Pune, Dec. 07, 2024 (GLOBE NEWSWIRE) -- Artificial Intelligence in Fintech Market Size Analysis:

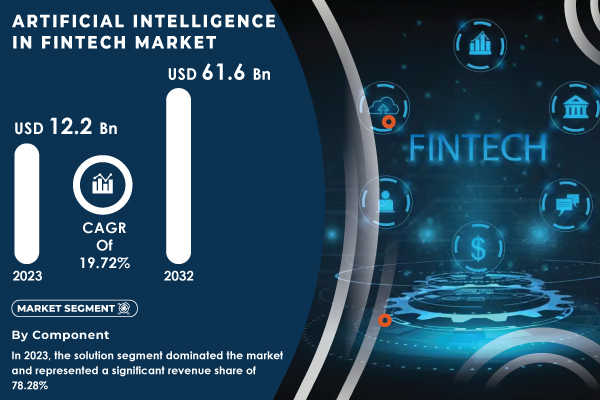

“The SNS Insider report indicates that the Artificial Intelligence (AI) in the Fintech market was valued at USD 12.2 billion in 2023 and is projected to grow to USD 61.6 billion by 2032, expanding at a compound annual growth rate (CAGR) of 19.72% during the forecast period from 2024 to 2032.”

The growing demand for Artificial Intelligence (AI) in the fintech sector is driven by financial institutions and fintech companies seeking to boost the efficiency, accuracy, and customer experience of their offerings. AI-driven technologies, such as machine learning algorithms for fraud detection and AI-based chatbots for customer support, are reshaping traditional financial models, catalyzing a significant shift within the industry. AI's ability to process large volumes of data allows for more precise risk assessments, predictions, and personalized services, enhancing both customer satisfaction and operational efficiency. This gives early adopters a competitive advantage in the rapidly evolving market. AI also plays a crucial role in enhancing cybersecurity across financial systems. By detecting patterns and anomalies in real-time, AI is pivotal in identifying and preventing fraudulent activities. Furthermore, AI-powered chatbots streamline customer service operations, allowing users to resolve issues anytime, anywhere, boosting both efficiency and user experience. As more financial institutions integrate AI technologies, the market is poised for substantial growth, supported by government initiatives that promote digitalization and financial inclusivity, further driving AI adoption in fintech.

A key catalyst for AI’s role in fintech is its impact on financial inclusion. AI and machine learning enable institutions to assess creditworthiness using alternative data, granting access to loans for individuals without traditional credit histories. This fosters greater financial inclusion by enabling underserved populations to access essential services like loans, insurance, and credit. AI has also revolutionized wealth management with the rise of robo-advisors, offering personalized investment advice at a fraction of the cost of traditional advisors, making wealth management services more accessible. This shift toward automated financial advisory services is expected to significantly boost the demand for AI in fintech.

Moreover, AI’s ability to improve decision-making and operational efficiency within the fintech sector is driving its widespread adoption. Financial institutions leverage AI to automate processes, minimize human error, and enhance data analysis capabilities, leading to better financial predictions and insights. As the volume of data increases, AI’s role in analyzing and extracting valuable insights will further accelerate market growth.

Get a Sample Report of Artificial Intelligence in Fintech Market@ https://www.snsinsider.com/sample-request/1259

Major Players Analysis Listed in this Report are:

- Upstart - AI-driven loan origination platform

- Ant Group - Ant Financial's credit scoring system

- Zest AI - AI-based credit underwriting software

- Cognitivescale - AI-powered financial services platform

- Kiva - AI-powered micro-lending platform

- PayPal - AI-based fraud detection system

- Mastercard - AI-driven fraud prevention solutions

- Credit Karma - AI-driven credit score and financial advice tool

- Stripe - AI-powered payment processing and fraud detection

- Square - AI-based payment and point-of-sale solutions

- SoFi - AI-driven personal finance and investment platform

- LenddoEFL - AI-based credit scoring system using alternative data

- Betterment - AI-powered robo-advisor platform

- Wealthfront - Automated AI-driven investment management

- Kabbage - AI-powered small business lending platform

- Onfido - AI-based identity verification and fraud detection

- IBM - Watson for Financial Services

- Nuance Communications - AI-powered voice biometric authentication

- Clarity Money - AI-based personal finance management app

- Finbox - AI-driven data-driven financial analysis platform

Artificial Intelligence in Fintech Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 12.2 Billion |

| Market Size by 2032 | USD 61.6 Million |

| CAGR | CAGR of 19.72% from 2024-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | •Increased reliance on AI-driven fraud detection systems to analyze transactions in real time and enhance security •Shift toward digital financial services accelerated by the pandemic and customer preferences for online solutions. •Adoption of machine learning to analyze alternative data sources for accurate credit assessments and reduced defaults. |

Do you have any specific queries or need any customization research on Artificial Intelligence in Fintech Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/1259

Segmentation Analysis

By Deployment

In 2023, the on-premise accounted for the largest revenue share, at over 57.00%. On-premise deployment helps enterprises install software or services on the premises/systems of a financial institution. The cloud segment is expected to grow at the highest CAGR in the period, 2024 to 2032. Cloud-based AI algorithms learn from historical data, identify current patterns, and provide recommendations, leading to this growth. Cloud and AI have the potential to boost productivity, efficacy, and digital security for data handling and authenticity and this automated process eradicates the errors made by humans while processing data. Many fintech companies progressed in 2023 by leveraging artificial intelligence in the financial services space. For instance, UnionBank in the Philippines used AI-based credit scoring models to offer financial services to the unbanked population using alternative data sources to develop credit scores. Untapped communities were able to secure credit that traditional banking systems lacked access to through this initiative

AI is hosted in the cloud to learn from the past, provide guidance, and assess the current trends in AI. For instance, in 2023, U.S. Bank renewed a partnership with Microsoft to accelerate the transformation of our banking operations on Microsoft Azure. This partnership is centered on not just innovating faster in digital banking but scaling its new products faster and enhancing experiences within the customer journey for the bank. U.S. Bank has also enabled the automation of core engineering, security, and risk management processes via the integration of cloud technologies, shortening the time it takes to roll out new services. This will also help the bank in improving data analysis and the ability to respond to customers, thus making informed decisions. This is in line with an emerging digital banking trend to enhance agility and a personalized, secure financial services experience

Artificial Intelligence in Fintech Market Segmentation:

By Components

- Solution

- Services

- Managed

- Professional

By Deployment

- On-Premises

- Cloud

By Application

- Virtual Assistant (Chatbots)

- Business Analytics and Reporting

- Customer Behavioural Analytics

- Fraud Detection

- Quantitative and Asset Management

- Others

Regional Analysis

In 2023, North America dominated the market and represented revenue share of more than 38.90% share of the global revenue. The high share reflects the importance of the advanced economies of the U.S. and Canada to inventions originating in R&D. They're among the most competitive and rapidly developing regions in the world related to fintech AI technology. Numerous startups and emerging corporations offering AI solutions to the finance industry are also fueling it.

Asia Pacific is expected to grow at the fastest CAGR from 2024-2032. The upward trend can be linked as a result of the fast shift towards digital payments and an uptrend in internet services in the area. Due to increased technical improvement in APAC, this region has come out as a potential market. Moreover, the rapid growth of domestic companies along with favorable government policies presents many possibilities for AI development in the fintech industry. Moreover, regional market growth is supplemented as key players are investing in new markets of the region as a part of their business strategy.

Buy an Enterprise-User PDF of Artificial Intelligence in Fintech Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/1259

Recent Developments

May 2024: Lemonade expanded its AI-powered insurance platform to incorporate new machine learning models that optimize claims processing and improve fraud detection.

July 2024: The company unveiled an AI-driven auto insurance pricing model that offers more personalized premiums based on driving behavior, integrating machine learning to detect fraudulent claims.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Artificial Intelligence In Fintech Market Segmentation, By Component

8. Artificial Intelligence In Fintech Market Segmentation, by Deployment

9. Artificial Intelligence In Fintech Market Segmentation, by Application

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Details of Artificial Intelligence in Fintech Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/ai-in-fintech-market-1259

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.