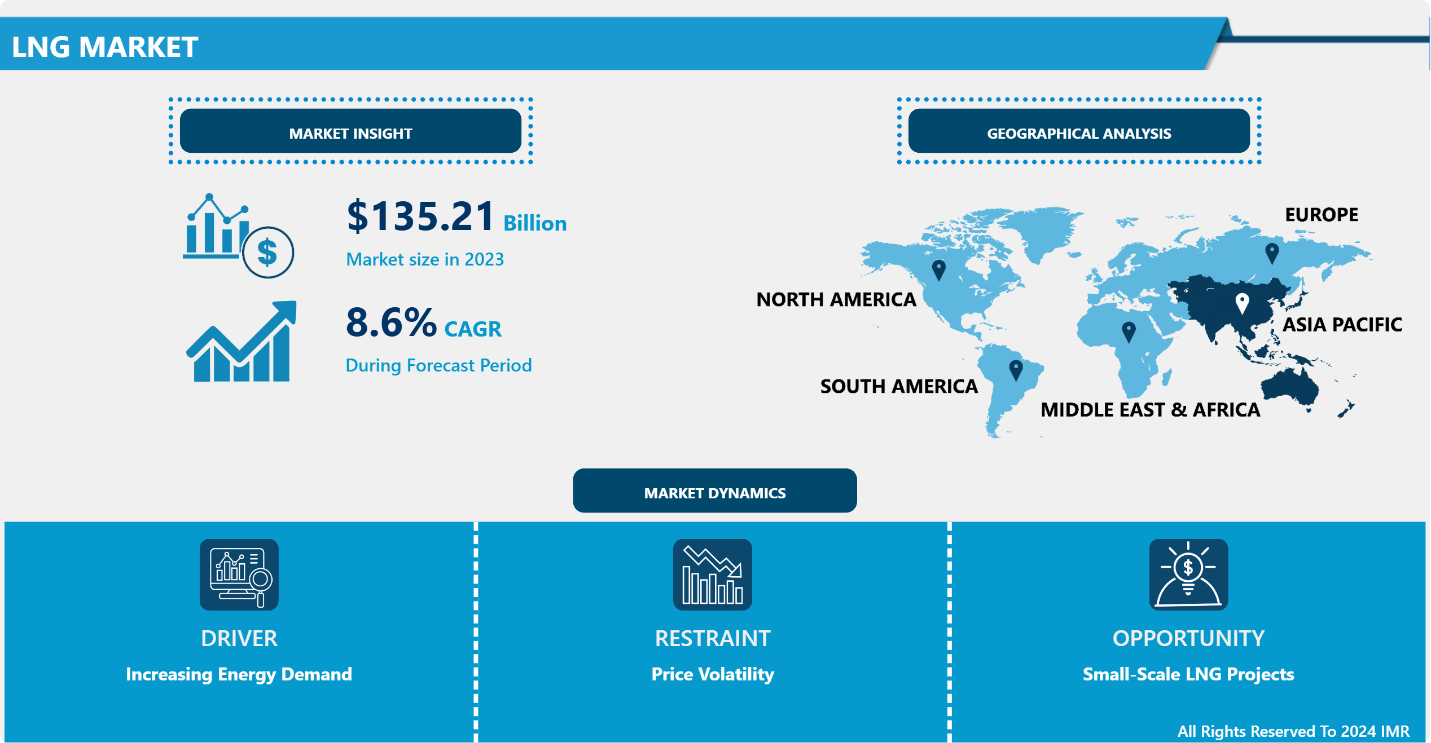

United Kingdom, London, Nov. 27, 2024 (GLOBE NEWSWIRE) -- The LNG market is growing due to several factors such as the Increasing Energy Demand. The growing demand for liquefied natural gas (LNG) in emerging markets across South and Southeast Asia presents a significant opportunity for the LNG market. Shell projects that its Australian LNG supplies will play a pivotal role in meeting this demand, as these regions are expected to absorb much of the anticipated global supply increase by the end of the decade. With rapid industrialization and urbanization, these markets are poised for substantial LNG consumption, driving growth and investment opportunities in the sector.

Introspective Market Research is thrilled to announce the release of its newest report, "LNG Market" This comprehensive analysis reveals that the global LNG Market, valued at USD 135.21 Billion in 2023, is on a trajectory of significant growth, projected to reach USD 284.10 Billion by 2032. This upward momentum corresponds to a robust CAGR of 8.6% over the forecast period from 2024 to 2032.

Natural gas is converted into a liquid through cryogenic cooling, significantly decreasing its volume by approximately 600 times, resulting in liquefied natural gas (LNG). This process takes place at a temperature of approximately -162°C (-260°F) under normal atmospheric pressure. LNG is mainly made up of methane (85-95%), along with small quantities of ethane, propane, butane, and nitrogen, varying based on the origin and treatment. The advantages of liquid natural gas, especially in transportation and storage, are significant. Because of its smaller size, LNG is simpler and more cost-effective to transport, making it a perfect option for areas without extensive pipeline systems.

LNG is a crucial component of the global energy mix, particularly in the UK, where it has been integrated into the energy system for a long time. LNG is considered crucial as a "bridge fuel" during the global shift to cleaner, low-carbon energy sources. When compared to coal and oil, LNG is much more environmentally friendly. It emits 40% fewer carbon dioxide (CO2) emissions than coal and 30% less than oil. LNG releases lower levels of harmful particles like soot and dust, and it generates minimal quantities of sulfur dioxide, mercury, and other air pollutants.

The liquefaction process also enhances the safety of handling and transporting LNG. Once it is turned into liquid form, it becomes safe for storage and transport as it is not flammable, explosive or toxic. LNG is kept in big cryogenic tanks with superior insulation to reduce evaporation into the air. These tanks are created with the same principles as a vacuum flask to keep temperatures low.

LNG is utilized in different ways, such as powering generators, heating industrial processes, distributing to homes, and fueling vehicles that run on LNG. It is moved by LNG carriers, tanker trucks, or cryogenic pipelines. The variety of uses for LNG across various industries, coupled with its reduced environmental harm in comparison to other fossil fuels, renders it a compelling substitute for power production and heating.

LNG's high energy density makes it a crucial component in the worldwide shift to cleaner fuels. In the pursuit of net-zero carbon emissions, countries are considering LNG as a cleaner alternative to coal and oil. Its capacity to uphold energy security and decrease carbon emissions is in line with the objectives of the "energy trilemma" accessible, secure, and environmentally friendly energy. Therefore, LNG is in a favorable position to have a crucial role in the global shift towards sustainable and carbon-neutral energy systems in the next few decades.

Download Sample 250 Pages of LNG Market Report@ https://introspectivemarketresearch.com/request/17010

Key Industry Insights

Increasing Energy Demand

Growing economies, particularly in areas like Asia, Africa, and Latin America, are experiencing rapid financial growth and industrialization. The advancement of businesses, infrastructure, and urban development necessitates substantial increases in energy usage. Countries such as China, India, and various African nations are increasing their manufacturing capabilities and urban areas, leading to a greater demand for reliable and efficient energy sources.

Urban development also plays a crucial role in increasing the need for energy. With more people relocating to urban areas seeking improved opportunities and quality of life, the demand for energy for housing, transportation, and public services is increasing rapidly. Cities need reliable and flexible energy sources to sustain economic activities and support their residents. Many emerging economies are also experiencing significant population growth. A larger population naturally needs increased energy for homes, businesses, and public facilities.

Rising Number of LNG-Fueled Fleet

Using LNG as a fuel is a solution that has been proven and is commercially accessible. LNG provides significant benefits, particularly for ships, given the increasingly strict emission regulations. Traditional oil-based fuels are predicted to continue being the primary fuel choice for the majority of ships shortly, with LNG potentially becoming a popular option in the distant future.

Passenger ferries, offshore service vessels, coastguard vessels, tankers, and various other types of ships operating on the oceans are fueled by LNG. Shipbuilders are placing more emphasis on utilizing LNG as a ship fuel, as various stakeholders have recognized the advantages of this developing technology. In certain countries, the government is offering financial assistance and grants to encourage the use of LNG-powered vehicles.

Technological Advancements in LNG

Technological advancements, process optimization, and environmental sustainability drive the evolution of Liquefied Natural Gas (LNG) production. Advancements in liquefaction technologies, like mixed refrigerant processes, have greatly increased energy efficiency, while modular building methods have lowered expenses and project schedules. The combination of automation and digitalization improves control systems, leading to safer and more efficient operations. Emerging technologies such as floating LNG (FLNG) and small-scale modular liquefaction units allow for decentralized production, increasing flexibility and decreasing infrastructure needs. These developments increase production capabilities and promote worldwide energy availability, establishing LNG as a cleaner energy option. These advancements in technology boost resilience and effectiveness in LNG supply chains, reducing issues such as geopolitical risks and logistical challenges, and aiding in the exploitation of gas reserves that were previously inaccessible.

"Research made simple and affordable – Trusted Research Tailored just for you – IMR Knowledge Cluster"

https://www.imrknowledgecluster.com/

How can small-scale LNG projects drive market expansion opportunities?

The growth of small-scale LNG projects is increasingly acknowledged as a crucial strategy to expand market presence, particularly in remote and underserved areas. These enterprises focus on producing, moving, and using LNG in smaller quantities than traditional large-scale projects, promoting a range of advantages and opportunities. Small-scale LNG projects are integrally more flexible and can be resized more easily compared to large-scale operations. They can be tailored to meet the specific energy requirements of local or regional markets, allowing for a more precise balance of supply and demand. This flexibility is crucial for areas where energy needs the investment in large-scale infrastructure.

One of the primary benefits of small-scale LNG is its ability to access remote areas that lack access to outdated energy sources like natural gas pipelines or established power grids. These areas often rely on expensive and environmentally harmful fuels such as diesel. Small-scale LNG offers a cleaner and more affordable alternative, advancing energy access and promoting local development. In contrast to big LNG projects, small-scale operations need less capital investment. The lower financial cost allows smaller entities, including local governments, community utilities, and private businesses, to participate in and reap the benefits of LNG.

This lower investment threshold can accelerate the distribution of LNG in various areas. Small-scale LNG projects usually progress more quickly because they are smaller and have simpler infrastructure needs. This enables quicker arrangement and speedier achievement of advantages. Small-scale LNG provides a convenient and effective solution for communities and businesses in need of quick energy solutions. Nearby economies can benefit from job creation, skills enhancement, and increased economic activity through the small-scale LNG projects. Local businesses can participate in the supply chain, enhanced energy security, and quality of life for communities. These endeavors trigger widespread growth and progress in the financial sector. Small LNG projects help the environment by substituting more polluting fuels like coal, oil, and diesel, promoting sustainability. LNG emits less sulfur dioxide, nitrogen oxides, particulate matter, and significantly less carbon dioxide than other fossil fuels. This shift to cleaner energy sources helps reduce local air pollution and supports global efforts to fight climate change.

How does price volatility challenge the LNG market dynamics?

The LNG market faces major challenges from price volatility, which directly affects the stability and predictability needed for long-term planning and investments. The rapid changes witnessed in the latter part of 2023 illustrate these problems. The price of LNG rose by 21% in October 2023, then plummeted by 29% in December 2023. The unpredictable price fluctuations confuse suppliers and consumers, making decision-making for contracts, procurement, and production scheduling more difficult.

Price instability has the potential to cause financial instability for suppliers. The market's unpredictability poses a challenge in predicting revenue, which could impact the ability to reinvest in infrastructure and growth. Industries that depend on LNG for energy production, like power plants and manufacturing facilities, encounter higher risks due to the fluctuating operational costs on the consumer side. This could result in disturbances to their strategies for managing costs, impacting their ability to compete.

The fluctuating prices can discourage long-term investments in the LNG industry, leading investors to hold back on funding projects that are at risk of these changes. This situation can impede the development of LNG infrastructure, essential for maintaining a steady supply and fulfilling future energy needs. In general, price instability disrupts the balance of the LNG market, creating difficulties for both suppliers and buyers to manage.

Key Manufacturers

Market key players and organizations within a specific industry or market that significantly influence its dynamics. Identifying these key players is essential for understanding competitive positioning, market trends, and strategic opportunities.

- Qatar Petroleum (QP) (Qatar)

- Royal Dutch Shell (Netherlands/UK)

- ExxonMobil (USA)

- Chevron (USA)

- TotalEnergies (France)

- BP (British Petroleum) (UK)

- PetroChina (China)

- CNOOC (China National Offshore Oil Corporation) (China)

- Cheniere Energy (USA)

- ConocoPhillips (USA)

- Petronas (Petroliam Nasional Berhad) (Malaysia)

- Gazprom (Russia)

- Novatek (Russia)

- Eni (Italy)

- Repsol (Spain)

- Woodside Petroleum (Australia)

- Santos Limited (Australia)

- Equinor (formerly Statoil) (Norway)

- Sempra Energy (USA)

- KOGAS (Korea Gas Corporation) (South Korea)

- Mitsubishi Corporation (Japan)

- Mitsui & Co., Ltd. (Japan)

- JERA (Japan)

- Indian Oil Corporation (IOCL) (India)

- Sonatrach (Algeria) and Other Major Players.

Do you need any industry insights on LNG Market, Make an enquiry now >>? https://introspectivemarketresearch.com/inquiry/17010

Recent Industry Development

In May 2024, Shell sees emerging Asian markets taking more of world's growing LNG supply; Shell expects its Australian supplies of liquefied natural gas (LNG) to help meet demand from emerging markets in south and southeast Asia, which are tipped to absorb some of the pickup in global supplies towards the end of this decade.

In June 2024, the Indian Oil Corporation (IOC) and the Oil and Natural Gas Corporation (ONGC) signed an agreement to establish a small-scale liquefied natural gas (LNG) plant near the Hatta gas field in Madhya Pradesh. The collaboration aimed to enhance India’s LNG production capacity and improve the supply of natural gas to regional markets. The plant, located in a strategic area, will contribute significantly to the country’s energy infrastructure and support sustainable energy growth in the region.

In March 2023: Sempra reported that Sempra Infrastructure Partners LP (Sempra Infrastructure), its 70%-owned subsidiary, reached a positive final investment decision (FID) for the development, construction, and operation of the Port Arthur LNG Phase 1 project in Jefferson County, Texas.

Key Segment of Market Report:

By Nature:

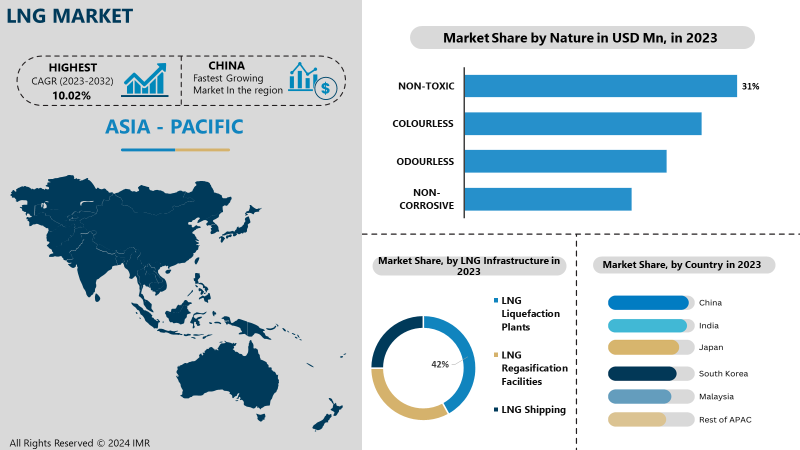

The lack of toxicity in Liquefied Natural Gas (LNG) is a major factor in its market success, leading to its widespread use and acceptance. LNG is scentless, non-hazardous, and non-corrosive, which makes it easier to manage than other hydrocarbons. This feature lessens the risk of harm in the event of a spill or leak, as LNG does not pose the same health hazards as poisonous substances. In contrast to numerous other fuels, LNG has minimal impact on human health or the environment during accidents, making it appealing for industrial and residential purposes.

The lack of toxicity in LNG helps to adhere to strict safety rules, which encourages its utilization in different industries. Governments and regulatory authorities support LNG projects because they have less negative impact on the environment and pose lower health risks. LNG's quick evaporation when spilled helps reduce its environmental impact by preventing the buildup of harmful residues. This characteristic also makes LNG a perfect substitute for situations where safety is of utmost importance, like in heating, cooking, and transportation. LNG's lack of toxicity allows to use in both commercial and residential areas, broadening its market penetration. LNG is becoming more popular as a cleaner form of fossil fuel, leading to the global growth of the LNG market due to its safety and sustainability benefits.

By LNG Infrastructure:

LNG liquefaction plants mark the start of the LNG supply chain. These services can convert natural gas into a liquid form, reducing its volume around 600 times, and allowing for effective transportation of large quantities over protracted distances. If liquefaction did not exist, the entire LNG sector would not be possible, due to the impracticality and high cost of transporting natural gas in its gaseous form over long distances. Liquefaction facilities demand significant investment and advanced technology. Complex techniques such as gas decontamination, desiccation, and cooling to cryogenic temperatures are included. This renders them fundamental and pivotal to the LNG framework, often representing the most significant financial and technical leap within the LNG value chain.

The size and output of liquefaction facilities often dictate the global flow of LNG supply. Countries with large shared gas reserves play a significant role in the export of LNG by investing heavily in liquefaction plants, impacting global energy markets. The proximity of these plants establishes these countries as important figures in the LNG sector. Liquefaction facilities have a significant economic impact, often generating important job opportunities and boosting the local and national economy through exports. They are typically viewed as valuable assets for a country's strategic interests.

By Region:

Several countries across the Asia-Pacific region, such as China, India, Japan, and South Korea, are going through rapid economic growth and industrial progress. This increase is causing a rise in energy consumption, particularly in natural gas, to fuel industries, businesses, and households. A large proportion of the global population resides in the Asia-Pacific region. With the growth of populations and expansion of cities, there will be a significant rise in the demand for energy, particularly cleaner-burning fuels like natural gas. With the increasing awareness of environmental concerns and a greater focus on minimizing greenhouse gas emissions, countries in the Asia-Pacific area are opting more and more for natural gas instead of coal and oil in various sectors like power generation, industrial processes, and transportation. Nations in the Asia-Pacific area are establishing strategic partnerships and alliances to secure dependable sources of LNG in the future. These collaborations include agreements to advance LNG initiatives, establish extended supply contracts, and work together on LNG infrastructure to guarantee a steady and dependable flow of natural gas in response to growing demand.

If you require any specific information that is not covered currently, we will provide the same as a part of the customization >> https://introspectivemarketresearch.com/custom-research/17010

Comprehensive Offerings:

- Historical Market Size and Competitive Analysis (2017–2023): Detailed assessment of market size and competitive landscape over the past years.

- Historical Pricing Trends and Regional Price Curve (2017–2023): Analysis of historical pricing data and price trends across different regions.

- Market Size, Share, and Forecast by Segment (2024–2032): Projections and detailed insights into market size, share, and future growth by segment.

- Market Dynamics: In-depth analysis of growth drivers, restraints, opportunities, and key trends, with a focus on regional variations.

- Market Trend Analysis: Evaluation of emerging trends that are shaping the market landscape.

- Import and Export Analysis: Examination of trade patterns and their impact on market dynamics.

- Market Segmentation: Comprehensive analysis of market segments and sub-segments, with a regional breakdown.

- Competitive Landscape: Strategic profiles of key players across regions, including competitive benchmarking.

- PESTLE Analysis: Evaluation of the market through Political, Economic, Social, Technological, Legal, and Environmental factors.

- PORTER’s Five Forces Analysis: Assessment of competitive forces influencing the market.

- Industry Value Chain Analysis: Examination of the value chain to identify key stages and contributors.

- Legal and Regulatory Environment by Region: Analysis of the legal landscape and its implications for business operations.

- Strategic Opportunities and SWOT Analysis: Identification of lucrative business opportunities, coupled with a SWOT analysis.

- Conclusion and Strategic Recommendations: Final insights and actionable recommendations for stakeholders.

Related Report Links:

Offshore Signaling Devices Market: The Offshore Signaling Devices Market size was valued at $ 1564.42 Million in 2023 and is projected to reach $ 2211.17 Million by 2032, registering a CAGR of 4.42% from 2023 to 2032.

Turbine Oils Market: Turbine Oils Market Size Was Valued at USD 5.60 Billion in 2023, and is Projected to Reach USD 9.27 Billion by 2032, Growing at a CAGR of 5.76% From 2024-2032.

Bio-Lubricant Market: Bio-Lubricant Market Size is Valued at USD 2.3 Billion in 2023 and is Projected to Reach USD 3.1 Billion by 2032, Growing at a CAGR of 3.4% From 2024-2032.

Cold Gas Spray Coating Market: Cold Gas Spray Coating Market Size is Valued at USD 1.17 Billion in 2023, and is Projected to Reach USD 1.54 Billion by 2032, Growing at a CAGR of 3.45% From 2024-2032.

Biofuel Additives Market: Biofuel Additives Market Size Was Valued at USD 15067.49 Million in 2023 and is Projected to Reach 38293.91 Million by 2032, Growing at a CAGR of 10.92% From 2024-2032.

Oil Storage Market: Oil Storage Market Size Was Valued at USD 13.77 Billion in 2023 and is Projected to Reach USD 20.38 Billion by 2032, Growing at a CAGR of 4.45% From 2024-2032.

Crude Oil Market: Crude Oil Market Size Was Valued at USD 4,998.33 Million in 2023 and is Projected to Reach USD 6,949.68 Million by 2032, Growing at a CAGR of 4% From 2024-2032.

Virtual Pipelines Market: Virtual Pipelines Market Size Was Valued at USD 2,378 Million in 2023, and is Projected to Reach USD 3983.60 Million by 2032, Growing at a CAGR of 5.9% From 2024-2032.

Subsea Control Systems Market: Subsea Control Systems Market Size Was Valued at USD 25 Billion in 2023, and is Projected to Reach USD 33 Million by 2032, Growing at a CAGR of 3.24% From 2024-2032.

Autogas Market: Autogas Market Size Was Valued at USD 48.9 Billion in 2023 and is Projected to Reach USD 81.22 Billion by 2032, Growing at a CAGR of 6% From 2024-2032.

About Us:

Introspective Market Research is a premier global market research firm, leveraging big data and advanced analytics to provide strategic insights and consulting solutions that empower clients to anticipate future market dynamics. Our team of experts at IMR enables businesses to gain a comprehensive understanding of historical and current market trends, offering a clear vision for future developments.

Our strong professional network with industry-leading companies grants us access to critical market data, ensuring the generation of precise research data tables and the highest level of accuracy in market forecasting. Under the leadership of CEO Mrs. Swati Kalagate, who fosters a culture of excellence, we are committed to delivering high-quality data and supporting our clients in achieving their business goals.

The insights in our reports are derived from primary interviews with key executives of top companies in the relevant sectors. Our robust secondary data collection process includes extensive online and offline research, coupled with in-depth discussions with knowledgeable industry professionals and analysts.

Contact Us:

Canada Office

Introspective Market Research Private Limited, 138 Downes Street Unit 6203- M5E 0E4, Toronto, Canada.

APAC Office

Introspective Market Research Private Limited, Office No. 401, Saudamini Commercial Complex, Kothrud, Pune, India 411038

Ph no: +91-81800-96367 / +91-7410103736

Email: sales@introspectivemarketresearch.com

LinkedIn| Twitter| Facebook | Instagram

Ours Websites : https://introspectivemarketresearch.com | https://imrknowledgecluster.com/knowledge-cluster | https://imrtechsolutions.com | https://imrnewswire.com/ | https://marketnresearch.de |