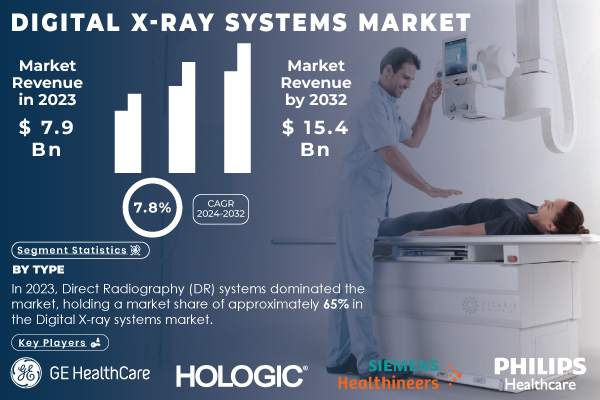

Austin, Nov. 25, 2024 (GLOBE NEWSWIRE) -- The Digital X-Ray Systems Market was valued at USD 7.9 billion in 2023 and is expected to reach USD 15.4 billion by 2032, growing at a CAGR of 7.8% over the forecast period from 2024 to 2032. This growth is primarily driven by the advancements in imaging technology, increasing demand for early diagnosis, and the growing preference for non-invasive medical procedures.

Market Overview

Digital X-ray systems are a key element of modern diagnostic imaging, providing high-resolution images that assist healthcare professionals in accurate diagnosis and treatment planning. The growing prevalence of chronic diseases, advancements in healthcare infrastructure, and rising awareness about the benefits of early diagnosis are boosting the adoption of digital X-ray systems globally.

Additionally, these systems offer faster image processing, enhanced clarity, and lower radiation exposure compared to traditional X-rays, making them more preferred in healthcare facilities. The demand for efficient, reliable, and high-quality diagnostic equipment is driving growth, especially in hospitals and diagnostic centers that require high-volume imaging solutions. Furthermore, the rise in outpatient imaging centers and the shift toward outpatient care are expected to significantly impact market demand. The need for mobile and portable solutions is also gaining traction as healthcare providers look for flexible imaging solutions.

Download PDF Sample of Digital X-Ray Systems Market @ https://www.snsinsider.com/sample-request/4508

Key Players:

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Canon Medical Systems Corporation

- Fujifilm Holdings Corporation

- Carestream Health

- Hologic, Inc.

- Agfa-Gevaert Group

- Samsung Medison Co., Ltd.

- Konica Minolta Healthcare

Digital X-Ray Systems Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 7.9 Billion |

| Market Size by 2032 | USD 15.4 Billion |

| CAGR | CAGR of 7.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Computed Radiography (CR), Direct Radiography (DR)) • By Technology (Flat Panel Detectors, Charge-Coupled Device (CCD)) • By Portability (Portable Digital X-Ray Systems, Fixed Digital X-Ray Systems [Ceiling Mounted, Floor Mounted]) • By Application (General Radiography, Dental Radiography, Mammography, Orthopedic Imaging, Emergency Care, Others) • By End-user (Hospitals, Diagnostic Imaging Centers, Orthopedic Clinics, Dental Clinics, Veterinary Clinics) |

| Key Drivers | • Innovations in digital X-ray technology enhance image quality, reduce radiation exposure, and improve diagnostic accuracy • Rising investments in healthcare infrastructure drive the adoption of advanced diagnostic tools |

If You Need Any Customization on Digital X-Ray Systems Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/4508

Segment Analysis

By Type

In 2023, Direct Radiography (DR) systems dominated the Digital X-ray systems market with a market share of 65.0%. DR systems have a significant edge over Computed Radiography (CR) systems due to their superior image quality, faster processing speed, and lower radiation exposure. These systems capture digital images directly using detectors, enabling immediate results and reducing time and resource consumption. DR systems are especially favored in high-volume healthcare settings, including hospitals, emergency rooms, and diagnostic centers, for their efficiency and reliability.

DR systems are expected to continue their dominance in the forecast period due to their efficiency in processing images, making them the preferred choice in most healthcare facilities.

By Technology

In 2023, Flat Panel Detectors (FPD) dominated the market, with an estimated share of 70.0%. FPD technology offers exceptional image quality, rapid processing, and integration into digital workflows, making it highly preferred in hospitals and imaging centers. These detectors produce high-resolution images with clear contrast and detail, essential for accurate diagnosis. Flat Panel Detectors also expose patients to less radiation while providing quicker imaging results, making them ideal for high-demand environments like trauma and emergency care.

The adoption of FPD technology is anticipated to grow rapidly due to its superior diagnostic capabilities, setting a high standard for digital X-ray systems in the healthcare sector.

By Portability

Fixed Digital X-ray Systems held a dominant position in 2023, with 75.0% of the market share. Fixed systems, including ceiling-mounted and floor-mounted units, are favored for their high image quality and robust performance across a wide range of clinical applications. They are particularly preferred in hospitals and diagnostic centers due to their ability to handle large patient volumes while ensuring consistency in image resolution. The advanced features of these fixed systems, such as space optimization and efficiency, make them indispensable in high-traffic healthcare settings.

While portable systems are expected to show growth, fixed systems will remain dominant due to their stability, efficiency, and ability to deliver high-resolution images in various clinical scenarios.

By Application

General Radiography, which contributed around 50.0% of the market share in 2023, was the largest segment. It remains essential for routine diagnostic procedures, such as chest X-rays, skeletal imaging, and abdominal scans. General Radiography systems are critical in emergency departments, outpatient settings, and routine screenings, offering versatile solutions across various medical conditions. The demand for these systems continues to grow as healthcare providers seek reliable, fast, and non-invasive diagnostic tools.

By End-user

The hospital segment dominated the Digital X-ray systems market with a share of about 60.0% in 2023. Hospitals require a wide range of imaging capabilities, from routine exams to complex diagnostic procedures. The multi-modality imaging suites in hospitals can accommodate various digital X-ray systems, making them a vital user group. The robust installation of digital X-ray systems in hospitals reflects their broad utility across different departments, including radiology, emergency care, and internal medicine.

Buy Full Research Report on Digital X-Ray Systems Market 2024-2032 @ https://www.snsinsider.com/checkout/4508

Recent Developments

- May 2024: AI-enhanced Digital X-ray systems have revolutionized image acquisition processes, significantly reducing the time radiographers spend on each image. AI-powered systems can identify and analyze image data quickly, assisting radiologists in making quicker, more accurate diagnoses. This technological improvement is expected to boost the overall efficiency of healthcare facilities, especially in high-demand environments.

- January 2024: Carestream Health launched its newest digital X-ray system designed to set new standards for imaging quality and clinical productivity. The system offers enhanced resolution, faster processing speeds, and a user-friendly interface, meeting the increasing demand for high-quality, efficient imaging solutions in hospitals and diagnostic centers.

- November 2023: Carestream introduced the Horizon Digital X-ray system, offering a high-quality, economic solution suitable for a variety of healthcare settings. This system is designed to be both cost-effective and efficient, providing hospitals and outpatient clinics with an affordable alternative to traditional X-ray technologies without compromising on diagnostic quality.

Table of Contents – Major Key Points

1. Introduction

- Market Definition

- Scope (Inclusion and Exclusions)

- Research Assumptions

2. Executive Summary

- Market Overview

- Regional Synopsis

- Competitive Summary

3. Research Methodology

- Top-Down Approach

- Bottom-up Approach

- Data Validation

- Primary Interviews

4. Market Dynamics Impact Analysis

- Market Driving Factors Analysis

- PESTLE Analysis

- Porter’s Five Forces Model

5. Statistical Insights and Trends Emergency Care

- Production Capacity and Utilization, by Country, by Region, 2023

- Adoption Rates, by Country, by Region, 2023

- Regulatory Impact, by Country, by Region, 2023

- Technological Innovation and R&D, by Region, 2023

6. Competitive Landscape

- List of Major Companies, By Region

- Market Share Analysis, By Region

- Product Benchmarking

- Strategic Initiatives

- Technological Advancements

- Market Positioning and Branding

7. Digital X-Ray Systems Market Segmentation, by Type

8. Digital X-Ray Systems Market Segmentation, by Technology

9. Digital X-Ray Systems Market Segmentation, By Portability

10. Digital X-Ray Systems Market Segmentation, By Application

11. Digital X-Ray Systems Market Segmentation, By End-user

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practices

15. Conclusion

Speak with Our Expert Analyst Today to Gain Deeper Insights @ https://www.snsinsider.com/request-analyst/4508

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.