Dublin, Dec. 04, 2024 (GLOBE NEWSWIRE) -- The "Construction Equipment Finance Market Opportunities and Strategies to 2033" report has been added to ResearchAndMarkets.com's offering.

This report describes and explains the construction equipment finance market and covers 2018-2023, termed the historic period, and 2023-2028, 2033F termed the forecast period. The report evaluates the market across each region and for the major economies within each region.

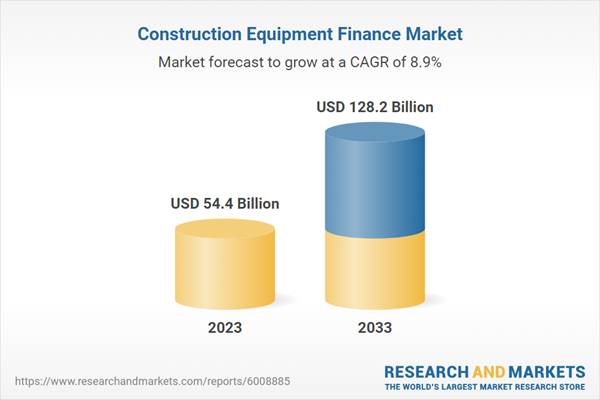

The global construction equipment finance market reached a value of nearly $54.38 billion in 2023, having grown at a compound annual growth rate (CAGR) of 5.47% since 2018. The market is expected to grow from $54.38 billion in 2023 to $82.53 billion in 2028 at a rate of 8.70%. The market is then expected to grow at a CAGR of 9.20% from 2028 and reach $128.15 billion in 2033.

Growth in the historic period resulted from the expansion of smart cities initiatives, increased focus on infrastructure development, rise in equipment costs and government support for the construction industry. Factors that negatively affected growth in the historic period include currency fluctuations.

The construction equipment finance market is segmented by financing type into loans, leases and mortgage. The loans market was the largest segment of the construction equipment finance market segmented by financing type, accounting for 61.9% or $33.66 billion of the total in 2023. Going forward, the leases segment is expected to be the fastest growing segment in the construction equipment finance market segmented by financing type, at a CAGR of 9.41% during 2023-2028.

The construction equipment finance market is segmented by equipment into earthmoving, material handling, concrete and road construction and transportation. The earthmoving market was the largest segment of the construction equipment finance market segmented by equipment, accounting for 52.4% or $ 28.47 billion of the total in 2023. Going forward, the material handling segment is expected to be the fastest growing segment in the construction equipment finance market segmented by equipment, at a CAGR of 9.81% during 2023-2028.

The construction equipment finance market is segmented by application into enterprise, municipal and other applications. The enterprise market was the largest segment of the construction equipment finance market segmented by application, accounting for 60.1% or $32.7 billion of the total in 2023. Going forward, the other applications segment is expected to be the fastest growing segment in the construction equipment finance market segmented by application, at a CAGR of 10.17% during 2023-2028.

The construction equipment finance market is segmented by end-user into small and medium enterprises and large enterprises. The large enterprises market was the largest segment of the construction equipment finance market segmented by end-user, accounting for 58.6% or $31.86 billion of the total in 2023. Going forward, the small and medium enterprises segment is expected to be the fastest growing segment in the construction equipment finance market segmented by end-user, at a CAGR of 9.01% during 2023-2028.

Asia-Pacific was the largest region in the construction equipment finance market, accounting for 33.6% or $18.28 billion of the total in 2023. It was followed by North America, Western Europe and then the other regions. Going forward, the fastest-growing regions in the construction equipment finance market will be Asia-Pacific and Africa, where growth will be at CAGRs of 10.27% and 9.82% respectively. These will be followed by the Middle East and South America, where the markets are expected to grow at CAGRs of 9.32% and 8.69% respectively.

The global construction equipment finance market is highly concentrated, with large players operating in the market. The top ten competitors in the market made up 54.1% of the total market in 2023. Komatsu Ltd. was the largest competitor with a 28.2% share of the market, followed by Caterpillar Financial Services Corporation with 17.6%, Bank of America Corporation with 3.6%, JPMorgan Chase & Co. with 1.2%, Wells Fargo & Company with 1.2%, TD Bank, N.A. with 0.7%, Societe Generale S.A. with 0.5%, General Electric Company (GE) with 0.5%, U.S. Bank National Association. with 0.4% and CIT Group Inc. with 0.3%.

The top opportunities in the construction equipment finance market segmented by financing type will arise in the loans segment, which will gain $17.15 billion of global annual sales by 2028. The top opportunities in the construction equipment finance market segmented by equipment will arise in the earthmoving segment, which will gain $15.14 billion of global annual sales by 2028.

The top opportunities in the construction equipment finance market segmented by application will arise in the enterprise segment, which will gain $15.68 billion of global annual sales by 2028. The top opportunities in the construction equipment finance market segmented by end-user will arise in the large enterprises segment, which will gain $16.0 billion of global annual sales by 2028. The construction equipment finance market size will gain the most in the USA at $4.87 billion.

Market-trend-based strategies for the construction equipment finance market include innovative excavator leasing programs with extended powertrain warranty, enhanced financing and leasing options for heavy machinery, strategic collaborations and partnerships among market players and launch of new equipment finance solutions targeting large-ticket equipment.

Player-adopted strategies in the construction equipment finance market include focus on expanding business through new promotional offers, expanding business through new platform developments and providing comprehensive construction equipment financing solutions through strategic acquisitions.

To take advantage of the opportunities, the analyst recommends the construction equipment finance companies to focus on offering flexible leasing solutions for construction equipment, focus on enhancing financing and leasing options for heavy machinery, focus on expanding large-ticket equipment finance solutions, focus on leases segment, focus on material handling segment, expand in emerging markets, focus on strategic partnerships to broaden service offerings, focus on expanding distribution channels through strategic partnerships, focus on implementing flexible pricing models for construction equipment finance, continue to use B2B promotions, participate in trade shows and events, focus on enterprise segment and focus on small and medium enterprises.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 306 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value (USD) in 2023 | $54.4 Billion |

| Forecasted Market Value (USD) by 2033 | $128.2 Billion |

| Compound Annual Growth Rate | 8.9% |

| Regions Covered | Global |

Major Market Trends

- Innovative Excavator Leasing Programs With Extended Powertrain Warranty

- Enhanced Financing and Leasing Options for Heavy Machinery

- Strategic Collaborations and Partnerships Among Market Players

- Launch of New Equipment Finance Solutions Targeting Large-Ticket Equipment

Competitive Landscape and Company Profiles

- Komatsu Limited

- Caterpillar Financial Services Corporation

- Bank of America Corporation

- JPMorgan Chase & Co

- Wells Fargo & Company

Other Major and Innovative Companies

- TD Bank, N.a.

- Societe Generale S.a.

- General Electric Company (GE)

- U.S. Bank National Association

- CIT Group Inc

- Cholamandalam Investment and Finance Company Ltd

- Tata Capital Limited

- CNH Industrial N.V.

- De Lage Landen International B.V. (DLL)

- Fundera

- Tetra Corporate Services, LLC

- Crest Capital

- American Capital Group

- Marlin Leasing Corporation (PEAC Solutions)

- Hitachi Construction Machinery Co., Ltd

Key Mergers and Acquisitions

- Groupe BPCE Acquired Societe Generale Equipment Finance

- JA Mitsui Leasing Acquired Oakmont Capital Holdings

- NARCL Acquired Srei Equipment Finance and Srei Infrastructure Finance

- Servus Credit Union Acquired Stride Capital Corporation

- American Bank Acquired ACG Equipment Finance

- FBLC and FBCC Acquired Encina Equipment Finance

- Commercial Credit Inc. (CCI) Acquired Keystone Equipment Finance

- TD Bank Acquired Wells Fargo'S Canadian Direct Equipment Finance Business

For more information about this report visit https://www.researchandmarkets.com/r/nsxvm4

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment