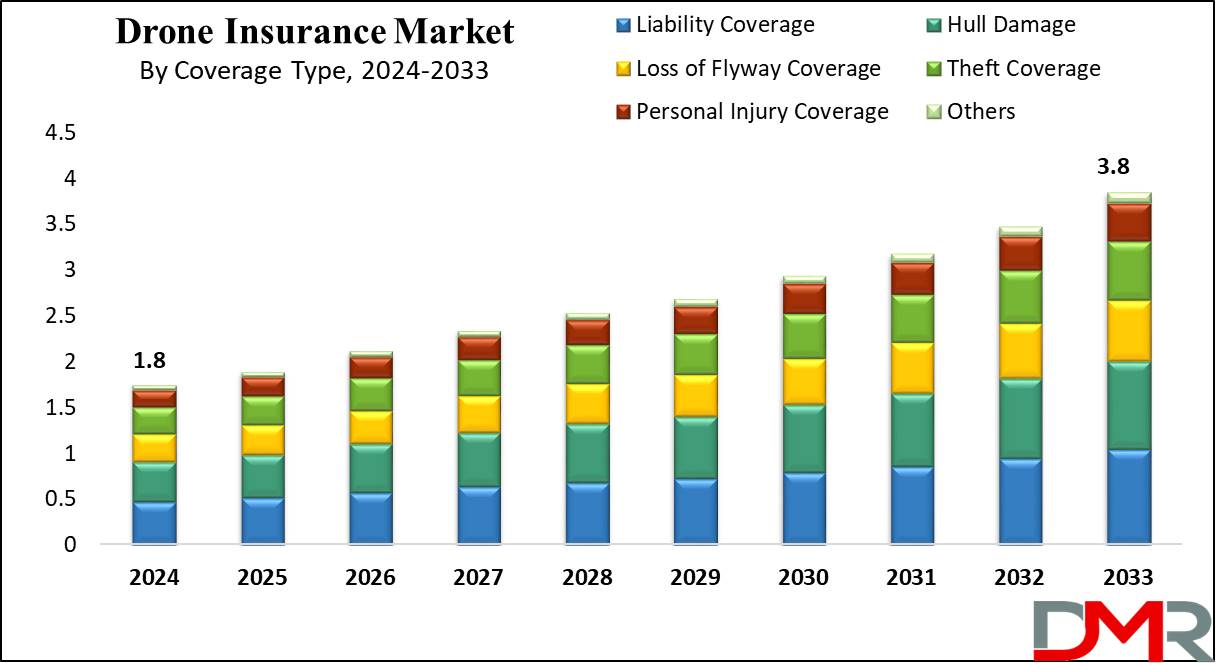

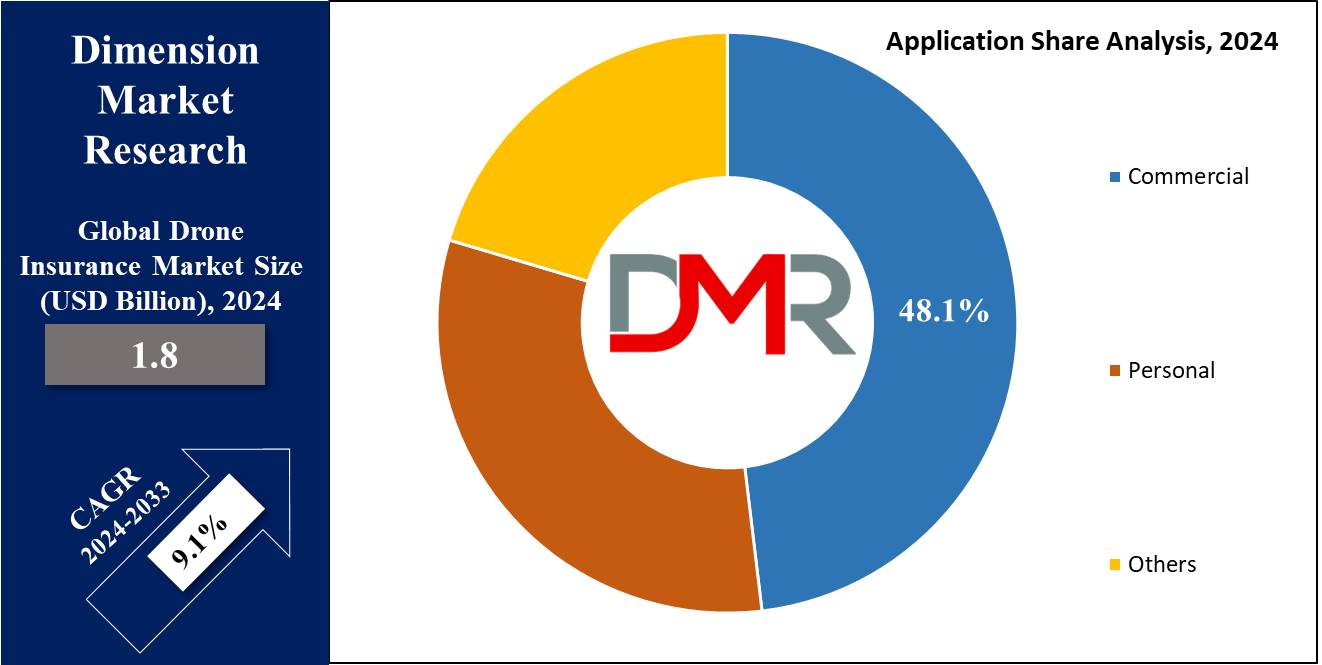

The Drone Insurance Market size is expected to reach USD 1.8 billion by 2024 and is further anticipated to reach USD 3.8 billion by 2033 according to Dimension Market Research. The market is anticipated to register a CAGR of 9.1% from 2024 to 2033.

Drone insurance is a special type of insurance coverage made to protect individuals and businesses that own and operate drones (unmanned aerial vehicles). It provides financial protection against probable liabilities, damages, and losses that may grow from drone operations. As the use of drones continues to expand across many industries, drone insurance has become increasingly important to mitigate risks and ensure compliance with regulations.

Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/drone-insurance-market/request-sample/

The US Overview

The Drone Insurance Market in the US is projected to reach USD 0.6 billion in 2024 at a compound annual growth rate of 8.5% over its forecast period.

The U.S. drone insurance market is increasing due to expanding commercial drone applications in agriculture, construction, and logistics, along with better regulatory requirements for liability coverage. Demand for customized, usage-based insurance solutions is growing, driven by drone adoption in delivery services and infrastructure inspections. However, high premiums and limited awareness among smaller operators remain key challenges to broader market penetration.

Important Insights

- The Drone Insurance Market is expected to grow by USD 3.8 billion by 2033 from 2025 with a CAGR of 9.1%.

- The liability coverage type is anticipated to dominate in 2024 with a majority & is anticipated to dominate throughout the forecasted period.

- The commercial segment is projected to get the dominant revenue share in 2024 in the Drone Insurance Market.

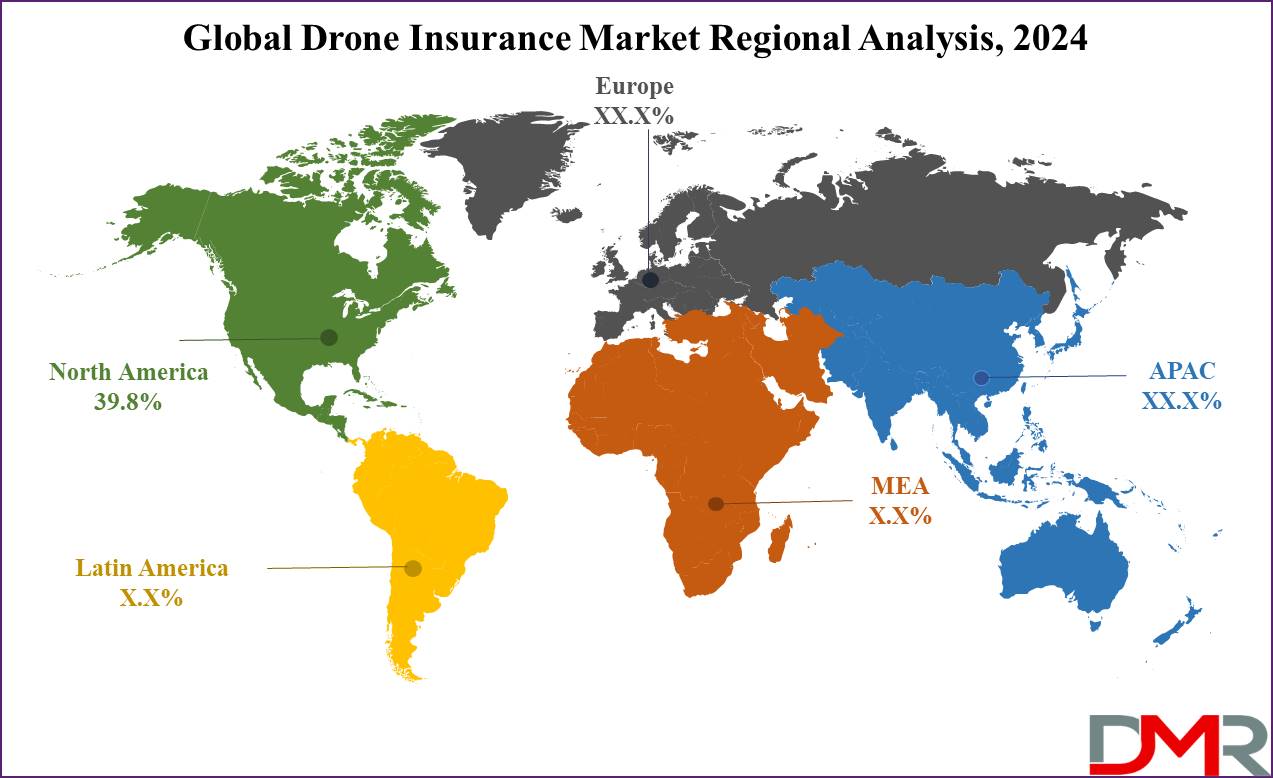

- North America is predicted to have a 39.8% share of revenue share in the Global Drone Insurance Technology Market in 2024.

Global Drone Insurance Market: Trends

- Increased Adoption of Usage-Based Models: Insurers are highly offering usage-based insurance, where premiums are tied to drone usage & risk levels, providing more flexible & cost-effective coverage.

- Enhanced Data Analytics: The use of AI & big data is growing to assess risks more accurately, creating better underwriting and claims management.

- Stricter Regulatory Compliance: The new and evolving regulations are pushing for better insurance coverage, mainly for commercial drone operations, to ensure safety and compliance.

- Growth in Insurtech Innovations: The integration of technology in insurance processes, like digital platforms for policy management and claims, is streamlining operations and improving customer experience

Drone Insurance Market: Competitive Landscape

The drone insurance market is highly competitive, with many insurers providing specialized policies for recreational and commercial operators. Also, the growing demand for coverage addressing risks like liability, damage, and theft drives this competition. Insurers are focusing on flexible pricing and usage-based models to attract customers. As drone technology and regulations evolve, companies are innovating to meet the diverse needs of various industries.

Some of the major players in the market include Moonrock Insurance, Avion Insurance, SkyWatch, AIG US, Coverdrone, Aligned, and more.

Some of the prominent market players:

- Moonrock Insurance

- Avion Insurance

- SkyWatch

- AIG US

- Coverdrone

- Aligned

- USAIG

- BWI

- REIN

- Global Aerospace Inc

- Other Key Players

Transform your business approach with strategic insights from our report. Get in touch to request our brochure today at https://dimensionmarketresearch.com/report/drone-insurance-market/download-reports-excerpt/

Drone Insurance Market Scope

| Report Highlights | Details |

| Market Size (2023) | USD 1.8 Bn |

| Forecast Value (2032) | USD 3.8 Bn |

| CAGR (2023-2032) | 9.1% |

| The US Market Size (2024) | USD 0.6 Bn |

| Leading Region in terms of Revenue Share | North America |

| Percentage of Revenue Share by Leading Region | 39.8% |

| Historical Data | 2018 - 2023 |

| Forecast Data | 2024 - 2033 |

| Base Year | 2023 |

| Estimate Year | 2024 |

| Segments Covered | By Coverage Type, By Application |

| Regional Coverage | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Segment Analysis:

The commercial segment is anticipated to lead the drone insurance market due to the growth in the use of drones in industries like agriculture, real estate, construction, and film production. These sectors depend on drones for tasks such as aerial photography, surveying, and crop monitoring, which need customized insurance coverage. Strict regulations also mandate comprehensive insurance for commercial operators, covering liability, hull damage, and theft. As businesses recognize the affordability and benefits of drones, demand for both drones and insurance products continues to grow, keeping the commercial segment dominant.

Drone Insurance Market Segmentation

By Coverage Type

- Liability Coverage

- Hull Damage

- Loss or Flyway Coverage

- Theft Coverage

- Personal Injury Coverage

- Others

By Application

- Commercial

- Personal

- Others

Purchase the Competition Analysis Dashboard Today at https://dimensionmarketresearch.com/checkout/drone-insurance-market/

Global Drone Insurance Market: Driver

- Increasing Commercial Drone Applications: Drones are being broadly used across industries like agriculture, construction, and logistics, driving the need for insurance to cover risks like property damage and liability.

- Evolving Regulatory Requirements: Governments are mandating insurance coverage for commercial drone operations, mainly for liability protection, boosting the market's growth.

- Rising Drone Usage for Delivery Services: The increase in the use of drones in delivery and e-commerce services increases the demand for specialized insurance policies.

- Technological Advancements: Enhancements in drone technology, like better safety features and data analytics, create opportunities for insurers to offer customized, usage-based policies.

Global Drone Insurance Market: Restraints

- High Insurance Premiums: The cost of drone insurance, mainly for commercial operators, can be high, preventing smaller businesses from purchasing coverage.

- Limited Awareness: Many drone operators, mainly hobbyists and small enterprises, lack awareness about the importance & availability of drone insurance.

- Lack of Standardization: Inconsistent insurance policies ®ulations across regions can develop confusion, slowing market growth and adoption.

- Complex Regulatory Requirements: Inspecting complex and varying regulatory frameworks for drone operations and insurance compliance can be a barrier for new operators entering the market.

Global Drone Insurance Market: Opportunities

- Expansion in Emerging Markets: Growth in drone utilization in emerging industries like healthcare, mining, and energy presents new opportunities for customized insurance solutions.

- Usage-Based Insurance: Providing flexible, usage-based policies that adjust premiums based on flight hours or operational risk can attract more customers and increase adoption.

- Integration of Advanced Technologies: Using AI and real-time data analytics can help insurers provide more accurate risk assessments, developing customized and competitive insurance offerings.

- Drones in Urban Areas: As drones become more common in urban areas for tasks like delivery & surveillance, the demand for comprehensive insurance solutions will expand, opening new market avenues.

Click to Request Sample Report and Drive Impactful Decisions at https://dimensionmarketresearch.com/report/drone-insurance-market/request-sample/

Regional Analysis

The North American drone insurance market is expanding rapidly and is expected to capture 39.8% of the total market share by 2024 due to growth in demand for drone services in industries like aerial photography, surveying, and delivery. Also, the increase in the numbers of drone operators and new safety regulations further boost insurance demand for protection against physical damage, liability, and injury. In addition, the Asian market is also growing, driven by increased drone manufacturing and services. Despite challenges like limited awareness and high premiums, the market is set to expand as drone use rises across various sectors.

By Region

North America

- The U.S.

- Canada

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Recent Developments in the Drone Insurance Market

- March 2024: Terra Drone Corporation & Advanced Air Mobility (AAM) announced an investment in Aloft Technologies (Aloft), to make Terra Drone the largest shareholder in Aloft, with Aloft becoming an affiliate company of Terra Drone.

- February 2024: AutoPylot launched complete drone insurance into its all-in-one flight planning solution underwritten by Allianz Commercial, along with collaboration with Stere, as it makes the company emerge as one of the first FAA-approved B4UFLY and LAANC service providers to integrate complete insurance directly into its platform.

- October 2023: SkyWatch acquired Droneinsurance.com’s assets, to bring together two innovative platforms, and provide its clients with a better experience with more options.

- October 2023: Moonrock Drone reported that it has been accepted as a member of the Managing General Agents Association (MGAA), which will help the company in attaining many opportunities and contribute to all the important discussions in the MGA space.

- October 2023: Moonrock Insurance announced a partnership with Flyability, to allow all commercial pilots flying Elios drones designed for the inspection and exploration of the most inaccessible places to obtain a personalized insurance product for their drone through Moonrock Insurance.

Browse More Related Reports

The Global NLP in Finance Market is expected to reach a value of USD 5.7 billion in 2023, and it is further anticipated to reach a market value of USD 57.5 billion by 2032 at a CAGR of 29.2%.

The Europe Creator Economy Market is expected to reach a value of USD 13.4 billion by the end of 2024, and it is further anticipated to reach a market value of USD 84.1 billion by 2033 at a CAGR of 22.6%.

Global Impact Investing Market size is estimated to reach USD 1.45 Trillion in 2024 and is further anticipated to value USD 2.6 Trillion by 2033, at a CAGR of 8.3%.

Global Trade Finance Market size was valued at USD 53.0 Bn in 2024 and it is further anticipated to reach a market value of USD 84.3 Bn in 2033 at a CAGR of 5.3%.

Global Home Insurance Market size was valued at USD 268.6 Bn in 2023 and it is further anticipated to reach a market value of USD 509.6 Bn in 2033 at a CAGR of 7.4%.

The Global Pet Insurance Market is expected to reach a market value of USD 11.8 billion in 2024 and is projected to show subsequent growth by reaching a value of USD 54.6 billion in 2033 at a CAGR of 18.6% in the forthcoming period of 2024 to 2033.

The Travel Insurance Market is expected to reach a market value of USD 25.3 billion in 2024, globally, which will further grow to USD 95.9 billion by 2033 at a CAGR of 16.0%.

The Global Healthcare Insurance Market is expected to project a market value of USD 2,584.8 billion in 2024 which will further reach USD 5,120.9 billion in 2033 at a CAGR of 7.9%.

The Global Term Insurance Market is expected to reach a value of USD 1,215.0 billion by the end of 2024, and it is further anticipated to reach a market value of USD 2,601.2 billion by 2033 at a CAGR of 8.8%.

The Global Generative AI in Customer Services Market is expected to reach a value of USD 490.4 million by the end of 2024, and it is further anticipated to reach a market value of USD 3,673.7 million by 2033 at a CAGR of 25.1%.

The Global Educational Tourism Market size is expected to reach a market value of USD 416.8 billion in 2024 which will further increase and will reach USD 1,301.6 billion in 2033 at a CAGR of 13.5%.

The Global Education & Learning Analytics Market size is expected to reach a market value of USD 13.0 billion in 2024 which is further anticipated to reach USD 79.7 billion in 2033 at a CAGR of 22.3%.

The Global Mobile Banking Market is expected to reach a value of USD 2.2 billion by the end of 2024, and it is further anticipated to reach a market value of USD 11.2 billion by 2033 at a CAGR of 20.0%.

The Europe Creator Economy Market is expected to reach a value of USD 13.4 billion by the end of 2024, and it is further anticipated to reach a market value of USD 84.1 billion by 2033 at a CAGR of 22.6%.

About Dimension Market Research (DMR):

Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts into work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world. We also believe that our clients don’t always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.