Austin, Dec. 10, 2024 (GLOBE NEWSWIRE) -- Market Size & Growth Analysis:

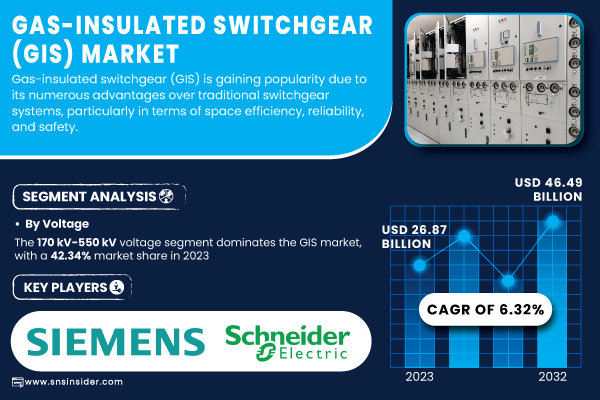

The SNS Insider report indicates that,“The Gas-Insulated Switchgear (GIS) Market size was valued at USD 26.87 billion in 2023 and is projected to reach USD 46.49 billion by 2032, growing at a compound annual growth rate (CAGR) of 6.32% during the forecast period of 2024–2032.”

The Growing Demand for Gas-Insulated Switchgear (GIS)

Gas-insulated switchgear (GIS) has become an essential component of modern power systems due to its compact design, reliability, and safety features. This technology is especially valuable in urban and industrial environments where space constraints pose challenges for traditional switchgear installations. With the rise of grid modernization initiatives and the development of smart grids, GIS systems are increasingly preferred for their minimal maintenance requirements and adaptability to advanced power distribution networks. Moreover, the integration of renewable energy sources, such as solar and wind, has further boosted GIS adoption due to its suitability for high-voltage applications. In 2023, renewables accounted for 12.7% of global energy consumption, with significant investments in clean energy infrastructure, especially in developing regions. Strict safety and environmental regulations also promote GIS deployment, ensuring operational security and accident prevention. The growing trend of urbanization, coupled with increasing renewable energy integration, positions GIS as a cornerstone of efficient, reliable, and sustainable energy systems.

Get a Sample Report of Gas-Insulated Switchgear Market Forecast @ https://www.snsinsider.com/sample-request/4837

Dominant Market Players with their Products Listed in this Report are:

- Siemens AG (GIS 8DQ1, 8DAB 12)

- Schneider Electric (GHA, GCB)

- General Electric (GE) (GIS 38kV, 72.5kV GIS)

- ABB Ltd. (ELK-04, ELK-03)

- Hitachi Energy (Z-3 Series, Z-5 Series)

- Mitsubishi Electric (GIS 170 kV, GIS 72.5 kV)

- Toshiba Corporation (GIGATAP, GIGATAP-M)

- Eaton Corporation (XGIS, R3 Series)

- Nissin Electric Co., Ltd. (GIS-CC, GIS-CF)

- LS Electric (E-GIS, GSC Series)

- Hyundai Electric (GIS 550 kV, GIS 170 kV)

- China XD Group (GCGIS, XGIGIS)

- S&C Electric Company (Vista Underground, PureWave)

- Pars Mavad (PM GIS, PM XGIS)

- Crompton Greaves Consumer Electricals Ltd. (GIS 36 kV, GIS 72 kV)

- Keco Co., Ltd. (K-GIS, K-EGIS)

- General Electric (GE) (B105, B165)

- Asea Brown Boveri (ABB) (Type A, Type B)

- Bharat Heavy Electricals Limited (BHEL) (BHEL GIS 400kV, BHEL GIS 220kV)

- Siemens Energy (SIVACON S8, SIVACON 8PS).

The Push for Renewable Energy Integration

One of the primary drivers of the GIS market is the global transition toward renewable energy. Governments and industries are investing heavily in solar, wind, and other clean energy technologies to meet climate goals and reduce dependency on fossil fuels. GIS systems play a critical role in enabling these renewable projects by offering robust and compact high-voltage solutions, ideal for remote installations and urban infrastructures. As the renewable energy sector grows, advanced transmission systems are needed to manage the fluctuating power generated by solar and wind sources. GIS ensures seamless integration of renewables into the grid, with minimal energy loss and improved reliability. With global renewable energy jobs reaching 13 million in 2023 and over 80% of new capacity coming from solar and wind, the demand for GIS is poised to accelerate further.

"Comprehensive Segment Breakdown Highlights Emerging Opportunities in the Market"

By Installation: The outdoor GIS segment led the market in 2023, holding 53% of the market share. These systems are designed for high voltage and exhibit superior resilience against harsh environmental conditions. Outdoor installations are favored for large-scale applications like substations and transmission lines, where space is available, and rugged reliability is essential.

By Voltage: The 170 kV–550 kV voltage segment dominated the GIS market in 2023, with a 42% share. This range is widely used in high-capacity transmission and distribution systems, balancing efficiency and capacity. Urban and rural electrification projects rely heavily on this segment, particularly as countries upgrade their power grids.

By End-Use: The Utilities segment accounted for 51% of the GIS market share in 2023. These organizations are the backbone of power generation, transmission, and distribution, and they are increasingly investing in GIS to enhance infrastructure, integrate renewable energy, and ensure reliable electricity supply in space-constrained urban areas.

Do you Have any Specific Queries or Need any Customize Research on Gas-Insulated Switchgear Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/4837

Key Market Segments:

By Installation

Indoor

Outdoor

By Voltage

Up to 66 kV

66 kV-170 kV

170 kV-550 kV

Above 550 kV

By End Use

Utilities

Industrial

Commercial

Residential

Other

"Unlocking Regional Opportunities: In-Depth Market Insights and Forecasts"

Asia-Pacific held a commanding 43.67% market share in 2023 and is also forecasted to grow at the highest CAGR of 6.58% during the forecast period, driven by rapid urbanization, infrastructure investments, and high electricity demand in nations like China, India, and Japan. Governments in the region prioritize grid modernization and renewable energy integration, fueling GIS adoption. Companies like Siemens and ABB have deployed advanced GIS solutions for industrial and renewable energy projects. Countries are focusing on smart grid advancements and emission control, further increasing GIS adoption. ABB and Schneider Electric are among the key players supporting infrastructure projects in this region.

Purchase an Enterprise User License of Gas-Insulated Switchgear Market Report at 40% Discount @ https://www.snsinsider.com/checkout/4837

Recent Developments in Gas Insulated Switchgear

- February 2023: ABB India opened its advanced factory in Nashik, increasing its Gas Insulated Switchgear (GIS) production capacity twofold. This plant will produce primary and secondary GIS. It will cater to clients in multiple sectors such as power distribution, smart cities, data centers, transportation (metro, railways), tunnels, ports, highways, and other infrastructure projects.

- November 2024: Siemens to launch its inaugural gas-insulated switchgear without fluorinated gases to the medium-voltage market in the U.S. The NXPLUS C 24-blue GIS switchgear features a reduced CO2 footprint to aid in grid decarbonization and boasts an arc-resistant design to improve the safety of personnel and equipment.

Table of Contents - Key Points Analysis

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Gas-Insulated Switchgear Production Volumes, by Region (2023)

5.2 Gas-Insulated Switchgear Design Trends (Historic and Future)

5.3 Gas Insulated Switchgear Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

7. Gas-Insulated Switchgear Market Segmentation, by Installation

8. Gas-Insulated Switchgear Market Segmentation, by Voltage

9. Gas-Insulated Switchgear Market Segmentation, by End-Use

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Insights of Gas-Insulated Switchgear Market Growth & Outlook 2024-2032@ https://www.snsinsider.com/reports/gas-insulated-switchgear-market-4837

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.