Austin, Dec. 07, 2024 (GLOBE NEWSWIRE) -- Market Size & Growth Insights:

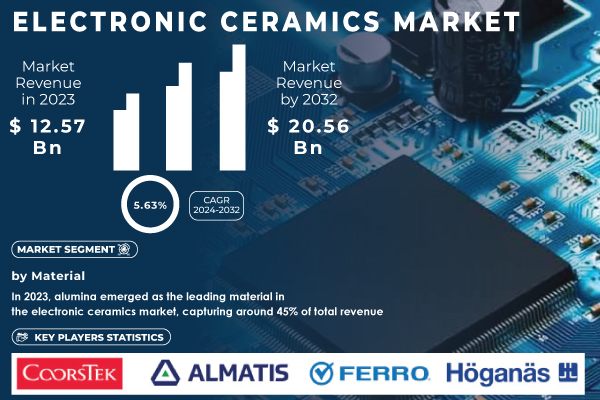

According to the SNS Insider, “The Electronic Ceramics Market Size was valued at USD 12.57 Billion in 2023 and is expected to reach USD 20.56 Billion by 2032, and grow at a CAGR of 5.63% over the forecast period 2024-2032.”

Electronic Ceramics Powering the Evolution of EV Batteries and Advanced Technologies

The electronic ceramics market is experiencing robust growth, driven by advancements in technology and the rising adoption of electric vehicles (EVs). These ceramics are vital for their thermal stability, electrical insulation, and dielectric properties, making them indispensable in EV battery systems and electronic components. The Global EV Outlook 2024 reports a 40% surge in EV battery demand, exceeding 750 GWh in 2023, fueled by electric car sales. Regions like the U.S. and Europe saw the fastest growth rates, while China remained the largest market at 415 GWh. This demand has increased the need for raw materials like lithium and cobalt, reducing battery costs through supply chain expansion. As battery production scales globally, electronic ceramics play a pivotal role in enhancing battery efficiency, durability, and thermal management. These advancements highlight the importance of material science in transforming industries, particularly in aligning with the EV market's rapid evolution and technological needs.

Get a Sample Report of Electronic Ceramics Market Forecast @ https://www.snsinsider.com/sample-request/1319

Leading Market Players with their Product Listed in this Report are:

- CoorsTek Inc. (Technical ceramics, ceramic substrates)

- Almatis GmbH (Alumina products, specialty aluminas)

- American Elements (Advanced ceramic materials, metal oxides)

- Ferro Corporation (Ceramic glazes, specialty coatings)

- Hoganas AB (Metal powders, ceramic powders)

- Merck KgA (Specialty chemicals, electronic materials)

- Noritake Co. Ltd. (Ceramic materials, grinding wheels)

- Ishihara Sangyo Kaisha Ltd. (Zirconia ceramics, functional ceramics)

- L3Harris Technologies Inc. (Advanced electronic systems, ceramic capacitors)

- Physik Instrumente GmbH & Co. KG (Piezo ceramics, precision positioning systems)

- Sensor Technology Ltd. (Ceramic sensors, piezoelectric devices)

- Venator Materials Plc (Titanium dioxide, specialty chemicals for ceramics)

- APC International, Ltd. (Piezoelectric ceramics, ceramic capacitors)

- CeramTec Holding GmbH (Industrial ceramics, ceramic substrates)

- Central Electronics Limited (Ceramic materials for electronics, insulators)

- Kyocera Corporation (Multilayer ceramic capacitors, ceramic filters)

- Maruwa Co., Ltd. (High-frequency ceramic components, ceramic substrates)

- Morgan Advanced Materials (Technical ceramics, insulation materials)

- Murata Manufacturing Co., Ltd. (Ceramic capacitors, piezoelectric devices)

- PI Ceramics (Precision ceramics, actuator components)

- Sparkler Ceramics Pvt. Ltd. (Ceramic materials for various applications).

Electronic Ceramics Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 12.57 Billion |

| Market Size by 2032 | USD 20.56 Billion |

| CAGR | CAGR of 5.63% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by material (Zirconia, Silica, Alumina, Others) • by Product (Monolithic ceramics, Ceramic matrix composites, Ceramic coatings, Others) • by End-User (Medical, Electronics, Automobile, Aerospace & Defense, Others) • by Application (Actuators & Sensors, Capacitors, Data Storage Devices, Optoelectronic Devices, Power Distribution Devices, Others) |

| Key Drivers | • Sustainability and Circular Economy as Key Drivers Shaping the Electronics Ceramics Market. |

Do you Have any Specific Queries or Need any Customize Research on Electronic Ceramics Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/1319

Alumina and Monolithic Ceramics Leading the Charge in Electronic Ceramics Market Growth

By Material

In 2023, alumina dominated the electronic ceramics market, accounting for 45% of total revenue due to its exceptional thermal stability, electrical insulation, and chemical resistance. This versatile material is widely used in electronic components such as integrated circuit substrates, capacitors, and insulators, across industries like consumer electronics, telecommunications, and automotive. Alumina's cost-effectiveness and advanced manufacturing techniques support its growing demand, particularly in high-frequency applications and electric vehicles. Companies like CeramTec, Kyocera, NGK Insulators, and CoorsTek have introduced innovative alumina-based products, positioning it as a key material for the next generation of electronic technologies.

By Product

In 2023, monolithic ceramics held a dominant 50% share of the electronic ceramics market, driven by their excellent mechanical strength, thermal stability, and electrical insulation. These properties make them ideal for high-performance applications like capacitors and integrated circuit substrates. Monolithic ceramics are widely used across industries such as consumer electronics and automotive, benefiting from cost-effective manufacturing and adaptability. Recent advancements in materials science have improved their performance and enabled the production of complex shapes. Their recyclability also supports sustainability initiatives. Companies like Murata, Kyocera, CeramTec, and NGK have launched innovative products, reinforcing monolithic ceramics' role in advancing technology.

Asia-Pacific and North America Lead the Growth of the Electronic Ceramics Market

In 2023, the Asia-Pacific region dominated the electronic ceramics market, accounting for 35% of global revenue. This is largely due to the region’s strong electronics manufacturing sector, with China, Japan, and South Korea leading the charge. China, as the largest manufacturer of electronic goods, benefits from extensive production facilities, government support, and a booming consumer electronics market. The region’s investments in 5G infrastructure and electric vehicles further fuel growth. Companies like Kyocera and Murata are launching innovative products, including non-toxic ceramics, while PI Ceramic's Piezoceramic Composites highlight the region's focus on sustainability. Meanwhile, North America emerged as the fastest-growing region in 2023, driven by technological advancements and major investments, positioning it as a leader in global innovation.

Purchase Single User PDF of Electronic Ceramics Market Report (33% Discount) @ https://www.snsinsider.com/checkout/1319

Recent Development

- Aug. 28, 2024 – Physik Instrumente introduces the S-335 two-axis fast steering mirror with PICMA piezo actuators, designed for high-speed laser beam control in aerospace, optics, and photonics. The system provides millisecond response times, dynamic linearity, and a long angular travel range for precise, high-resolution imaging applications.

- Dec. 1, 2024 – Murata Electronics announces a 62 billion baht investment to build a new advanced capacitor factory in Lamphun, Thailand, set to focus on multilayer ceramic capacitors (MLCCs) for smartphones, telecom devices, and vehicles. The factory will expand by 2028 to cover 200 rai.

- Sep. 13, 2024 – Kyocera launches a $60 million fund, Kyocera Venture Fund-I (KVF-I), to invest in startups across the US and EMEA, focusing on sectors such as energy, AI, healthcare, and semiconductors. The fund will invest between $200,000 and $2 million in seed to series B-stage companies.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 High-Performance Materials

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Cost Analysis

6. Competitive Landscape

7. Electronic Ceramics Market Segmentation, by Material

8. Electronic Ceramics Market Segmentation, by Product

9. Electronic Ceramics Market Segmentation, by End-User

10. Electronic Ceramics Market Segmentation, by Application

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access More Research Insights of Electronic Ceramics Market Growth & Outlook Report 2024-2032@ https://www.snsinsider.com/reports/electronic-ceramics-market-1319

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.